Hawaii Assignment Trust For The Future

Description

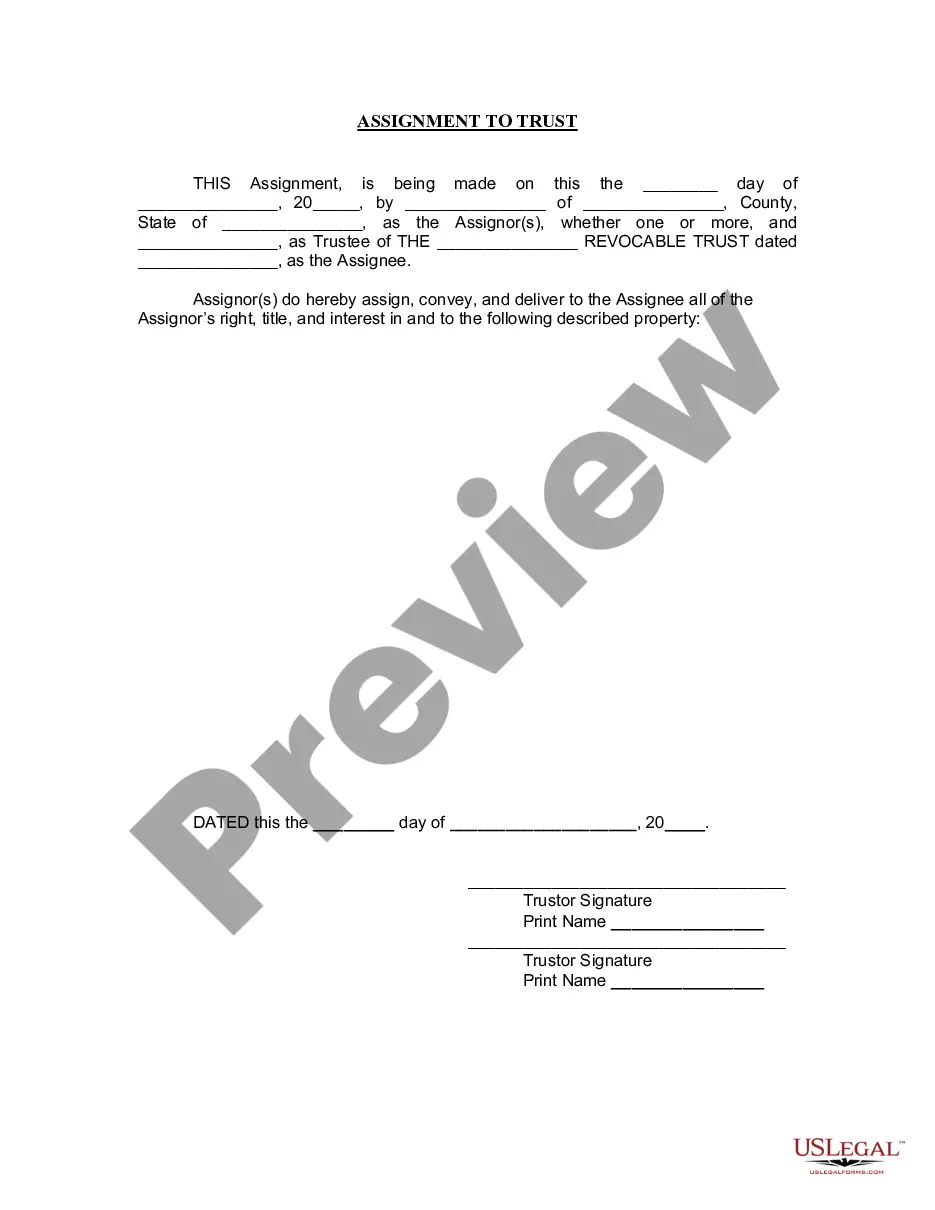

How to fill out Hawaii Assignment To Living Trust?

- Access your account on the US Legal Forms website. If you're a returning user, log in and check your subscription validity.

- In case you’re new to the service, begin by exploring the form previews and descriptions to ensure they align with your requirements in your local jurisdiction.

- If you need a different template, use the Search tab to find the appropriate document that meets your needs.

- Once you have found the correct document, click on 'Buy Now' and select a subscription plan that suits you best. You’ll need to create an account for full access.

- After selecting your plan, proceed with the payment using your credit card or PayPal account.

- Finally, download the form template to your device and store it securely. You can also access it later in the My Forms section of your profile.

In conclusion, US Legal Forms empowers individuals and attorneys alike with a comprehensive library of over 85,000 legal forms. Their robust collection ensures you’ll find exactly what you need efficiently and accurately.

Start your journey towards a sustainable future today by leveraging the benefits of US Legal Forms!

