Owner Contractor Located With Llc

Description

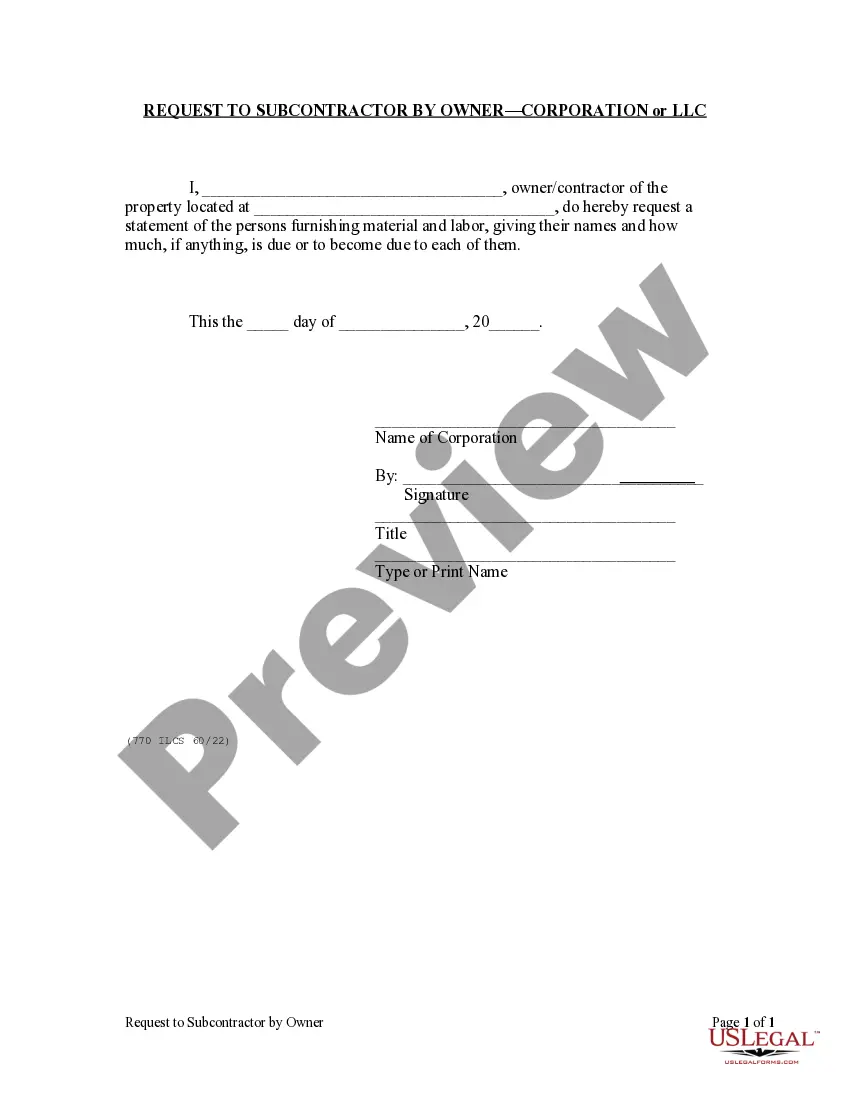

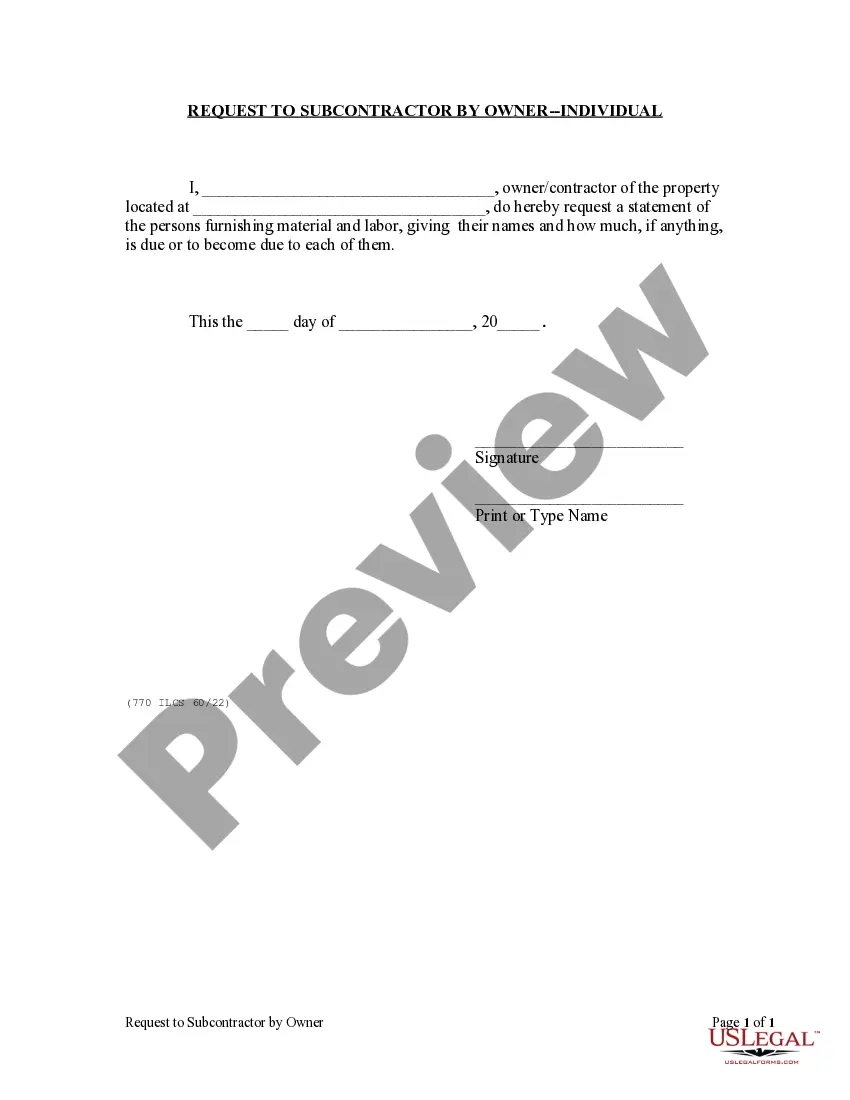

How to fill out Illinois Request By Owner To Subcontractor For List Of Suppliers, Labor - Mechanic Liens - Individual?

- If you are a returning user, log in to your account, verify your subscription status, and download the document you want by clicking the Download button.

- For new users, first, explore the Preview mode and read through the form description to find the document that fits your specific requirements.

- If the selected form isn’t suitable, use the Search tab at the top to find an alternative that meets your needs and complies with your jurisdiction.

- Once you find the right form, proceed by clicking the Buy Now button and selecting your preferred subscription plan while creating an account for access.

- Enter your payment details through credit card or PayPal to complete your purchase and gain access to the library.

- Finally, download the template to your device and find it later in the My Forms section of your profile.

With US Legal Forms, you not only gain access to an extensive library of legal documents but also the assurance of precision and assistance from premium experts. This empowers you to complete your documentation effortlessly.

Start unlocking the full potential of your legal needs today. Visit US Legal Forms and experience the convenience!

Form popularity

FAQ

The primary document that shows company ownership is called the Articles of Organization for LLCs. This formal filing includes the names of the members and is filed with the state. Accessing this document can help you reveal the owner contractor located with LLC and provide clarity in your research.

The owner of an LLC is often referred to as a 'member.' This term identifies individuals who have ownership rights and responsibilities within the business. Understanding the role of a member can help clarify the dynamics of the owner contractor located with LLC and how it operates.

Identifying who is behind a company involves researching its registrations and filings with state authorities. You can also look at online business databases that may provide insight into the owner contractor located with LLC. By exploring these resources, you can gain a better understanding of the company's leadership.

