Receipt And Release Form Estate Withdrawal

Description

How to fill out Louisiana Receipt And Release?

Well-crafted official paperwork is one of the essential assurances for preventing issues and legal disputes, but securing it without the assistance of a lawyer may require time.

Whether you require to swiftly locate a current Receipt And Release Form Estate Withdrawal or any other documentation for work, family, or business matters, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and press the Download button adjacent to the selected document. Furthermore, you can retrieve the Receipt And Release Form Estate Withdrawal anytime later, as all paperwork previously obtained on the platform is accessible within the My documents section of your account. Conserve time and resources in preparing official documentation. Experience US Legal Forms today!

- Verify that the form is appropriate for your situation and locality by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Press Buy Now once you discover the relevant template.

- Select the pricing option, Log In to your account or create a new one.

- Choose your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Select either PDF or DOCX format for your Receipt And Release Form Estate Withdrawal.

- Click Download, then print the document to complete it manually or upload it to an online editor.

Form popularity

FAQ

STEP 1: Download and complete your forms.STEP 2: Mail or hand deliver a copy of your forms to all people who have an interest in the estate.STEP 3: File JDF 965 Statement of Personal Representative Closing Administration with the court.STEP 1: Download and complete your forms.More items...

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. However, any subsequent earnings on the inherited assets are taxable, unless it comes from a tax-free source.

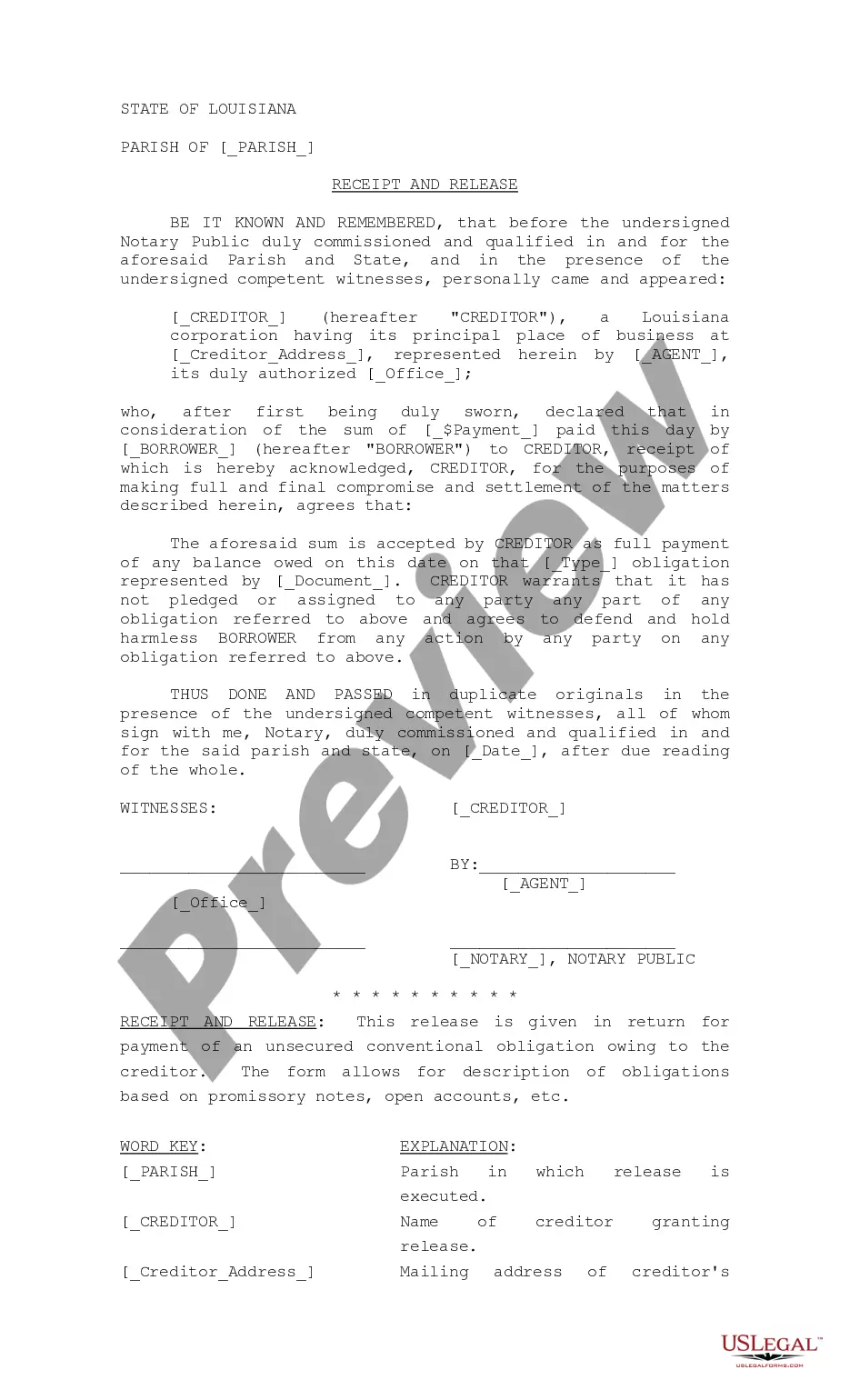

Many of the releases signed when estate distributions are made are called "Receipt, Release and Refunding Bond". It is a legal document in which you as the heir would acknowledge receipt of a distribution, release (no claims) against the personal administrator and then agree to refund or return the money if necessary.

In order for the closing of an estate to occur, a final accounting showing that all estate assets have been distributed to beneficiaries in accordance with the written will or Virginia law if no will exists and a statement by the executor that all taxes have been paid must be filed and approved by the Commissioner of

STEP 1: Download and complete your forms.STEP 2: Mail or hand deliver a copy of your forms to all people who have an interest in the estate.STEP 3: File JDF 965 Statement of Personal Representative Closing Administration with the court.STEP 1: Download and complete your forms.More items...