Individuals generally connect legal documentation with something intricate that exclusively a professional can handle.

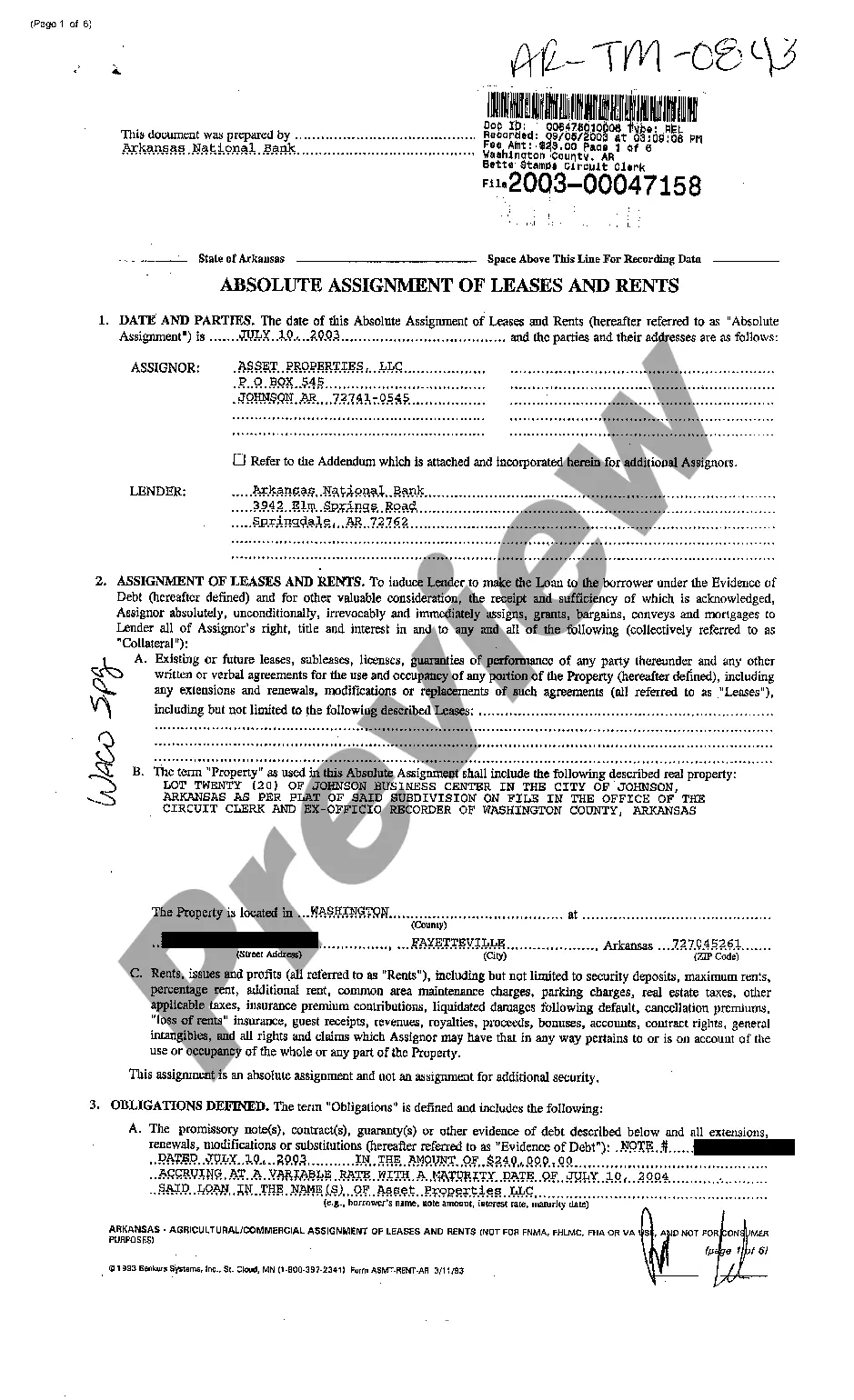

In a sense, this is accurate, as formulating Kentucky Lease Purchasing With Property Withholding necessitates comprehensive expertise in subject specifications, encompassing state and county laws.

Nonetheless, with US Legal Forms, matters have transformed into being more straightforward: pre-prepared legal documents for any life and business circumstance tailored to state regulations are consolidated in a singular online directory and are presently accessible to everyone.

