Hawaii Promissory Note With Payment Schedule

Description

How to fill out Hawaii Promissory Note - Horse Equine Forms?

Maneuvering through the intricacies of official documentation and templates can be challenging, particularly for those who do not engage in such tasks professionally.

Even locating the suitable template for a Hawaii Promissory Note With Payment Schedule can be tedious, as it needs to be valid and precise to the last detail.

However, you will find yourself investing significantly less time acquiring a suitable template from a resource you can rely on.

Obtain the correct form in a few straightforward steps.

- US Legal Forms is a platform that streamlines the process of searching for the correct forms online.

- US Legal Forms is a single source where you can find the most recent document samples, check their usage, and download these samples to complete them.

- This is a repository comprising over 85K forms relevant in numerous domains.

- When searching for a Hawaii Promissory Note With Payment Schedule, you won’t have to doubt its legitimacy since all forms are authenticated.

- Having an account at US Legal Forms guarantees you have all the essential samples at your disposal.

- Store them in your history or add them to the My documents catalog.

- You can access your saved documents from any device by clicking Log In at the library site.

- If you do not yet have an account, you can always search further for the template you need.

Form popularity

FAQ

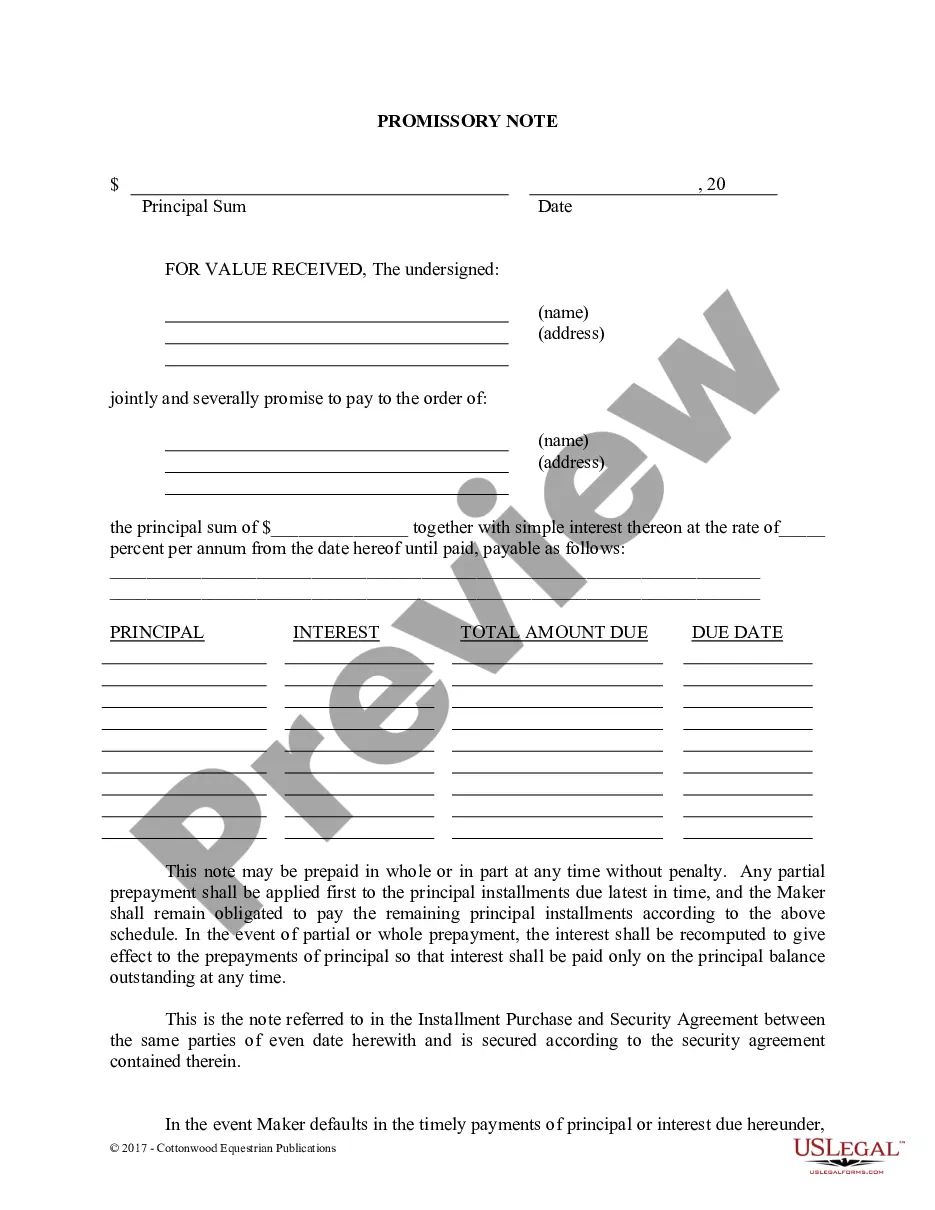

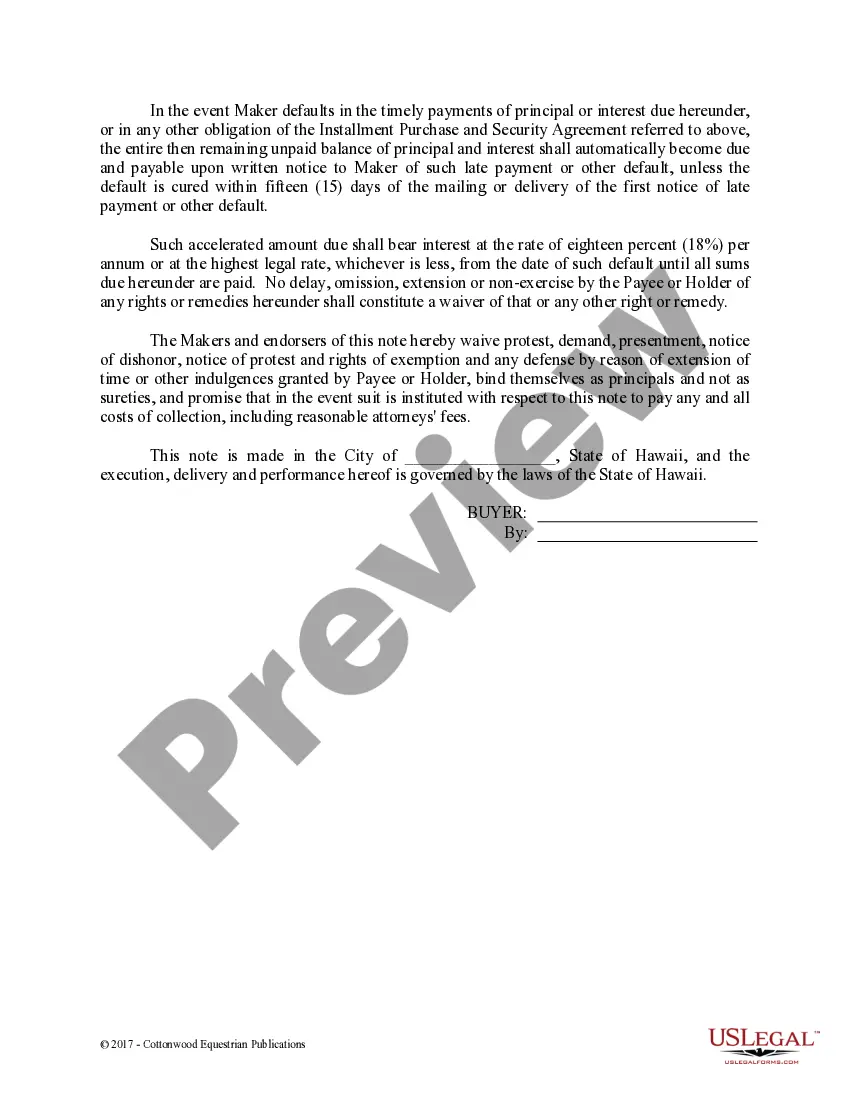

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Date of Repayment - The note must clearly state the date on which the repayment for the loaned amount must be paid. Rate of Interest - In case interest is being charged on the lent or borrowed amount, the note must mention the rate of interest which will be calculated on the basis of APR (annual percentage rate).