Louisiana Usufruct And Right Of Habitation

Description

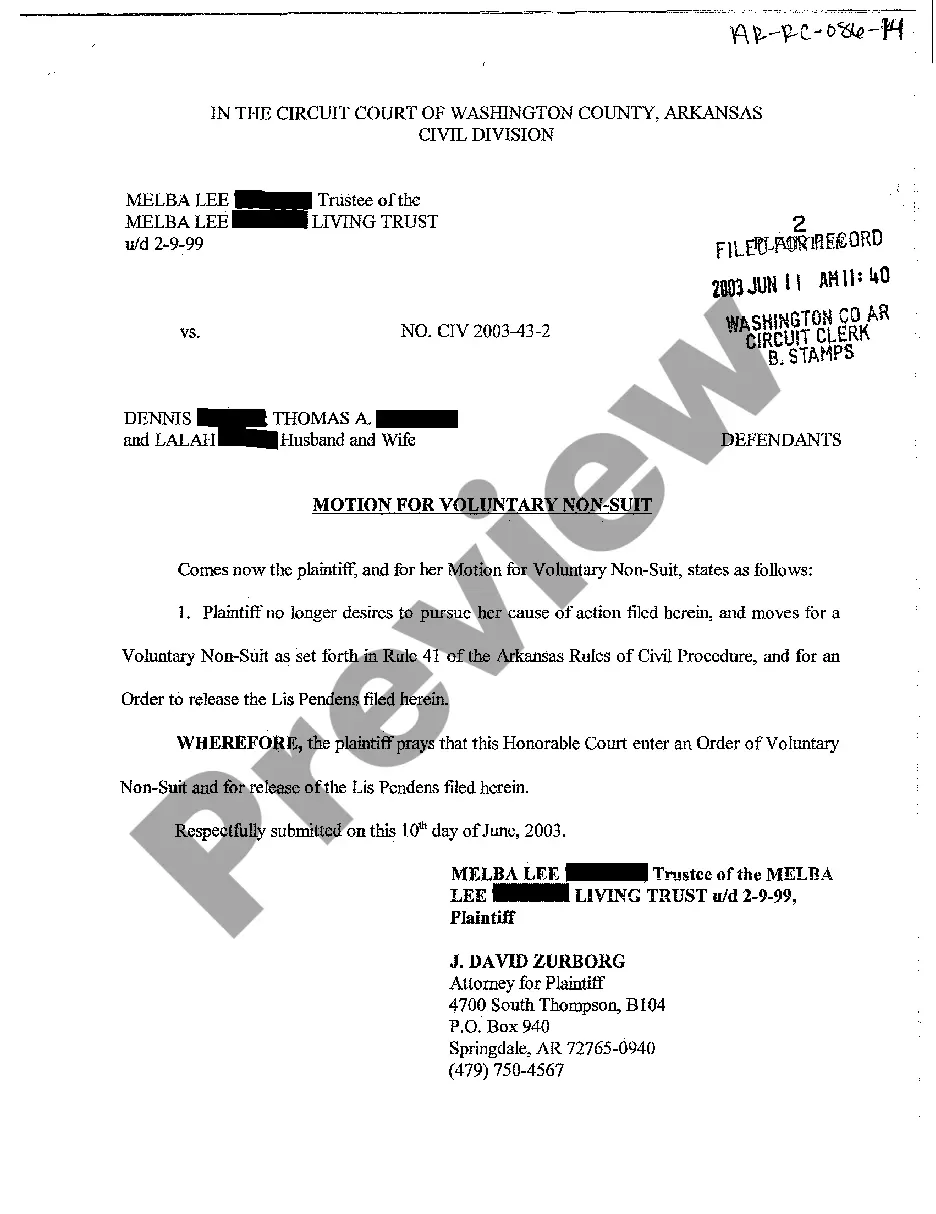

How to fill out Louisiana Termination Of Usufruct Over Real Estate?

Managing legal paperwork and procedures can be a lengthy addition to your schedule.

Documents such as Louisiana Usufruct And Right Of Habitation typically require you to locate them and grasp how to fill them out accurately.

Therefore, whether you are addressing financial, legal, or personal issues, possessing a comprehensive and accessible online repository of forms will greatly assist you.

US Legal Forms is the premier online service for legal templates, providing over 85,000 state-specific forms along with various resources to help you complete your documents efficiently.

Merely Log In to your account, locate Louisiana Usufruct And Right Of Habitation, and download it instantly from the My documents section. You can also retrieve previously saved documents.

- Explore the collection of relevant forms available to you with a simple click.

- US Legal Forms grants you access to state- and county-specific documents ready for download at any time.

- Streamline your document management tasks with a high-quality service that enables you to create any form within moments without any additional or hidden fees.

Form popularity

FAQ

In Louisiana, the usufructuary is typically responsible for property taxes during their period of enjoyment. This means that while they benefit from the property, they also bear the tax burden. It’s important to discuss these obligations clearly with the property owner upfront to avoid misunderstandings. For further clarification on the tax implications of Louisiana usufruct and right of habitation, you may find valuable insights at uslegalforms.

The right of habitation in Louisiana allows an individual to live in a property owned by another, while ensuring the owner retains ownership rights. This right is more limited than usufruct as it does not include the right to rent or sell the property. To summarize, while you can reside in the property, you cannot leverage it commercially. If you want to explore the nuances of Louisiana usufruct and right of habitation, consider using resources available at uslegalforms.

