Trust Account For Attorney

Description

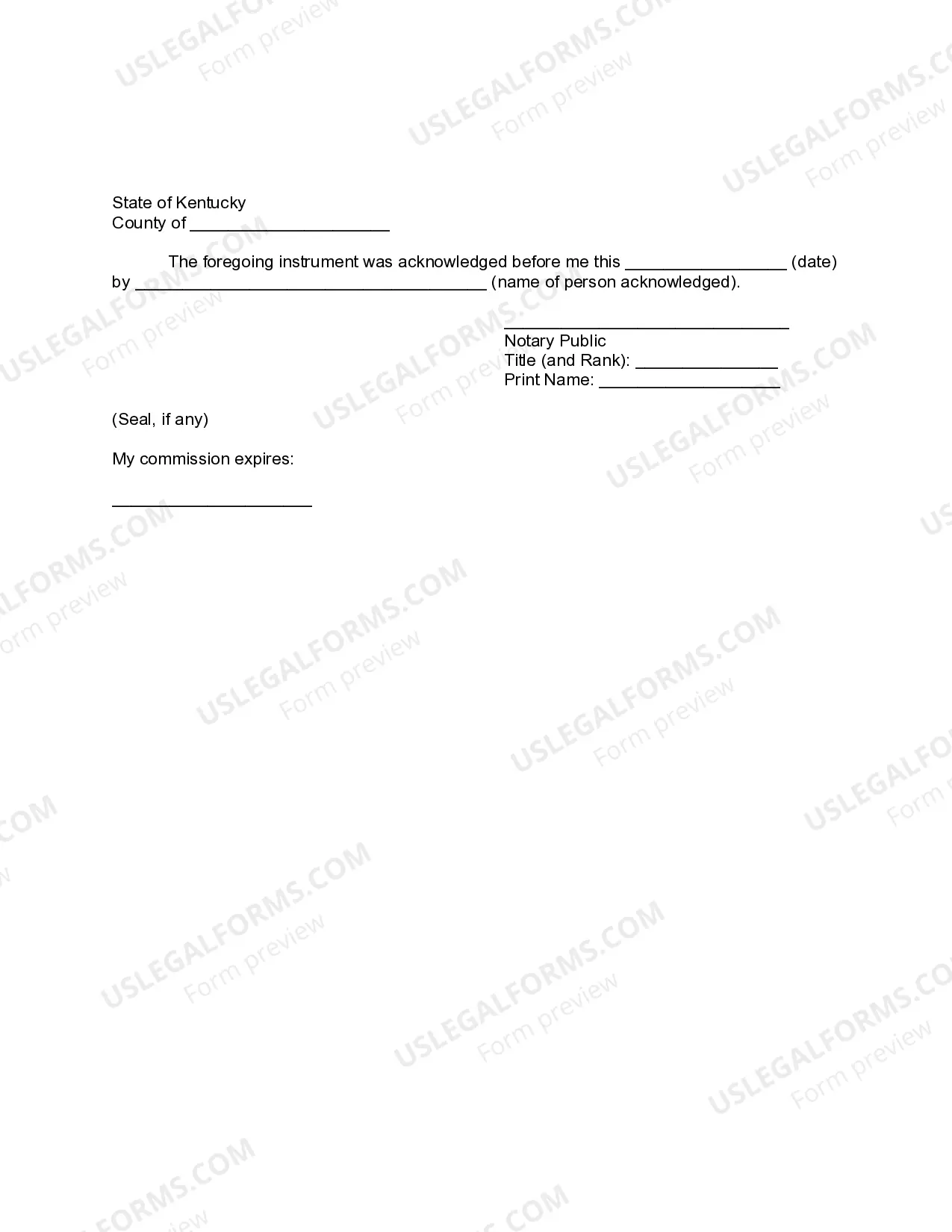

How to fill out Kentucky Financial Account Transfer To Living Trust?

- Log in to your account at US Legal Forms. If you are not a member yet, you will need to create an account to access the forms.

- Browse or search for the appropriate trust account forms that meet your state’s regulations. Use the preview options to ensure they align with your needs.

- Select the necessary forms and complete your purchase by choosing a subscription plan that fits your requirements.

- Fill out the form directly within the platform, using our fillable fields for convenience and accuracy.

- Download your completed forms and save them securely. You can also find them later in the 'My Forms' section of your profile.

In summary, US Legal Forms offers a robust library of resources that can help attorneys manage trust accounts efficiently. By following these steps, you’ll ensure compliance with legal requirements and save valuable time.

Start your journey today—visit US Legal Forms and explore their extensive collection of legal documents!

Form popularity

FAQ

The purpose of a client trust account is to protect client funds while ensuring they are used appropriately. It serves as a financial buffer, offering peace of mind to clients who trust you with their resources. Establishing a trust account for attorney activities demonstrates your commitment to ethical practices and financial integrity.

A client trust account is used to hold funds that belong to clients for specific purposes, such as legal fees or related expenses. It ensures that the attorney maintains proper custody of client funds until all obligations are fulfilled. By effectively managing your trust account for attorney responsibilities, you enhance trust and professionalism in your legal practice.

To record trust accounts, maintain an accurate ledger that details each transaction involving client funds. This includes documenting deposits, withdrawals, and any necessary transfers. Utilizing software solutions or templates from resources like uslegalforms will simplify your record-keeping and ensure your trust account for attorney remains compliant with legal standards.

To account for a trust, begin by keeping meticulous records of all funds received and disbursed. You should document deposits, withdrawals, and any earned fees accurately to maintain compliance. Using organizational tools available on platforms like uslegalforms can streamline the process, helping you maintain a clear summary of your trust account for attorney purposes.

A client account serves as a secure place for holding funds on behalf of clients. It is essential for maintaining transparency and trust in the attorney-client relationship. By using a trust account for attorney services, you can ensure that client funds are kept separate from your personal or business accounts, helping you manage them effectively.

Filling out a trust fund generally involves defining the trust's purpose, identifying the beneficiaries, and detailing the terms of the trust. To set it up, you can use a simple form that outlines the fund's specifics, including the assets involved and the trustee's responsibilities. Utilizing a trust account for attorney management ensures that your funds are handled properly and securely. Platforms like US Legal Forms can provide templates and guidance, helping you streamline this process.

To write a check to an attorney trust account, first ensure you have the correct account information. Typically, you will write the attorney's name or their law firm on the payee line, clearly indicating that the funds are for their trust account. Be sure to specify the purpose of the payment in the memo section, such as 'Retainer for legal services.' Using a trust account for attorney services helps protect client funds while maintaining accurate records.

While it is not mandatory to have a separate trust account for each client, many attorneys opt for this to enhance clarity and organization. Maintaining individual accounts facilitates accurate tracking of client funds and simplifies financial management. However, a single trust account can serve multiple clients as long as meticulous records are kept for each client's contributions and withdrawals. This practice underscores good financial stewardship, which is vital in establishing client trust.

Yes, a person can have more than one trust account if necessary. Lawyers may choose to set up separate trust accounts for different clients or specific types of transactions. Having multiple accounts can help in organizing client funds and ensuring compliance with various legal requirements. However, it is imperative to maintain clear records for each account to avoid confusion during audits or client inquiries.

Yes, a trust generally needs a separate bank account to ensure that trust funds remain distinct from personal or business financial resources. Creating a separate trust account for attorney helps in maintaining legal compliance and protects the interests of the trust beneficiaries. Managing funds in a dedicated account promotes transparency and accountability while simplifying the tracking process. It is a best practice to set up a specific account for trust purposes.