Donation With Usufruct

Description

How to fill out Louisiana Grant Of Usufruct?

Handling legal paperwork and processes can be a lengthy addition to your day.

Forms like Donation With Usufruct typically necessitate that you search for them and comprehend the best approach to fill them out properly.

For this purpose, whether you are managing financial, legal, or personal issues, utilizing a detailed and user-friendly online collection of forms at your disposal will greatly assist.

US Legal Forms is the leading online resource for legal templates, offering over 85,000 state-specific forms and various tools to help you fill out your documents with ease.

Is this your first time using US Legal Forms? Register and create your account in just a few minutes, and you’ll gain entrance to the form library and Donation With Usufruct. Then, follow the instructions below to finalize your form.

- Peruse the selection of relevant documents available to you with just one click.

- US Legal Forms grants you access to state- and county-specific forms for download at any moment.

- Protect your document management processes with top-quality services that allow you to prepare any form in minutes without additional or hidden fees.

- Simply Log In to your account, find Donation With Usufruct, and download it right away from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

The word usufruct comes from Latin roots and essentially means 'use' and 'fruit.' It describes an arrangement where one party can use an asset and benefit from its income or output without owning it. In practical terms, when engaging in a donation with usufruct, it allows individuals to effectively plan their estates, ensuring that loved ones receive benefits while the original owner maintains certain rights.

The usufruct of a property involves the privileges granted to a person or entity to use and derive income from the property owned by another, provided the property is not destroyed or diminished in value. This means that if you enter a donation with usufruct, you can live in, rent out, or cultivate the property, all while the original owner retains the overall ownership. This arrangement can create a win-win situation for both parties, offering benefits and security in property management.

Usufruct refers to the legal right to use and enjoy the benefits of someone else's property without altering its substance. In the context of a donation with usufruct, it allows the donor to retain control over the property while enabling the recipient to enjoy its benefits. This arrangement can be highly advantageous, particularly in estate planning, as it helps to ensure that the property remains within a family while allowing others to benefit from it.

Tax implications in a usufruct agreement can vary, impacting both the usufructuary and the property owner. For example, a donation with usufruct may involve gift tax considerations depending on the property value. Additionally, the usufruct may generate income subject to taxation, requiring accurate reporting. Accessing legal guides from US Legal Forms can help navigate these complexities.

The rule of usufruct allows one person to use and enjoy another person's property without altering its substance. This arrangement ensures that the owner maintains overall ownership while allowing the usufructuary to benefit from the property. When engaging in a donation with usufruct, it's crucial to clearly outline the terms to avoid disputes. Tools available through US Legal Forms can assist in solidifying these terms.

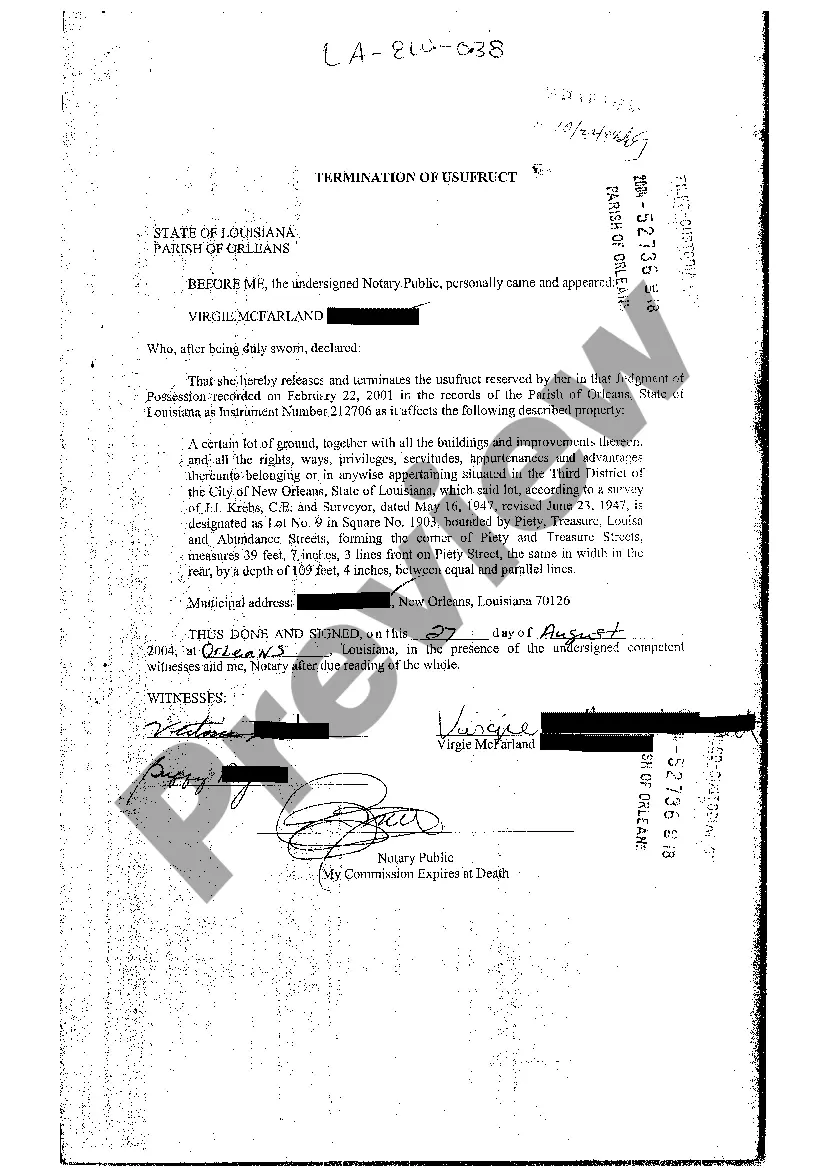

The death of a usufructuary generally leads to the termination of the usufruct rights. In such cases, the property returns to the owner or the remainderman, who inherits it fully. This transition can be complex, especially if the agreement includes specific directions for property distribution. For clarity on such matters, consider relying on legal resources like US Legal Forms.

Usufruct is treated as a transfer of income rights, leading to potential tax obligations. When you create a donation with usufruct, you may need to report any income you receive from the property on your tax return. It's essential to consult a tax professional familiar with usufruct taxation to understand your specific tax responsibilities. Using platforms like US Legal Forms can help guide you through the necessary documentation.

In a donation with usufruct, the usufructuary does not have the authority to sell the property itself. The legal ownership lies with the donor until the usufruct ends. Nonetheless, the usufructuary may have rights to lease or generate income from the property. To navigate these complexities, consider resources like uslegalforms for clarity on rights and arrangements.

Generally, a usufructuary can sell items from the property that are considered consumables or are used in the daily operation of the property. However, they cannot sell the property itself without the donor's consent. It's important for both parties to understand their rights and responsibilities to avoid disputes. Guidance from uslegalforms can help clarify what items may be sold and under what conditions.

When dealing with a donation with usufruct, it's crucial to report the donation on your tax return properly. Generally, the donor should disclose the value of the gift on the tax return and may need to fill out IRS Form 709 if the gift exceeds certain limits. Consulting a tax professional in combination with helpful tools available on platforms like uslegalforms can simplify this process for you.