Iowa Note Download With Key

Description

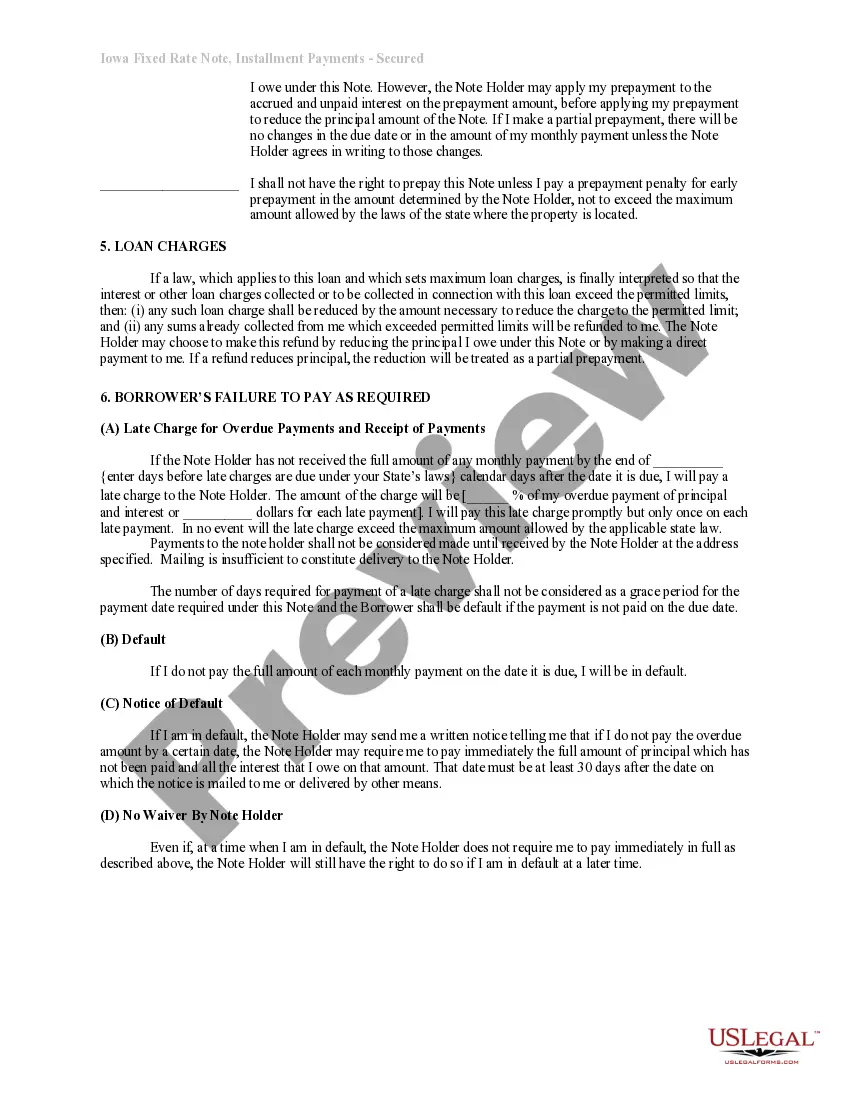

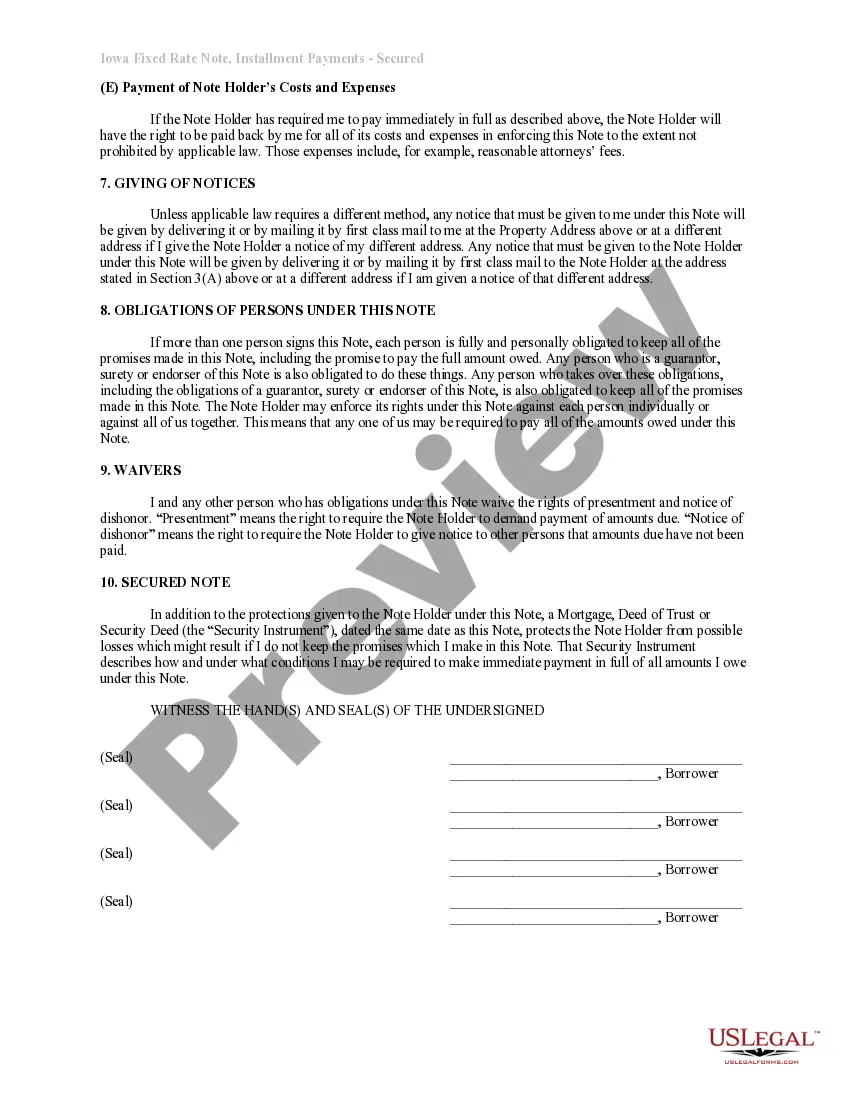

How to fill out Iowa Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

- Log in to your account if you have previously used US Legal Forms. Ensure your subscription is active. If necessary, renew based on your payment plan.

- Preview the form and read its description carefully to confirm it meets your requirements and adheres to local jurisdiction regulations.

- If the form is not suitable, utilize the Search tab to explore the extensive collection of legal templates to find the right one for you.

- Once you find the suitable document, click the Buy Now button. Choose your preferred subscription plan and create an account to unlock access to valuable resources.

- Complete your payment by entering your credit card details or using your PayPal account to finalize the purchase.

- Download the form to your device for completion and keep it accessible via the My Forms section in your profile whenever you need it.

US Legal Forms not only provides the convenience of downloading legal documents but also ensures precision and legality with the help of premium experts available to assist in form completion.

Start your legal document journey today with US Legal Forms and take advantage of their exceptional services!

Form popularity

FAQ

Refunds from state and local tax returns may be taxable if you deducted those taxes in a previous year. If you didn't deduct those local taxes, the refund is generally not taxable. For a better understanding of your tax situation, the Iowa note download with key offers valuable guidance on these specifics.

In Iowa, taxable income generally includes wages, salaries, dividends, and interest. Certain forms of retirement income and business profits are also taxable. Utilize the Iowa note download with key to accurately assess your taxable income and ensure compliance with Iowa tax law.

Your federal tax refund is not taxable in Iowa unless you claimed a deduction for state taxes on your federal return. If you deducted state taxes and then received a refund, you may need to report that refund on your Iowa return. The Iowa note download with key will help you navigate these tax implications clearly.

