Kansas Living Form For Sale

Description

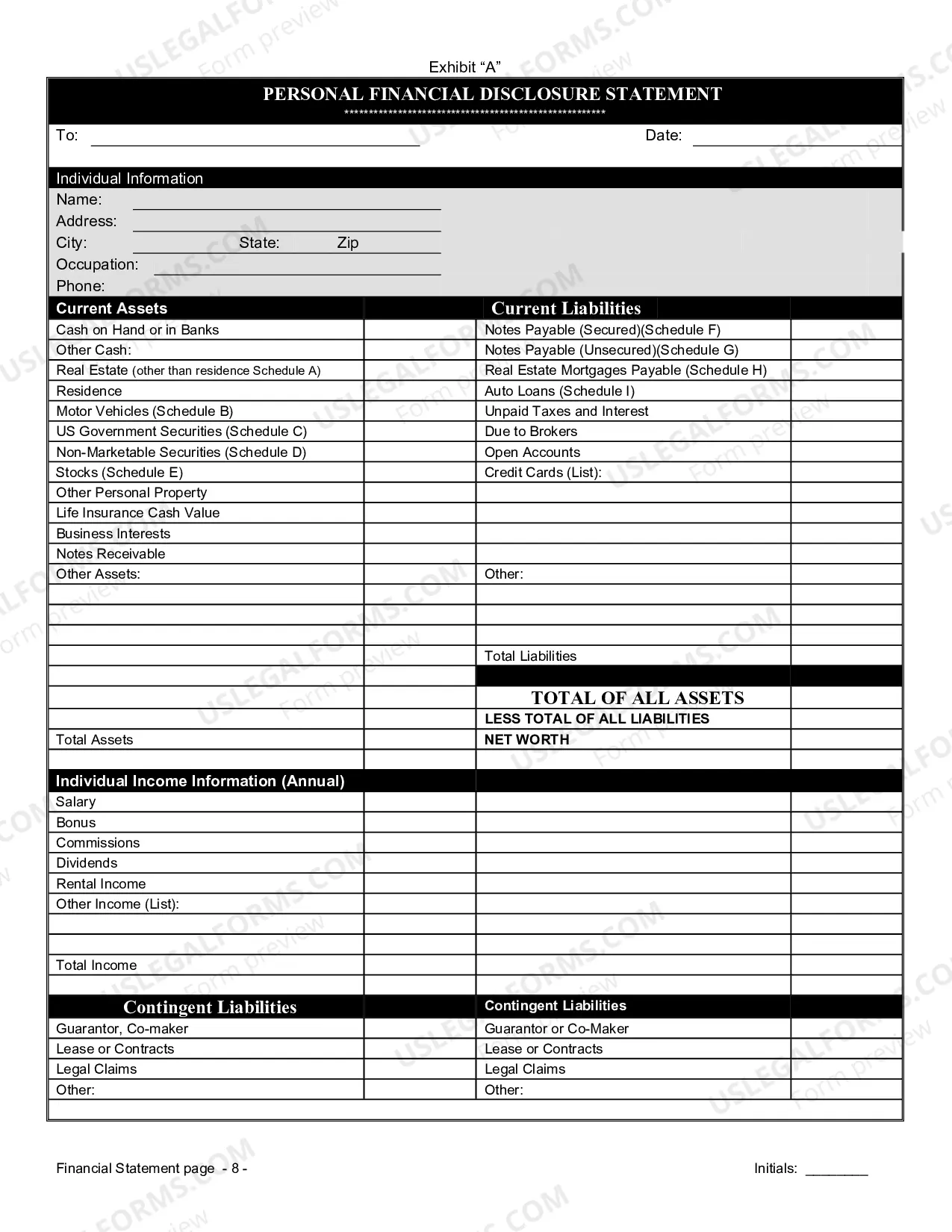

How to fill out Kansas Non-Marital Cohabitation Living Together Agreement?

- Start by inspecting the Preview mode and form description to confirm you have selected the appropriate template that aligns with your local laws.

- If the current template does not meet your requirements, utilize the Search feature to find another template better suited to your needs.

- Proceed to purchase the document by clicking the Buy Now button and selecting a subscription plan that works for you.

- Complete the checkout process by entering your payment details using a credit card or PayPal for added convenience.

- Once your payment is processed, download the form to your device and access it anytime through the My Forms section of your account.

In conclusion, US Legal Forms not only simplifies the process of obtaining essential legal documents but also ensures that users can create precise and compliant forms. Take advantage of their extensive library to ease your legal documentation needs.

Get started today and explore the Kansas living forms available for sale!

Form popularity

FAQ

To sell a car privately in Kansas, you'll need to gather the vehicle title, provide a completed bill of sale, and ensure you have the appropriate identification. You may also need to remove the license plates prior to transferring ownership. Utilizing a Kansas living form for sale can help you simplify the paperwork, ensuring you have everything in order.

A handwritten bill of sale for a car should include the same important information as a typed document — names of both parties, vehicle details, and the sale amount. Be clear and legible when writing this document. After writing it, both parties should sign it to acknowledge the agreement. Using a Kansas living form for sale can streamline this task, providing a complete template to fill out.

Yes, a bill of sale can still be valid even if it is not notarized in Kansas. The key is that both parties must agree to the terms written in the document. While notarization is helpful for verification, it is not a strict requirement. When using a Kansas living form for sale, you can create a clear agreement that can serve both parties well.

In Kansas, a notarized bill of sale is not always required. However, if you're selling a vehicle, having one can add a layer of security and trust between the buyer and seller. It's always best to check local regulations, as requirements may vary based on the type of sale. The Kansas living form for sale can help you ensure you're meeting all necessary guidelines.

For non-residents, Kansas taxes income derived from sources within the state. This typically includes wages earned in Kansas, business income, and certain investments. If you're expanding your activities in the state, using a Kansas living form for sale can aid in understanding what qualifies as taxable income and help manage your obligations.

Yes, if you sell goods or services in Kansas, a sales tax permit is required. This rule applies even to remote sellers who operate outside the state but sell to Kansas residents. To get started, consider obtaining a Kansas living form for sale that can help you organize your business information and comply with tax requirements.

To register as a remote seller in Kansas, you need to apply for a sales tax permit through the state's Department of Revenue. This process involves filling out the appropriate paperwork and providing necessary business information. A Kansas living form for sale can serve as a helpful tool to gather the required information and facilitate efficient registration.

A Kansas K-9 form serves as a schedule for reporting income, particularly regarding business taxes. It outlines income and expenses for individuals or businesses operating in Kansas. If you are involved in selling or operating a business, using a Kansas living form for sale could streamline the process of reporting your K-9 form accurately.

Certain groups, such as individuals with low income and specific retirement benefits, may be exempt from Kansas income tax. It's crucial to review your income and consult state guidelines to determine your eligibility. Moreover, a Kansas living form for sale can assist you in filing your taxes correctly and claiming any relevant exemptions.

Kansas offers some tax benefits for retirees, particularly related to Social Security income and pensions. However, tax rates on other forms of income like retirement account withdrawals can be higher. If you're interested in living in Kansas, consider finding a Kansas living form for sale that can simplify your transition into the state's tax system.