Release of Lien by Posting of Surety Bond - Individual

Note: This summary is not intended to be an all

inclusive discussion of Idaho's construction or mechanic's lien laws, but

does include basic provisions.

What is a construction or mechanic's lien?

Every State permits

a person who supplies labor or materials for a construction project to

claim a lien against the improved property. While some states differ

in their definition of improvements and some states limit lien claims to

buildings or structures, most permit the filing of a document with the

local court that puts parties interested in the property on notice that

the party asserting the lien has a claim. States differ widely in

the method and time within which a party may act on their lien. Also

varying widely are the requirements of written notices between property

owners, contractors, subcontractors and laborers, and in some cases lending

institutions. As a general rule, these statutes serve to prevent

unpleasant surprises by compelling parties who wish to assert their legal

rights to put all parties who might be interested in the property on notice

of a claim or the possibility of a claim. This by no means constitutes

a complete discussion of construction lien law and should not be interpreted

as such. Parties seeking to know more about construction laws in

their State should always consult their State statutes directly.

Who can file a lien in this State?

Idaho law permits "Every

person, ..., performing labor upon, or furnishing materials to be used

in the construction, alteration or repair of any mining claim, building,

wharf, bridge, ditch, dike, flume, tunnel, fence, machinery, railroad,

wagon road, aqueduct to create hydraulic power, or any other structure,

or who grades, fills in, levels, surfaces or otherwise improves any land,

or who performs labor in any mine or mining claim, and every professional

engineer or licensed surveyor under contract who prepares or furnishes designs, plans,

plats, maps, specifications, drawings, surveys, estimates of cost, on-site

observation or supervision, or who renders any other professional service

whatsoever for which he is legally authorized to perform in connection

with any land or building development or improvement, or to establish boundaries,

to have a lien upon the same for the work or labor done or professional services

or materials furnished, whether done or furnished at the instance of the

owner of the building or other improvement or his agent; and every contractor,

subcontractor, architect, builder or any person having charge of

any mining claim, or of the construction, alteration or repair, either

in whole or in part, of any building or other improvement, as aforesaid,

shall be held to be the agent of the owner for the purpose of this chapter

provided, and the lessee or lessees of any mining claim shall not be considered as

the agent or agents of the owner..." Idaho Code § 45-501.

How long does a party have to file a lien?

A party seeking to claim

a lien must file a claim of lien within ninety (90) days after the completion

of the labor or services or furnishing of materials. Idaho Code §

45-507.

What kind of notice is required prior to filing

a lien?

Idaho statutes do not

require an additional filing or notice other than the lien claim itself.

By what method is a lien filed in this State?

A Claim of Lien must

be filed containing a statement of the claimant's demand, the names of

relevant parties, and a property description. It must be verified

by the oath of the claimant and a copy must be served personally or by

certified mail to the property owner. Idaho Code § 45-507.

How long is a lien good for?

A party seeking to assert

a lien must begin legal proceedings to enforce the lien within six (6)

months after the claim of lien has been filed, or, if "a payment on account

is made, or extension of credit given with expiration date thereof, and

such payment or credit and expiration date is endorsed on the record of

the lien, then six (6) months after the date of such payment or expiration

of extension."

Are liens assignable?

Idaho statutes on construction

liens do not specifically speak as to whether liens may be assigned to

other parties.

Does this State require a notice prior to starting

work, or after work has been completed?

No. Idaho statutes

do not require a Notice of Commencement or a Notice of Completion as required in

some other States.

Does this State permit a person with an interest

in property to deny responsibility for improvements?

No. Idaho statutes

do not have a provision which permits the denial of responsibility for

improvements.

Is a notice attesting to the satisfaction of a

lien provided for or required?

No. Idaho statutes

do not provide for or require that a lien holder who has been paid produce

or file a notice to that effect.

