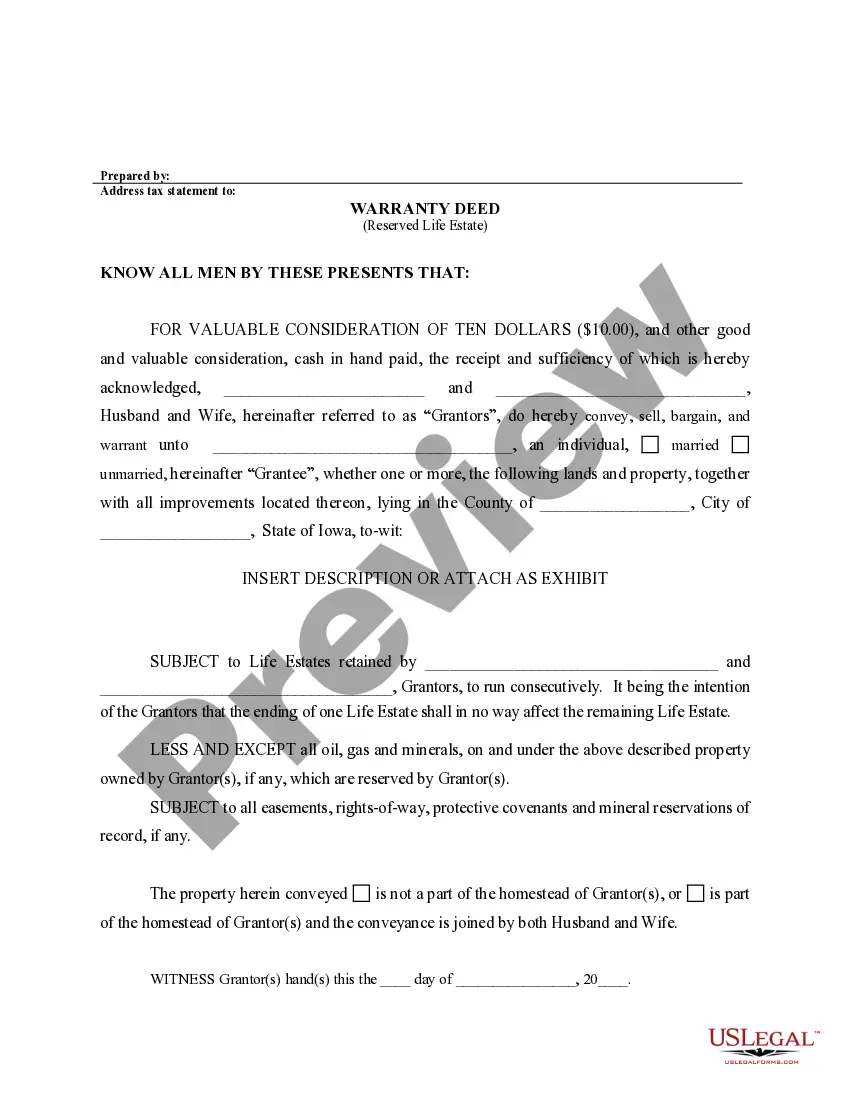

Life Estate Deed Explained

Description

How to fill out Iowa Warranty Deed To Child Reserving A Life Estate In The Parents?

Finding a go-to place to take the most recent and relevant legal samples is half the struggle of working with bureaucracy. Discovering the right legal documents requirements accuracy and attention to detail, which explains why it is crucial to take samples of Life Estate Deed Explained only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and view all the information concerning the document’s use and relevance for your situation and in your state or county.

Consider the following steps to finish your Life Estate Deed Explained:

- Use the library navigation or search field to find your template.

- Open the form’s information to check if it matches the requirements of your state and county.

- Open the form preview, if available, to ensure the template is definitely the one you are looking for.

- Go back to the search and look for the proper template if the Life Estate Deed Explained does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Choose the pricing plan that fits your needs.

- Go on to the registration to complete your purchase.

- Finalize your purchase by picking a payment method (credit card or PayPal).

- Choose the file format for downloading Life Estate Deed Explained.

- Once you have the form on your gadget, you can alter it using the editor or print it and finish it manually.

Eliminate the inconvenience that accompanies your legal paperwork. Explore the extensive US Legal Forms catalog where you can find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

If you hold the life estate your obligated to make repairs that are essential to the preservation of the property, your obligated to pay the interest on any outstanding mortgages and Property taxes.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

The life tenant is the property owner for life and is responsible for costs such as property taxes, insurance, and maintenance. Additionally, the life tenant also retains any tax benefits of homeownership.

In addition, life estates allow the owner to control the property in all respects, except that they cannot sell or mortgage the property without the consent of their heirs. If created in a timely manner, a life estate can even help its creator qualify for Medicaid assistance.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.