Llc Company Uk

Description

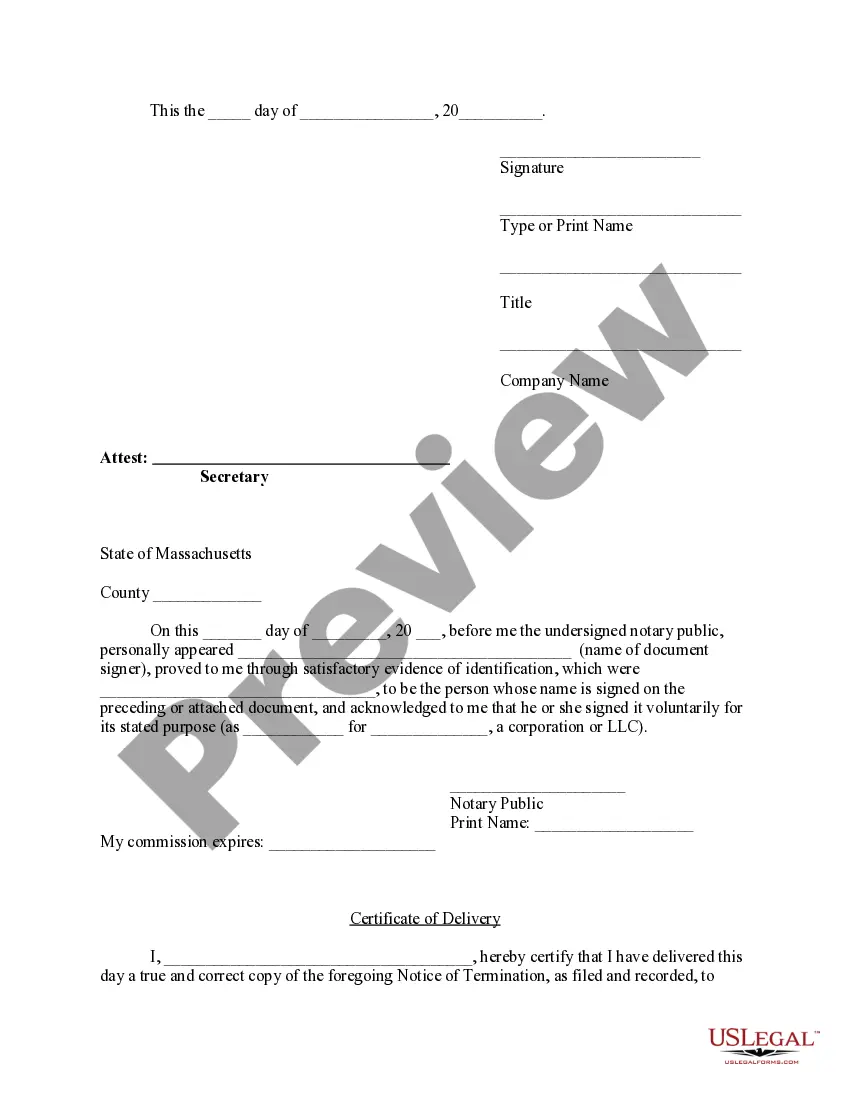

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- Log in to your account if you are an existing user. Ensure your subscription is active; otherwise, renew it to access the form templates.

- Preview the available form templates and their descriptions to find the one that aligns with your requirements and jurisdiction.

- Search for additional templates if necessary. If you notice any discrepancies, utilize the Search feature to locate the correct form.

- Proceed to purchase the selected document by clicking the 'Buy Now' button. Choose the subscription plan that best fits your needs.

- Complete your payment using either a credit card or PayPal. Ensure the transaction is confirmed to gain access to the necessary resources.

- Download the chosen form template to your device and visit the 'My Forms' section of your account whenever you need to retrieve it.

In conclusion, US Legal Forms simplifies the process of obtaining legal documents for your LLC company in the UK. With their vast library of over 85,000 fillable forms, coupled with expert assistance, you can ensure your documents are correct and meet all legal requirements.

Start your journey towards establishing your LLC today by exploring US Legal Forms!

Form popularity

FAQ

The US equivalent of a UK limited company (LTD) is the Limited Liability Company (LLC). Both structures provide liability protection, meaning that personal assets are generally safe from business debts. However, the operating principles and taxation can differ significantly between the two. If you aim to establish an LLC company in the US, leveraging services from uslegalforms can guide you through the formation process, ensuring you meet all necessary legal requirements.

The four main types of business structures in the UK are sole traders, partnerships, limited companies (LTD), and limited liability partnerships (LLP). Each structure offers distinct benefits and limitations concerning liability, taxation, and administrative responsibilities. If you’re exploring the LLC company UK concept, the LLP might closely resemble the characteristics of an LLC in the US. It's important to evaluate which structure best suits your business objectives.

In the UK, the term LLC is not commonly used; instead, the structure similar to an LLC is referred to as a Limited Liability Partnership (LLP). While you won’t find LLCs registered under UK law, many individuals seeking the benefits of limited liability choose to set up an LLP. This arrangement can provide the same protection for personal assets as an LLC company in the US. For tailored guidance, consider platforms like uslegalforms to facilitate your understanding.

An LLC, or Limited Liability Company, and an LTD, or Private Limited Company, serve different purposes in the UK. The primary difference lies in ownership and management. An LTD is more common in the UK, whereas LLCs are primarily recognized in the US. If you're interested in operating as an LLC company in the UK, understanding these distinctions can help you choose the right structure.

An LLC, or Limited Liability Company, is predominantly a US business structure, designed to provide limited liability to its owners. In the UK, the equivalent would be private limited companies, which share similar liability protections but differ in regulation and operation. Understanding whether to establish a business in the UK or the US will depend on various factors, including your goals and target market. Uslegalforms can aid you in navigating these choices effectively.

An example of a limited company is XYZ Limited, which operates under the UK's Companies Act. This structure allows businesses to limit their financial liabilities while providing a formal framework for operations. Many successful businesses in the UK operate as limited companies, enjoying the benefits of limited liability protection. If you're looking to form a limited company, uslegalforms can provide the necessary templates and guidance.

No, LLCs are primarily a US concept, but many countries have similar business structures that offer limited liability. For instance, the UK has private limited companies that imitate certain functions of an LLC. Understanding the distinctions helps you make informed decisions for your business setup. If you're exploring global options, familiarize yourself with local laws to ensure compliance.

The closest UK equivalent of a US LLC is a private limited company, often labeled as Ltd. This structure provides limited liability to its owners, similar to LLCs in the US. A private limited company separates personal finances from business debts, offering protection to its shareholders. If you’re considering this route, ensure you're aware of the reporting and compliance requirements involved.

Setting up a small limited company in the UK requires submitting specific documents to Companies House. You'll need to choose a company name, appoint directors, and create a statement of capital. It's essential to have a registered office address and to comply with legal obligations afterwards. For assistance with the process, consider using resources like uslegalforms, which can guide you through the paperwork.

A UK Ltd company is not exactly the same as an LLC, but they share some similarities. Both provide limited liability protection, meaning that your personal assets are generally safe from company debts. However, a UK Ltd company has different legal structures and regulations compared to an LLC in the US. Understanding these differences can help you choose the right option for your needs.