The IDR ID number in Iowa refers to the identification number assigned by the Iowa Department of Revenue to individual taxpayers and businesses. This number helps the Iowa Department of Revenue track tax payments and filings accurately. You can find resources like the Iowa note download with key to help you obtain and manage your IDR ID.

State taxes are not directly included in your federal tax return, as they are reported separately. However, if you itemize deductions, you can include state and local tax payments. The Iowa note download with key provides helpful tools for managing both federal and state tax details effectively.

Generally, a federal tax refund is not considered taxable income in the year it is received. However, if you previously deducted state taxes and received a refund, you may need to report some of it. Understanding these nuances can be straightforward with resources like the Iowa note download with key, guiding you through the specifics.

A Schedule 1 form in Iowa is used to report additional income or adjustments to income that are not included on the standard income tax form. This form is essential for accurately completing your Iowa tax return. If you have specific deductions or income types, the Iowa note download with key can assist you in detailing this information properly.

To get a copy of your Iowa driving record, visit the Iowa Department of Transportation's website or your local county office. You can request a copy online, by mail, or in person. This documentation is essential, especially when dealing with your Iowa note download with key for verified transactions.

Yes, Iowa has introduced a digital driver's license option. This can be accessed via the Iowa DOT app, which allows you to use your digital ID in various situations. It's a great time saver and enhances your Iowa note download with key experience seamlessly.

To add your Iowa license to Apple Wallet, go to the Wallet app and tap 'Add'. Follow the prompts to scan your license, ensuring you have an Iowa digital ID. This integration helps with your Iowa note download with key, making it easier to carry your identification digitally.