Amendment Living Trust With The Beneficiary

Description

How to fill out Idaho Amendment To Living Trust?

- If you are a returning user, log in to your account and download the appropriate amendment form by clicking the Download button. Ensure your subscription is active.

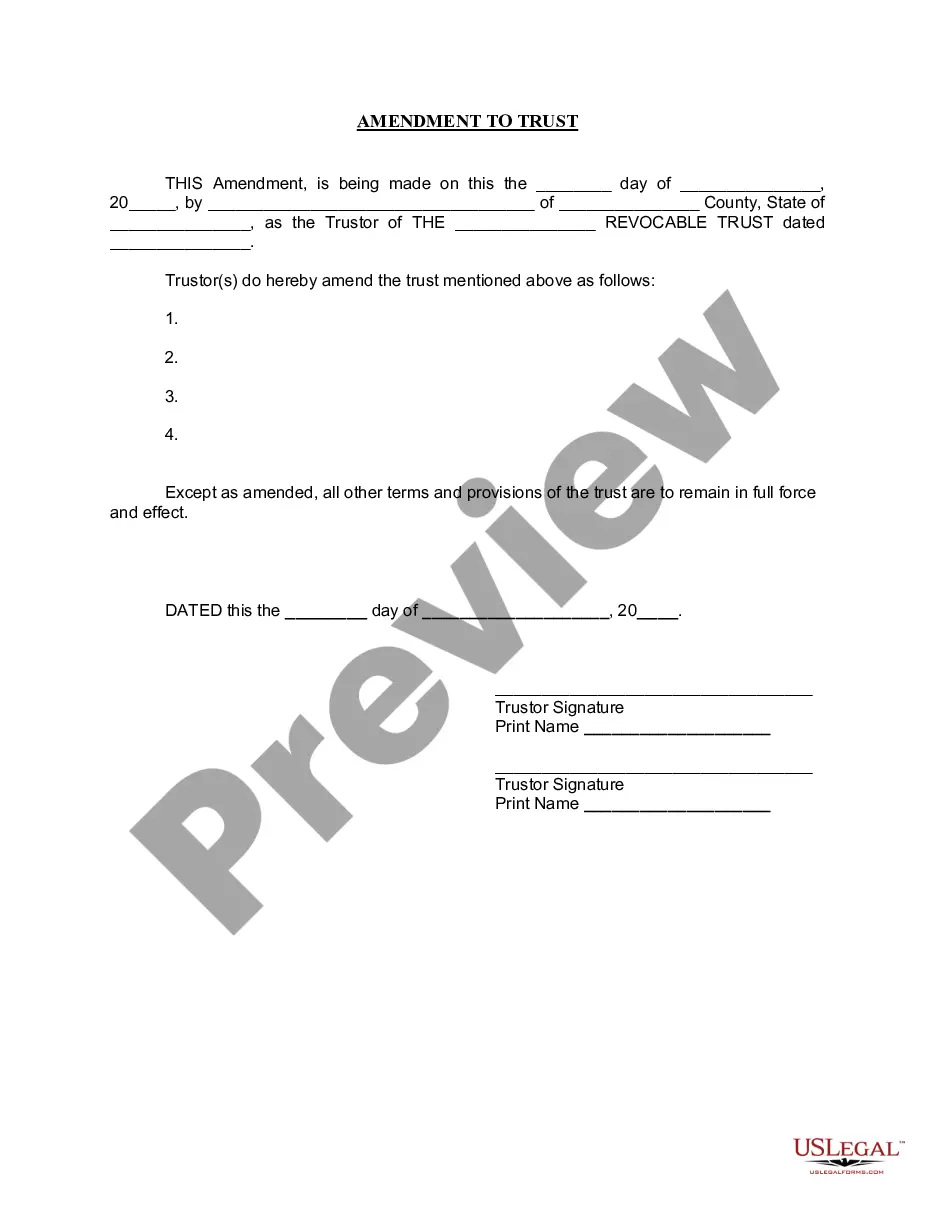

- For first-time users, start by checking the Preview mode and reading the form description to confirm it fits your needs based on local jurisdiction.

- If the form doesn't match your requirements, use the Search tab above to find the right amendment template.

- Once you've found the correct template, click the Buy Now button and select your preferred subscription plan. You'll need to create an account to access the library.

- Proceed to make your payment using your credit card or PayPal to finalize your subscription.

- Download your amended form to your device and access it anytime through the My Forms section of your profile.

Following these steps ensures that your amendment living trust with the beneficiary is legally compliant and accurately reflects your wishes.

Start your journey with US Legal Forms today for quick and reliable access to legal documents!

Form popularity

FAQ

A codicil pertains specifically to changing provisions in a will, while an amendment alters portions of a living trust. Each serves its purpose within estate planning, but they address different legal documents. Understanding these differences is essential when managing your amendment living trust with the beneficiary to ensure your estate plan functions as intended.

To amend a trust, you typically need the original trust document, a clear statement of the changes, and signatures of the grantor in the presence of a notary. Including a statement that the amendment applies to the specific sections is also beneficial. Taking these steps ensures that your amendment living trust with the beneficiary accurately reflects your intentions and remains legally sound.

