Bank Details Form For New Employee

Description

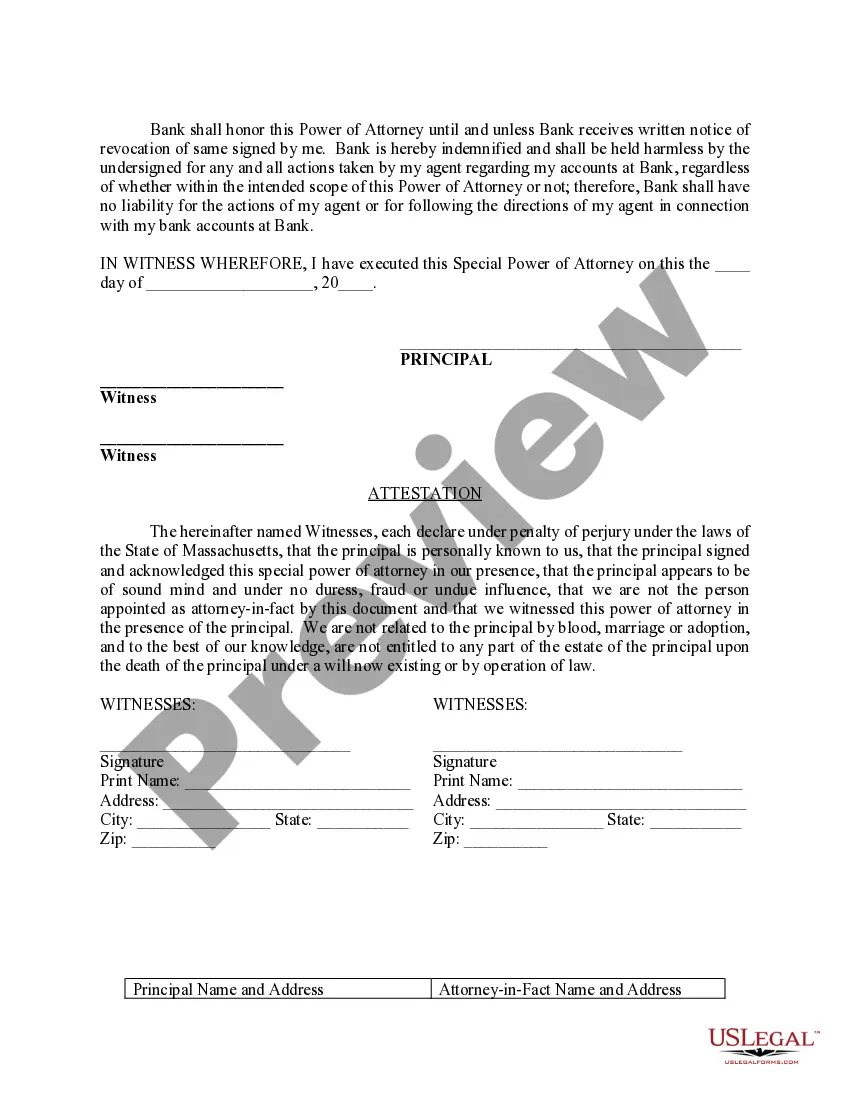

How to fill out Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

- If you are a returning user, log in to your account and download the necessary Bank details form for new employee template directly.

- For first-time users, start by searching for the Bank details form. Check the form's preview and description to ensure it meets your needs and complies with local requirements.

- If you need a different template, utilize the Search tab to find additional options that align better with your requirements.

- Once you've found the correct form, click on the 'Buy Now' button and select your preferred subscription plan. You'll need to create an account for access.

- Proceed with your purchase by entering payment details through your credit card or PayPal.

- Finally, download your selected form and save it on your device for easy access later, or find it in the My Forms section of your profile. During completion, don't hesitate to reach out to premium experts for assistance.

Using US Legal Forms not only empowers you to efficiently manage employee documentation, but it also guarantees you access to expert advice whenever needed.

Enhance your onboarding experience today by visiting US Legal Forms and start utilizing their extensive library for all your legal form needs!

Form popularity

FAQ

A bank details form for new employee is a document that collects essential financial information from new hires. This form typically includes the employee's bank account number, routing number, and account type, which are necessary for direct deposit of their salary. Using a standardized bank details form helps streamline payroll processes, ensuring timely salary payments. Additionally, platforms like US Legal Forms provide ready-to-use templates, making it easy for businesses to collect this vital information securely.

To hire a new employee, you typically need to complete a range of essential documents. One key document is the Bank details form for new employee, which ensures the employee's salary is deposited directly into their bank account. Accurate completion of this form simplifies payroll processing and minimizes delays in onboarding. By using uslegalforms, you can easily access and fill out the required forms, including the bank details form, making the hiring process smooth and efficient.

When providing bank info to your employer, include your account number, the routing number, and the name of your banking institution. This information is vital for direct deposit transactions and must be accurate to ensure timely payments. The bank details form for new employee simplifies this process by allowing you to organize and verify the required details efficiently. Always keep a copy for your records and confirm the details with your employer if necessary.

You need to give your employer your bank account number, routing number, and the name of your bank. This pertinent information is essential for processing your direct deposits without any hiccups. Utilizing the bank details form for new employee makes it easier to compile and submit the necessary information securely. Protect your privacy by ensuring that you provide this sensitive information only to authorized personnel.

You should provide your employer with your bank account number, the bank's routing number, and the type of account you have, like checking or savings. These details are crucial for setting up payroll and ensuring your direct deposits are directed accurately. By using the bank details form for new employee, you can organize and present this information clearly. Make sure to review everything before submission for accuracy.

For direct deposit, you need to provide your employer with your bank account number and the bank’s routing number. It's also helpful to include your bank’s name and possibly your account type, such as checking or savings. This information can be easily documented in the bank details form for new employee. Always double-check your entries to avoid any issues with deposit processing.

To fill out the bank details form for new employee, start by entering your personal information, such as your name and address. Next, provide your bank's name, account number, and routing number. Take your time to ensure all information is accurate, as errors could delay your direct deposit. Once completed, submit the form to your employer securely and confidently.

To provide your bank details to your employer, complete the bank details form for new employees accurately. You can deliver this form via email or through your company’s HR system for secure processing. Ensuring your bank information is correct helps you receive your salary through direct deposit without delays.

New employees generally need to fill out several forms including the W-4 for tax withholding and the I-9 for identity verification. You may also be required to complete a direct deposit form, often referred to as the bank details form for new employees, to ensure timely payment. Always communicate with HR for a comprehensive list of required paperwork.

As a new employee, the essential IRS form you need is the W-4, which reports your tax withholding preferences. Employers may also require an I-9 form to verify your identity and work authorization. Completing the bank details form for new employees is also important for managing your payroll efficiently.