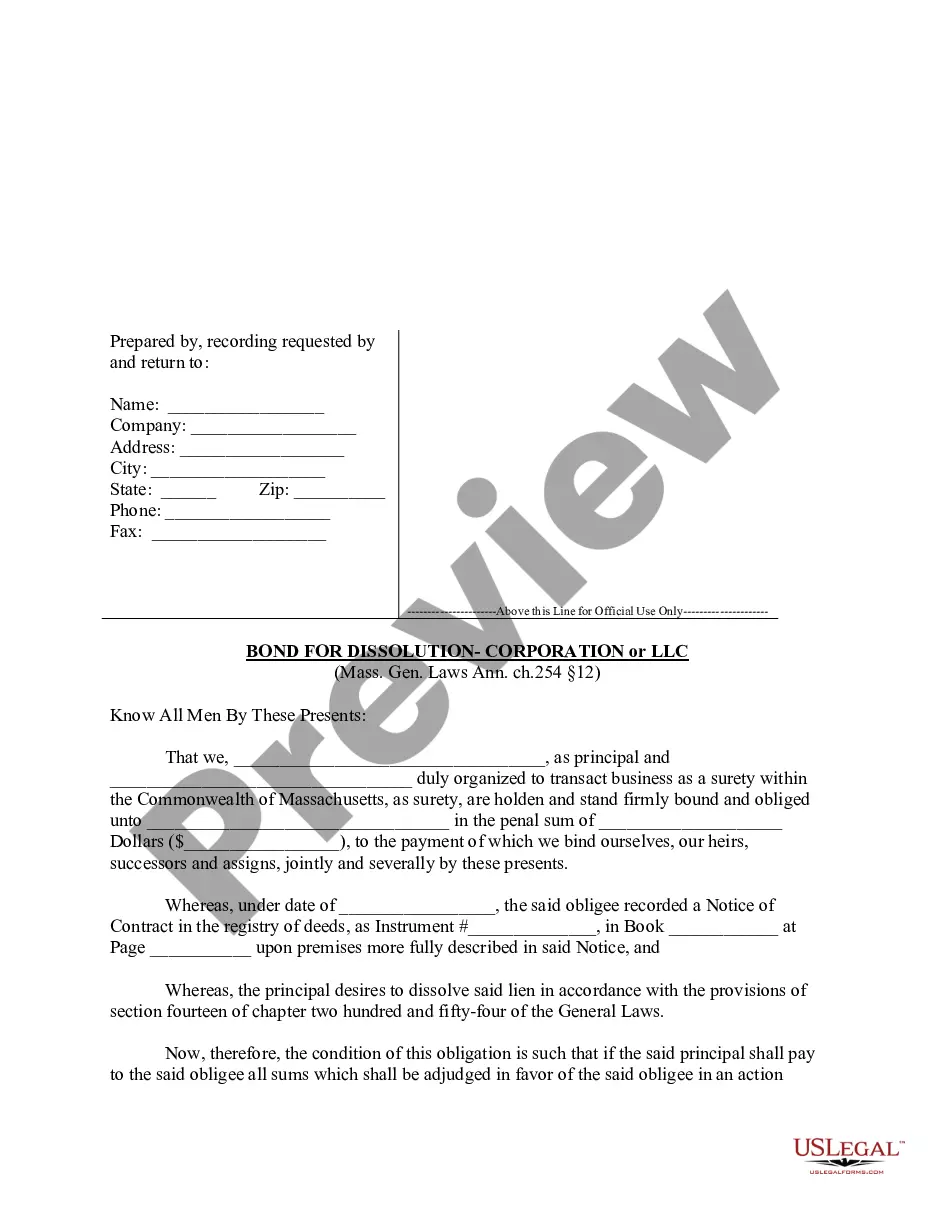

Massachusetts law provides for a very specific form with which a party with an interest in property may enter a bond equal to the amount of the contract.

Massachusetts Bond Form For Surety

Description

How to fill out Massachusetts Bond Form For Surety?