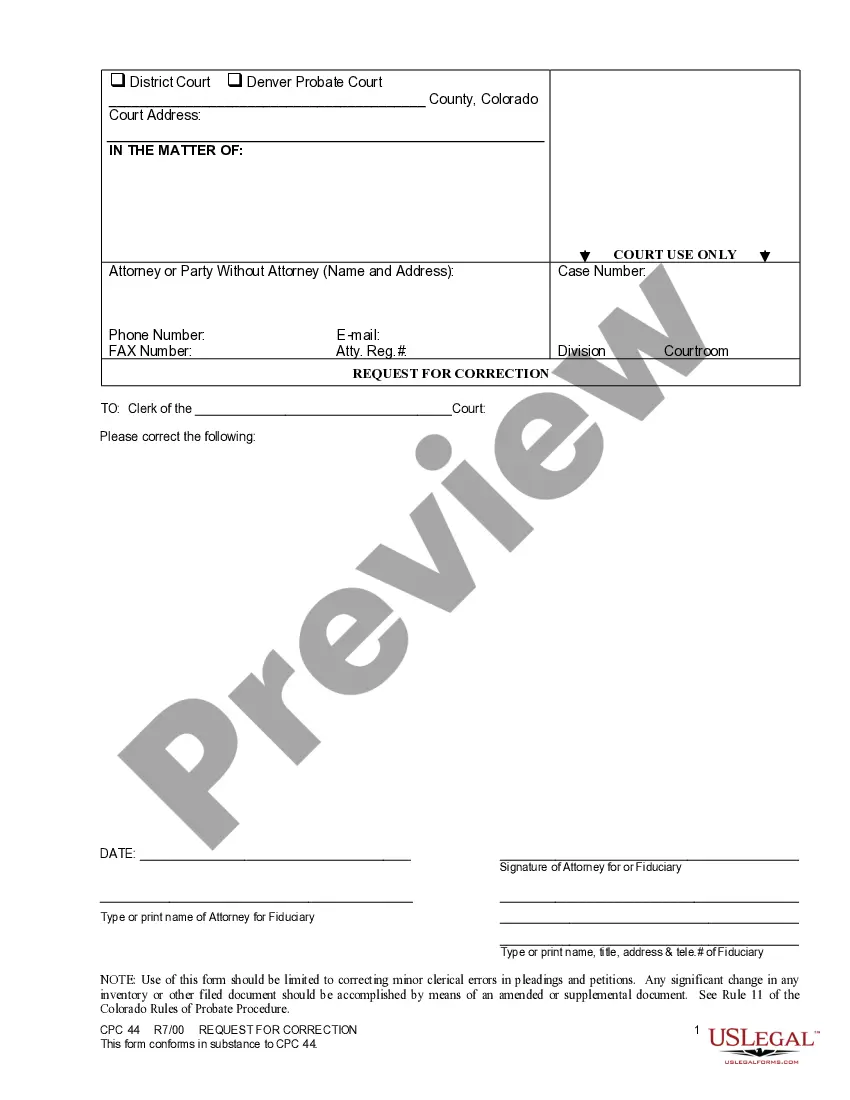

Generally, an amendment to a trust does not need to be recorded in public records to be effective; however, some states may require certain documents to be filed. It's important to check local laws for any specific recording requirements. Properly following the legal guidelines reinforces the validity of your amendment living trust with the beneficiary. Always consider consulting a legal expert for detailed guidance.

A codicil to a trust is similar to an amendment, but it works specifically with wills. To write a codicil, outline the changes you want to make to your existing trust and clearly state how these changes apply to the beneficiaries. Signing and notarizing the codicil is crucial for it to be legally binding, especially when you wish to modify your amendment living trust with the beneficiary.

An amendment to the trust agreement is a formal document that updates specific elements of a living trust. It allows you to make changes regarding the beneficiaries, trustee, or distribution of assets. This flexibility is important for adapting your amendment living trust with the beneficiary to reflect any changes in your life circumstances. Ensure that the amendment is signed properly to maintain its validity.

A trust amendment modifies specific parts of an existing trust, while a trust restatement rewrites the entire document as if it were new, consolidating all previous amendments. This distinction is crucial when considering how to manage your amendment living trust with the beneficiary. Restating the trust can simplify its administration, making it clearer for all parties involved.

To write an amendment to a living trust, you first need to identify the specific sections you wish to change. Clearly state the changes you want to make and ensure they align with your intentions regarding the beneficiary. It’s essential to sign and date the amendment in the presence of a notary public. This process helps maintain the legal integrity of your amendment living trust with the beneficiary.

A beneficiary cannot usually modify a trust on their own. The authority to make changes, such as an amendment to living trust with the beneficiary, typically lies with the trustee or the trust creator. However, if the trust allows for modifications or grants certain powers to beneficiaries, changes may be possible. For those looking to navigate these processes, US Legal Forms offers resources and templates to help you manage amendments efficiently.

While you can amend a trust on your own, consulting a lawyer may provide added assurance. If your situation is complex or involves significant changes, a lawyer can help you navigate the legal language. However, many individuals successfully use platforms like U.S. Legal Forms to create an amendment living trust with the beneficiary independently. This option is often more affordable and accessible for those comfortable with basic legal documents.

To amend a living trust, start by accessing your original trust document. Create an amendment document that describes the changes you wish to implement, focusing on the beneficiary details as necessary. U.S. Legal Forms provides resources to help you craft a precise and legally sound amendment living trust with the beneficiary. Ultimately, this process allows you to keep your trust up-to-date and aligned with your current wishes.