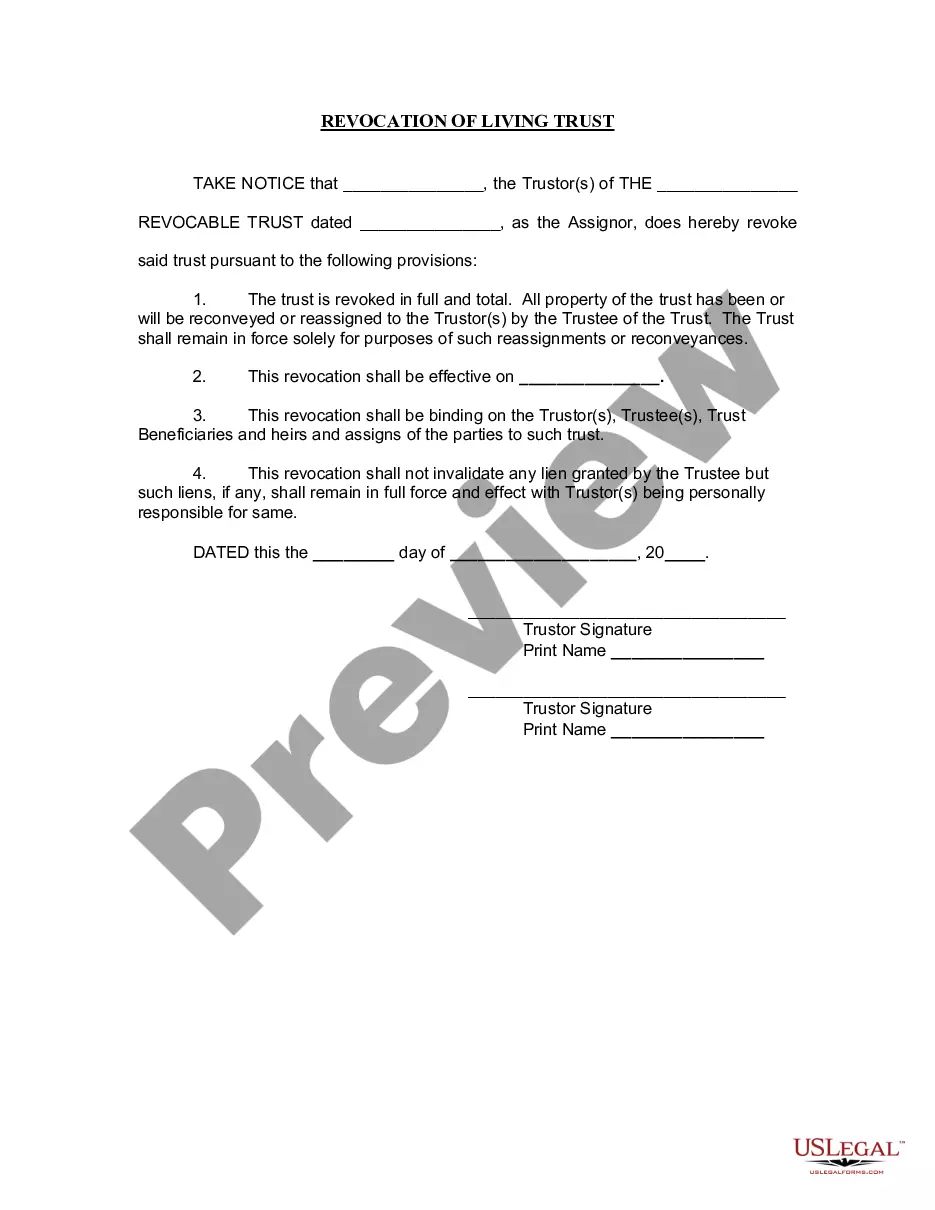

Revocation Cover

Description

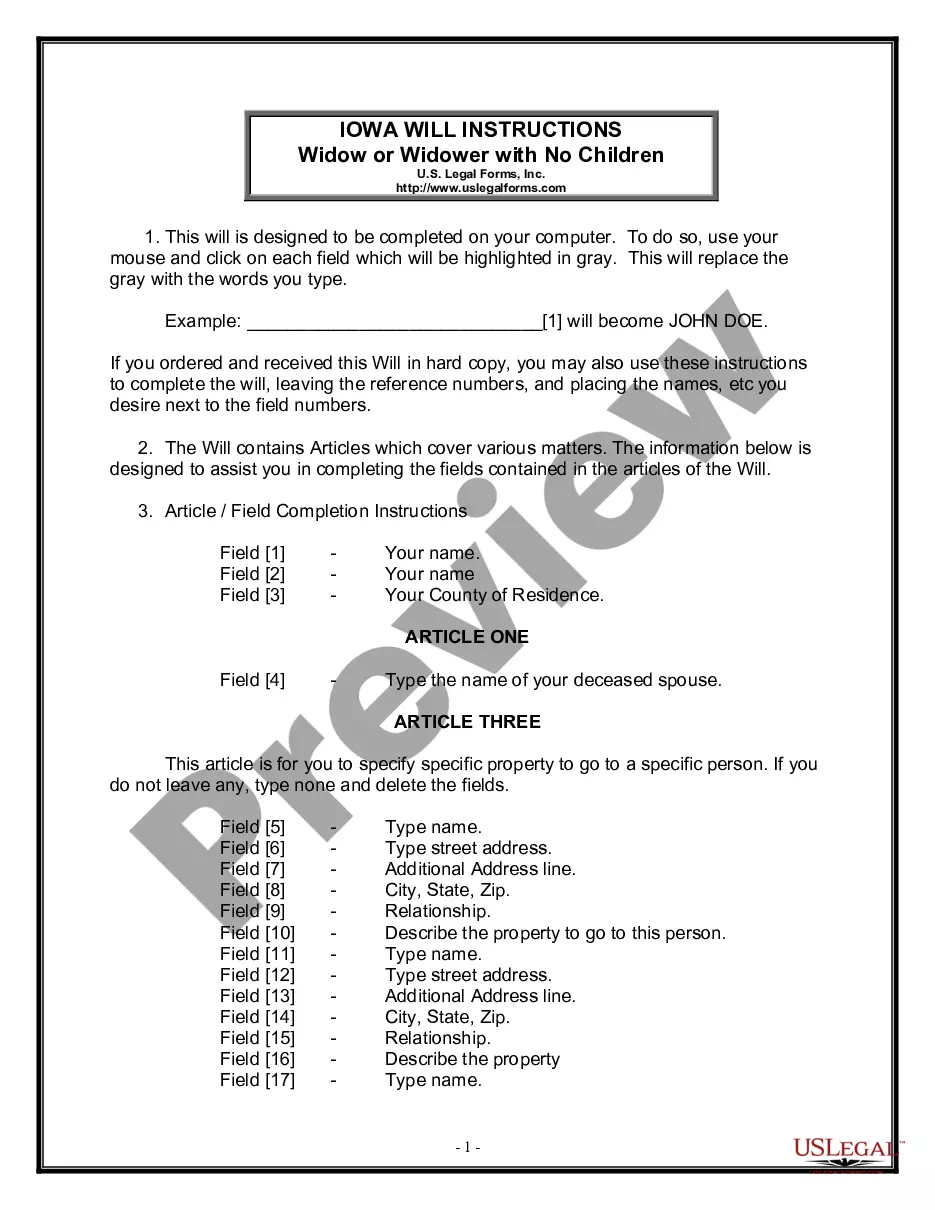

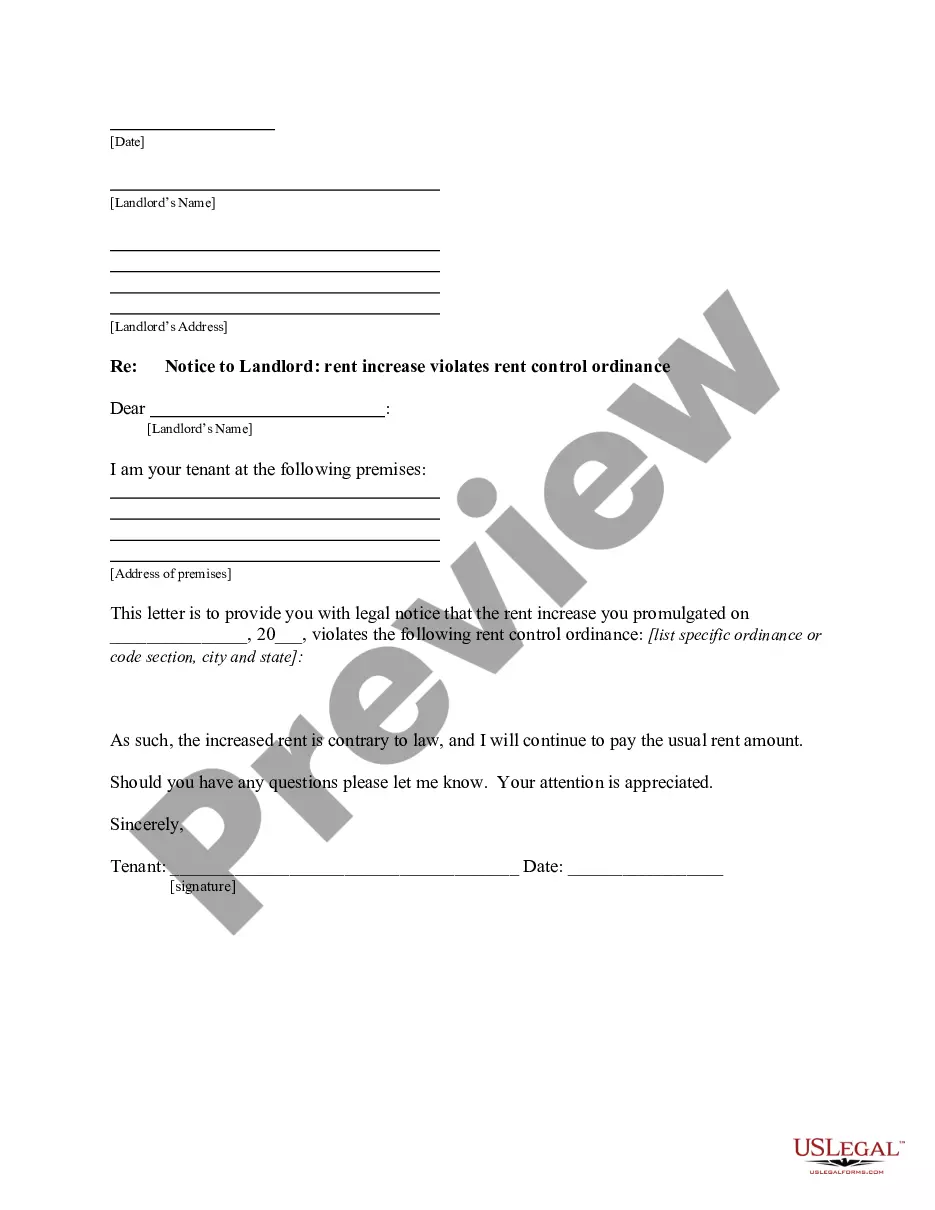

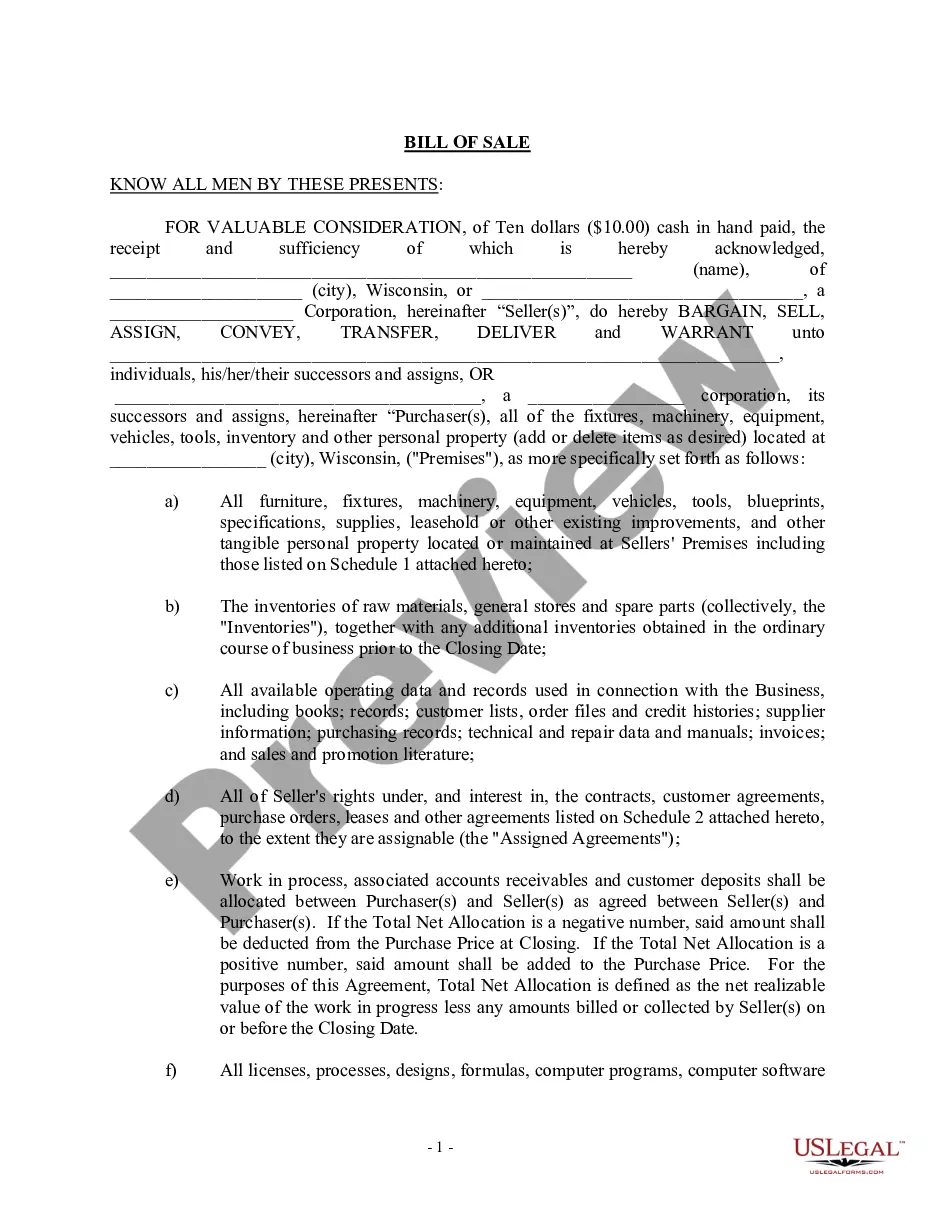

How to fill out Massachusetts Revocation Of Living Trust?

- If you are a returning customer, log in to your account and ensure your subscription is valid. Then, locate the form template and click the Download button.

- For first-time users, start by previewing the available forms. Review the form description to ensure it meets your needs and complies with your jurisdiction.

- If the form isn't suitable, use the Search feature to find another template that fits your requirements.

- Once you've selected the correct document, click 'Buy Now' to choose your subscription plan and create an account.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- After your payment is confirmed, download the form directly to your device and access it later in the My Forms section.

In conclusion, US Legal Forms provides a robust collection of legal forms, making it easier for you and your attorney to prepare necessary documents with accuracy. Experience the convenience and expertise that comes with their extensive library.

