Limited Liabiluty

Description

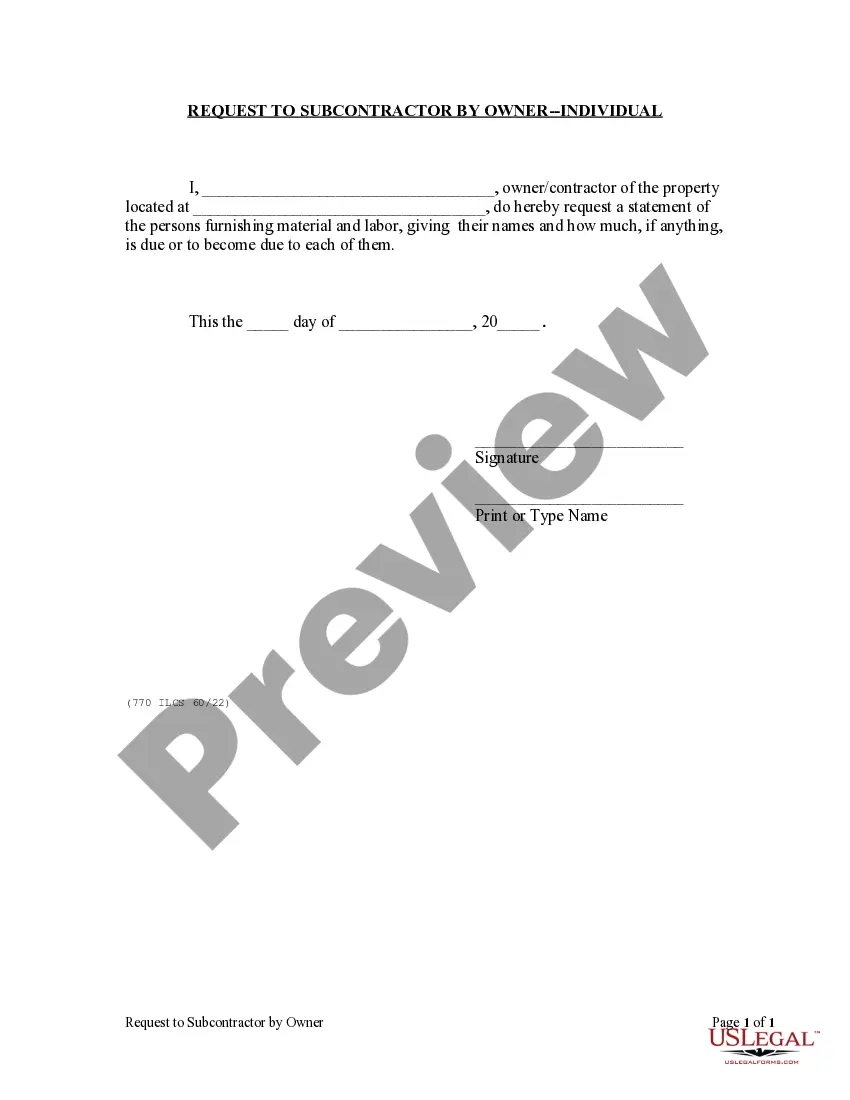

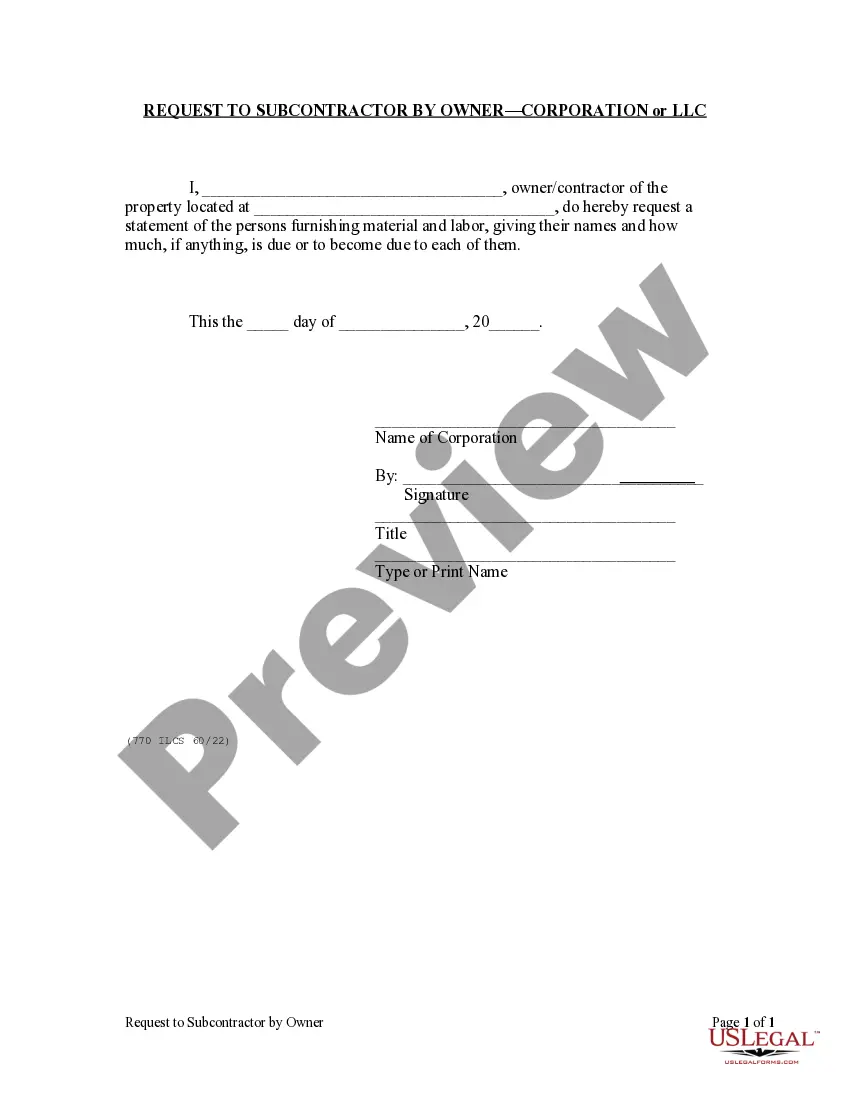

How to fill out Illinois Request By Owner To Subcontractor For List Of Suppliers, Labor - Mechanic Liens - Corporation Or LLC?

- If you're a returning user, log in to your account to download the required form template by clicking the Download button. Verify your subscription status and renew if necessary.

- For first-time users, start by previewing the available forms and their descriptions. Ensure that the selected document aligns with your needs and is compliant with your local jurisdiction.

- If you need a different template, utilize the Search function to find the suitable form. Make sure it meets your criteria before proceeding.

- Purchase your document by clicking on the Buy Now button and selecting your preferred subscription plan. You will need to create an account to unlock full access to the library.

- Complete your purchase by entering your payment details through your credit card or PayPal account.

- Finally, download the form to your device and access it anytime from the My Forms section of your profile.

In conclusion, US Legal Forms offers a robust collection of legal documents that help streamline your legal needs concerning limited liability. With easy access, a broad selection, and expert guidance, you can ensure your forms are accurate and ready for use.

Get started today by visiting US Legal Forms and navigate your legal documentation with confidence!

Form popularity

FAQ

To write a limited liability company, use the full name followed by the designation, such as 'XYZ Enterprises, Limited Liability Company.' Alternatively, you can use the abbreviation 'XYZ Enterprises, LLC.' Either format clearly indicates your business structure and the protection offered by limited liability.

LLC should be written as either 'Limited Liability Company' or as the abbreviation 'LLC.' It is essential to use the term consistently in business documents and public communications. This ensures clarity and legal recognition of your company's limited liability status.

The limited liabilities of an LLC include protecting the personal assets of its owners from business debts and legal obligations. This means that if the LLC faces lawsuits or financial troubles, the members are not personally liable for the company's debts beyond their investment. This separation fosters business stability and encourages entrepreneurial ventures.

