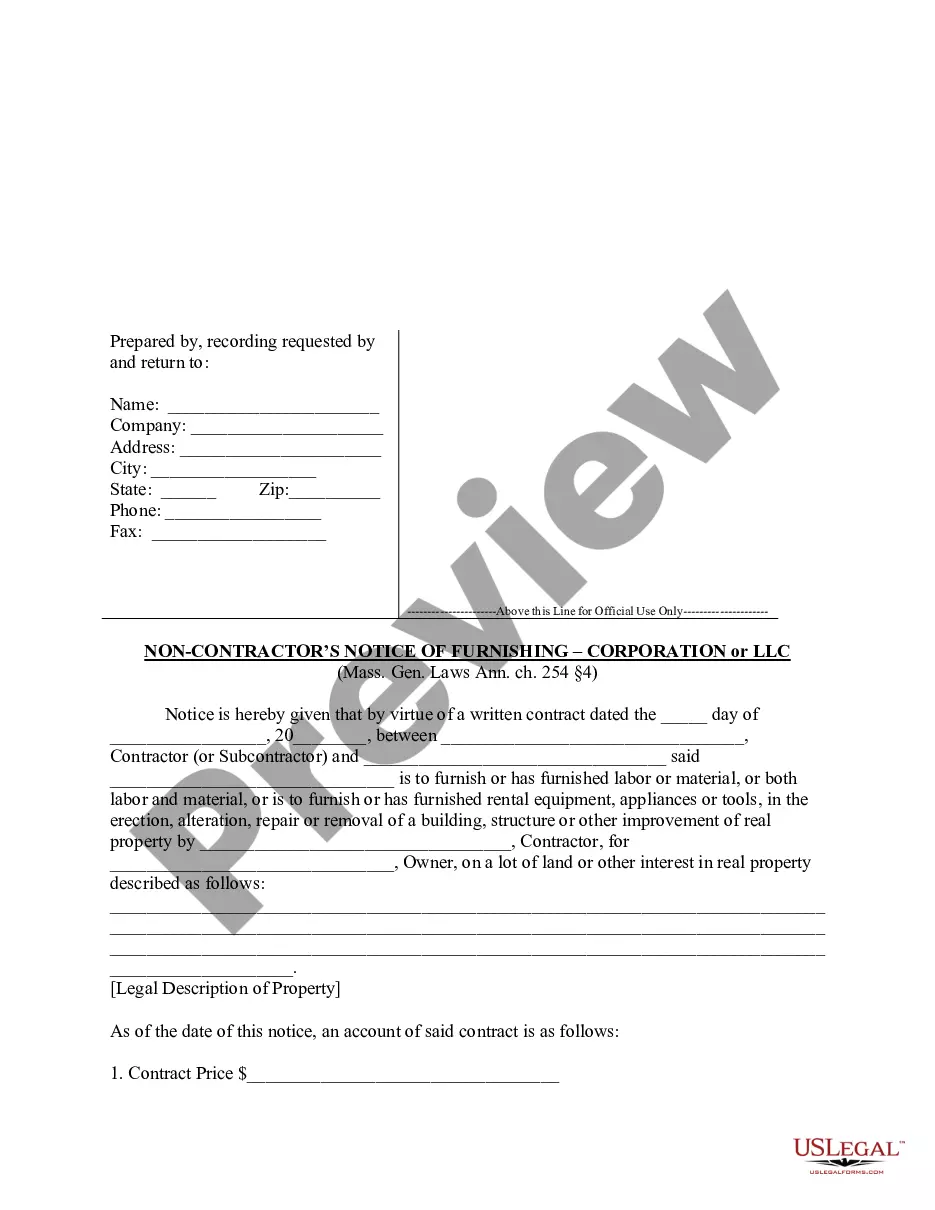

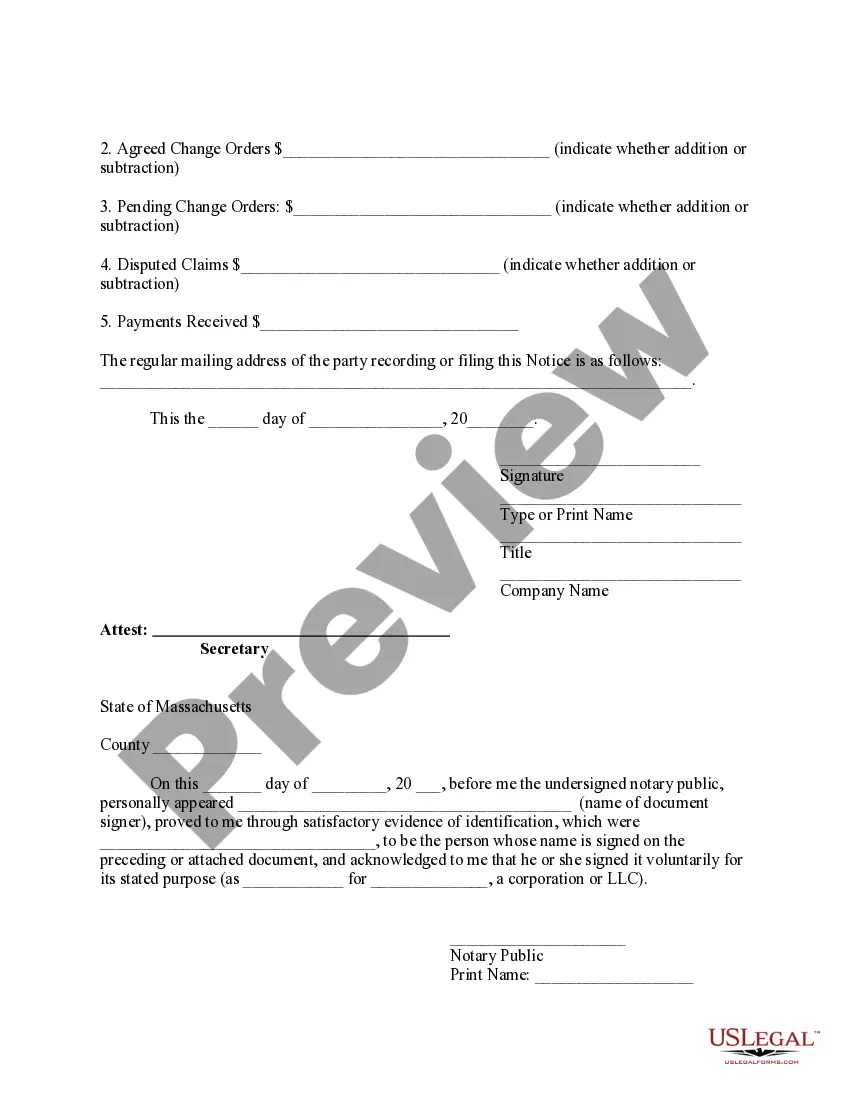

Non Contractor's Notice of Furnishing by Corporation or LLC

Note: This summary is not intended to be an all inclusive discussion of Massachusetts's construction or mechanic's lien laws, but does include basic provisions.

What is a construction or mechanic's lien?

Every State permits a person who supplies labor or materials for a construction project to claim a lien against the improved property. While some states differ in their definition of improvements and some states limit lien claims to buildings or structures, most permit the filing of a document with the local court that puts parties interested in the property on notice that the party asserting the lien has a claim. States differ widely in the method and time within which a party may act on their lien. Also varying widely are the requirements of written notices between property owners, contractors, subcontractors and laborers, and in some cases lending institutions. As a general rule, these statutes serve to prevent unpleasant surprises by compelling parties who wish to assert their legal rights to put all parties who might be interested in the property on notice of a claim or the possibility of a claim. This by no means constitutes a complete discussion of construction lien law and should not be interpreted as such. Parties seeking to know more about construction laws in their State should always consult their State statutes directly.

Who can file a lien in this State?

