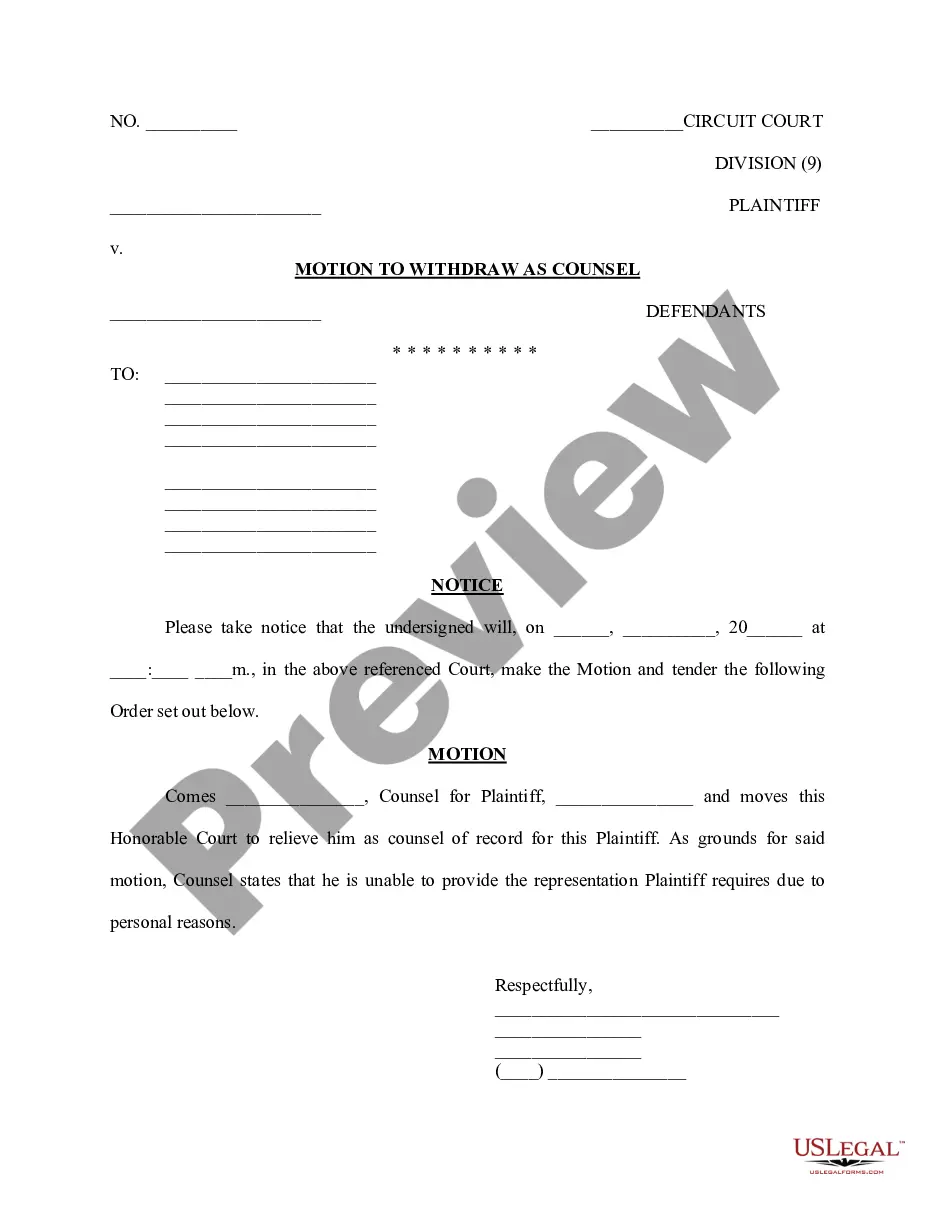

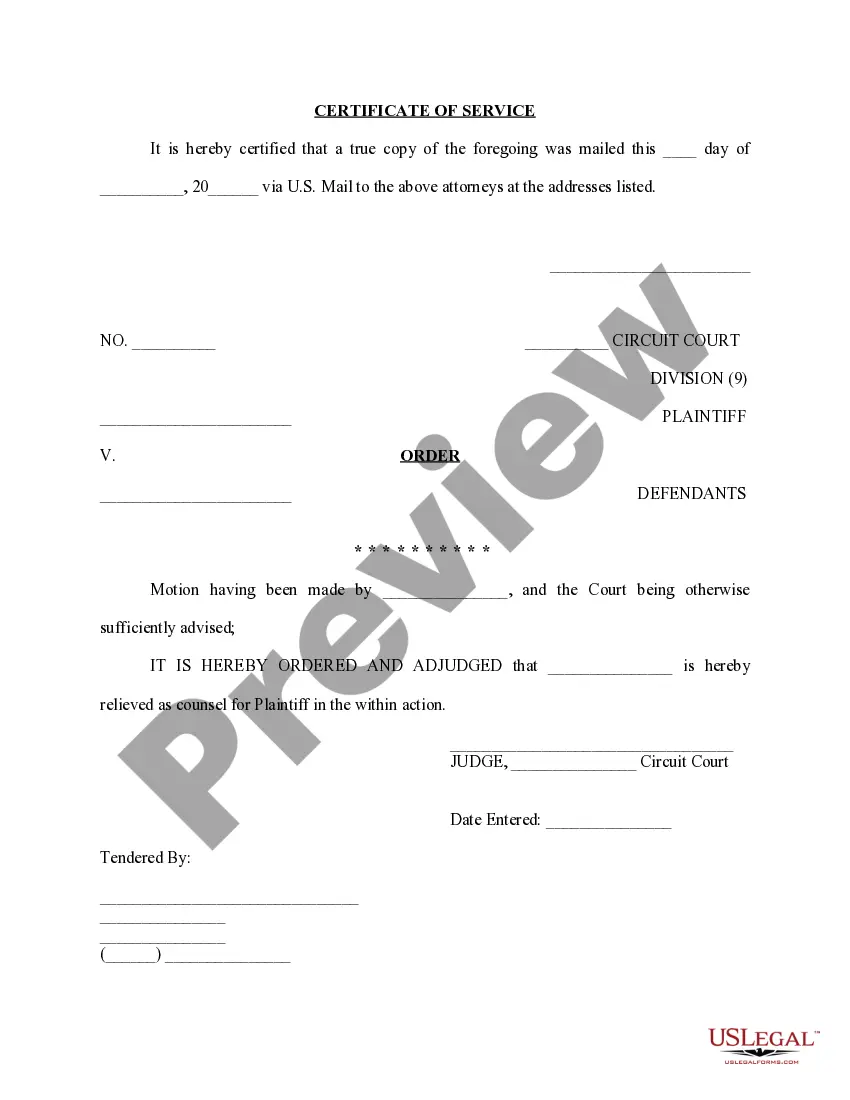

Motion To Withdraw As Counsel Sample With Response

Description

How to fill out Kentucky Motion To Withdraw As Counsel?

Creating legal documents from the ground up can frequently be overwhelming.

Some situations may require extensive research and significant amounts of money.

If you're seeking a more straightforward and economical method of generating Motion To Withdraw As Counsel Sample With Response or other forms without unnecessary complications, US Legal Forms is always available to you.

Our online collection of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal matters. With only a few clicks, you can quickly obtain state- and county-specific templates carefully compiled by our legal professionals.

Ensure the selected template meets the standards of your state and county, choose the appropriate subscription plan to acquire the Motion To Withdraw As Counsel Sample With Response, download the document, and then fill it out, sign it, and print it. US Legal Forms enjoys a strong reputation and over 25 years of experience. Join us today and transform form completion into a simple, efficient task!

- Utilize our site whenever you require a dependable and trustworthy service to easily search for and download the Motion To Withdraw As Counsel Sample With Response.

- If you're an existing user and have previously created an account, simply Log In to your account, find the form, and download it, or re-download it later from the My documents section.

- Not a member yet? No problem. Setting up an account is quick and easy.

- Before rushing to download Motion To Withdraw As Counsel Sample With Response, adhere to these guidelines.

- Review the document preview and descriptions to ensure you have located the form you need.

Form popularity