In Louisiana, usufruct grants a person the right to use and enjoy someone else's property while preserving its substance. The owner retains the bare ownership of the property, meaning they can reclaim it in the future. Usufruct can last for a specified time or until the usufructuary passes away. Understanding Louisiana usufruct and right of habitation can help you navigate property rights and protections.

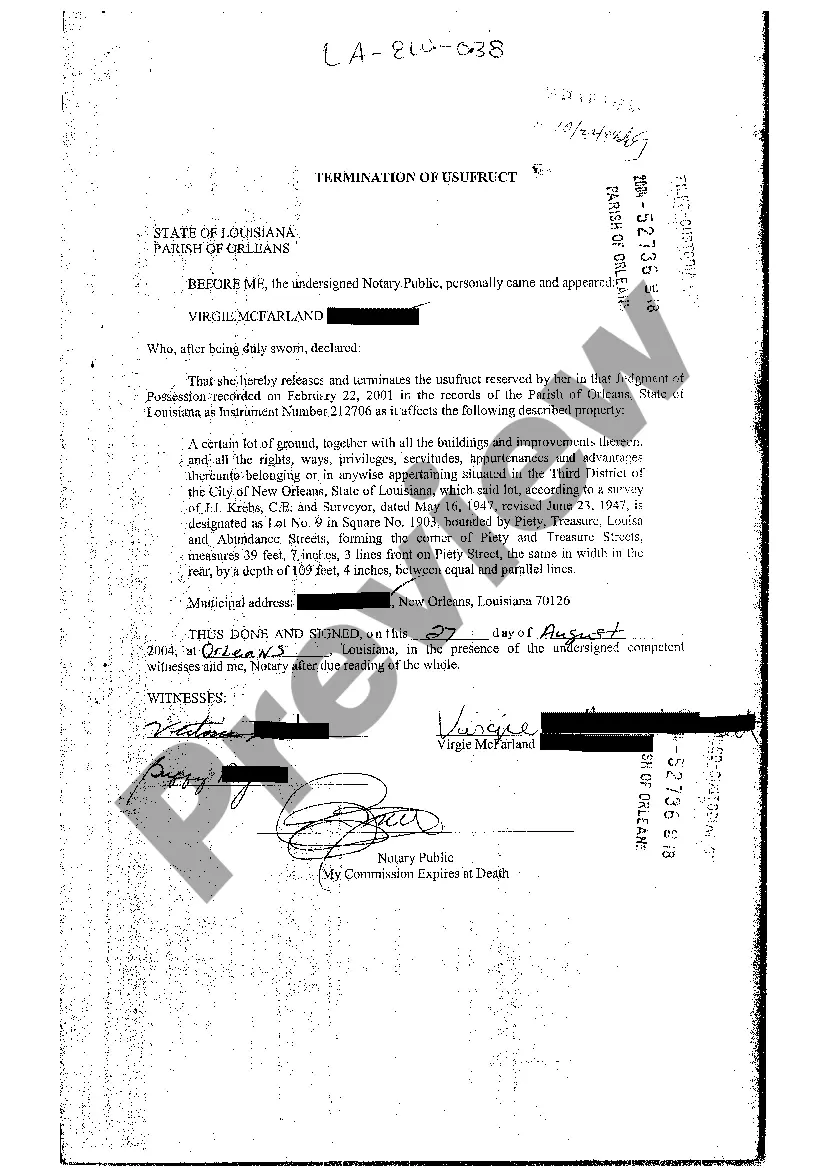

An usufruct in Louisiana can be terminated in several ways, such as reaching the end of its established duration or by mutual agreement of the parties involved. Additionally, the usufruct can end if the usufructuary fails to fulfill any significant obligations tied to the property. In cases where the usufructuary damages the property or uses it inappropriately, the right may also be revoked. To navigate these circumstances effectively, consider using US Legal Forms, which offers resources and documents tailored to issues related to Louisiana usufruct and right of habitation.

In Louisiana, usufruct can last for the lifetime of the usufructuary or for a specified term set by the grantor. This duration depends on how the usufruct is established, whether through a will, donation, or other legal means. It is important to remember that once the period ends, the right of habitation also ceases, returning property rights to the owner. For those navigating these complexities, UsLegalForms provides a straightforward way to create legally binding documents related to Louisiana usufruct and right of habitation.

Engaging in a usufruct agreement in Louisiana may have various tax implications, including property taxes and potential inheritance tax considerations. The usufructuary may be responsible for property taxes while enjoying the benefits of the property, but specific tax liabilities can depend on the structure of the agreement. Additionally, if the usufructuary passes away without proper planning, their rights can lead to estate tax issues. For guidance on navigating the complexities of Louisiana usufruct and right of habitation, exploring resources on platforms like UsLegalForms can be beneficial.

A life estate grants an individual ownership rights over property for the duration of their life, while a usufruct allows a person to use and benefit from the property without owning it. In essence, with a life estate, the individual holds legal ownership to an extent but must consider future interests, whereas usufruct focuses on temporary use and enjoyment. Recognizing these distinctions ensures you understand how Louisiana usufruct and right of habitation work in practice.

In Louisiana, usufruct refers to the right to use and enjoy someone else's property while maintaining its substance. The rules of usufruct specify that the usufructuary can benefit from the property but must also preserve it and avoid waste. This means that you cannot damage or alter the property beyond normal wear and tear. Understanding these rules can help you navigate the complexities of Louisiana usufruct and right of habitation.