Any Exempt Property For Chapter 7

Description

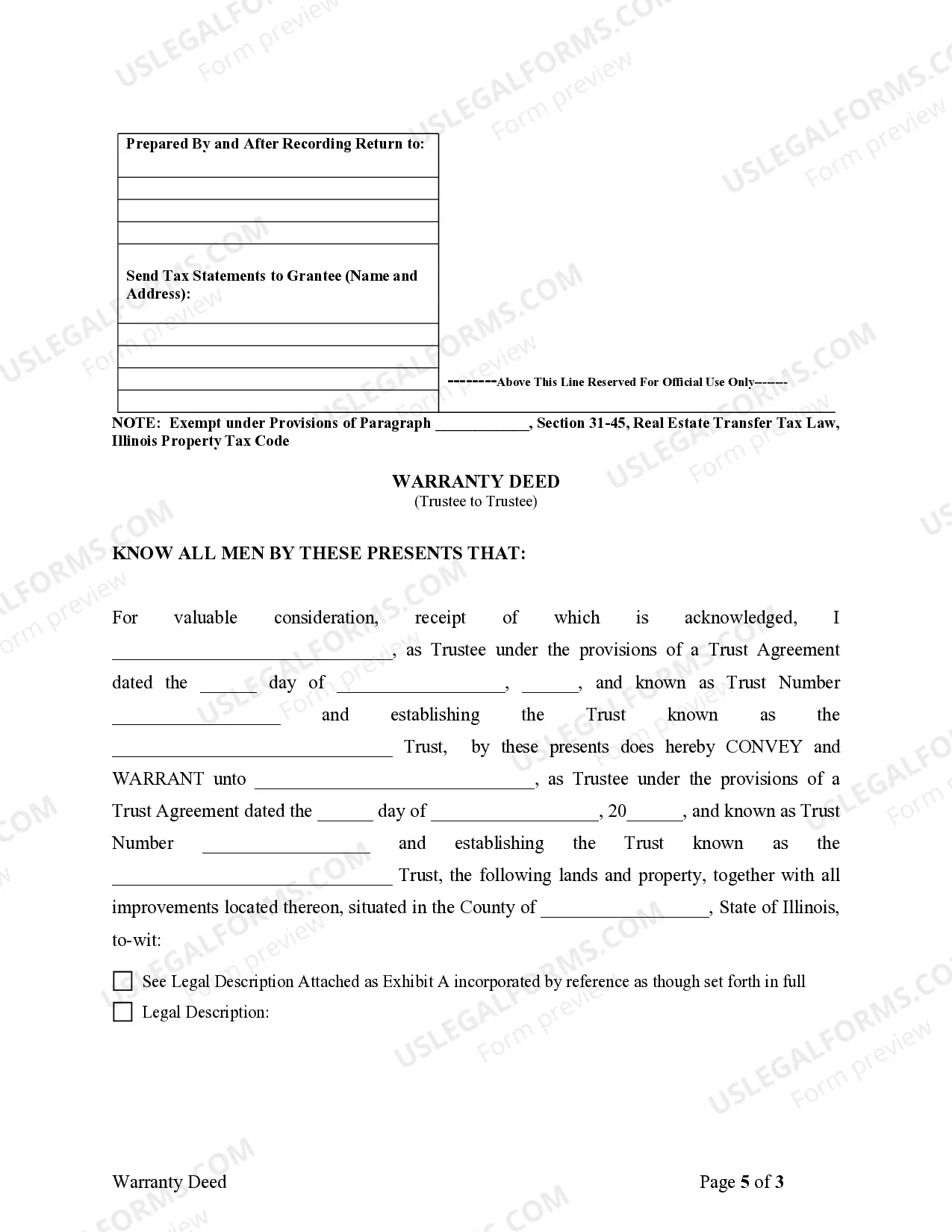

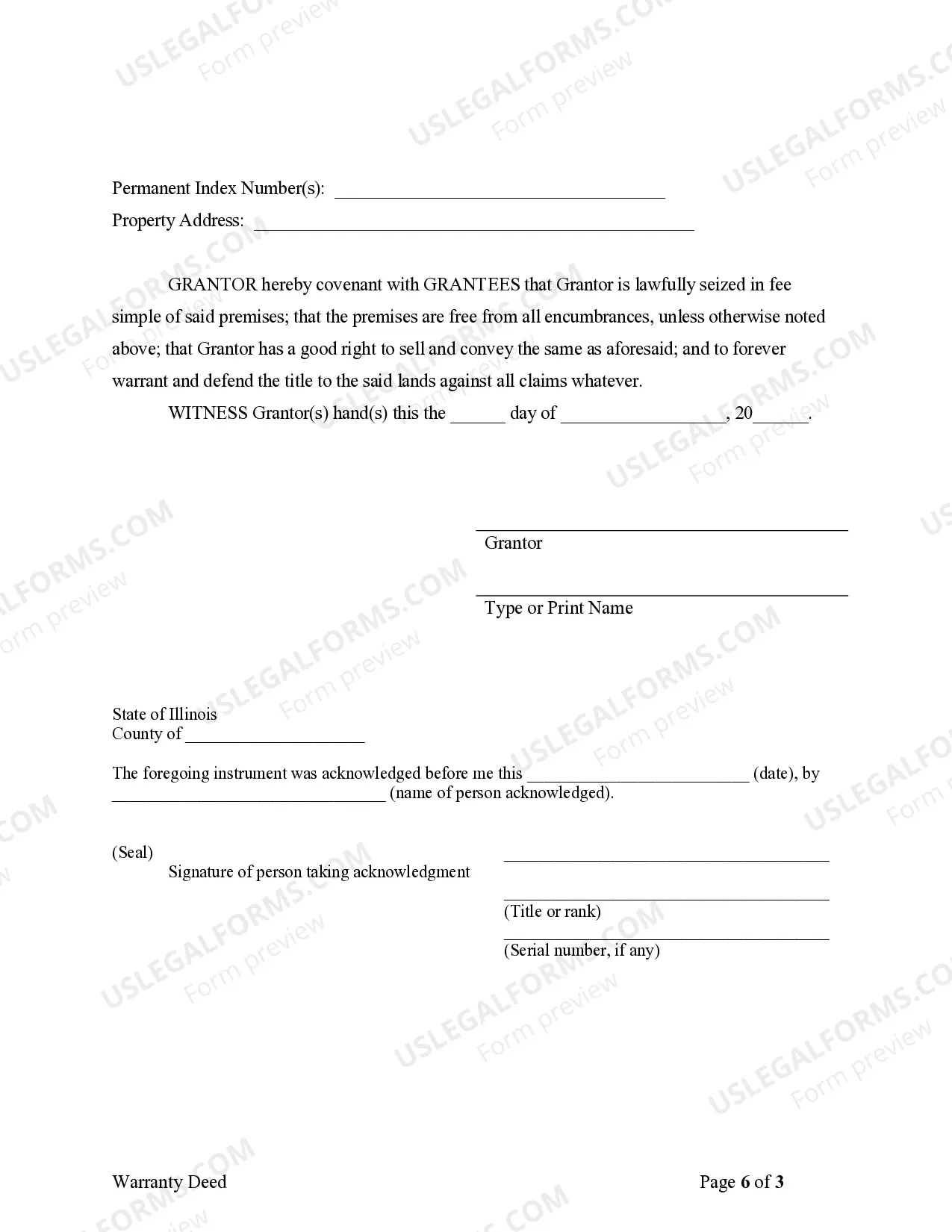

How to fill out Illinois Warranty Deed From Trustee To Trustee?

It’s clear that you cannot transform into a legal expert in a day, nor can you learn how to swiftly prepare Any Exempt Property For Chapter 7 without possessing a specialized skill set.

Drafting legal documents is a lengthy undertaking that necessitates particular education and expertise. So why not entrust the preparation of the Any Exempt Property For Chapter 7 to the experts.

With US Legal Forms, one of the most extensive legal document collections, you can obtain anything from court filings to templates for internal business communication.

Commence your search anew if you require a different form. Sign up for a complimentary account and select a subscription plan to purchase the template.

Select Buy now. Once the transaction is finalized, you can download the Any Exempt Property For Chapter 7, fill it out, print it, and send or mail it to the specified individuals or organizations.

- We recognize how crucial compliance and adherence to federal and local laws and regulations are.

- That’s why, on our platform, all forms are location-specific and current.

- Here’s how to begin with our website and acquire the form you need in just minutes.

- Find the form you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and read the supplementary description to ascertain if Any Exempt Property For Chapter 7 is what you are looking for.

Form popularity

FAQ

An individual or couple filing for bankruptcy can exempt an unlimited amount of equity in their home so long as they have owned the property for at least 1,215 days prior to filing their case. The property cannot be larger than a half-acre within the city limits or 160 acres outside of the city limits.

Income includes almost all of sources of income you may have including, but not limited to, business income, rental income, interested and dividends, pensions and retirements plans, amounts paid by others for your household expenses, and unemployment income.

Personal property includes motor vehicles, home furnishings, clothes, jewelry, household goods, livestock, and other items. There are many personal property bankruptcy exemptions in Texas. If you're filing bankruptcy as a single person, these exemptions can't exceed a total of $50,000.

Bankruptcy exemptions in Ontario ItemValueHousehold furniture, equipment, food and fuelUp to $14,180All clothingN/AA motor vehicleUp to $7,117Tools of trade or businessUp to $14,4054 more rows ?

Exempt property (items that a debtor may usually keep) can include: Motor vehicles, up to a certain value. Reasonably necessary clothing. Reasonably necessary household goods and furnishings.