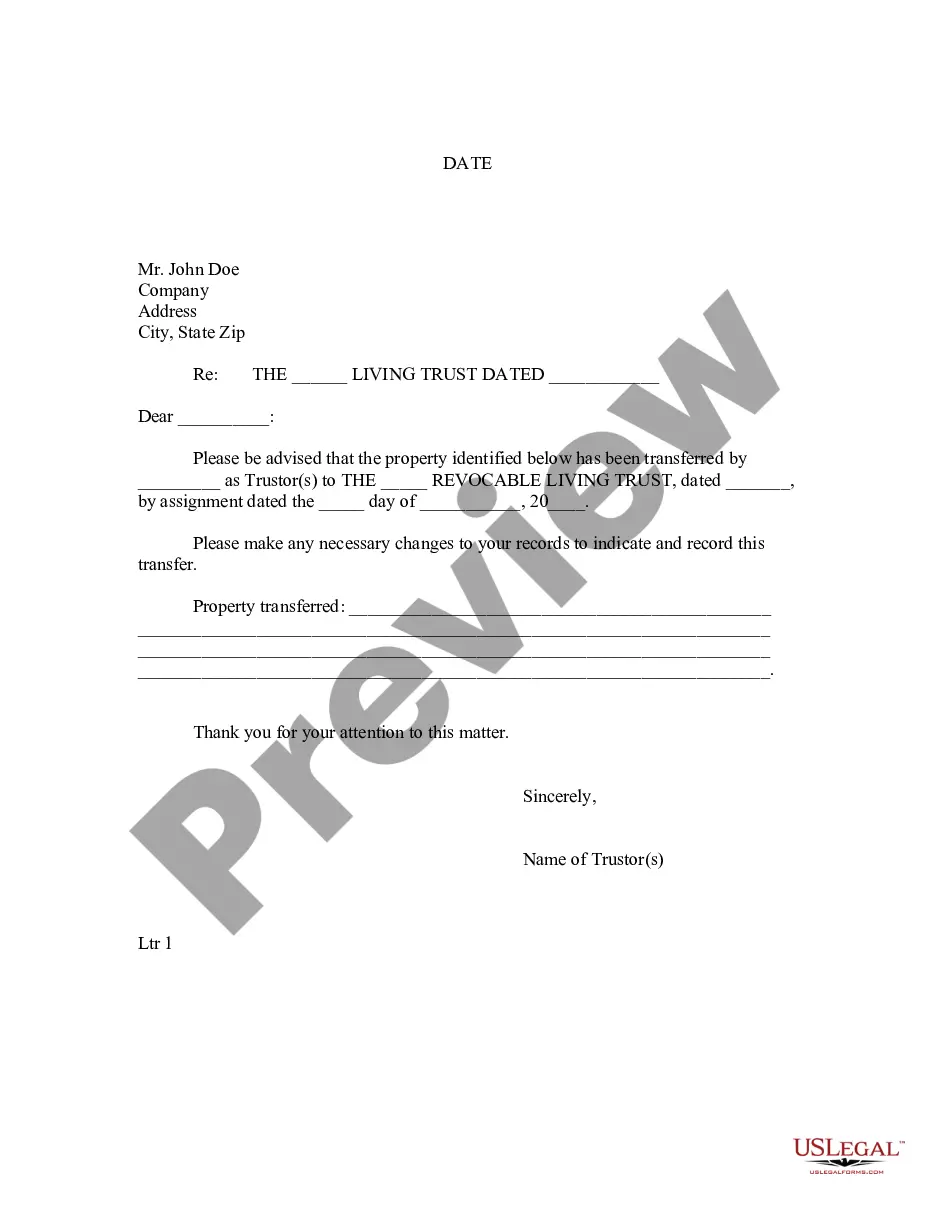

A letter of guarantee for payment is a formal document issued by a bank or financial institution that assures the recipient that payment will be made in full and on time by a specified party. This type of letter serves as a written commitment to fulfill financial obligations and is commonly used in various transactions and legal agreements to provide security and assurance. The letter of guarantee for payment acts as a protective measure for the beneficiary, ensuring that they will be compensated in case of default or non-payment by the obligated party. It helps establish trust and mitigate financial risks involved in business deals, contracts, loans, or transactions where substantial amounts of money are at stake. There are different types of letters of guarantee for payment, each serving a specific purpose and catering to diverse financial requirements: 1. Payment guarantee letter: This is the most common type of letter of guarantee for payment. It assures the beneficiary that a specific payment or debt will be settled by the guarantor in case the obligated party fails to fulfill their obligation. 2. Bid bond letter: In certain business scenarios, such as submitting tenders or bidding for contracts, a bid bond letter of guarantee is required. It asserts that the bidder has the financial capability to undertake the project and will provide the necessary performance and payment guarantees if awarded the contract. 3. Performance bond letter: This type of letter guarantees that a party will fulfill their contractual obligations satisfactorily. It ensures that the beneficiary will be compensated if the principal fails to honor their commitments, such as completing a project on time or meeting certain performance standards. 4. Advance payment guarantee letter: When a party advances funds or makes a prepayment for goods or services, an advance payment guarantee letter is issued to protect the recipient's interests. It assures the beneficiary that if the obligated party fails to deliver the agreed-upon goods or services or defaults on the contract, the advanced payment will be returned. 5. Customs guarantee letter: International trade often requires customs duties, fees, or taxes to be paid. A customs guarantee letter provides assurance that these financial obligations will be settled on behalf of the importer or exporter in case of non-compliance or inability to pay. In conclusion, a letter of guarantee for payment is an essential financial instrument that provides assurance and security in various business transactions and legal agreements. These letters are tailored to different circumstances and obligations, offering protection and ensuring the fulfillment of financial commitments.

Letter Of Guarantee For Payment

Description

How to fill out Letter Of Guarantee For Payment?

It’s obvious that you can’t become a law expert immediately, nor can you grasp how to quickly prepare Letter Of Guarantee For Payment without the need of a specialized set of skills. Putting together legal forms is a time-consuming venture requiring a specific training and skills. So why not leave the creation of the Letter Of Guarantee For Payment to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court paperwork to templates for in-office communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and get the form you need in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to figure out whether Letter Of Guarantee For Payment is what you’re looking for.

- Begin your search over if you need a different form.

- Set up a free account and select a subscription option to purchase the form.

