Limited Liability Formation With The Law

Description

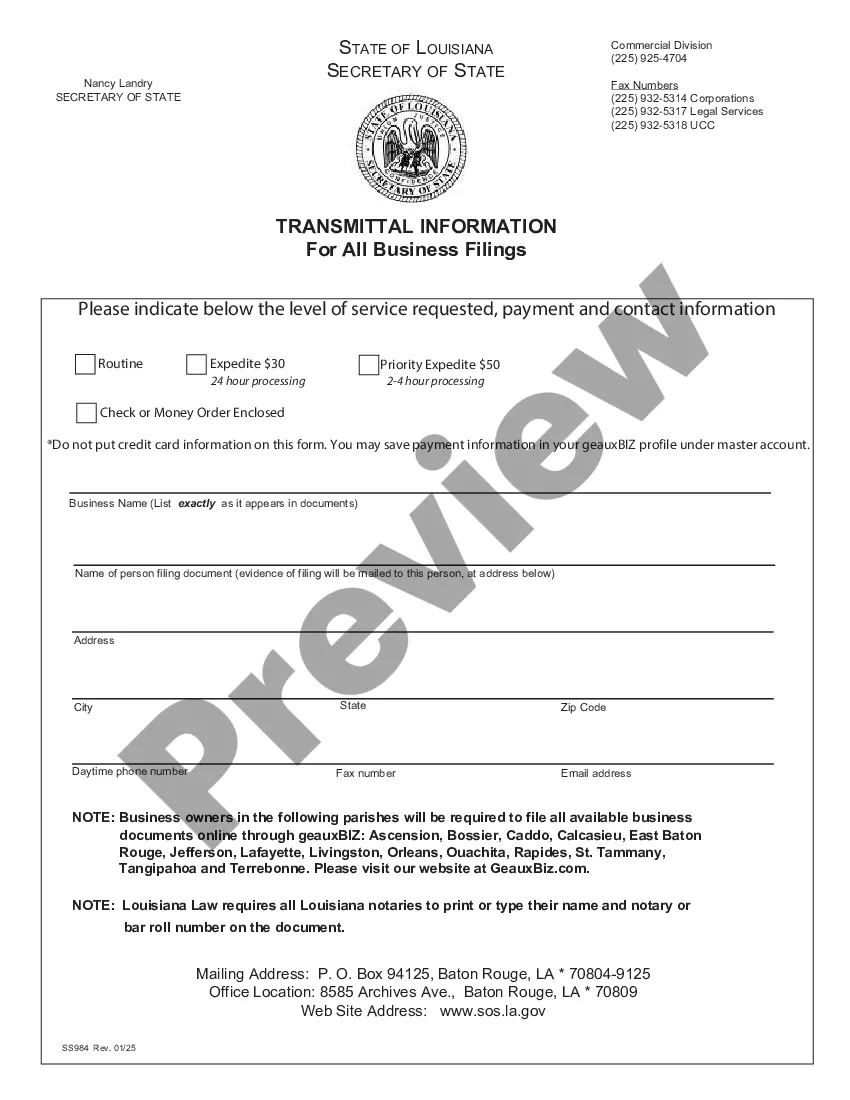

How to fill out Louisiana Limited Liability Company LLC Formation Package?

- Log into your existing US Legal Forms account and proceed to download your desired form template by clicking the Download button, ensuring your subscription is current. If it has lapsed, renew it based on your payment plan.

- Review the Preview mode and description of the selected form to confirm it aligns with your needs and complies with local jurisdiction regulations.

- If adjustments are necessary, utilize the Search feature to find additional templates that accurately reflect your requirements. Once you locate the correct document, proceed to the next step.

- Initiate the purchase of your form by clicking on the Buy Now button and selecting your preferred subscription plan, which requires account registration for resource access.

- Complete the payment process by entering your credit card details or utilizing your PayPal account to secure your subscription.

- Download the completed form to your device for editing, and you can always access it later through the My Forms section in your account.

After following these steps, you will efficiently obtain your limited liability formation document, ready for completion and submission. US Legal Forms not only simplifies the process but also provides access to a wealth of legal resources tailored to your needs.

Take the first step today and explore our extensive library to ensure your business is set up for success!

Form popularity

FAQ

While limited liability formation with the law offers many benefits, there are also downsides to consider. For instance, maintaining an LLC requires compliance with ongoing state regulations, which may come with additional costs and paperwork. Furthermore, some lenders view LLCs as higher-risk, which could affect your ability to secure financing. Weighing these factors carefully will help you make an informed decision.

You need to be aware of the benefits of limited liability formation with the law, which protects your personal assets from business debts. It's essential to choose the right state for formation based on the specific laws and fees associated with LLCs. Moreover, you should have a clear business plan in place, as this can guide your decisions and help in securing funding if necessary.

Before starting your LLC, it is important to understand the legal requirements involved in limited liability formation with the law. Each state has its own regulations, which can affect your business structure and tax obligations. Additionally, consider the costs associated with filing and maintaining your LLC, as they can add up. Researching these aspects can set you up for success.

A common form of limited liability is the limited liability company (LLC), which provides legal protection to its owners. In an LLC, members are not personally liable for the company's debts or liabilities, a key advantage in today's business climate. Exploring various forms of limited liability formation with the law can help you choose the right structure for your needs.

An example of limited liability is when a business incurs debt or faces a lawsuit, and only the company's assets are at risk, not the owners' personal property. For instance, if an LLC is sued for damages, only the business's assets can be claimed, leaving personal assets untouched. This feature of limited liability formation with the law is a significant advantage for business owners.

Choosing between an LLC or a Limited Partnership (LP) depends on your business needs and structure. An LLC provides personal asset protection for all members, while an LP has both general and limited partners, affecting liability and management roles. Evaluating your business goals can simplify your decision regarding limited liability formation with the law.

A limited liability company (LLC) is a business structure that combines the limited liability protection of a corporation with the pass-through taxation of a partnership. This means owners enjoy personal asset protection while retaining flexibility in how profits are taxed. Understanding how LLCs function is essential for effective limited liability formation with the law.

The law of limited liability protects business owners by separating their personal finances from their business liabilities. It implies that owners are only financially responsible for the company's debts to the extent of their investment. Limited liability formation with the law can encourage entrepreneurship by reducing financial risk for owners.

To determine if a company has limited liability, you can check its legal structure, which is often reflected in the company's name. Limited liability companies (LLCs) and corporations typically use designations like 'LLC' or 'Inc.' in their titles. By reviewing official documents or the company's registration, you can confirm its limited liability status.

Limited liability refers to a legal structure where a business owner's personal assets are protected from business debts and liabilities. This means that if the company faces financial trouble, creditors cannot pursue the owner's personal assets. Understanding limited liability formation with the law is crucial for entrepreneurs looking to safeguard their finances.