Dissolution Dissolve Corporation For 5 Years

Description

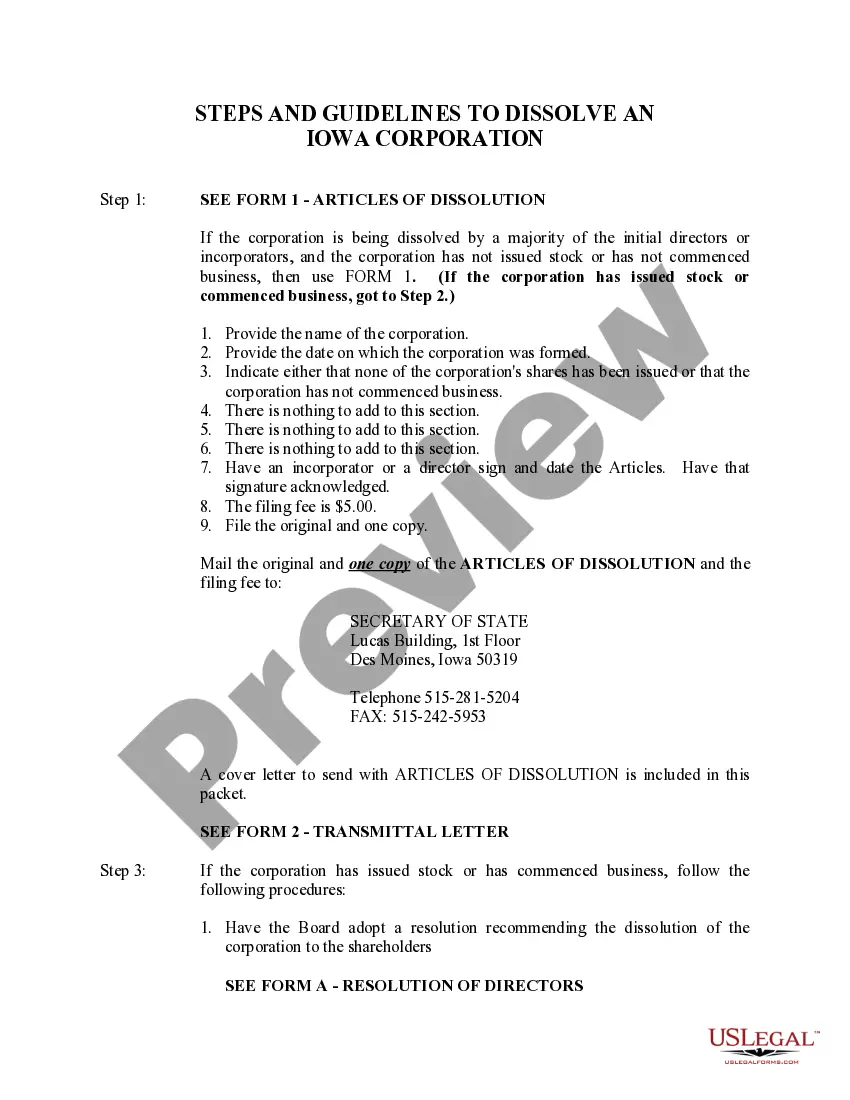

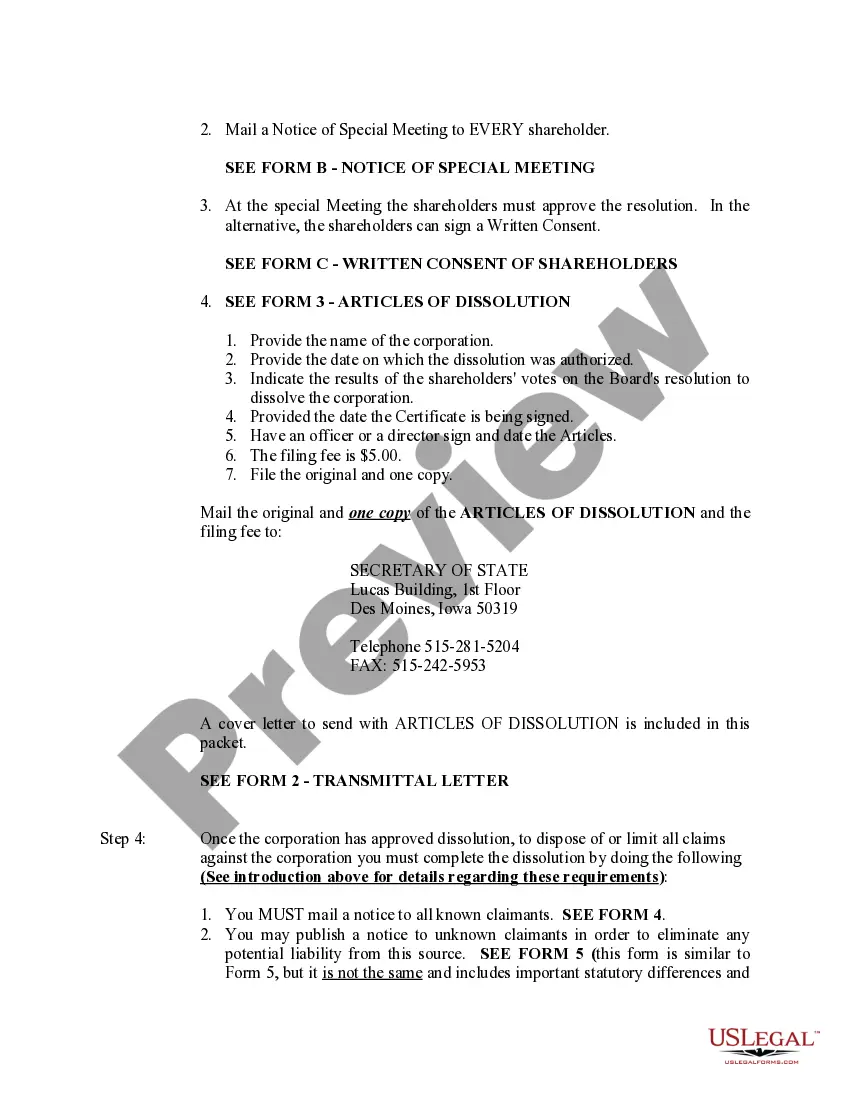