You no longer have to dedicate hours searching for legal documents to meet your local state obligations.

US Legal Forms has compiled all of them in one location, simplifying their availability.

Our platform offers over 85,000 templates for various business and personal legal matters organized by state and application area. All forms are expertly created and verified for accuracy, ensuring you receive an up-to-date Massachusetts Bond Form For Surety.

When you identify the right template, click Buy Now next to the template title. Select your desired subscription plan and either register for an account or Log In. Complete your subscription payment using a card or PayPal to proceed. Choose the file format for your Massachusetts Bond Form For Surety and download it to your device. You may print the form to fill it out manually or upload the sample if you prefer to use an online editor. Preparing legal documents in compliance with federal and state regulations is swift and straightforward with our platform. Try US Legal Forms today to keep your paperwork organized!

- If you are already acquainted with our service and possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents at any time by accessing the My documents section in your profile.

- For first-time users, the procedure will involve a few additional steps to finalize.

- Here’s how new users can locate the Massachusetts Bond Form For Surety in our collection.

- Carefully examine the page content to confirm it has the sample you require.

- Utilize the form description and preview options if available.

- Employ the Search field above to look for another sample if the prior one does not suit your needs.

Form popularity

FAQ

The process of a surety bond begins with determining the type of bond needed for your specific situation. After you apply, the surety company assesses your financial stability and risk profile. Once approved, you receive the bond and must fulfill any obligations associated with it. It's a reliable way to ensure compliance with contracts and protect all parties involved.

To put a claim on a surety bond, identify the bond issuer, which is typically a surety company. Next, prepare the necessary documentation, including evidence of the claim, such as contracts or agreements. Submit your claim directly to the surety company, detailing the situation and the financial impact. They will investigate your claim and decide based on the bond terms.

Filing a surety claim in Massachusetts involves notifying the surety company that issued your bond. Begin by gathering evidence that supports your claim, such as any relevant contracts or documentation. Submit your claim formally, specifying the breach and the damages incurred. The surety company will review the information before making a determination regarding the claim.

To obtain a Massachusetts bond form for surety, start by identifying the type of bond you need. You can apply through licensed surety bond agents or companies in the state. After gathering necessary documents and completing the application, the surety will evaluate your application. Once approved, you will receive the bond, which you must file with the appropriate entity.

To get a surety bond in Massachusetts, start by identifying the specific bond type you need for your situation. You can then complete a Massachusetts bond form for surety through platforms like US Legal Forms, which provide templates and guidance. After that, submit the form to a surety company, and they will evaluate your application based on your financial background and creditworthiness.

A BMC 84 surety bond is a specific bond form required by federal regulations for freight brokers and freight forwarders in the United States. This bond guarantees that the broker will comply with industry laws and regulations, acting as a protective measure for shippers. When looking for a Massachusetts bond form for surety relevant to this requirement, consider tools like uslegalforms to navigate the complexities and ensure you meet all legal obligations.

To find your surety bond, start by checking your records or contacting the provider who issued it. If you need a Massachusetts bond form for surety, reviewing the documentation you received during the bonding process can help. In case you cannot locate it, reaching out to your bonding company or using uslegalforms can assist you in obtaining the necessary information efficiently.

Surety bonds in Massachusetts are typically offered by licensed insurance companies or surety bond providers. These companies assess the applicant's qualifications, including credit history and financial stability, to issue a Massachusetts bond form for surety. By choosing a reputable provider, you can ensure a smooth process and compliance with state regulations. Utilizing platforms like uslegalforms can help streamline your search for a reliable surety bond provider.

To fill out a surety bond application using the Massachusetts bond form for surety, start by gathering all necessary information, including your personal details, the bond amount, and the specific purpose of the bond. Carefully read each section of the form, ensuring you provide accurate information as required. After completing the form, review your entries for accuracy, as mistakes can delay processing. Once satisfied, submit the completed Massachusetts bond form for surety through the appropriate channels to obtain your bond.