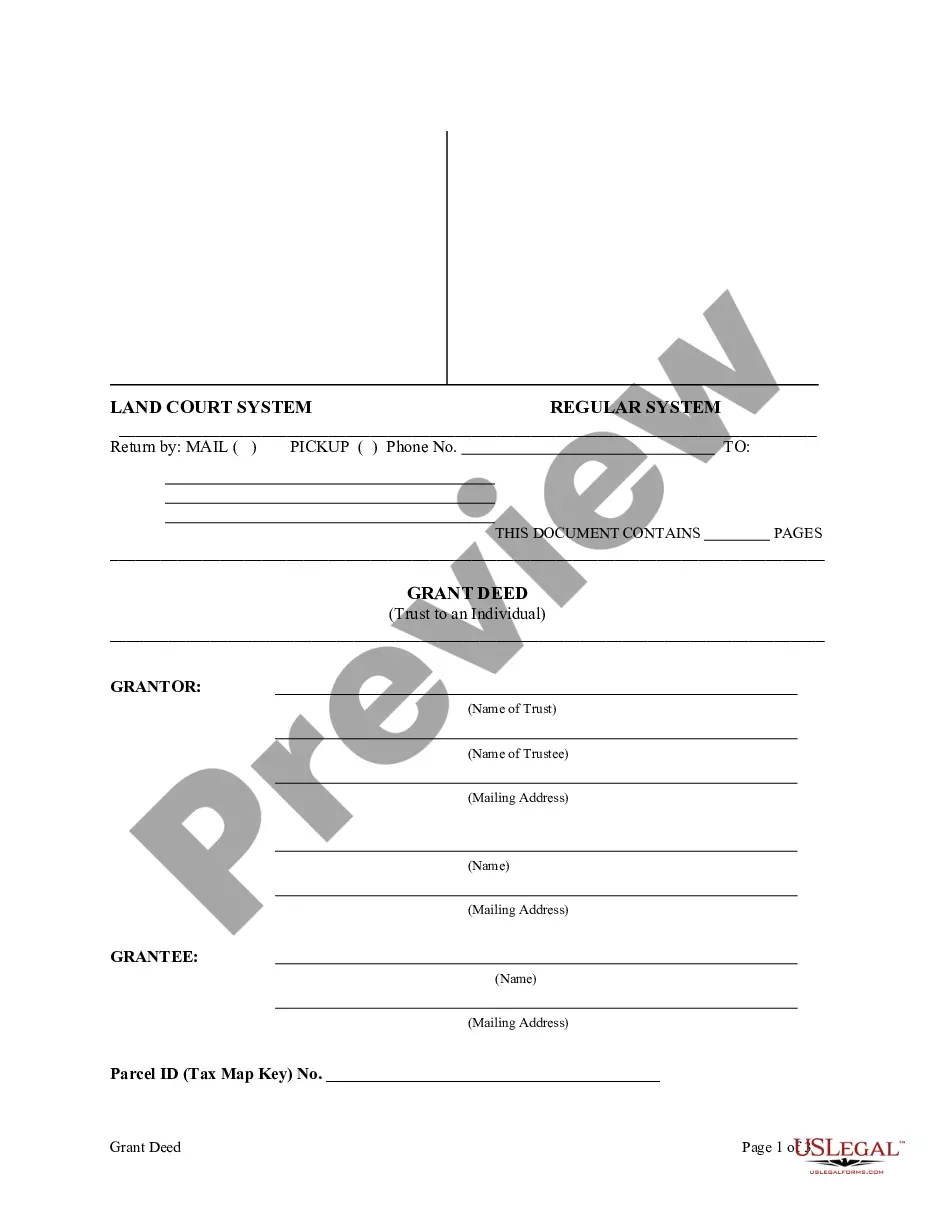

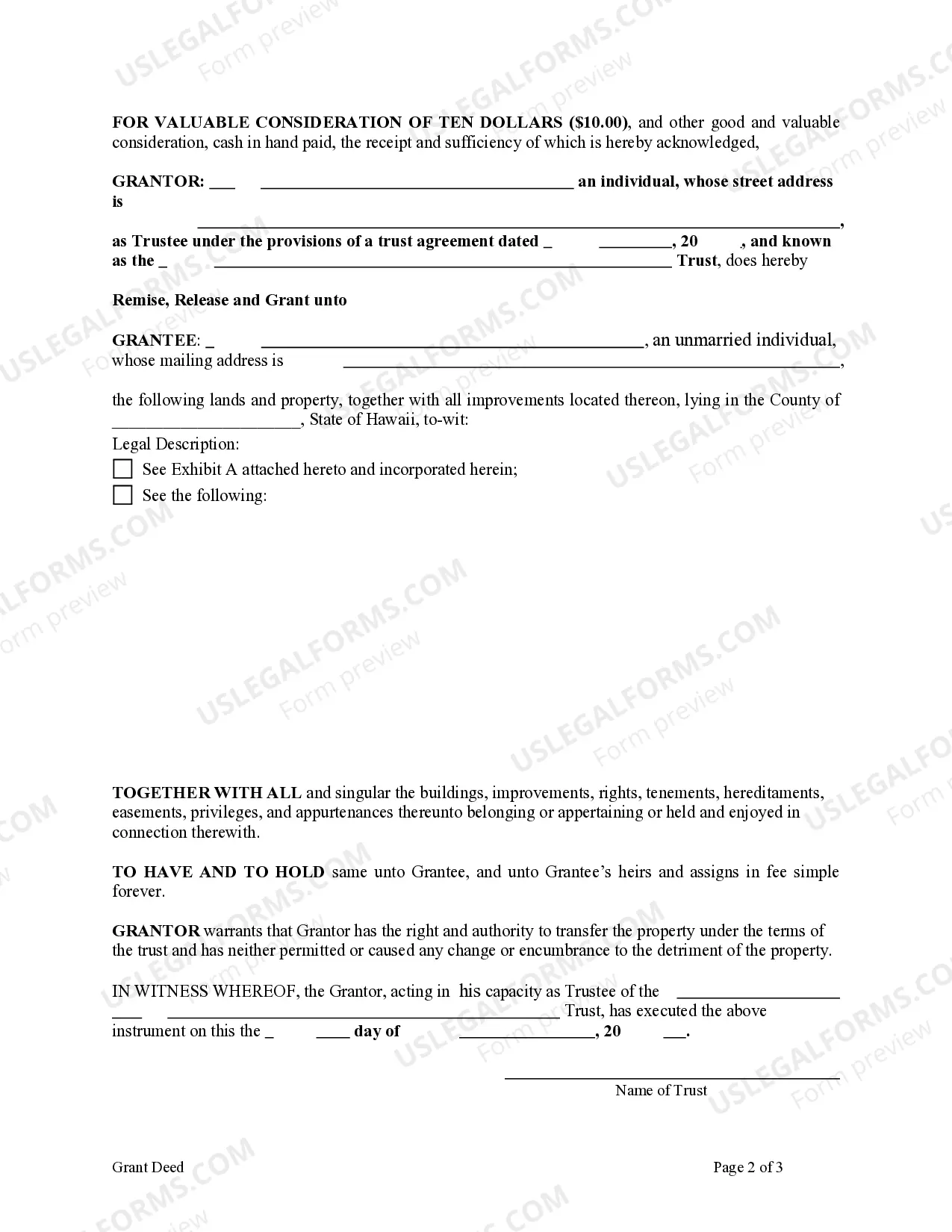

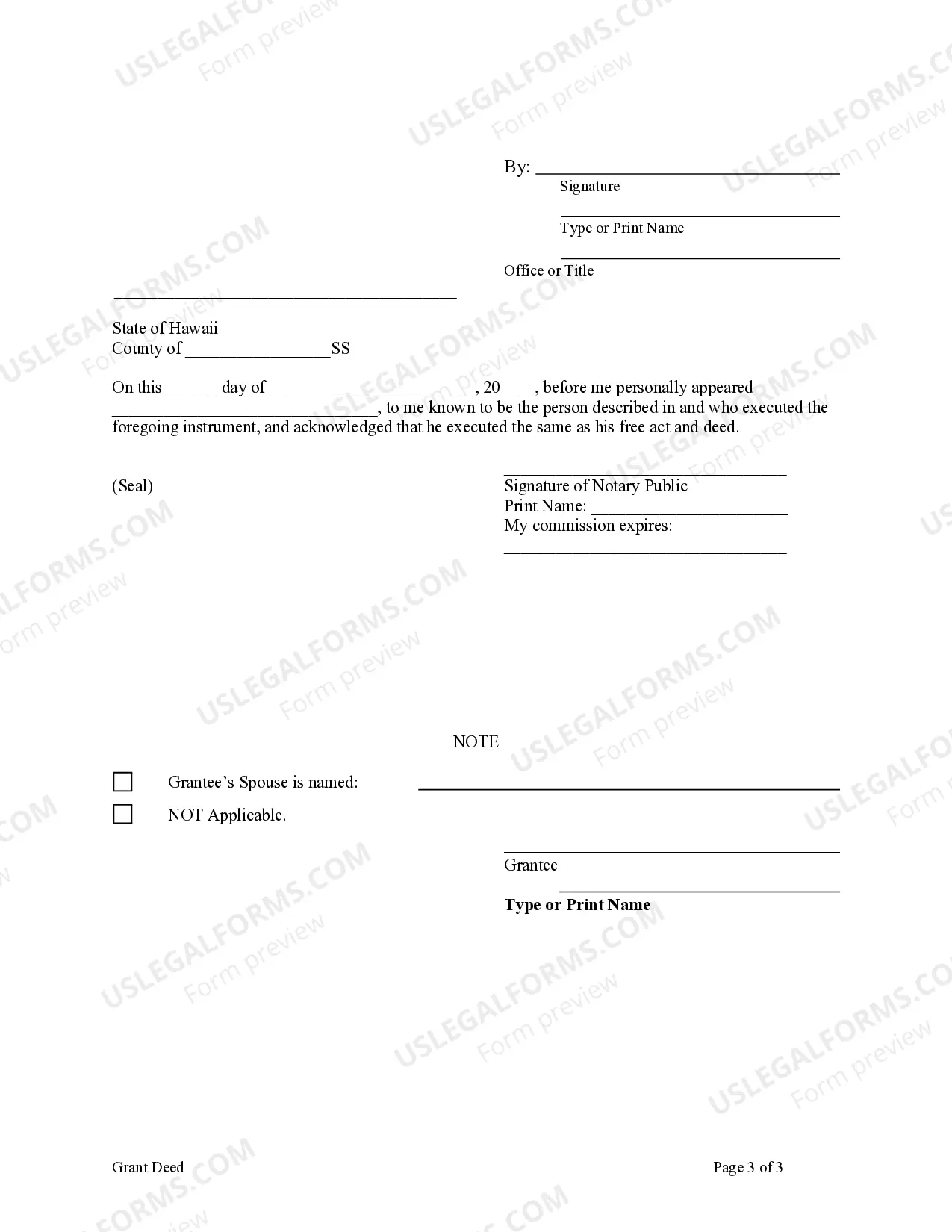

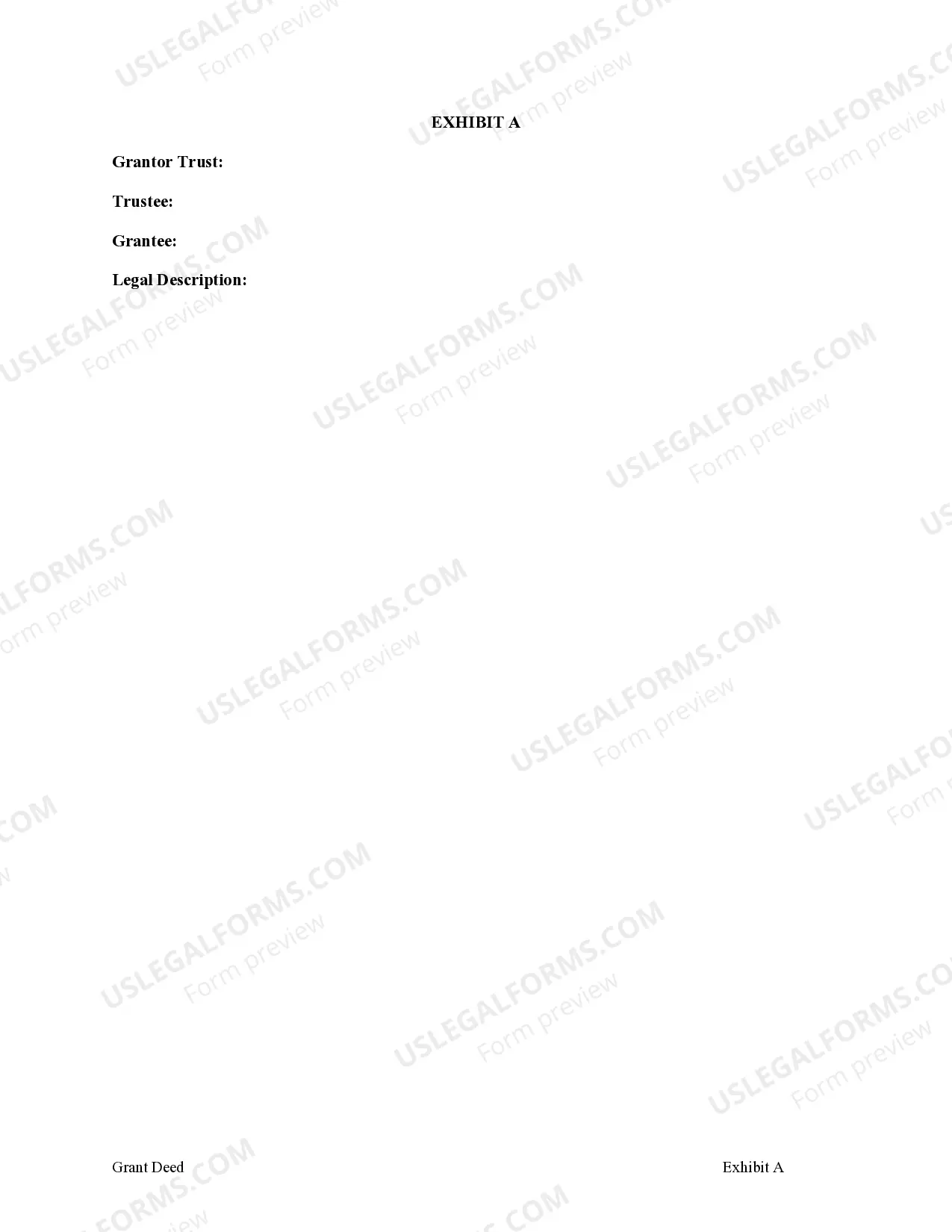

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is an Individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Hawaii Individual Grantee For Foreign Workers

Description

How to fill out Hawaii Warranty Deed From A Trust To An Individual?

- If you're a returning customer, log into your account and select the required form from your dashboard to download it. Ensure that your subscription is active; if it’s expired, renew it based on your payment plan.

- For first-time users, start by reviewing the Preview mode and form description for accuracy. Confirm that you have chosen a form that meets your requirements and adheres to local jurisdiction guidelines.

- If you need to find a different template, utilize the Search tab on the website to locate an appropriate document. If you find a suitable option, proceed to the next step.

- Purchase the document by clicking the Buy Now button. Select your preferred subscription plan and create an account to gain access to the extensive library of resources.

- Complete your payment by entering your credit card information or using your PayPal account to finalize your subscription.

- Download your selected form and save it to your device. You can access it anytime through the My Forms section of your profile.

