Llc Vs Ltd Canada

Description

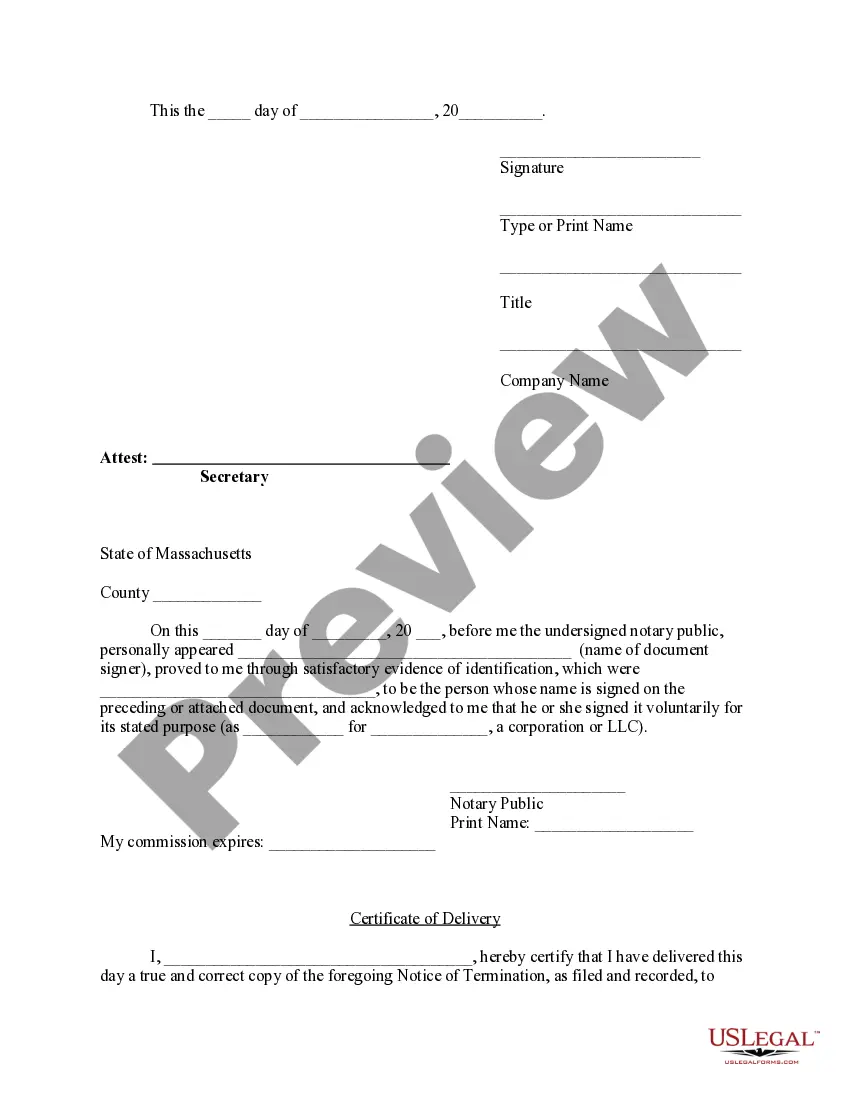

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- If you're a returning user, simply log in to your account and download the required form template. Ensure that your subscription is active; if it isn't, renew it according to your payment plan.

- For first-time users, start by exploring the Preview mode and reviewing the form description. This ensures you select the document that best fits your needs and complies with your local regulations.

- If the initial template doesn't meet your needs, utilize the Search tab above to locate a different form that suits your criteria.

- Once you've found the right document, click on the Buy Now button and choose your preferred subscription plan, ensuring you register an account to access the expansive library.

- Proceed to complete your purchase by entering your credit card information or using your PayPal account for secure payment.

- After your transaction is confirmed, download your chosen form and save it to your device. You can always revisit it later in the My Forms section of your profile.

US Legal Forms provides a robust collection of legal templates, exceeding competitors in variety and affordability. With over 85,000 editable forms, users can ensure compliance and precision in their legal documents.

Take control of your legal needs with US Legal Forms today. Start your journey to seamless document completion and ensure your business is set for success!

Form popularity

FAQ

While Canada does not have LLCs per se, the benefits of a similar structure, like a Corporation, can offer similar advantages. These benefits include limited liability, enhanced credibility, and potential tax advantages. When navigating the Llc vs ltd canada conversation, understanding these benefits equips you to make the right choices. For tailored guidance, consider seeking resources from platforms like uslegalforms.

LLCs are primarily a U.S. business entity, popular for their flexibility and protection. While similar structures exist globally, they may go by different names or have different characteristics. Therefore, if you’re working within the Llc vs ltd canada context, it’s vital to understand the offerings available in Canada. Familiarizing yourself with local regulations can aid in effective decision-making.

Canada has opted for different business structures, such as Corporations and Partnerships, instead of LLCs. The legal framework in Canada focuses on these forms, which provide liability protection and governance tailored for Canadian businesses. This distinction highlights a key difference when working through Llc vs ltd canada. Understanding these variations can help you make informed decisions about your business structure.

Yes, a Canadian can own an LLC, but this typically applies to LLCs registered in the United States. If you are a Canadian considering this option, it's essential to understand the regulations surrounding ownership. This involvement might impact your business strategy, especially when discussing Llc vs ltd canada. Consulting a legal expert can provide you with personal insights tailored to your situation.

In Canada, you won't find LLCs as they exist in the United States. Instead, businesses often register as Limited Partnerships or Corporations. This distinction is important to understand when comparing Llc vs ltd canada. Getting familiar with these terms can help you choose the right structure for your business aspirations.

In Canada, LTD, or Limited, refers to a corporation that provides limited liability to its shareholders. This type of corporation is a popular choice for many entrepreneurs due to its ability to separate personal and business assets. Navigating the landscape of LLC vs LTD Canada may seem daunting, but resources like US Legal Forms can aid you in making informed decisions.

Canada's version of an LLC is often referred to as a Limited Partnership or Limited Liability Company, depending on the province. These structures offer similar benefits, such as liability protection and flexibility in management. The choice between an LLC and LTD in Canada can depend on specific business goals and strategies. Consulting experts in this field will guide you toward the best decision.

In Canada, Ltd stands for 'Limited,' which designates a type of corporation that limits shareholder liability. This corporate structure enables growth and can attract investors while protecting personal assets. The regulations surrounding Ltd firms can vary by province, making it crucial to research local laws. Using platforms like US Legal Forms can help simplify this process.

Limited liability refers to the legal protection offered to owners, shielding personal assets from business debts. A corporation, such as an LTD, is a distinct legal entity that holds this liability protection. The main difference lies in complexity and structure; a corporation often has more regulatory requirements. Understanding these aspects is essential when navigating your options in LLC vs LTD Canada.

The US equivalent of LTD is generally referred to as a Corporation or an Inc. This structure offers liability protection to its owners and shareholders. The setup and maintenance of a Corporation can differ significantly, influencing your choice between LLC vs LTD Canada. Evaluating your business needs helps in making this decision.