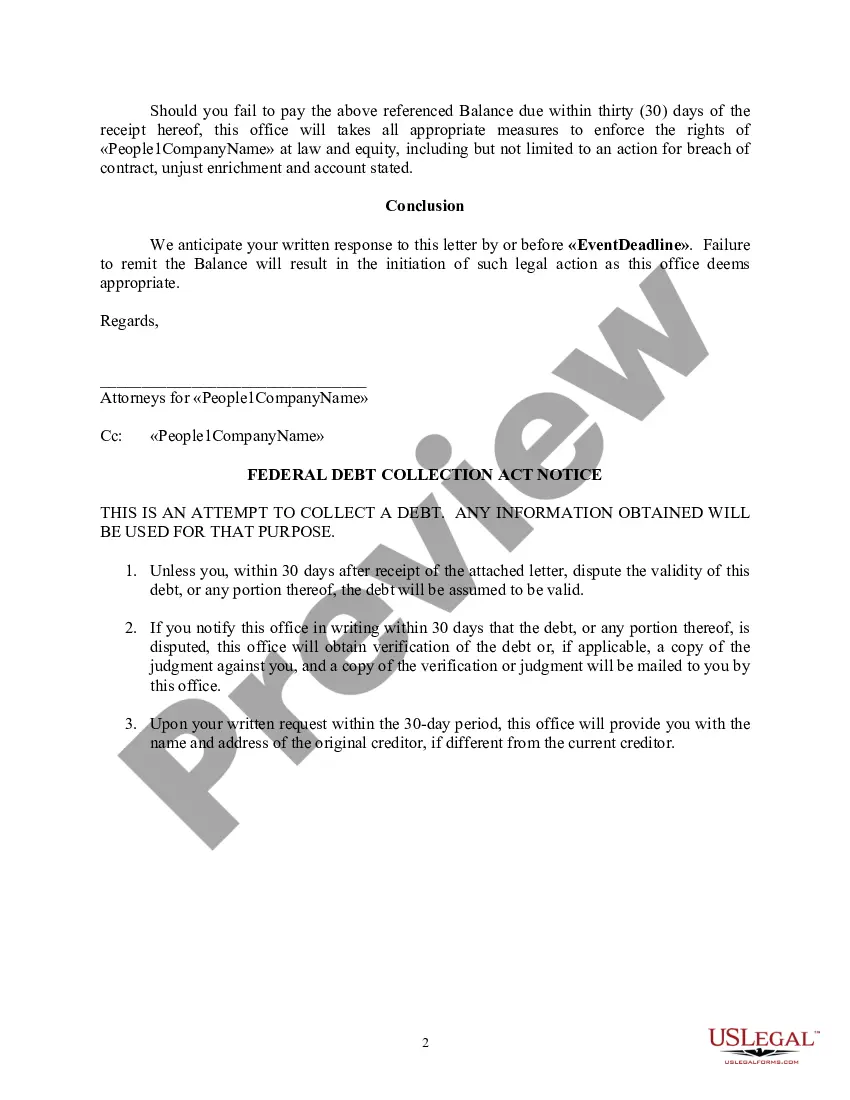

Collection letter format in business communication refers to the structure and framework used to compose written correspondence between a business and its customers regarding past due payments or outstanding invoices. These letters aim to remind, urge, and request customers to settle their dues promptly. The format and tone of a collection letter are critical in maintaining professionalism while effectively conveying the urgency of payment. There are several types of collection letter formats commonly used in business communication. These formats are designed to adapt to different stages of the collections process, offering varying levels of assertiveness and firmness. 1. Initial Reminder Letter: This is the first step in the collections process, sent shortly after a payment becomes overdue. The tone is usually polite and friendly, serving as a gentle reminder to the customer about the outstanding payment and requesting immediate resolution. 2. Follow-up Reminder Letter: If the initial reminder does not yield any response or payment, a more assertive follow-up reminder letter is employed. It emphasizes the importance of prompt payment, potential consequences of further delay, and may include specific details of the overdue payment. 3. Final Demand Letter: When previous reminders fail to yield any results, a final demand letter is sent as a last warning. This letter highlights the urgency and seriousness of the situation, emphasizing that legal action or debt collection agencies may be employed if the payment remains outstanding. 4. Suspension or Termination Letter: In cases where a customer consistently fails to make payments, a suspension or termination letter may be used. This letter states that the business will suspend services or terminate the customer's account if the payment is not made within a specific timeframe. 5. Letter Offering Settlement or Payment Plan: In situations where the customer is unable to make immediate payment, offering a settlement or proposing a payment plan can be a viable option. These letters provide a structured framework to negotiate a mutually agreeable payment arrangement that facilitates debt resolution. Regardless of the type of collection letter format employed, there are essential components that should be included: — Salutation: Begin the letter with a polite and professional greeting, using the recipient's name if possible. — Reference: State the purpose of the letter, highlighting the outstanding amount, invoice number, and the date it was due. — Explanation: Provide a concise explanation of the consequences of non-payment, any late fees or interest charges involved, and the potential impact on the customer's credit. — Urgency: Clearly express the urgency of the situation and the need for immediate payment or resolution. — Payment Options: Include information on available payment methods and provide clear instructions on how the payment can be made. — Contact Information: Provide relevant contact details, such as a dedicated collections department phone number or email address, for the customer to reach out for inquiries or payment-related matters. — Closing: End the letter with a polite closing, expressing hope for quick resolution and reiterating the consequences of further non-payment if applicable. By employing the appropriate collection letter format in business communication, companies can maintain a professional tone while effectively recovering outstanding payments and maintaining positive customer relationships.

Collection Letter Format In Business Communication

Description

How to fill out Collection Letter Format In Business Communication?

It’s no secret that you can’t become a law professional overnight, nor can you grasp how to quickly prepare Collection Letter Format In Business Communication without having a specialized set of skills. Putting together legal documents is a time-consuming process requiring a particular education and skills. So why not leave the preparation of the Collection Letter Format In Business Communication to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court documents to templates for internal corporate communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and get the document you need in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Collection Letter Format In Business Communication is what you’re looking for.

- Begin your search over if you need any other form.

- Set up a free account and select a subscription option to buy the form.

- Choose Buy now. Once the transaction is complete, you can download the Collection Letter Format In Business Communication, complete it, print it, and send or mail it to the designated individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Collection letter sample template Dear [Client name], We're sending you this letter as a friendly reminder that your account in the amount of [amount due to you] is past due. Your invoice was due on [month, day and year their payment was originally due as stated in their invoice].

Dear [RECIPIENT'S NAME], Despite our previous reminders, the above amount due remains unpaid. As such, we would appreciate you making this payment as soon as possible. We regret to advise that unless payment is received by [DATE] this collection will be passed over to our debt collection agency/lawyer.

How to Write Debt Collection Letters: Main Points Get to the Point: Clearly state your purpose without unnecessary details. Maintain Politeness: Use a professional tone to avoid confrontations. Keep it Concise: Short letters are often more effective and clear. Ease of Payment: Provide clear payment instructions.

How to Write Debt Collection Letters: Main Points Get to the Point: Clearly state your purpose without unnecessary details. Maintain Politeness: Use a professional tone to avoid confrontations. Keep it Concise: Short letters are often more effective and clear. Ease of Payment: Provide clear payment instructions.