Assignment of Partnership Interest

Description

Key Concepts & Definitions

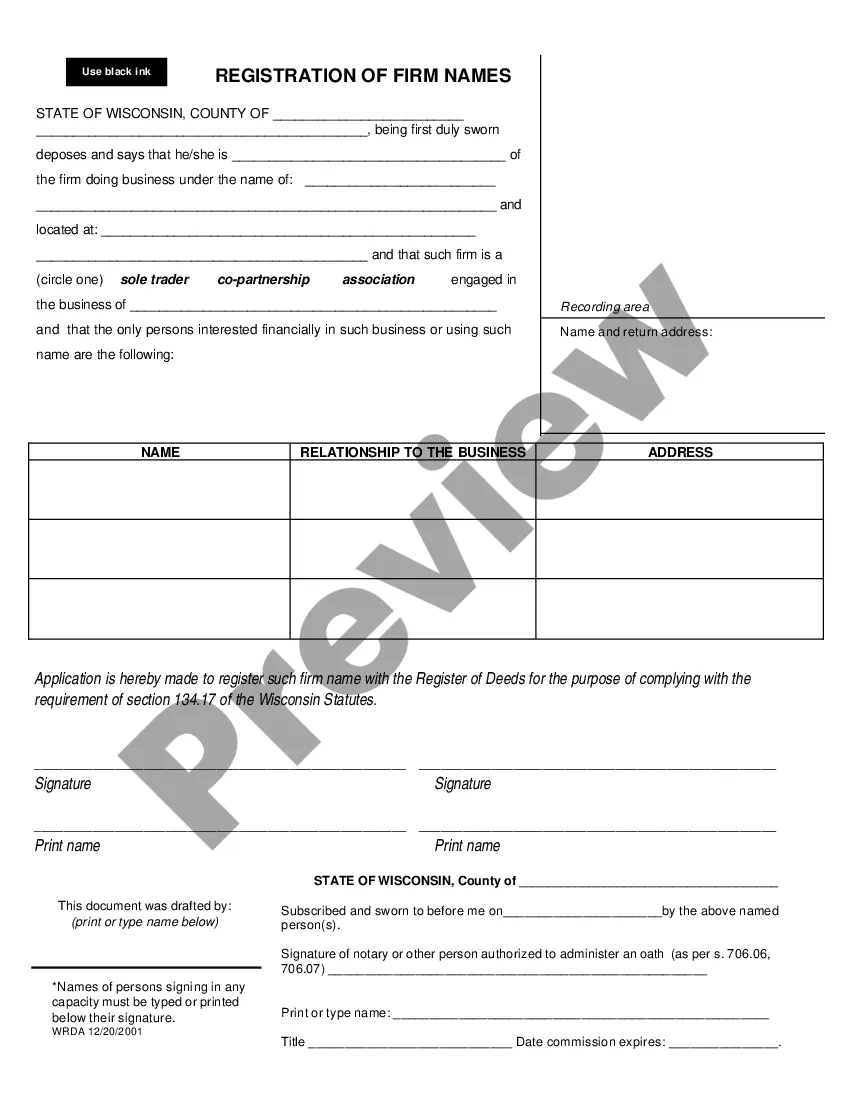

Assignment of Partnership Interest refers to the process by which one partner transfers their ownership interest in a partnership to another party. This can involve the transfer of rights to share in profits and losses, and to participate in the management of the partnership. This transfer is governed by the partnership agreement, as well as applicable state laws in the United States.

Step-by-Step Guide to Assigning Partnership Interest

- Review the Partnership Agreement: Examine the partnership agreement for any clauses related to the transfer of interest and compliance requirements.

- Check State Laws: Refer to the state laws governing partnerships in the state where the partnership is registered.

- Obtain Consent: Most states and partnership agreements require the consent of the remaining partners.

- Value the Partnership Interest: Determine the value of the partnership interest being transferred.

- Execute an Assignment Agreement: Draft and execute an agreement detailing the transfer of partnership interest and responsibilities.

- Update Partnership Records: Reflect the assignment in the partnership's records and notify necessary governmental bodies.

Risk Analysis

- Legal Risks: If not executed according to the partnership agreement and state law, the transfer could be deemed invalid.

- Financial Risks: Incorrect valuation of the partnership interest could lead to financial losses.

- Relationship Risks: Potential conflict among partners, especially if consent is not sought or if the terms are not transparently communicated.

Pros & Cons

- Pros: Enables liquidity and flexibility in managing partnership stakes. Facilitates succession planning.

- Cons: Can create conflicts if not transparently managed. Legal complexities could arise from improper adherence to agreements and laws.

Best Practices

- Always consult legal and financial advisors to review and execute the assignment.

- Ensure transparent communication among all partners involved in the assignment.

- Meticulously follow the partnership agreement and state laws during the transaction.

Common Mistakes & How to Avoid Them

- Ignoring Partnership Agreement: Always review and adhere to the stipulations within the partnership agreement.

- Failing to Get Consent: Ensure all partners agree to the assignment to avoid legal hurdles.

- Inaccurate Valuation: Engage professional services to accurately value the partnership interest.