Sign up for an account or Log In to advance to the payment page.

- US Legal Forms offers over 85,000 up-to-date records categorized by state and area of application, making it easy to search for Kentucky Lease Purchasing With Property Withholding or any other specific template in just a few minutes.

- Previously registered clients with a valid subscription must Log In to their account and select Download to acquire the form.

- New users to the service will first need to create an account and subscribe before they can save any documentation.

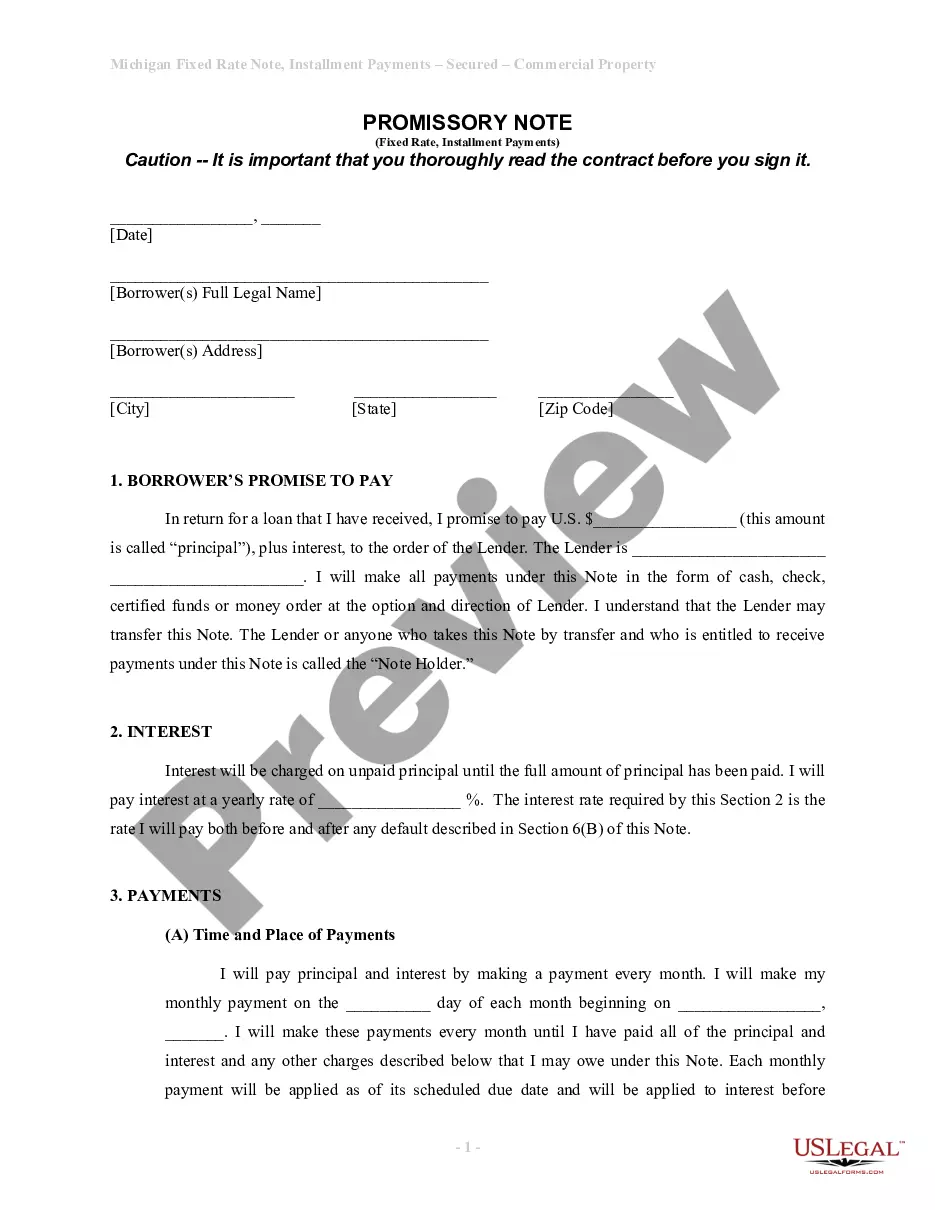

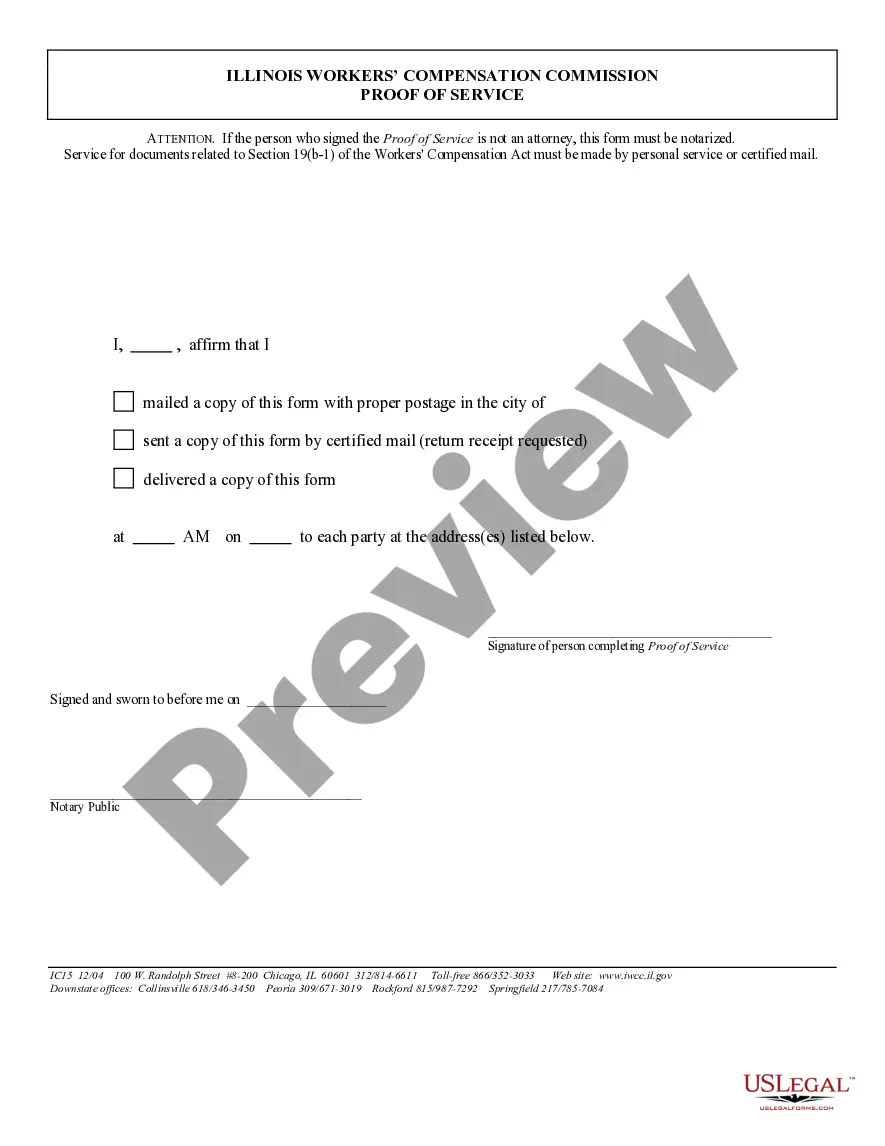

- Here’s a detailed guide on how to obtain the Kentucky Lease Purchasing With Property Withholding.

- Examine the page details meticulously to confirm it meets your requirements.

- Review the form description or verify it through the Preview option.

- Search for another example via the Search field above if the previous one does not fulfill your criteria.

- Click Buy Now once you locate the appropriate Kentucky Lease Purchasing With Property Withholding.

- Select the subscription plan that meets your preferences and financial considerations.

As a rental property owner, you want to have control over your investment. Apartments.Com's Rental Manager is the most comprehensive resource for independent property owners and landlords across the galaxy. Learn about property management laws in the state of Kentucky, including info on laws about rent, security deposits, and more. Public Financed and Subsidized Housing. 20. As a buyer and seller, it's important to learn about Kentucky's real estate transfer tax and how it can affect buying or selling a home. This extended date will apply to all business entities filing a Net Profit Return with the City of Bowling Green, Kentucky. What is a school district income tax . You can exclude this capital gain from your income permanently.