Revocation Living Trust With A Beneficiary

Description

How to fill out Massachusetts Revocation Of Living Trust?

- Log into your US Legal Forms account if you’re a returning user. Make sure your subscription is up-to-date for uninterrupted access.

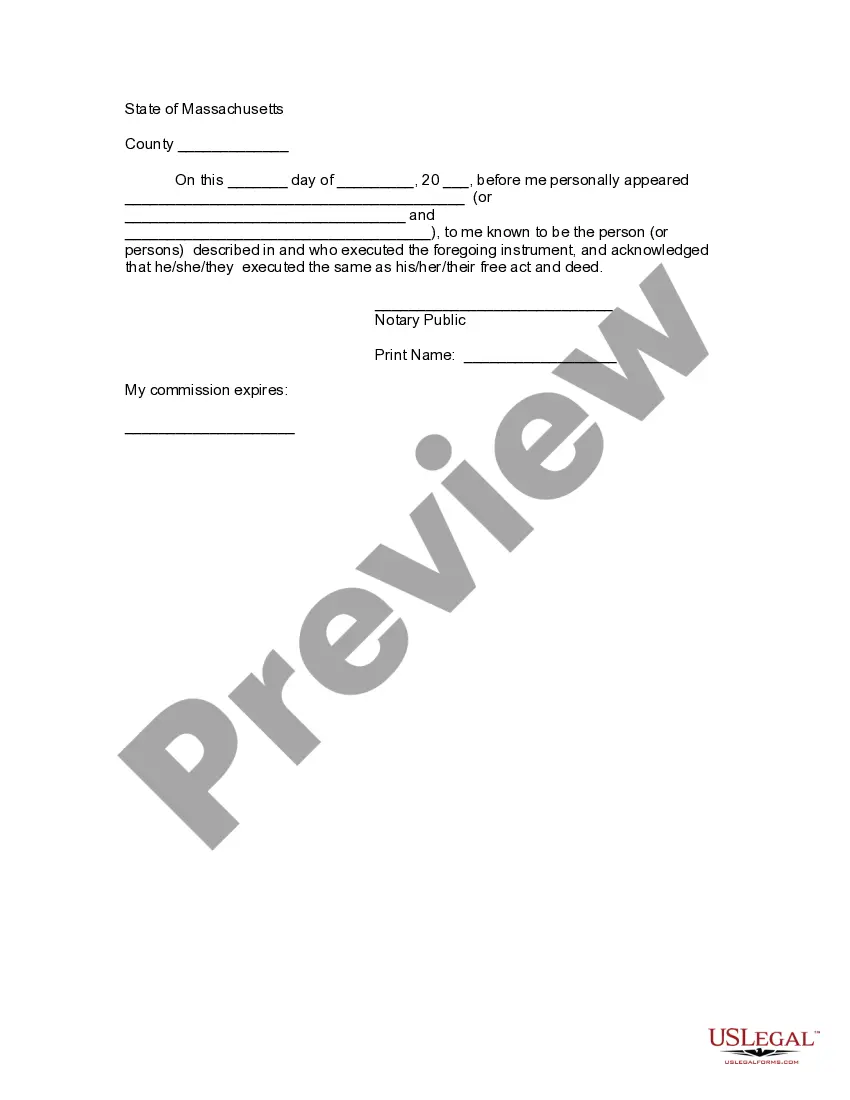

- For new users, begin by browsing the Preview mode to find the appropriate living trust revocation form that aligns with your local laws.

- Utilize the Search feature to locate other necessary templates if your needs change. Ensure the form you select is fully compliant with your jurisdiction's regulations.

- Click on the Buy Now button once you’ve found the correct form. Choose a subscription plan that suits you best.

- Complete your purchase by entering your payment details via credit card or PayPal to finalize your subscription.

- Download your living trust revocation form and save it on your device. You can access it any time from the My Forms section of your profile.

By following these steps, you can efficiently revoke your living trust while ensuring compliance with legal standards. US Legal Forms empowers you with a vast library, expert assistance, and user-friendly templates.

Start your legal journey today by visiting US Legal Forms and explore how easy it is to manage your legal documents!

Form popularity

FAQ

Yes, a beneficiary can be removed from a revocation living trust with a beneficiary, but it requires specific legal processes. To do this correctly, an amendment or a full revocation may be necessary. It's important to document this change properly to ensure clarity and minimize disputes. Consulting resources from US Legal Forms can aid in preparing these legal documents effectively.

An example of a revocation living trust with a beneficiary involves formally stating your intent to cancel the trust. This typically includes identifying the trust by name and clearly stating the date it was created. Following this, you would detail the assets within the trust and outline their new distribution. Tools provided by US Legal Forms can help you create a precise revocation.

One significant mistake is failing to properly name beneficiaries in a revocation living trust with a beneficiary. Parents may overlook regular updates or changes in circumstances, like marriage or divorce, which can impact beneficiary designations. Another mistake is lacking clarity in instructions for asset distribution. Thorough guidance helps avoid confusion and ensures wishes are honored.

A revocation living trust with a beneficiary requires a formal notice to dissolve the trust. This sample typically includes your name as the trustor, the date of the original trust, and a statement revoking it. You should also mention the assets held in the trust and clarify that they will be transferred. Using templates from US Legal Forms can simplify this process and ensure accuracy.

The 5 year rule for trusts typically pertains to tax implications and asset transfers. Under certain conditions, if you create a revocation living trust with a beneficiary, the assets within that trust might be subject to this timeframe for tax considerations. This rule indicates that any assets transferred to a trust might risk being included in your taxable estate if you pass away within five years. Consulting with a tax professional can help clarify how this rule affects your trust.

The revocation of a living trust refers to the formal cancellation of the trust and its terms. When you initiate a revocation living trust with a beneficiary, you can transfer your assets back to your name or redistribute them according to your wishes. To ensure that your assets are handled correctly after revocation, follow the legal steps for revocation and confirm that all beneficiaries are updated. Utilizing platforms like US Legal Forms can simplify this process.

A trust can be invalid due to improper execution or lack of intent. For instance, if a revocation living trust with a beneficiary is not signed or witnessed correctly, it may not hold up in court. Moreover, if the trust creator changes their mind about the trust's terms without following legal procedures, the trust could also be deemed invalid. Always review your trust regularly and consult a legal expert to ensure its validity.

Several factors can render a trust void, including lack of proper execution, absence of capacity, or failure to meet legal requirements. If a revocation living trust with a beneficiary does not adhere to these standards, it may become invalid. Additionally, if the creator of the trust lacked the mental capacity to create it or if the trust purpose is illegal, it may also be declared void. Therefore, ensuring legal compliance during setup is essential.

A living trust does not override a beneficiary designation, but it can complement it. When you have a revocation living trust with a beneficiary, the trust outlines how your assets will be distributed. If you name a beneficiary in your trust, they will receive your designated assets according to the trust's terms. It's crucial to ensure that both your trust and beneficiary designations align to avoid confusion later.

Revoking a revocable trust is generally straightforward. The essential step is to express your clear intent to terminate the trust legally. By creating a revocation document and notifying all relevant parties, you can successfully navigate this process, making it easier to manage any revocation living trust with a beneficiary you may have in place.