Form popularity

FAQ

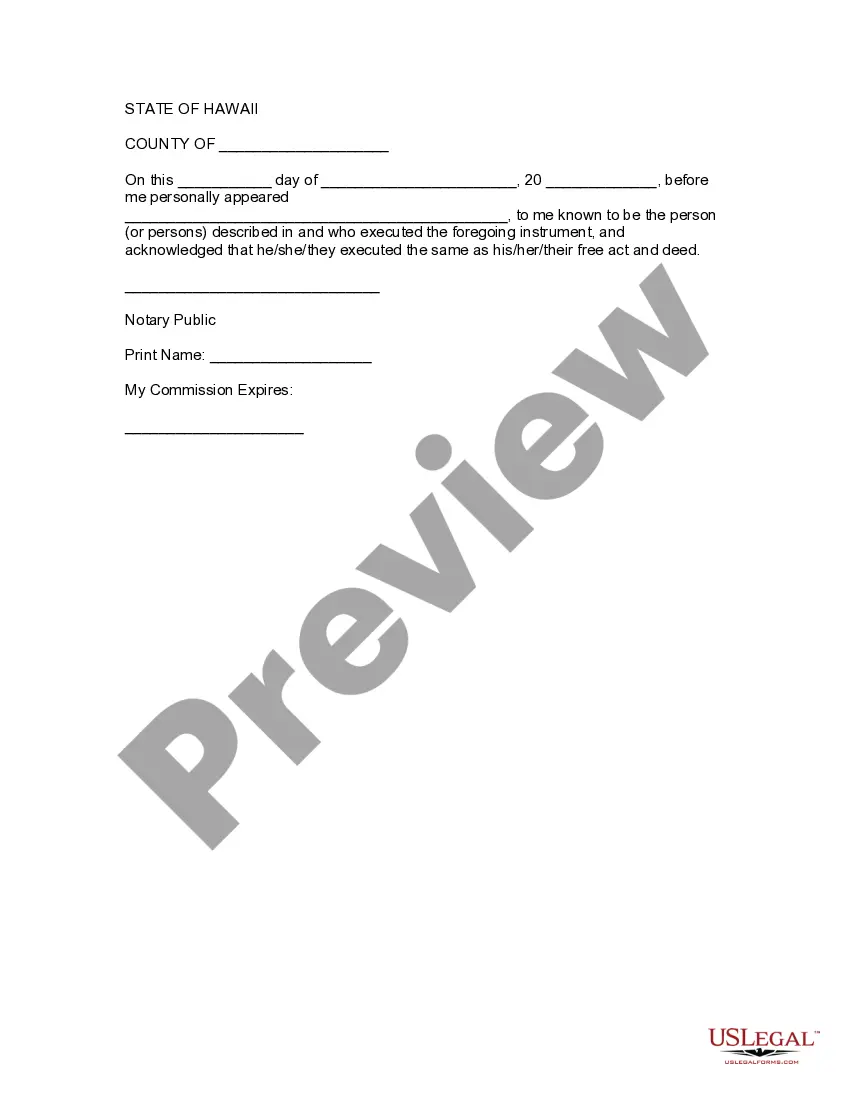

In Hawaii, a trust does not always need to be notarized, but it is advisable to do so. Notarization can provide an extra layer of authenticity and protection, especially for a Hawaii assignment trust for the future. If you plan to deal with real property or require the trust to be recognized in court, notarization might be necessary. Therefore, consulting with a legal expert can help clarify the requirements for your particular trust.

The best place to store trust documents is in a secure and accessible location, such as a safe or a safety deposit box. You may also choose to keep digital copies in a secure, encrypted cloud storage service. Utilizing a Hawaii assignment trust for the future requires you to keep these documents safe, as they contain crucial information about your estate and its management. Additionally, inform a trusted family member of the storage location for easy access if needed.

To record a trust in Hawaii, you must file the trust document with the Bureau of Conveyances. This process ensures that your trust is legally recognized and offers protection for your assets. Using a Hawaii assignment trust for the future can help you preserve your estate and clarify your wishes. It is wise to consult with a legal professional to ensure all details are correctly addressed during this process.

A will is considered valid in Hawaii if it adheres to specific legal requirements, including being in writing, signed by the testator, and witnessed by two individuals. The testator must be mentally competent and at least 18 years old when signing. To ensure your will's validity and effectiveness, especially in conjunction with a Hawaii assignment trust for the future, consult with a legal professional or use resources like USLegalForms for guidance.

Yes, you can write your own will in Hawaii, and having it notarized can help strengthen its validity. However, it's essential to ensure it meets Hawaii's legal requirements, including having the necessary witnesses. While a DIY approach may seem appealing, consider the advantages of a Hawaii assignment trust for the future for a more structured and comprehensive estate plan that minimizes legal complexities.

Yes, establishing a trust in Hawaii can help you avoid the probate process, which can be time-consuming and public. When you set up a Hawaii assignment trust for the future, your assets are transferred to the trust, allowing for private and efficient distribution after your passing. This can be beneficial for your loved ones as it saves time and reduces stress during an already difficult time.

One of the most significant mistakes people make with wills is failing to update them after major life changes, like marriage, divorce, or the birth of a child. This oversight can lead to unintended distributions that do not reflect your current wishes. By incorporating a Hawaii assignment trust for the future, you can ensure your assets are managed and distributed according to your latest intentions.

For a will to be valid in Hawaii, it must be written, signed by the person making the will, and witnessed by at least two individuals who are not beneficiaries. Additionally, the person must be at least 18 years old and of sound mind when signing the will. Ensuring these criteria are met is crucial to avoid challenges later, especially when utilizing the Hawaii assignment trust for the future to secure your wishes.

In Hawaii, a will is a legal document that outlines how you want your assets distributed after your death. A trust, however, can manage your assets during your lifetime and provide instructions for distribution after your death. The Hawaii assignment trust for the future allows you to set terms on how and when your assets are passed to your beneficiaries, potentially avoiding the lengthy probate process associated with a will.

To establish a Hawaii assignment trust for the future, you should begin by determining the type of trust that suits your needs. Next, consult with a legal professional or use the US Legal Forms platform, which offers resources and templates for creating trusts. Ensure that you gather all necessary documents, including the names of beneficiaries and details about the assets you intend to place in the trust. Once you have prepared the trust document, you will need to sign it in front of a notary public to finalize its establishment.