A person entering into a written contract with the owner of any interest in real property, or with any person acting for, on behalf of, or with the consent of such owner for the whole or part of the erection, alteration, repair or removal of a building, structure, or other improvement to real property, or for furnishing material or rental equipment, appliances, or tools therefor, shall have a lien upon such real property, land, building, structure or improvement owned by the party with whom or on behalf of whom the contract was entered into, as appears of record on the date when notice of said contract is filed or recorded in the registry of deeds for the county or district where such land lies, to secure the payment of all labor, including construction management and general contractor services, and material or rental equipment, appliances, or tools which shall be furnished by virtue of said contract. Said notice may be filed or recorded in the registry of deeds in the county or registry district where the land lies by any person entitled under this section to enforce a lien. Mass. Gen. Laws Ann. ch. 254 §2.

How long does a party have to file a lien?

Such person may file or record the notice of contract at any time after execution of the written contract whether or not the date for performance stated in such written contract has passed and whether or not the work under such written contract has been performed, but not later than the earliest of: (i) sixty days after filing or recording of the notice of substantial completion under section two A; or (ii) ninety days after filing or recording of the notice of termination under section two B; or (iii) ninety days after such person or any person by, through or under him last performed or furnished labor or materials or both labor and materials. Mass. Gen. Laws Ann. ch. 254 §2.

By what method is a lien filed in this State?

Liens under sections two and four shall be dissolved unless the contractor, subcontractor, or some person claiming by, through or under them, shall, not later than the earliest of: (i) ninety days after the filing or recording of the notice of substantial completion under section two A; (ii) one hundred and twenty days after the filing or recording of the notice of termination under section two B; or (iii) one hundred and twenty days after the last day a person, entitled to enforce a lien under section two or anyone claiming by, through or under him, performed or furnished labor or material or both labor and materials or furnished rental equipment, appliances or tools, file or record in the registry of deeds in the county or district where the land lies a statement, giving a just and true account of the amount due or to become due him, with all just credits, a brief description of the property, and the names of the owners set forth in the notice of contract. Liens under sections 2C and 2D shall be dissolved unless a like statement is filed or recorded at the appropriate registry of deeds within 30 days after the last day that a notice of contract may be filed or recorded under the applicable section. A lien under section one shall be dissolved unless a like statement, giving the names of the owner of record at the time the work was performed or at the time of filing the statement, is filed or recorded in the appropriate registry of deeds within the ninety days provided in said section. Nothing in this section shall prohibit the filing or recording of a statement under this section prior to the filing or recording of the notices under section two A or two B. Mass. Gen. Laws Ann. ch. 254 §8.

How long is a lien good for?

Liens under sections two and four shall be dissolved unless the contractor, subcontractor, or some person claiming by, through or under them, shall, not later than the earliest of: (i) ninety days after the filing or recording of the notice of substantial completion under section two A; (ii) one hundred and twenty days after the filing or recording of the notice of termination under section two B; or (iii) one hundred and twenty days after the last day a person, entitled to enforce a lien under section two or anyone claiming by, through or under him, performed or furnished labor or material or both labor and materials or furnished rental equipment, appliances or tools, file or record in the registry of deeds in the county or district where the land lies a statement, giving a just and true account of the amount due or to become due him, with all just credits, a brief description of the property, and the names of the owners set forth in the notice of contract. Liens under sections 2C and 2D shall be dissolved unless a like statement is filed or recorded at the appropriate registry of deeds within 30 days after the last day that a notice of contract may be filed or recorded under the applicable section. A lien under section one shall be dissolved unless a like statement, giving the names of the owner of record at the time the work was performed or at the time of filing the statement, is filed or recorded in the appropriate registry of deeds within the ninety days provided in said section. Nothing in this section shall prohibit the filing or recording of a statement under this section prior to the filing or recording of the notices under section two A or two B. Mass. Gen. Laws Ann. ch. 254 §8.

Are liens assignable?

Massachusetts statutes on construction liens do not specifically speak as to whether liens may be assigned to other parties.

Does this State require or provide for a notice from subcontractors and laborers to property owners?