- Pick Buy now. As soon as the transaction is complete, you can download the Letter Of Guarantee For Payment, complete it, print it, and send or mail it to the necessary individuals or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

A letter of guarantee can be issued by banks, insurance companies, or other financial entities that evaluate the risk involved. Additionally, individuals with sufficient resources and trust can also act as guarantors. It is advisable to work with professionals who can ensure the letter of guarantee for payment meets all necessary legal requirements.

To guarantee payment, the guarantor must assure that they will cover the payment if the primary party defaults. This can include issuing a formal letter of guarantee for payment outlining the terms and conditions. It is vital that all parties involved understand the extent of the guarantee and the obligations it entails.

The three common types of guarantees include performance guarantees, payment guarantees, and bid bonds. Each type serves a distinct purpose in contract agreements and provides assurance to the other party involved. Understanding these distinctions is essential when considering a letter of guarantee for payment, ensuring you select the right type for your needs.

You can get a payment guarantee by approaching a reputable financial institution or interested guarantor with a solid proposal. Start by preparing your financial records to demonstrate your creditworthiness. Platforms like US Legal Forms can provide templates and legal assistance to draft a proper letter of guarantee for payment.

Guarantees are typically issued by banks, credit unions, or insurance companies that independently assess the financial capacity of the individual or entity seeking the guarantee. These institutions ensure that there is sufficient collateral to back the letter of guarantee for payment. Their involvement lends credibility and security to the transaction.

A guarantee letter is often written by a lender, financial institution, or a reliable individual who agrees to take responsibility for a payment. This writer outlines the terms and conditions of the guarantee, ensuring it aligns with the expectations of the recipient. It's critical that the writer clearly expresses their intention to guarantee payment.

To obtain a payment guarantee, you must first identify a reliable financial institution or guarantor willing to issue the letter. You will need to provide relevant financial documentation and information to support your request. Using a platform like US Legal Forms can simplify this process, guiding you to create an appropriate letter of guarantee for payment.

A guarantor letter can be written by individuals with sufficient financial standing and trustworthiness. This could include family members, close friends, or business partners. It is essential that the guarantor understands the obligations tied to the letter of guarantee for payment, as they assume liability for the payment responsibility.

A letter of guarantee for payment is typically provided by a financial institution, such as a bank, or a trusted third party. These entities assess the creditworthiness of the individual or business requesting the letter and then issue it based on their financial stability. This letter assures the recipient that payment will be made as agreed.

A letter of guarantee on a financial statement indicates a company’s commitment to fulfill another company’s financial obligations. It reassures stakeholders of the company’s reliability and integrity in business transactions. This letter is often included to provide additional assurance to investors and creditors, highlighting the company’s financial stability and responsibility.