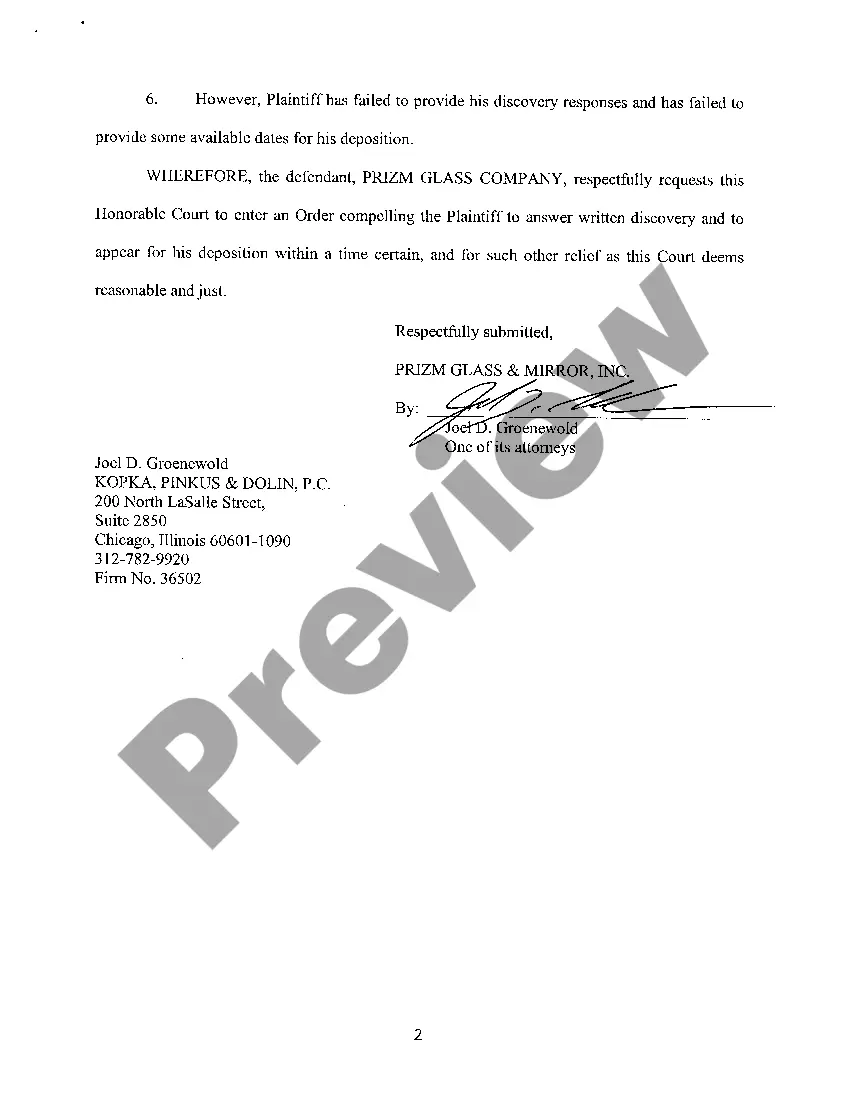

201 K Letter Withdraw

Description

How to fill out Illinois Motion To Compel?

Creating legal documents from the ground up can frequently be overwhelming. Certain situations may require extensive research and substantial financial investment.

If you're looking for an easier and more cost-effective method of drafting a 201 K Letter Withdraw or any other forms without unnecessary complications, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-specific templates meticulously crafted for you by our legal experts.

Utilize our platform whenever you require dependable and trustworthy services through which you can promptly locate and download the 201 K Letter Withdraw. If you're familiar with our site and have previously registered an account with us, simply Log In to your account, select the form and download it or re-download it at any time later in the My documents section.

Download the form. Then complete, sign, and print it out. US Legal Forms enjoys a solid reputation and boasts over 25 years of expertise. Join us now and simplify your form-filling process!

- Don't have an account? No problem. It takes just a few minutes to create one and explore the library.

- Before you rush to download the 201 K Letter Withdraw, take note of these suggestions.

- Examine the document preview and descriptions to ensure you have found the correct document.

- Ensure the form you select meets the regulations of your state and county.

- Select the appropriate subscription plan to obtain the 201 K Letter Withdraw.

