Account Trust Contract Formal

Description

How to fill out Utah Financial Account Transfer To Living Trust?

Whether you handle documents frequently or occasionally need to send a legal paper, it's crucial to have a repository where all samples are pertinent and current.

One essential step when using an Account Trust Contract Formal is to ensure it is the most recent version, as this determines its eligibility for submission.

If you wish to streamline your search for the most recent document examples, turn to US Legal Forms.

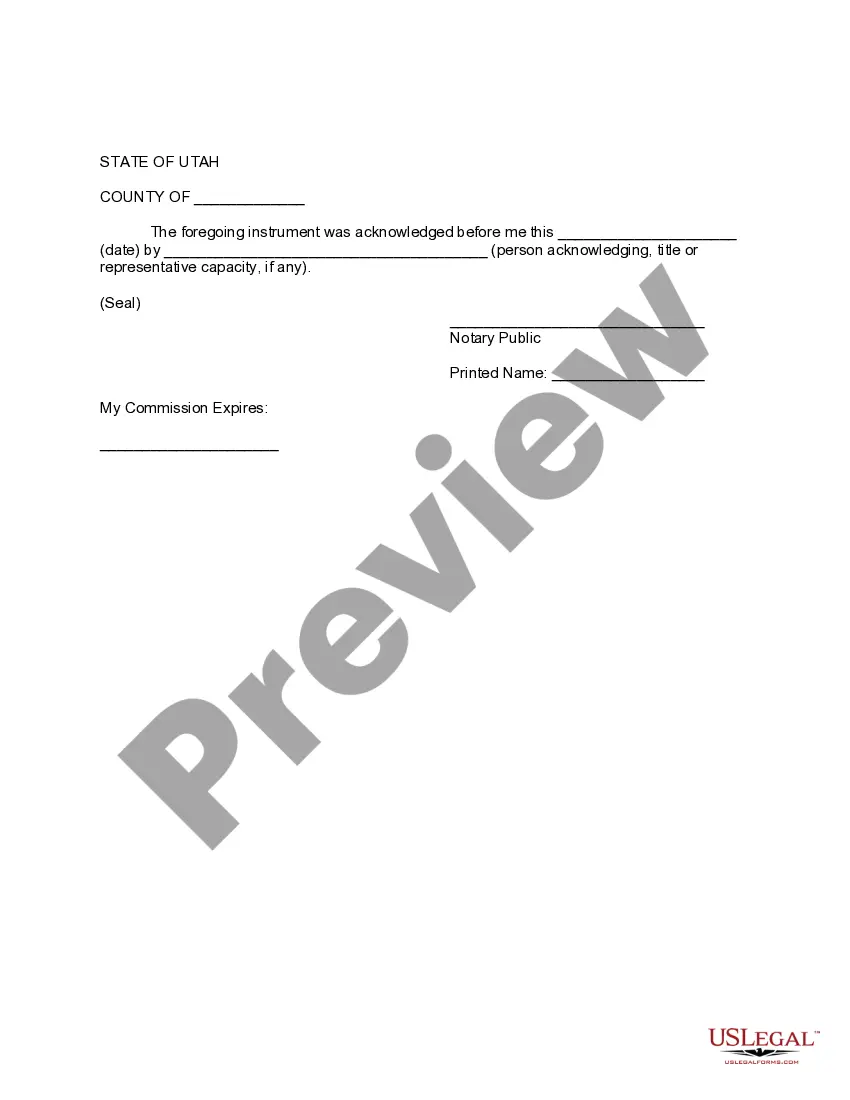

Use the search field to locate the form you need. Review the Account Trust Contract Formal preview and description to confirm it is exactly what you're looking for. After verifying the form, simply click Buy Now. Select a subscription plan that suits you. Create a new account or Log In to your existing one. Use your credit card information or PayPal account to complete the transaction. Choose the download file format and confirm your selection. Eliminate the confusion of managing legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a collection of legal documents that includes almost every type of document sample you might desire.

- Look for the templates you need, evaluate their relevance immediately, and discover more about their application.

- With US Legal Forms, you gain access to approximately 85,000 form templates across various domains.

- Obtain the Account Trust Contract Formal samples quickly and store them at any time in your account.

- A US Legal Forms account will allow you to access all the templates you need with ease and minimal hassle.

- Simply click Log In at the top of the website and navigate to the My documents section where all your required forms are readily available, saving you time searching for the ideal template or assessing its applicability.

- To acquire a form without an account, follow these procedures.

Form popularity

FAQ

Formal accountings can take up a lot of your time. When we say formal accounting we are referring to a Trust accounting that is prepared according to the format rules of the Probate Code (section 1060) and filed with the court to court approval.

A trust is a fiduciary relationship in which one party, known as a trustor, gives another party, the trustee, the right to hold title to property or assets for the benefit of a third party, the beneficiary.

What is a Formal (non-court) Accounting pursuant to Probate Code §16063? A formal non-court accounting is done by the trustee and sent out to the trust beneficiaries. Such an accounting is done in the situation where there are no lawsuits or disputed court petitions involving the trust.

Information that should be included in a trust accounting includes details regarding:Taxes paid, disbursements made to trust beneficiaries, and gains and losses on trust assets.Fees and expenses paid to advisors of the trustee, such as attorneys, CPAs, and financial advisors.More items...?

Trust accounting rules: Know what they are?No comingling or mixing funds.Maintain a separate ledger.Verify trust accounts regularly.If you haven't earned it, don't touch it.Don't rob Peter to pay Paul.Create checks and balances.Follow state bar and government regulations.No collecting interest.