Using US Legal Forms provides a wealth of benefits, including access to an extensive collection of over 85,000 editable legal documents tailored to meet diverse needs.

With these resources, individuals and attorneys can easily draft precise legal documents. Get started today to simplify your legal processes efficiently!

Form popularity

FAQ

You can obtain a Hawaii tax ID number by completing an application with the Hawaii Department of Taxation. This process is vital for individuals and businesses, including foreign workers classified as Hawaii individual grantees. The application can often be completed online, providing a straightforward way to meet your tax obligations. Ensure all information is accurate to avoid delays in processing.

Certain entities are exempt from the general excise tax in Hawaii, including specific nonprofit organizations and certain government entities. Additionally, some types of income may be excluded, which can benefit those in the Hawaii individual grantee for foreign workers program. Understanding your tax responsibilities and available exemptions is crucial for compliance. Be sure to consult a tax professional for tailored advice.

Non-residents are required to file a return if they earn income sourced from Hawaii, which includes wages, rental income, and business earnings. This requirement is especially important for Hawaii individual grantees for foreign workers. Ensure that you file accurately and on time to avoid penalties. Utilize professional resources to confirm your specific obligations.

If you receive income from Hawaii sources as a non-resident, you must file a nonresident state return. This rule applies to individuals in the Hawaii individual grantee for foreign workers program, who might have earnings tied to Hawaii. Failing to file can lead to tax penalties, so it’s crucial to assess your income carefully. Consider using platforms like US Legal Forms to simplify your filing process.

The G 45 and G 49 forms in Hawaii pertain to general excise tax, with each serving a different purpose. The G 45 is the regular excise tax return for businesses, while the G 49 is an annual reconciliation form. Understanding these forms is crucial for those in the Hawaii individual grantee for foreign workers program, as they help ensure compliance with state tax laws. Accurate filing can prevent unnecessary complications.

Individuals who earn income from Hawaii sources while residing outside of the state need to file a Hawaii nonresident return. This includes foreign workers eligible for the Hawaii individual grantee designation. If you have rental income, business earnings, or wages sourced from Hawaii, filing is necessary to meet tax obligations. Staying informed about your filing requirements will help you avoid penalties.

Hawaii requires individuals who earn income from Hawaii sources to file a state tax return. This requirement applies to residents and non-residents alike, including those in the Hawaii individual grantee for foreign workers category. If you meet the income threshold, you must submit a tax return, regardless of your residency status. Always check for the latest rules to ensure compliance.

Yes, foreign workers must file taxes if they earn income in Hawaii. This filing is necessary to comply with local tax laws and ensure proper tax contributions. You might need to complete forms such as the N11 to accurately report your income. Staying informed about your tax responsibilities is crucial for maintaining a good financial standing.

The withholding tax for non-US residents in Hawaii is applicable to income earned within the state. If you are a foreign worker, specific rates apply to the income you generate. Compliance with these regulations is important to avoid penalties. Consulting with uslegalforms can provide clarity on your withholding tax responsibilities and help manage your tax duties.

The non-resident property tax in Hawaii applies to real estate properties owned by individuals who do not reside in the state. This tax is assessed based on property value and location. Foreign workers who own property in Hawaii should be aware of these obligations. Knowing the tax rates and how they work can help you plan your investments effectively.