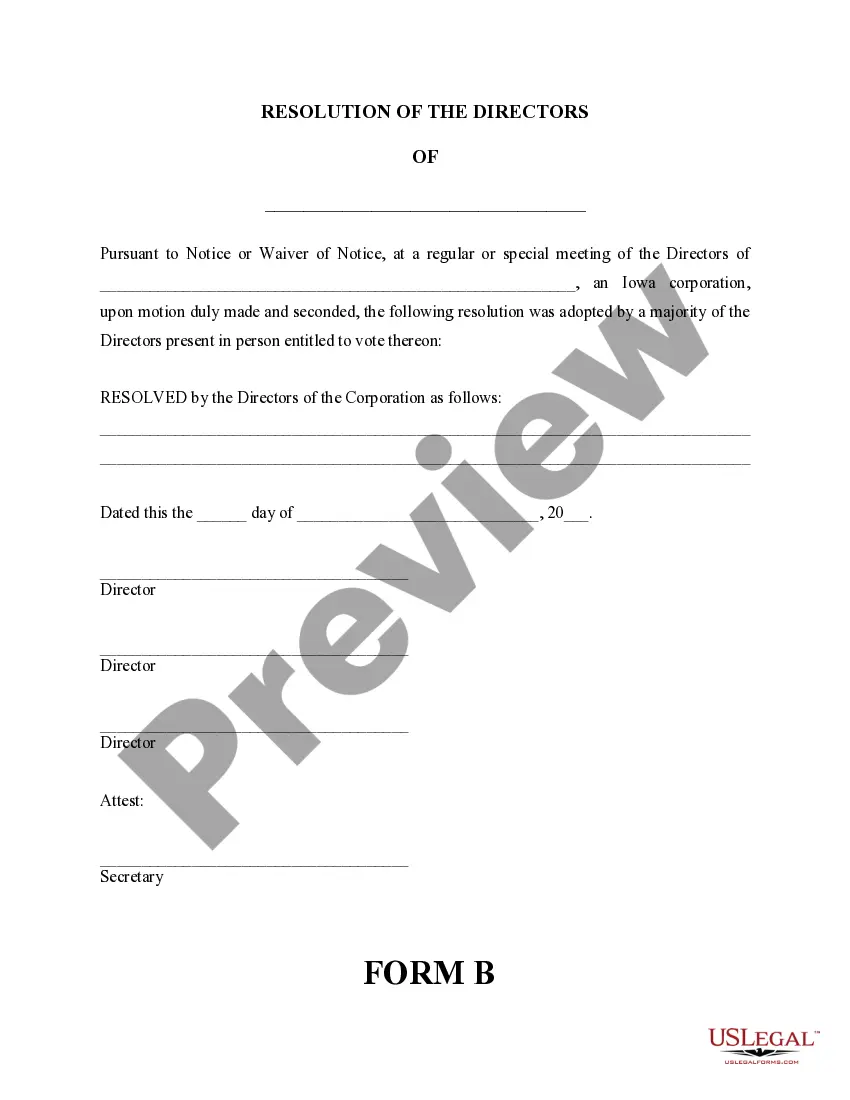

How to fill out Iowa Dissolution Package To Dissolve Corporation?