Form popularity

FAQ

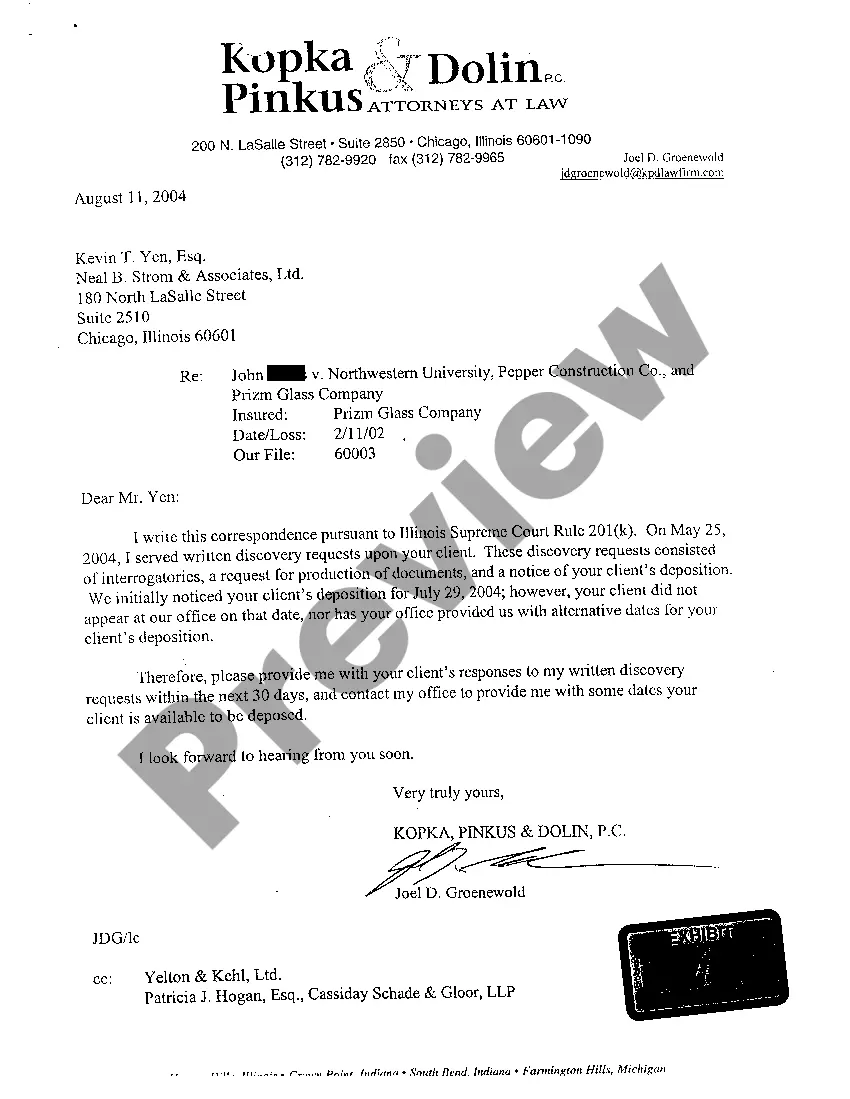

The discovery Rule 201 in Illinois pertains to the processes involved in the discovery phase of a legal case. This rule establishes guidelines for how parties can obtain information and evidence from each other before trial. It ensures a fair exchange of information, fostering transparency in legal proceedings. If you're navigating discovery issues or have questions about related topics like the 201 k letter withdraw, US Legal Forms offers valuable resources and templates to support you.

A motion to withdraw in court is a formal request made by an attorney to remove a previously filed document or motion from the court's consideration. This could involve withdrawing a plea, a legal claim, or other court documents. Understanding this concept is vital for clients, as it can influence the direction of a case. For further assistance regarding motions to withdraw and related paperwork, consider utilizing resources from US Legal Forms.

A 201k letter in Illinois serves as a formal communication that indicates the withdrawal of a motion or legal request. This letter is crucial for ensuring that the court and all involved parties are aware of the change. It helps prevent misunderstandings and keeps the legal process transparent. To learn more about drafting a 201k letter, check out US Legal Forms for templates and guidance.

A 201k letter is a document related to legal proceedings in Illinois, specifically concerning the withdrawal of certain motions or filings. This letter is essential for notifying the court and relevant parties about the withdrawal. If you are facing a situation involving a 201 k letter withdraw, it's important to understand its legal context and implications. US Legal Forms provides helpful templates and resources to navigate this process.

When an attorney says 'withdrawn', it typically refers to the removal of a legal document or motion from consideration by the court. This can occur for various reasons, such as a change in strategy or new information that affects the case. Understanding the implications of this term is crucial for clients, as it may impact their case outcomes. For clarity on such legal terminology, consider exploring resources like US Legal Forms.

There are various reasons for withdrawing a case, including reaching an amicable agreement, realizing the case lacks merit, or personal circumstances that make proceeding impractical. Submitting a 201 k letter withdraw can formally communicate your decision to the court. Each situation is unique, so it’s wise to consider the legal implications before making this choice. Consulting with a legal expert can provide valuable insights.

Several factors can negatively impact a custody case, including a lack of communication, failure to meet obligations, or any evidence of neglect. Demonstrating a willingness to cooperate is crucial, so avoid hostile behavior. A well-documented case can also help, so consider using resources to prepare, including a 201 k letter withdraw if necessary. Understanding these factors can help you present a stronger case.

To disengage from a lawyer, write a clear and concise letter stating your decision. Include your reasons for the disengagement and reference any ongoing cases, such as a 201 k letter withdraw if applicable. Make sure to thank them for their services and request a copy of your files. This approach helps maintain professionalism in your communication.

Yes, you can withdraw a custody case if you determine that it is in your best interest. This process usually involves submitting a 201 k letter withdraw to the court. Make sure to understand the legal consequences of this decision, as it can impact your rights. Talking to a lawyer can provide clarity and guidance through this process.

When a case is withdrawn, it essentially means that the legal proceedings are halted. The court will dismiss the case, and you may not be able to refile without a valid reason. Using a 201 k letter withdraw can help clarify your intentions to the court. It's important to understand the implications of this decision, so consider seeking legal advice.