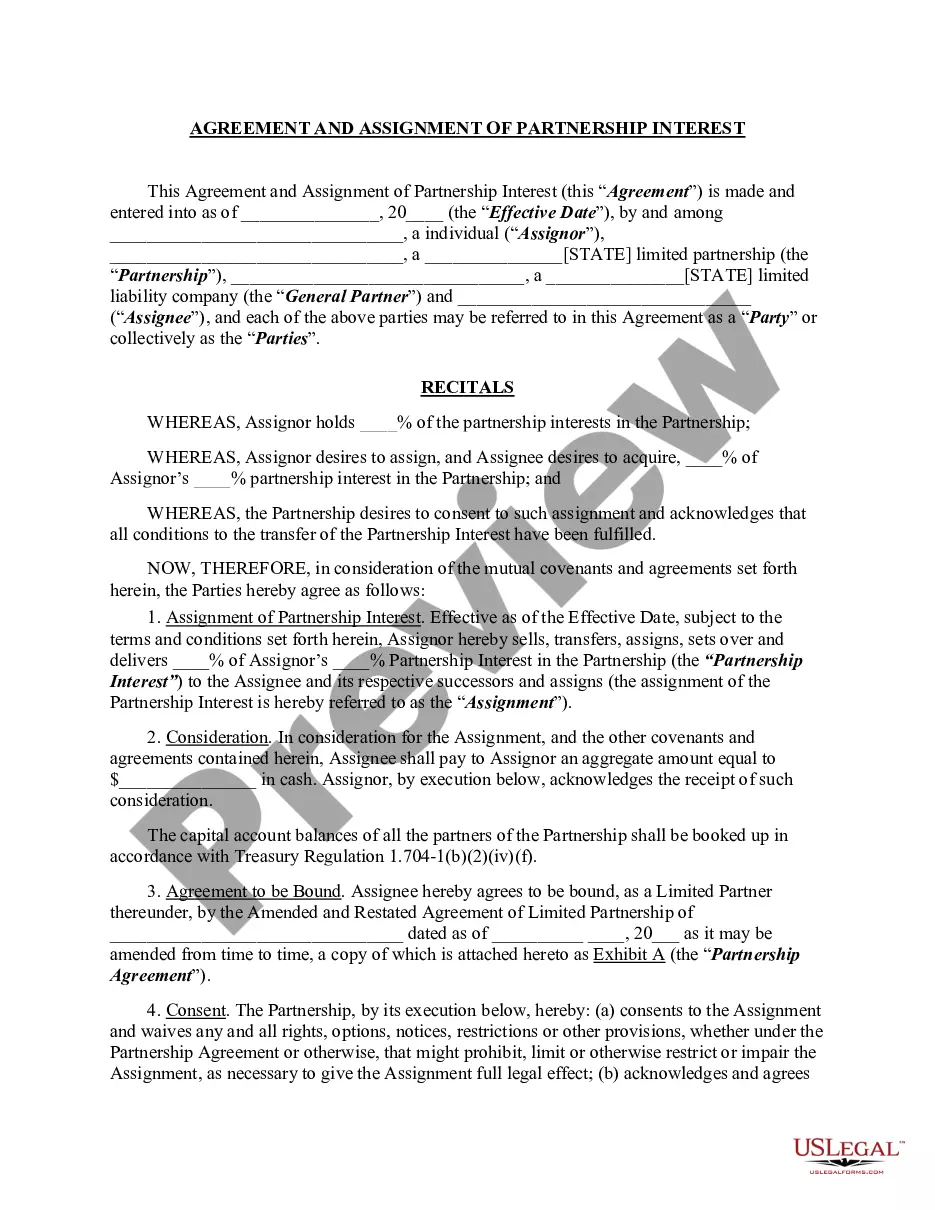

How to fill out Assignment Of Partnership Interest?

Aren't you tired of choosing from numerous samples each time you want to create a Assignment of Partnership Interest? US Legal Forms eliminates the lost time an incredible number of American people spend searching the internet for appropriate tax and legal forms. Our professional team of attorneys is constantly upgrading the state-specific Templates catalogue, to ensure that it always offers the proper documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription need to complete a few simple actions before being able to get access to their Assignment of Partnership Interest:

- Make use of the Preview function and look at the form description (if available) to make sure that it is the appropriate document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right sample for your state and situation.

- Utilize the Search field at the top of the webpage if you have to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your sample in a needed format to complete, print, and sign the document.

Once you’ve followed the step-by-step guidelines above, you'll always have the capacity to sign in and download whatever document you require for whatever state you want it in. With US Legal Forms, completing Assignment of Partnership Interest templates or any other official paperwork is simple. Begin now, and don't forget to examine your samples with certified lawyers!

Form popularity

FAQ

Although there's no requirement for a written partnership agreement, often it's a very good idea to have such a document to prevent internal squabbling (about profits, direction of the company, etc.) and give the partnership solid direction. Limited liability partnerships do have a writing requirement.

Name of the partnership. Contributions to the partnership. Allocation of profits, losses, and draws. Partners' authority. Partnership decision-making. Management duties. Admitting new partners. Withdrawal or death of a partner.

An assignment of interest is a transfer of a limited liability company (LLC) owner's interest in the LLC. The most common reasons for an LLC owner to transfer their interest in an LLC are to leave the LLC, to pay off a debt, or to secure a loan.

Name of your partnership. Contributions to the partnership and percentage of ownership. Division of profits, losses and draws. Partners' authority. Withdrawal or death of a partner.

A partner's interest in a partnership is considered personal property that may be assigned to other persons. In addition, an assignment of the partner's interest does not give the assignee any right to participate in the management of the partnership.

A partnership agreement is a written agreement between the owners of a company. If the company is a limited liability company, the agreement is an Operating Agreement. For a corporation, the agreement is a Shareholder Agreement. If the parties form a general partnership, it is a Partnership Agreement.

"Partnership interest" means a partner's share of the profits and losses of a limited partnership and the right to receive distributions of partnership assets.

Like any contractual agreement, partnership agreements do not have to be in writing, as verbal agreements are also legally binding.In a partnership, each person is liable for the debts and actions of the other partners, so the contractual relationship and obligations need to be completely transparent.

An Assignment of Partnership Interest is a legal document that transfers the rights to receive benefits from an original business partner (Assignor) to a new business partner (Assignee).Assignee: name and address of the new partner receiving the business interest.