Start safeguarding your legal interests today by accessing US Legal Forms!

Form popularity

FAQ

Yes, you can use TurboTax to file Form 8332 electronically when it is included as an attachment with your tax return. This feature helps streamline the way you manage your revocation cover. Just ensure that you follow the prompts within the software to correctly attach the form to your submission.

Several IRS forms cannot be filed electronically, including Form 8832 and certain other complex forms. It's important to refer to the IRS website for updates and a complete list. If you find yourself needing to handle revocation cover, have your physical copies ready for mailing to ensure compliance with regulations.

IRS Form 8832, which allows you to elect classification as a corporation or partnership, cannot currently be filed online. You will need to print the completed form and mail it to the IRS. Ensure that you check the instructions for revocation cover on the IRS website for any specific details regarding your submission.

The best way to submit a Power of Attorney (POA) to the IRS is by using Form 2848, which allows you to designate an individual to represent you. You can mail this form to the relevant IRS address based on your location. Including details about your revocation cover will help clarify the authority you are granting and the specifics of your case.

You can submit Form 8332 by first completing it with the necessary details related to child support agreements or revocation cover. Then, if you are filing a paper return, include it as part of your tax documents. For electronic submissions, simply attach it to your e-filed return and check for confirmation to ensure successful submission.

Currently, Form 8332 cannot be filed electronically on its own, but you can submit it as an attachment with your electronic tax return. This method simplifies the process, especially when dealing with revocation cover situations. Utilizing tax software like TurboTax can streamline this, ensuring you include the form correctly.

To submit Form 56, you should start by filling out the form with accurate information regarding the revocation cover you are addressing. After ensuring that all fields are completed, you can mail it to the appropriate IRS office based on your location. It's crucial to check the IRS website for the correct mailing address to avoid delays.

Hospice revocation can be initiated by the patient, their family, or the healthcare team. Patients may decide to withdraw from hospice care or may be advised based on their medical condition. Understanding revocation cover is crucial in these circumstances, ensuring that you are prepared for any transitions. US Legal Forms can assist by providing the relevant forms and information needed during this process.

Common reasons for hospice revocation include recovery from illness, a shift to curative treatment, or dissatisfaction with the hospice service. Families may also decide to explore other care options that better meet their needs. Understanding revocation cover can help you navigate your choices effectively. Consider utilizing US Legal Forms for guidance and the necessary documentation.

The revocation rate for hospice patients varies, but studies indicate that a small percentage elect to stop hospice care at some point. Factors contributing to this include personal choice and changes in health status. It's crucial to understand revocation cover to make informed decisions about ongoing care. For further support, US Legal Forms provides resources to help you address these matters.