Life Estate Deed Example With Powers

Description

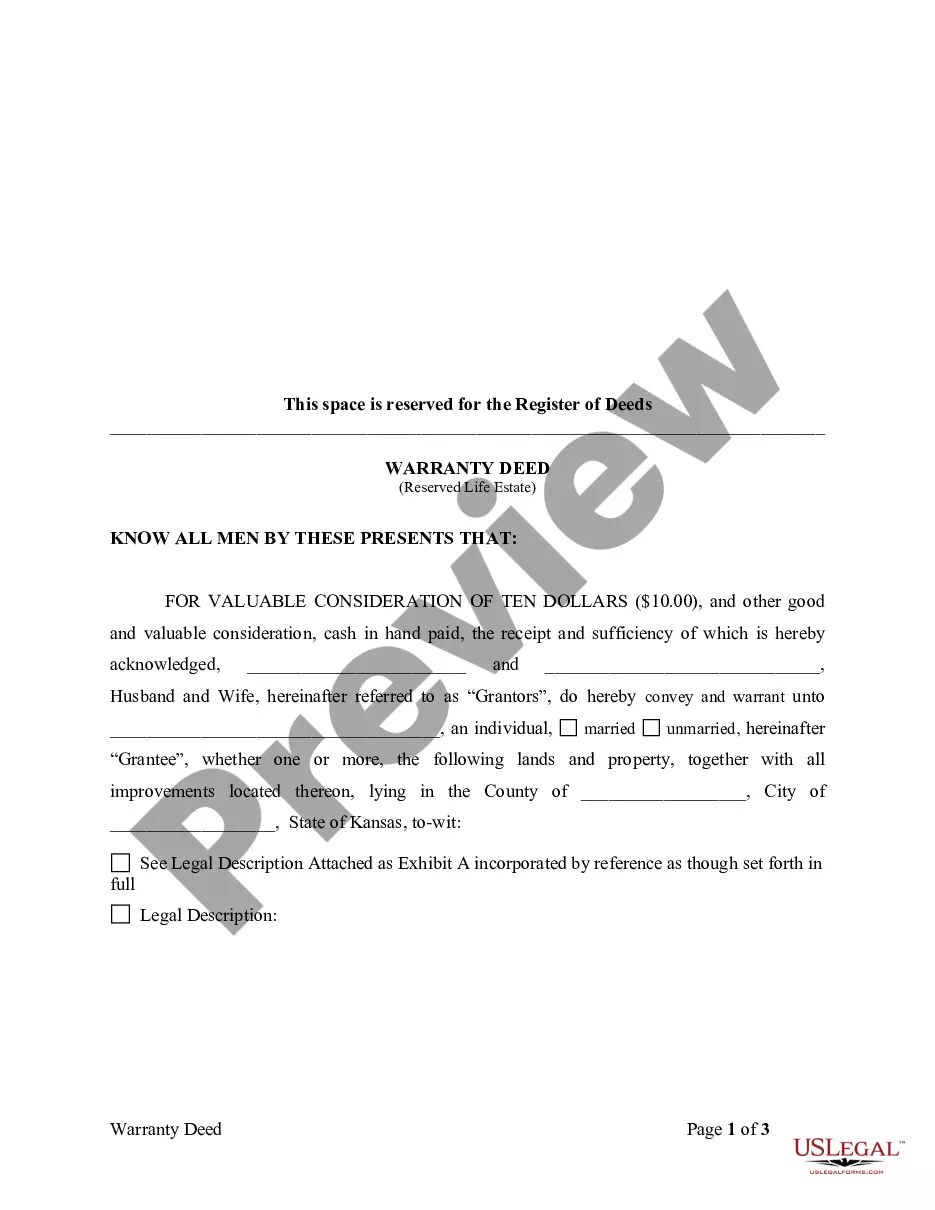

How to fill out Kansas Warranty Deed To Child Reserving A Life Estate In The Parents?

When you need to complete a Life Estate Deed Example With Authorities in line with your local state's laws, there can be many choices to select from.

There's no need to scrutinize every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a dependable service that can assist you in acquiring a reusable and current template on any topic.

Utilizing US Legal Forms makes obtaining expertly drafted official documents effortless. Furthermore, Premium members can also benefit from the robust integrated features for online document editing and signing. Try it today!

- US Legal Forms is the most extensive online repository with an archive of over 85,000 ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's laws and regulations.

- Consequently, when downloading Life Estate Deed Example With Authorities from our platform, you can rest assured that you possess a legitimate and up-to-date document.

