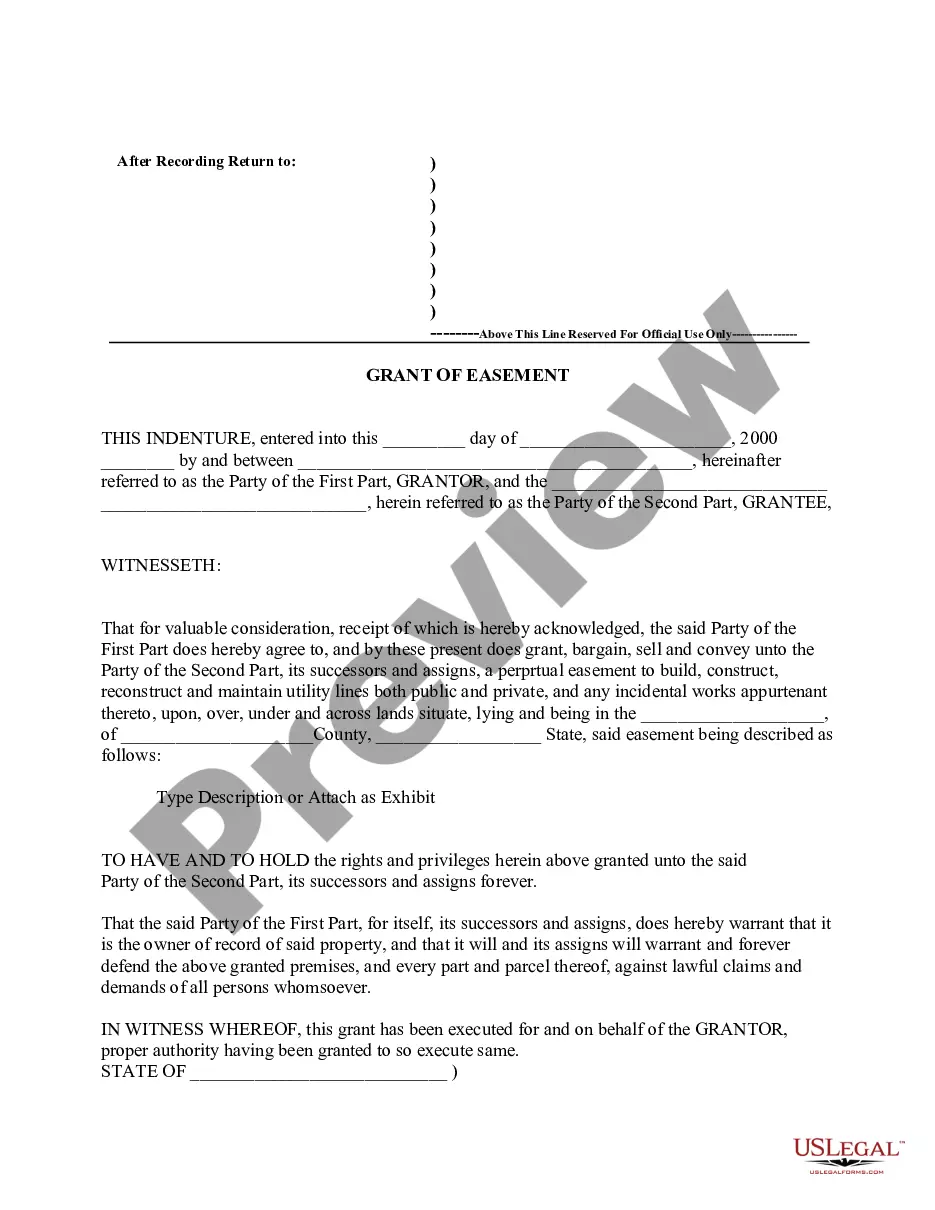

Easement In Gross Example

Description

How to fill out Idaho Easement For Utilities?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain cases may require hours of investigation and substantial financial investment.

If you’re looking for a simpler and more cost-effective method of drafting Easement In Gross Example or other papers without the hassle, US Legal Forms is always here to help.

Our online collection of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can promptly access state- and county-compliant templates meticulously crafted by our legal professionals.

Ensure that the form you select adheres to the rules and legislation of your state and county. Choose the most appropriate subscription option to purchase the Easement In Gross Example. Download the form, then complete, sign, and print it. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us today and transform form completion into something straightforward and efficient!

- Utilize our platform whenever you require trustworthy and dependable services to swiftly locate and obtain the Easement In Gross Example.

- If you’re already familiar with our services and have set up an account with us, simply Log In to your account, find the template, and download it or re-download it anytime later in the My documents section.

- Not signed up yet? No problem. It takes little to no time to create an account and explore the library.

- However, before proceeding to download the Easement In Gross Example, consider these suggestions.

- Review the document preview and descriptions to confirm that you have located the document you are looking for.

Form popularity

FAQ

In general, personal easements in gross cannot be assigned to someone else. This type of easement is tied to the individual and does not attach to the land. Therefore, when considering an easement in gross example, it is essential to understand that it typically remains with the original holder. However, certain easements may have unique provisions that allow for transferability.

A Massachusetts LLC is created by filing a Limited Liability Company Certificate of Organization with the Secretary of the Commonwealth Corporations Division. The certificate must include: the LLC's federal (employer) identification number (if any) the LLC's name and street address in Massachusetts.

The fee to file the Massachusetts LLC Certificate of Organization is $500. (Add $20 if filing online or by fax.) Filing your Certificate of Organization with the Secretary of the Commonwealth officially creates your Massachusetts LLC.

Updated August 25, 2023. A Massachusetts LLC operating agreement is used to include the ownership, business purpose, and day-to-day operations of the company.

In Massachusetts, you're not required to create an operating agreement for your SMLLC. However, having one in place between you (as the single member) and your LLC can provide many benefits. Having an agreement in place can help with liability protection by separating your business from you personally.

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year.

Massachusetts does not require you to submit an Operating Agreement to form your LLC.

A Massachusetts single-member LLC operating agreement is a legal document that is acquired for completion by a sole proprietor (single owner) who would like to establish standard operating procedures and policies for their company.

Starting an LLC in Massachusetts will include the following steps: #1: Name Your Massachusetts LLC. #2: Appoint a Registered Agent. #3: File Your Certificate of Organization. #4: Take Special Steps if You're Filing a PLLC. #5: Craft an Operating Agreement.