Massachusetts Odometer Disclosure Statement Withholding Tax

Description

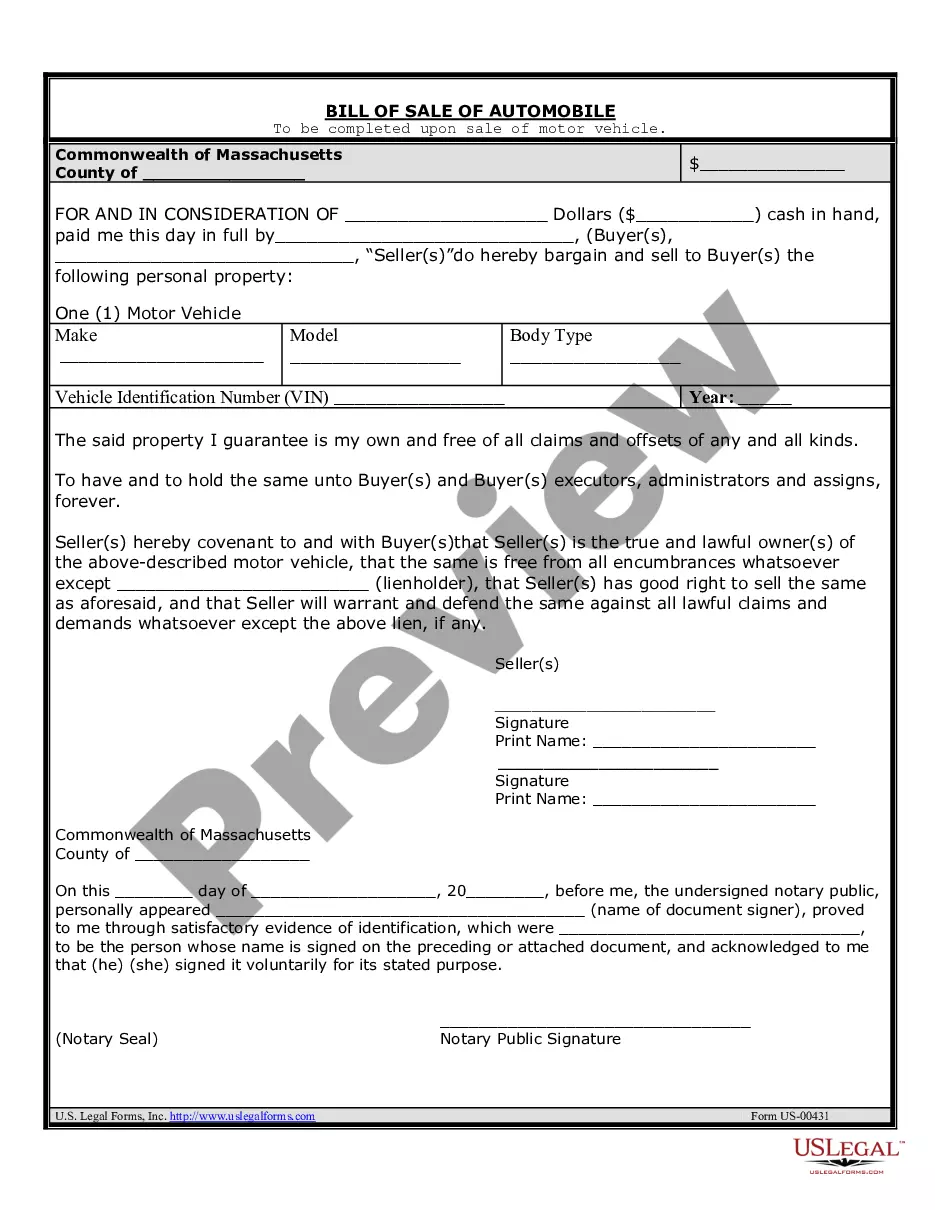

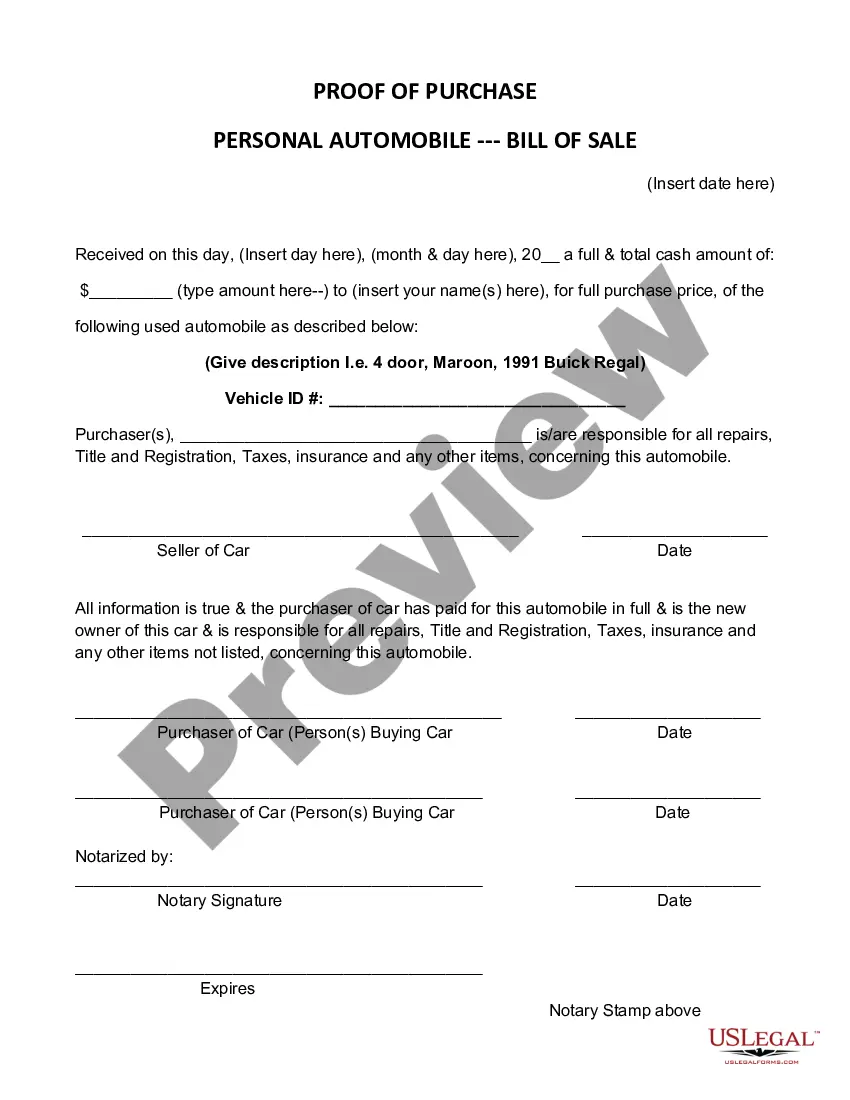

How to fill out Massachusetts Bill Of Sale Of Automobile And Odometer Statement?

Managing legal documents can be daunting, even for the most seasoned professionals.

When you are seeking a Massachusetts Odometer Disclosure Statement Withholding Tax and do not have the opportunity to invest time in finding the correct and updated version, the process can be overwhelming.

Benefit from a valuable resource archive of articles, guides, and manuals pertinent to your circumstance and requirements.

Conserve time and effort in locating the documents you require, and use US Legal Forms’ advanced search and Preview feature to find the Massachusetts Odometer Disclosure Statement Withholding Tax and obtain it.

Confirm that the template is accepted in your state or county. Proceed to select Buy Now when you are ready. Choose a subscription plan that suits you. Find the file format you need, and Download, complete, eSign, print, and send your documents. Leverage the US Legal Forms online library, backed by 25 years of expertise and reliability. Revamp your routine document management into a seamless and user-friendly experience today.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check the My documents section to view the documents you previously saved and manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account for unlimited access to all the library's benefits.

- Here are the steps to follow after obtaining the form you require.

- Ensure it is the right form by reviewing it and examining its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to all requests you may have, from personal to corporate paperwork, in one convenient location.