When writing an LLC example, start by including the name you have selected for your company, followed by the phrase 'Limited Liability Company' or its abbreviation 'LLC.' For instance, you may write 'ABC Widgets, LLC.' This clearly communicates to your customers and partners that your business enjoys the benefits of limited liability.

A limited liability example is when a business owner forms an LLC, thereby ensuring personal assets are protected from company debts. Suppose a customer sues the LLC for damages; the owner’s personal property, like their home or savings, remains safe from any legal claims. This protection illustrates the fundamental benefit of limited liability arrangements for individuals.

To fill for an LLC, begin by choosing a unique name that complies with your state’s regulations. Next, you need to file the Articles of Organization with your state’s business filing office, along with any required fees. After that, consider creating an operating agreement to outline the management structure and operational guidelines for your limited liability company.

The start-up costs for a Limited Liability Company (LLC) can vary significantly based on various factors. Initial expenses often include filing fees, legal assistance, and any necessary licensing or permits, which may range from a few hundred to a couple of thousand dollars. It's wise to budget for ongoing costs as well, such as annual reports and taxes. If you need assistance navigating these costs, consider using US Legal Forms to help streamline your LLC formation.

Limited liability for all owners means that every partner or shareholder in a business enjoys the same protection of their personal assets against the company's debts. This framework promotes fairness and encourages more individuals to invest without the fear of losing personal wealth. Utilizing platforms like USLegalForms can help you establish the proper legal structure to ensure limited liability for all involved.

Limited liability means that an owner's financial responsibility is confined to their investment in the business. This structure is beneficial for protecting personal assets against business debts and legal claims. Essentially, if the business faces bankruptcy or legal issues, only the business assets are at risk, not the owner's personal belongings.

The key difference between limited and unlimited liabilities lies in the level of personal financial risk involved. With limited liability, your personal assets are shielded, reducing your financial exposure. Conversely, with unlimited liability, you risk losing personal assets to cover business debts, which can lead to significant financial challenges.