Limited Companies

Description

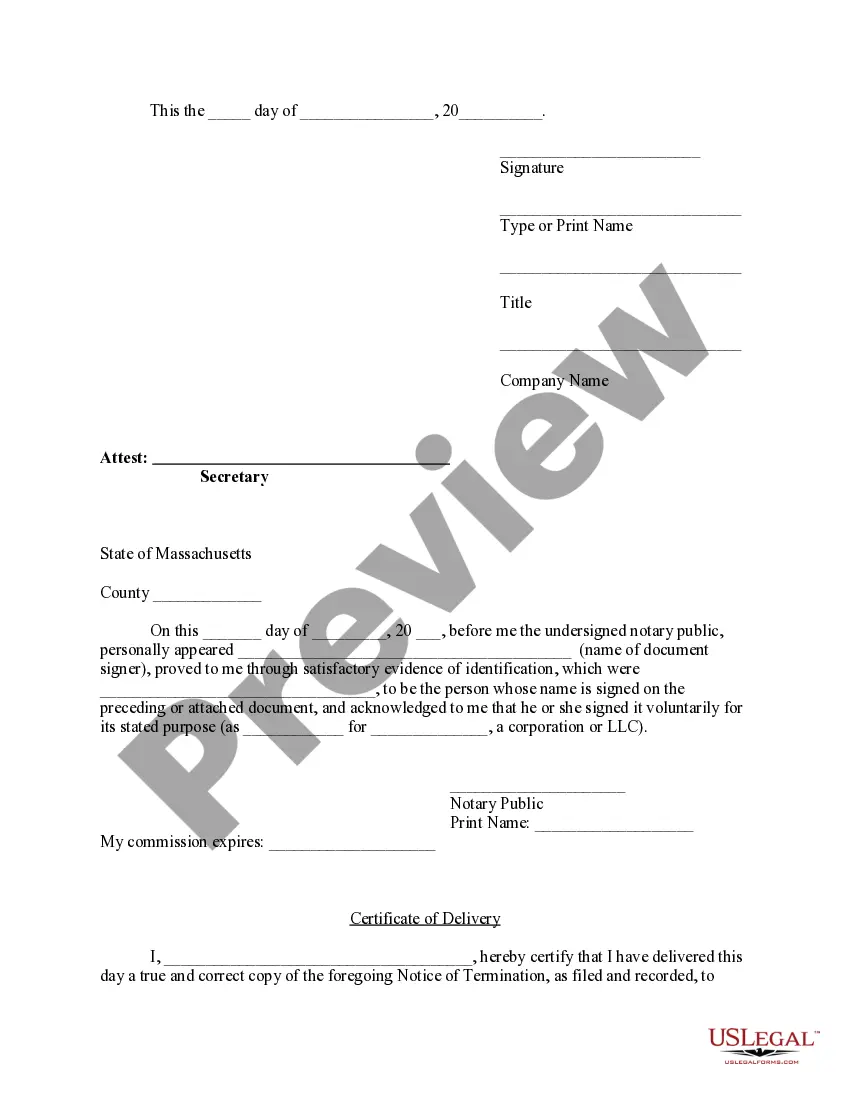

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- Log in to your account if you're a returning user and verify your subscription status to access your preferred forms.

- If you are new to US Legal Forms, start by exploring the extensive library of templates. Make sure to preview the documents and confirm they meet your specific jurisdiction requirements.

- Utilize the search feature to find alternative templates if you don’t find the right one initially. Ensure the template is suitable before proceeding.

- Select the desired form and click 'Buy Now' to choose a subscription plan that works for you. You will need to create an account to access the library.

- Complete your purchase by entering your payment details via credit card or PayPal to finalize your subscription.

- Download the completed form to your device. You can later access it anytime through the 'My Forms' section in your account.

Using US Legal Forms empowers both individuals and attorneys to swiftly create essential legal documents. With a robust collection of over 85,000 fillable forms, you get unique benefits not found in other services, including access to premium experts for guidance.

Take advantage of US Legal Forms today to streamline the legal documentation process for your limited company. Start your journey by visiting their website for more details!

Form popularity

FAQ

One significant disadvantage of a limited company is the potential for reduced control by its owners. As companies grow and bring in additional investors or shareholders, founders may find their influence diminished. Additionally, the legal obligations and complexities associated with maintaining a limited company can be overwhelming for small business owners without sufficient support or experience.

The primary difference between Ltd and LLC lies in their formation and regulatory frameworks. An Ltd, or limited company, is typically governed under corporate laws and can issue shares to the public. In contrast, an LLC, or limited liability company, is often favored for its flexibility and simpler management structure, protecting owners from personal liability while requiring fewer formalities.

Public limited companies face unique challenges. Firstly, they must comply with extensive regulations and disclosure requirements, which can be burdensome. Secondly, they are subject to market pressures, affecting decision-making and potentially prioritizing short-term profits over long-term strategy. Finally, ownership is diluted as shares are sold to the public, which may reduce control for original founders.

Choosing to form a limited company can be a good idea, depending on your business goals. It offers personal liability protection and can enhance your credibility with customers. Moreover, limited companies have more options for raising capital through share sales, making them attractive for growing businesses.

Limited companies have several disadvantages. They face stricter regulations and more administrative work compared to sole proprietorships. Additionally, the initial setup costs can be higher due to legal filings and compliance requirements. Owners may also have limited access to certain tax benefits available to sole traders.

To clarify whether you are an S corporation or an LLC, look at your business structure and tax designation. An LLC can elect to be taxed as an S corp, but it retains its limited liability status as a company. Most importantly, confirm your tax filings and procedural documents to verify your status. For thorough assistance, platforms like uslegalforms provide comprehensive support and guides related to limited companies.

Choosing between an S corp and a C corp for your startup involves understanding your future growth and funding goals. An S corporation allows for pass-through taxation, which may benefit startups expecting to distribute profits to shareholders. Conversely, a C corporation might be the better choice if your startup plans to reinvest profits or attract venture capital. Weigh these options carefully, and consult professionals if you're unsure.

To determine if your LLC operates as a C corp or an S corp, review your IRS filings and the election form you submitted when you opted for S corporation status. If you elected S corporation status by filing IRS Form 2553, then your LLC is an S corp. If you have not made any such election, your LLC is treated as a C corporation by default. For help with this, uslegalforms offers resources to clarify your filing status.

A limited company typically needs to file specific documents to maintain its status and legally operate. The most common requirements include filing annual reports, tax returns, and any other state-mandated documents. As regulations can vary by state, it's crucial to consult local laws regarding what your limited company must file. Using platforms like uslegalforms can simplify this process through easy guides and templates.

Determining whether your LLC is classified as an S or C corporation hinges on the tax status you’ve chosen for your business. If you filed for S corporation status, your LLC is an S corp; otherwise, it defaults to classification as a C corporation. Carefully review your tax filings or consult a tax professional to confirm your LLC’s classification. This can significantly impact your tax obligations as a limited company.