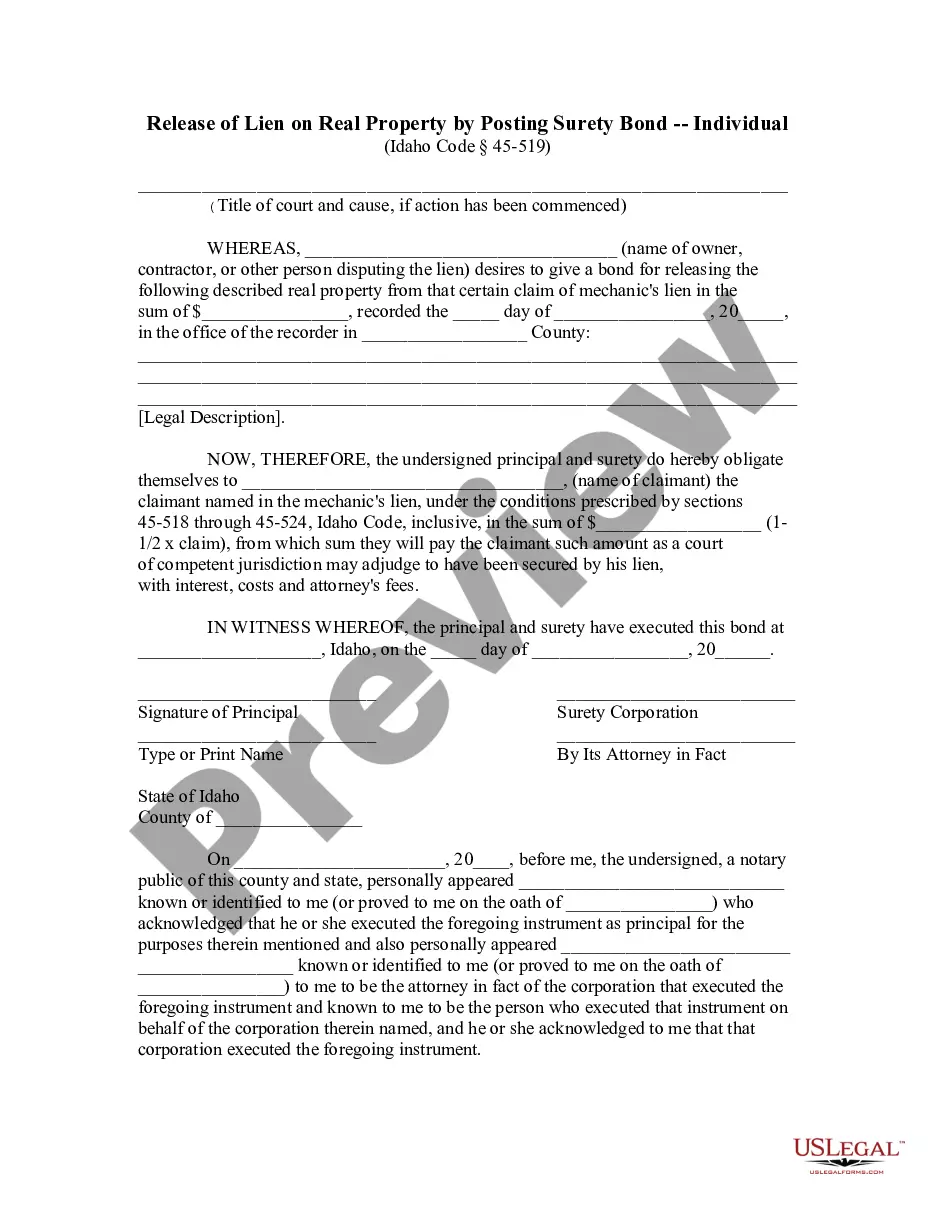

Does this State permit the use of a bond to release

a lien?

Yes.

Idaho has several provisions for the release of a lien after the proper

filing of a bond. However, the filing of a petition and a hearing

before a judge in the appropriate court is required before obtaining an

order releasing the lien.