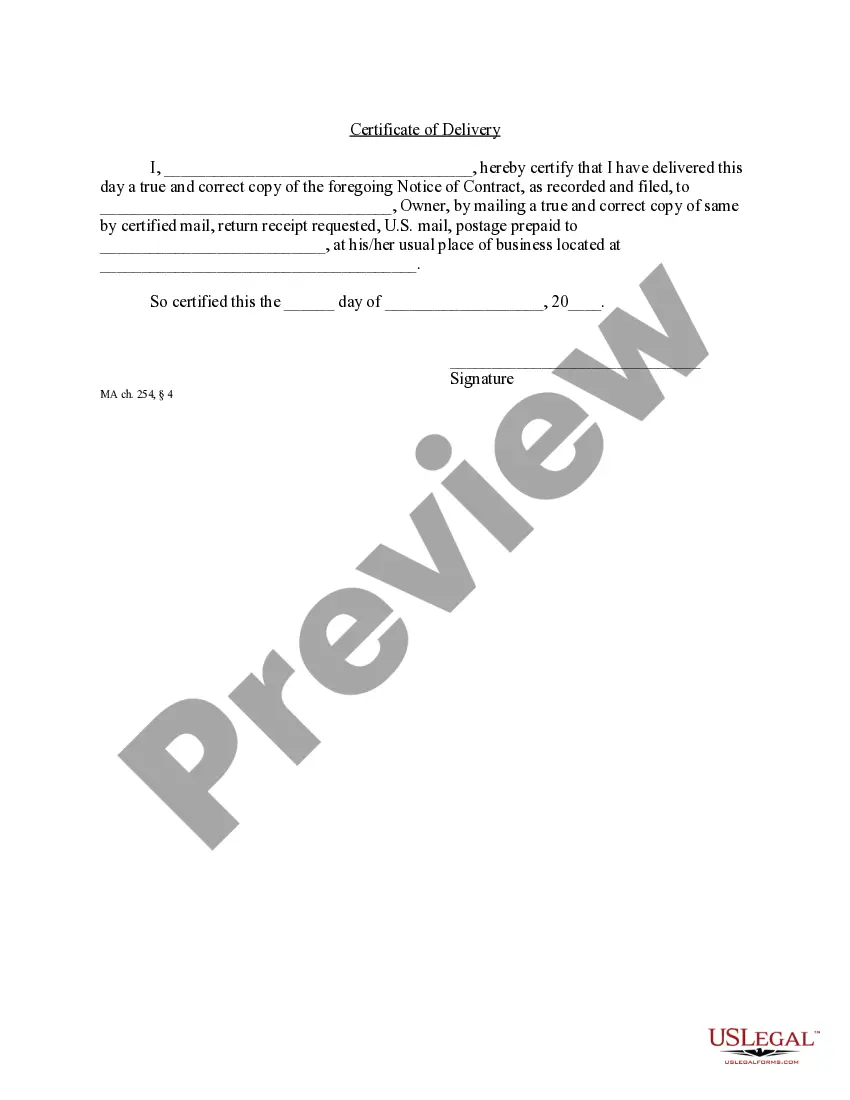

Yes. Massachusetts statutes provide that contractors and subcontractors put the property owner on notice by filing a notice of contract. Also, parties who contract with the contractor or subcontractor may also provide notice with a notice of furnishing. Finally, either the owner or the contractor may provide notice that the project is complete by filing a notice of substantial completion.

Does this State require or provide for a notice from the property owner to the contractor, subcontractor, or laborers?

Property owners may record a notice of substantial completion as well as a notice of termination if the contract is terminated prior to substantial completion.

Does this State require a notice prior to starting work, or after work has been completed?

A contractor, subcontractor, or other party, may signify a project has started with a notice of contract and either the property owner or the principal contractor may file a notice of substantial completion.

Does this State permit a person with an interest in property to deny responsibility for improvements?

No. Massachusetts statutes do not have a provision which permits the denial of responsibility for improvements.

By what method does the law of this State permit the release of a lien?

Lien holders may use a dissolution of lien form to record the release of a lien. Also, Massachusetts statutes permit a bond to be filed to release a lien.