FAQ

In Idaho, independent contractors are evaluated on a case-by-case basis. However, most independent contractors are not covered by workers compensation insurance. If you're not sure whether you're a contract worker or an employee, contact a workers comp lawyer to find out whether you have a case.

Ing to Title 72, Idaho Code, ?employee? is defined as any person who has entered into the employment of, or who works under contract of service or apprenticeship with, an employer, as opposed to an ?independent contractor? which is defined as any person who renders service for a specified recompense for a ...

Idaho Workers' Compensation Exemptions Household domestic service workers. Workers covered by the federal workers' compensation law. Dusting or agricultural spraying pilots (these are only exempt under certain conditions) Commission-based real estate brokers and salespeople.

Family members of business owners operating either as a sole proprietorship or as a single member limited liability company that is taxed as a sole proprietorship are automatically exempt from coverage under the Idaho workers' compensation law and the insurance requirement of that law, but only so long as the family ...

The simplest kind of workers' compensation claim may involve only medical expenses and perhaps some lost wages. Injuries that are more debilitating may trigger additional payments over longer periods of time.

Workers Compensation Insurance: Employers having one or more full-time, part-time, seasonal or occasional employees must provide workers compensation insurance unless specifically exempt under Idaho law.

Ask your employer or the Idaho Industrial Commission for a First Report of Injury or Illness form. Fill out the form to the best of your ability. Return your completed form to the Idaho Industrial Commission's main office in Boise.