- Start by logging into your US Legal Forms account if you are a returning user. Click on the Download button to obtain the required form template, ensuring your subscription is active. If your subscription is expired, renew it based on your chosen payment plan.

- For new users, the first step is to review the Preview mode and the form description. This ensures you select the appropriate template that aligns with your needs and complies with local jurisdiction.

- Should you need another template, utilize the Search tab to find a more suitable option. Confirm it meets your criteria before proceeding.

- Once you've identified the correct document, click the Buy Now button and select a subscription plan that fits your needs. You'll need to create an account for full access to the library.

- Proceed to make your purchase by entering your payment details or using your PayPal account to finalize the subscription.

- After your transaction is complete, download the chosen form to your device. You can access this document anytime through the My Forms menu in your profile.

By utilizing US Legal Forms, you gain access to an extensive collection of over 85,000 legal forms, which are fillable and editable. This ensures you have the right tools to complete your dissolution process accurately.

Empower yourself with accurate legal documentation today. Visit US Legal Forms to get started!

Form popularity

FAQ

Proving a business is dissolved generally involves obtaining documentation from the Secretary of State, where formal dissolution filings are stored. You can request a certificate of dissolution, which officially confirms the status of the corporation. Additionally, tax records or business filings may indicate inactivity, further supporting the claim of dissolution. If you need assistance in navigating this process, US Legal Forms provides tools to help you acquire the necessary proof of a corporation's dissolution.

To tell if a business has been dissolved, start by checking public records available through the state’s business registry. You can often find a list of dissolved corporations, which indicates their legal status. If you suspect a company’s existence but can’t find recent activity, it might indicate that it has gone through the dissolution process. Utilizing US Legal Forms allows you to explore detailed documents related to dissolution and maintain updated information.

You can verify if a company is dissolved by reviewing its status on your state’s Secretary of State website, where you can find detailed records. Typically, a dissolved corporation will no longer be active or able to conduct business. Additionally, legal notices pertaining to the dissolution may be published, announcing the status change. For further clarity on the process of dissolution or to confirm the status of a corporation for 5 years, US Legal Forms offers helpful resources.

To find out if a business is closed down, you can check with your state’s Secretary of State office. This office maintains records of all registered businesses and can indicate if a corporation has undergone dissolution. Additionally, you can search online databases for business status, which often list companies that have been inactive. Engaging with platforms like US Legal Forms can also provide comprehensive insights into the dissolution status of a corporation.

Dissolving a company is not the exact equivalent of closing a business. While closing may indicate a temporary halt to operations, dissolution means the company no longer exists legally. If you're facing a situation where dissolution has been needed for 5 years, understanding the distinction is essential for compliance and future planning.

To dissolve a company means to terminate its legal status and business activities officially. This process includes settling debts and distributing any remaining assets among owners and stakeholders. Taking into account a dissolution that lasted for 5 years, it is crucial to follow legal protocols to avoid future liabilities.

When an LLC is dissolved, it means that the company is ending its legal existence. The members need to follow specific procedures to ensure proper distribution of assets and payment of debts. This process can be intricate, so it is often advisable to consult platforms like US Legal Forms for guidance on the dissolution process that has persisted for 5 years.

If you don't file Form 966 when dissolving a corporation, it can lead to complications with the IRS and the state. Not filing this form could result in additional taxes or penalties, as it serves to formally notify authorities of your intent to dissolve. Therefore, it's critical to complete this step promptly, especially when considering the dissolution of a corporation for 5 years.

Dissolving a corporation does not automatically trigger an audit; however, the IRS may focus on your final tax returns during the dissolution process. Proper documentation and timely filing of notices help minimize the chances of an audit. Maintaining accurate records for at least five years can support your dissolution and facilitate a smoother transition.

The three types of dissolution include voluntary dissolution, where the corporation’s owners agree to dissolve, administrative dissolution by the state due to noncompliance, and judicial dissolution directed by a court due to various disputes. Each type serves different needs and circumstances. Understanding these categories can help clarify which path to take when you are considering dissolving a corporation for five years.