- Utilize sophisticated tools to fill out and oversee your Massachusetts Odometer Disclosure Statement Withholding Tax.

Form popularity

FAQ

Yes, if you have overpaid your withholding tax, it is possible to receive a refund. You must file the appropriate forms with the state to initiate the refund process. Be sure to keep all records of your transactions and tax filings, as this documentation is crucial for a successful claim. If you have questions about the process, uslegalforms can offer guidance through the necessary steps.

To remove withholding tax from your transaction, you'll need to provide relevant documentation that proves your exemption under Massachusetts law. This could involve submitting an exemption certificate or proving a specific type of transaction qualifies for an exemption. Using uslegalforms can simplify the process, providing templates you can fill out easily. Always check the latest tax regulations to ensure compliance.

You are charged withholding tax on the sale or transfer of a vehicle as part of the Massachusetts odometer disclosure statement process. This tax is imposed to ensure that the state collects revenue from vehicle sales. Understanding this requirement helps you prepare for the costs associated with vehicle transactions. If you need more help with documentation, consider using a comprehensive platform like uslegalforms for accurate forms.

In Massachusetts, the odometer disclosure statement withholding tax is required for certain transactions. If your situation qualifies under the tax law, you may not have to withhold taxes. To ensure clarity, consult a tax professional who can guide you based on your unique circumstances. By doing so, you can better understand your options regarding this withholding tax.