The owner of a company is typically the individual or group listed on the incorporation documents. For an LLC, this person or group manages the business profits and liabilities. You can easily identify the owner contractor located with LLC by reviewing public filings with the state’s business registry.

To find the background of a company, start by checking the business's filings with the Secretary of State. You can also look for online databases that compile business information. Additionally, platforms like uslegalforms can assist you in obtaining comprehensive reports about the company, including the owner contractor located with LLC.

Yes, the owner of an LLC is generally considered public record. Each state requires the filing of certain documents that outline the LLC's ownership structure. You can often access this information through your state’s Secretary of State website. By checking these records, you can find details about the owner contractor located with LLC.

Documenting ownership in an LLC involves creating an operating agreement, membership certificates, and maintaining detailed records of capital contributions. These documents illustrate each member's investment and role clearly. For owner contractors located with LLCs, comprehensive documentation serves as vital proof of ownership, protecting your interests in the business.

When filling out a W9 as a single member LLC, you’ll list your LLC name and the type of entity you are, which is a disregarded entity for tax purposes. Include your social security number or EIN, depending on what you choose for tax identification. For owner contractors located with LLCs, correctly completing this form is vital for providing accurate information to clients.

Yes, the owner of an LLC can receive a 1099 if they are classified as independent contractors. This form reports income earned from clients or businesses, reflecting your earnings accurately. For owner contractors located with LLCs, understanding this tax obligation ensures compliance and proper record-keeping.

As an independent contractor operating under an LLC, your business address should be the official address registered with your state. This address represents your LLC legally and is used for correspondence. Correctly listing this address is particularly important for owners contractors located with LLCs seeking credible presence in their industry.