An Advantage Of A Limited Liability Company (llc) Is

Description

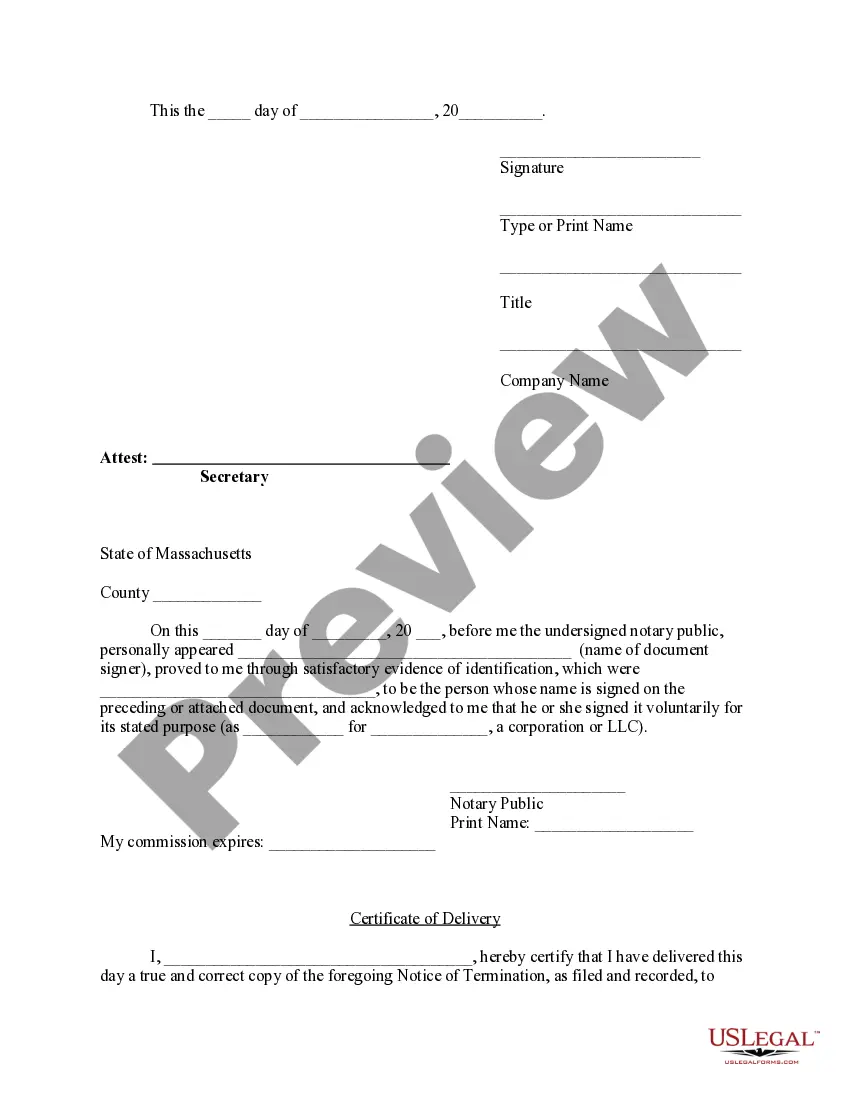

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- Begin by visiting the US Legal Forms website. If you're an existing user, log in to your account to access your library.

- Select your desired form by reviewing the Preview mode and form description to ensure it meets your specific needs and complies with local regulations.

- If necessary, utilize the search function to find the correct template that fits your requirements.

- Choose the document you need and click the Buy Now button. Select a subscription plan that aligns with your needs and create an account for full access.

- Proceed to purchase by entering your payment details, either via credit card or PayPal.

- Finally, download the form to your device and access it anytime through the My Forms section of your profile.

In summary, US Legal Forms not only offers a vast library of over 85,000 legal forms but also provides access to premium experts who can assist you in completing your forms accurately.

Start your journey towards establishing your LLC today by visiting US Legal Forms and ensuring your legal documentation is in order!

Form popularity

FAQ

An advantage of a limited liability company (LLC) is its ability to limit personal liability for business debts. This means that your personal assets are generally protected if your business faces legal issues or financial troubles. This protection gives you the peace of mind needed to focus on growing your business with confidence.

An advantage of a limited liability company (LLC) is the protection it offers your personal assets while allowing you to benefit from the business's profits. You can expand your business opportunities, apply for loans, and take on new projects. By using your LLC strategically, you can leverage tax deductions and gain credibility in the market.

An advantage of a limited liability company (LLC) is the way it integrates into your personal tax situation. As a single-member LLC owner, you usually report your business income on your personal tax return, which simplifies filings. This can save time and may help you qualify for certain credits or deductions.

An advantage of a limited liability company (LLC) is that it simplifies tax filing for many business owners. Generally, if you are the sole owner, your LLC's income gets reported on your personal tax return. This combination streamlines the process and can make it easier to manage your finances.

An advantage of a limited liability company (LLC) is that it offers various tax benefits. LLCs can be taxed as sole proprietorships, partnerships, or corporations, allowing owners to choose the most advantageous structure. This flexibility enables individuals to reduce their overall tax burden and maximize their deductions easily.

An advantage of a limited liability company (LLC) is the straightforward process of writing off taxes. Owners can identify and document all business-related expenses throughout the year. Engaging with a tax professional or using platforms like USLegalForms can simplify the process and help maximize your deductions effectively.

An advantage of a limited liability company (LLC) is the ability to claim a variety of deductions. While many expenses are partially deductible, certain costs are 100% deductible. Examples include business insurance premiums, professional services fees, and advertising expenses, all of which can significantly lower your taxable income.

An advantage of a limited liability company (LLC) is the combination of liability protection and flexible management options. Owners can manage the business without exposing personal assets to risks. Utilizing these benefits, along with tax efficiencies and operational perks, demonstrates how an LLC can be a powerful tool for business growth.

An advantage of a limited liability company (LLC) is the potential tax flexibility, but there are also disadvantages to consider. One major tax drawback is the self-employment tax that applies to LLC members. Additionally, LLCs may face varying tax treatment in different states, impacting the overall tax strategy.

An advantage of a limited liability company (LLC) is that it can minimize tax liabilities through various strategies. For instance, LLCs can take advantage of deductions for business expenses, allowing profits to be taxed at lower rates. Furthermore, some LLCs may qualify for tax credits that reduce overall tax burdens.