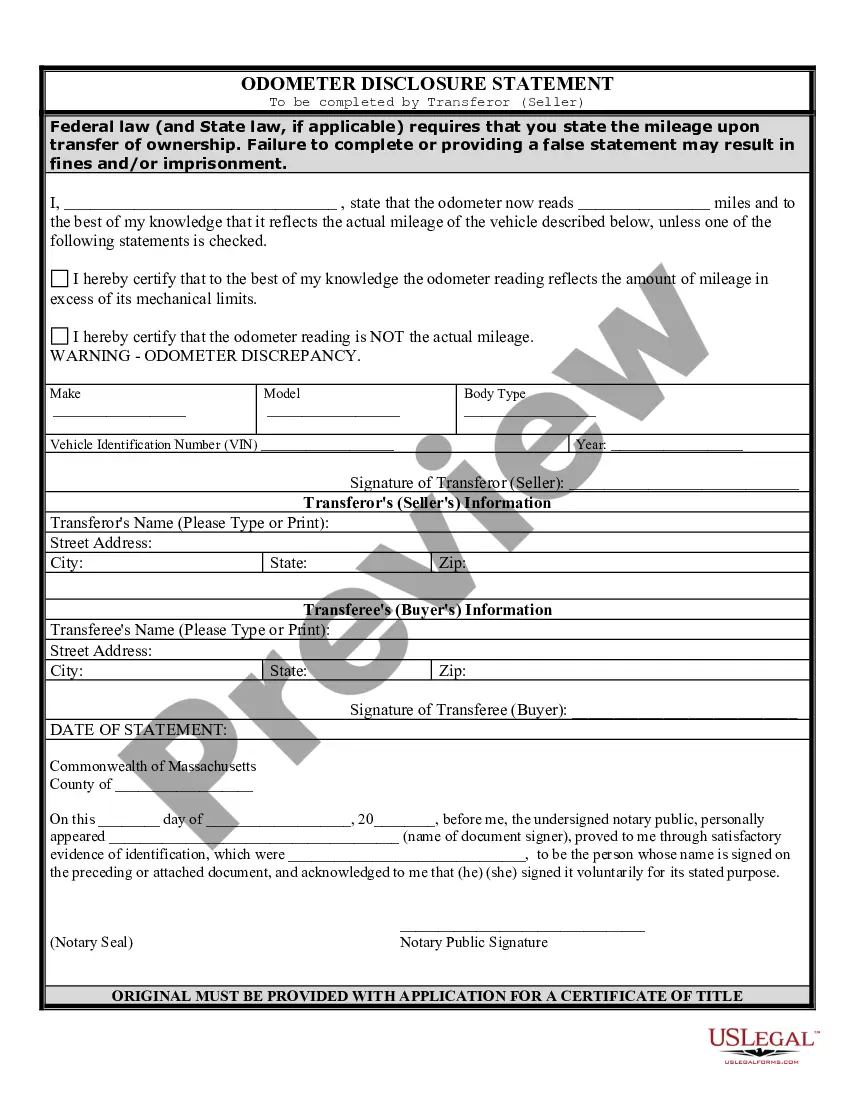

Yes, an odometer disclosure statement is required in Massachusetts for certain vehicle transactions, especially when transferring titles for cars less than ten years old. This statement protects both the buyer and seller by documenting the true mileage of the vehicle. Failing to provide this statement can lead to complications down the line. To navigate these requirements and stay compliant with the Massachusetts odometer disclosure statement withholding tax, turn to uslegalforms for reliable templates and assistance.

The Form M-3 is used by employers in Massachusetts to reconcile the income taxes that have been withheld from employees' wages throughout the year. This form helps to ensure that the total withheld aligns with what is reported to employees and the state. Completing the M-3 accurately is crucial to avoid potential penalties. For more information on tax processes, including Massachusetts odometer disclosure statement withholding tax, consider using the services offered by uslegalforms.

To create an odometer disclosure statement, you need to include key details such as the vehicle’s make, model, year, and the current mileage. It is important to clearly indicate if the odometer reading is accurate or if it has rolled over. Additionally, both the seller and buyer should sign and date the document to validate it. Resources like uslegalforms can assist you in crafting a compliant odometer disclosure statement while ensuring you stay informed about Massachusetts odometer disclosure statement withholding tax.

When filing your taxes in Massachusetts, you should review your personal situation to determine the number of exemptions you can claim. Generally, consider your filing status, dependents, and any special circumstances. It's essential to not overestimate your exemptions, as this could lead to under-withholding and result in tax dues. Utilizing tools or services that specialize in the Massachusetts odometer disclosure statement withholding tax can guide you on the right path.

Fill out the CT sales and use tax resale certificate by providing your business details. Include the reason for the resale, along with your state tax identification number. Once completed, present this certificate to your vendor to ensure your purchases are tax-exempt, which ties back to managing your Massachusetts odometer disclosure statement withholding tax effectively.

Mail Massachusetts Form 1 NR py to the appropriate address listed on the form’s instruction page. Generally, non-residents send their completed forms to the Massachusetts Department of Revenue. Ensuring timely submission helps avoid any complications related to your Massachusetts odometer disclosure statement withholding tax.