Llc Limited Liability With Us Llc

Description

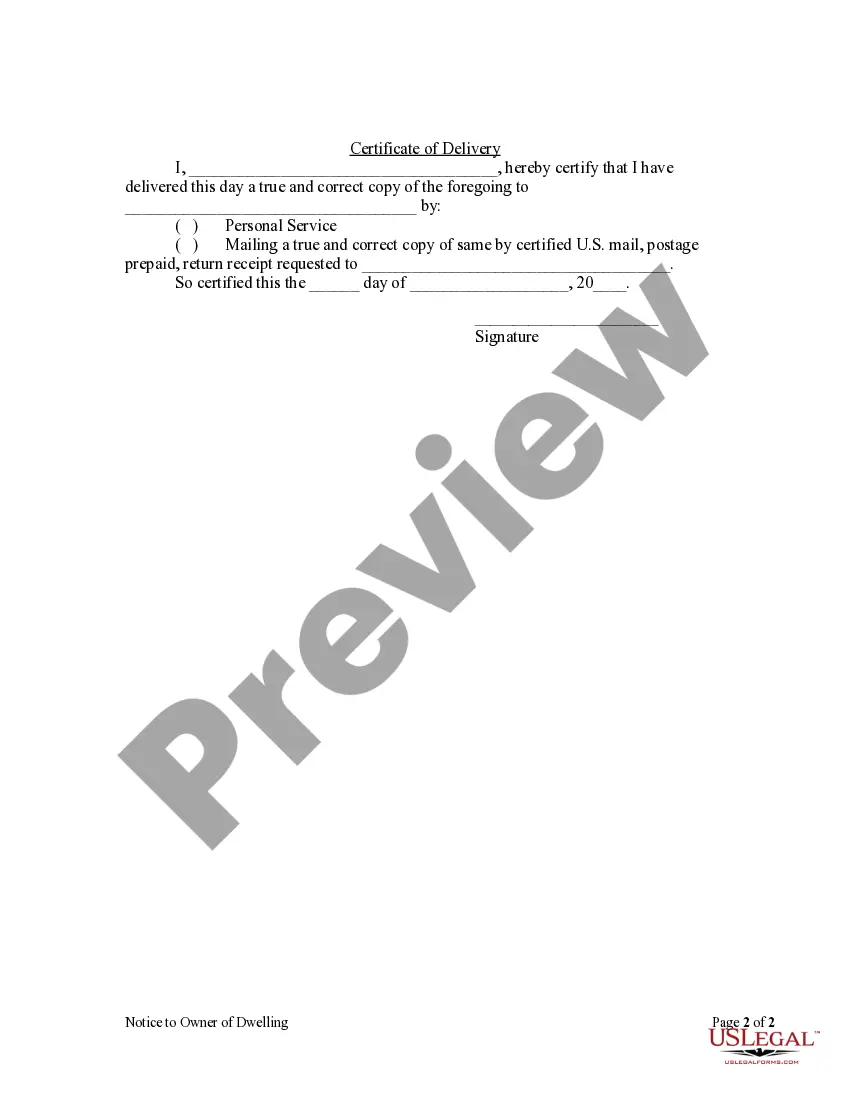

How to fill out Iowa Notice To Owner Of Dwelling By Corporation Or LLC?

- Begin by accessing your account. If you're a returning user, log in to download the required form template. Make sure your subscription is current; renew it if necessary.

- Review the available forms in Preview mode. This allows you to ensure the document aligns with your needs and complies with local regulations.

- Use the search function if additional forms are necessary. Should you find any discrepancies or need alternatives, locate the appropriate template using the search tab.

- Proceed to purchase your document by clicking the 'Buy Now' button and select a subscription plan that fits your needs. You'll need to create an account to access our full library.

- Complete your payment using credit card or PayPal. This grants you access to the vast array of legal forms available on our platform.

- Download the completed form and save it to your device. You can also find it under the My Forms section of your profile whenever needed.

By empowering individuals and attorneys alike, US Legal Forms simplifies the process of executing legal documents with confidence. Our extensive library features over 85,000 editable forms, ensuring you find the perfect fit for your LLC requirements.

Take advantage of our premium support to guarantee the accuracy of your legal documents. Start your LLC journey with US Legal Forms today!

Form popularity

FAQ

To register a Limited Liability Partnership (LLP) in the USA, you must file a certificate of limited liability partnership with your state and often include a partnership agreement. The requirements can vary by state, so it is essential to check specific regulations to ensure compliance. Platforms like uslegalforms can guide you through the registration process, helping you effectively establish your LLP with the benefits of limited liability protection.

While you cannot directly use 'limited' instead of LLC, it's crucial to know that in the U.S., LLC and limited are often used in different contexts. LLC signifies a limited liability company, which provides personal safeguards against liabilities. Therefore, using LLC limited liability with US LLC is a clearer choice for branding and legal protection in business, while 'limited' does not convey the same structure.

The primary difference between LLC and Ltd in the USA lies in their structure and liability. An LLC, or limited liability company, provides personal asset protection from business debts, while a Ltd, or limited company, is not a common structure in the U.S. The LLC structure is more flexible and allows for various management options. When considering LLC limited liability with US LLC, it is essential to understand these distinctions to choose the right business structure for your needs.

To write a limited liability company, you start by choosing a unique name that adheres to your state's guidelines. Next, you need to draft and file Articles of Organization with the appropriate state agency, outlining your LLC's business structure. It's also vital to create an Operating Agreement that defines how the company will be managed. Using uslegalforms simplifies these steps with ready-to-use templates and expert advice tailored for LLC formation.

In most cases, members of an LLC cannot be sued personally, thanks to the limited liability protection. However, there are exceptions where personal guarantees or illegal activities may put members at risk. Therefore, it’s crucial to maintain proper business practices and separate personal and business finances. You can find resources on uslegalforms to help you set up your LLC correctly and maintain that separation.

An example of a limited liability company, or LLC, could be a small business like a local bakery. This type of business structure allows the owners, known as members, to protect their personal assets from business debts. Essentially, if the bakery faces financial trouble, the owners’ personal property typically remains safe. Using uslegalforms can help you streamline the process of forming your LLC with limited liability.

On Instagram, LLC usually indicates that a business account operates as a limited liability company. This designation signals professionalism and personal asset protection for the owners. If you plan on promoting a business using an LLC limited liability with US LLC, including this in your social media presence can enhance credibility. Many users recognize the significance of such a structure, helping you build trust with your audience.

Yes, LLCs are legal in all states in the US, but specific rules and regulations vary by state. Each state has its own requirements for formation, fees, and compliance. When creating an LLC limited liability with US LLC, it's crucial to follow your state's specific guidelines to ensure compliance. Using platforms like US Legal Forms can simplify this process by providing the necessary resources for compliance in your state.

Limited companies face challenges, such as stricter regulatory requirements and increased administrative responsibilities. Owners may also encounter difficulties in accessing capital, especially in the early stages of the business. Additionally, limited companies may have higher operational costs compared to an LLC limited liability with US LLC. Understanding these drawbacks will help you choose the right structure for your business needs.

A limited liability partnership (LLP) may not be suitable for all types of businesses, particularly those that require significant investment or have high-risk operations. Partnerships can experience profit-sharing disputes, which may lead to tension among partners. Moreover, LLPs often provide less protection than an LLC limited liability with US LLC when it comes to personal asset security. It's essential to weigh these factors before deciding on your business structure.