This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Iowa Promissory Note With Collateral

Description

How to fill out Iowa Promissory Note With Collateral?

There's no longer a necessity to squander time searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in a single location and made their accessibility easier.

Our platform offers over 85k templates for any business and personal legal situations organized by state and area of use.

Prepare official documents under federal and state regulations swiftly and easily with our platform. Try US Legal Forms today to organize your documentation!

- All forms are expertly drafted and validated for authenticity, giving you confidence in obtaining a current Iowa Promissory Note With Collateral.

- If you are acquainted with our service and already maintain an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all acquired documentation at any time by accessing the My documents tab in your profile.

- For those who haven't used our service before, the process will involve a few additional steps to complete.

- Here's how new users can find the Iowa Promissory Note With Collateral in our library.

- Carefully examine the page content to ensure it includes the sample you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

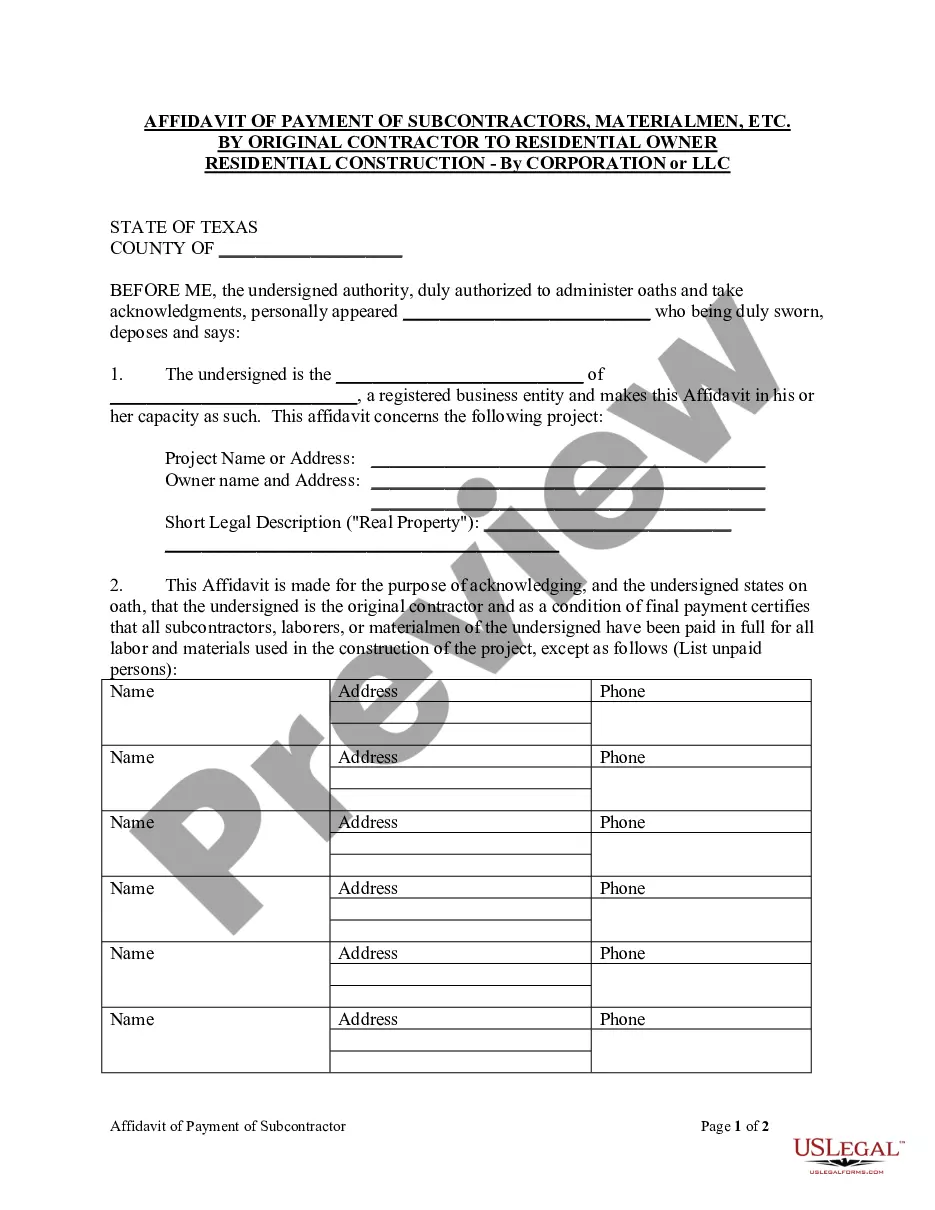

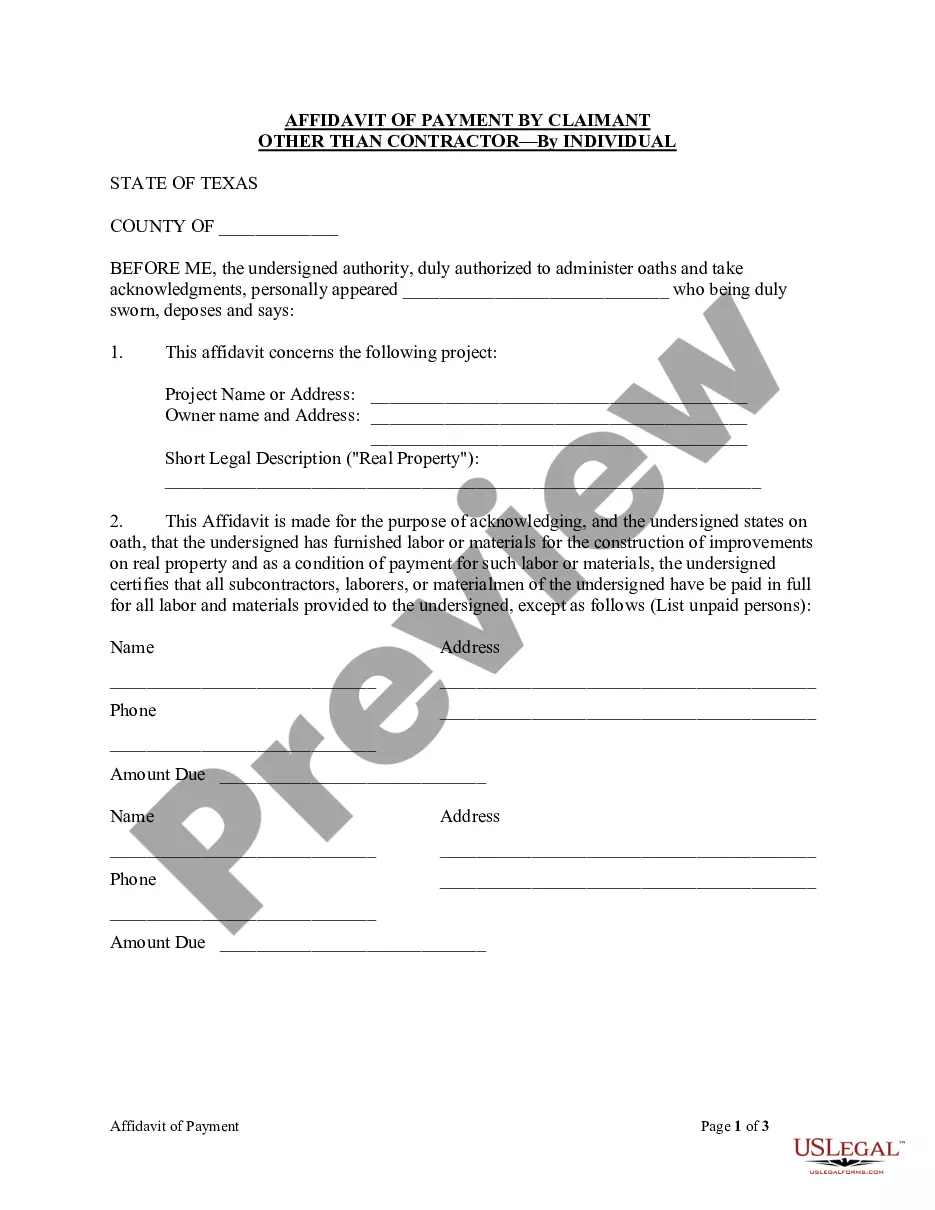

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Collateral notes are simply promissory notes that commit specific resources to the repayment of an outstanding loan amount. During the period of time in which the note is in force, the recipient of the loan may not sell or otherwise make use of the assets without the express permission of the lender.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.