- Obtaining the necessary sample from our platform is extremely simple.

- If you already have an account, just Log In to the system, confirm that your subscription is active, and save the chosen file.

- Later on, you can access the My documents section in your profile and maintain access to the Life Estate Deed Example With Authorities at any time.

- If this is your first experience with our website, kindly follow the instructions below.

- Browse the suggested page and assess it for alignment with your needs.

Form popularity

FAQ

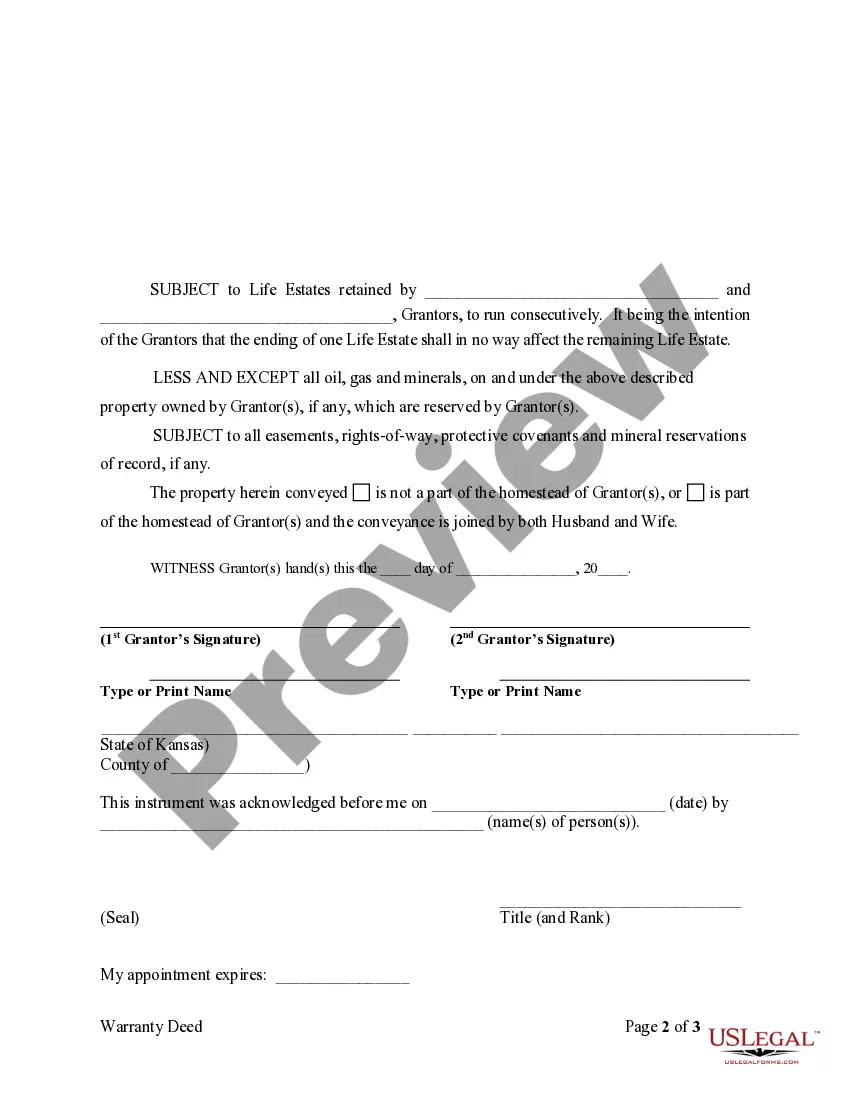

Life Estates are simple and inexpensive to establish; merely requiring that a new Deed be recorded. Life Estates avoid probate; the property automatically transfers to your heirs upon the death of the last surviving Life Tenant. Transferring title following your death is a simple, quick process.

It can be granted to someone for his or her lifetime or for the lifetime of another. The life estate interest gives the holder the right to all the benefits of the property during the lifetime for which it is granted.

Life estate consThe life tenant cannot change the remainder beneficiary without their consent.If the life tenant applies for any loans, they cannot use the life estate property as collateral.There's no creditor protection for the remainderman.You can't minimize estate tax.More items...

The person owning the life estate has the current right to the property for the rest of his or her life. The other owner has a current ownership interest but has no right to control the real estate until the life estate owner dies causing the end of the life estate.

Life Estate WITH Powers. Under this type of Deed, the Life Tenant is not restricted from doing anything the Life Tenant would like to do with the property including selling, gifting, leasing, conveyancing or mortgaging the property.