Hawaii University

Description

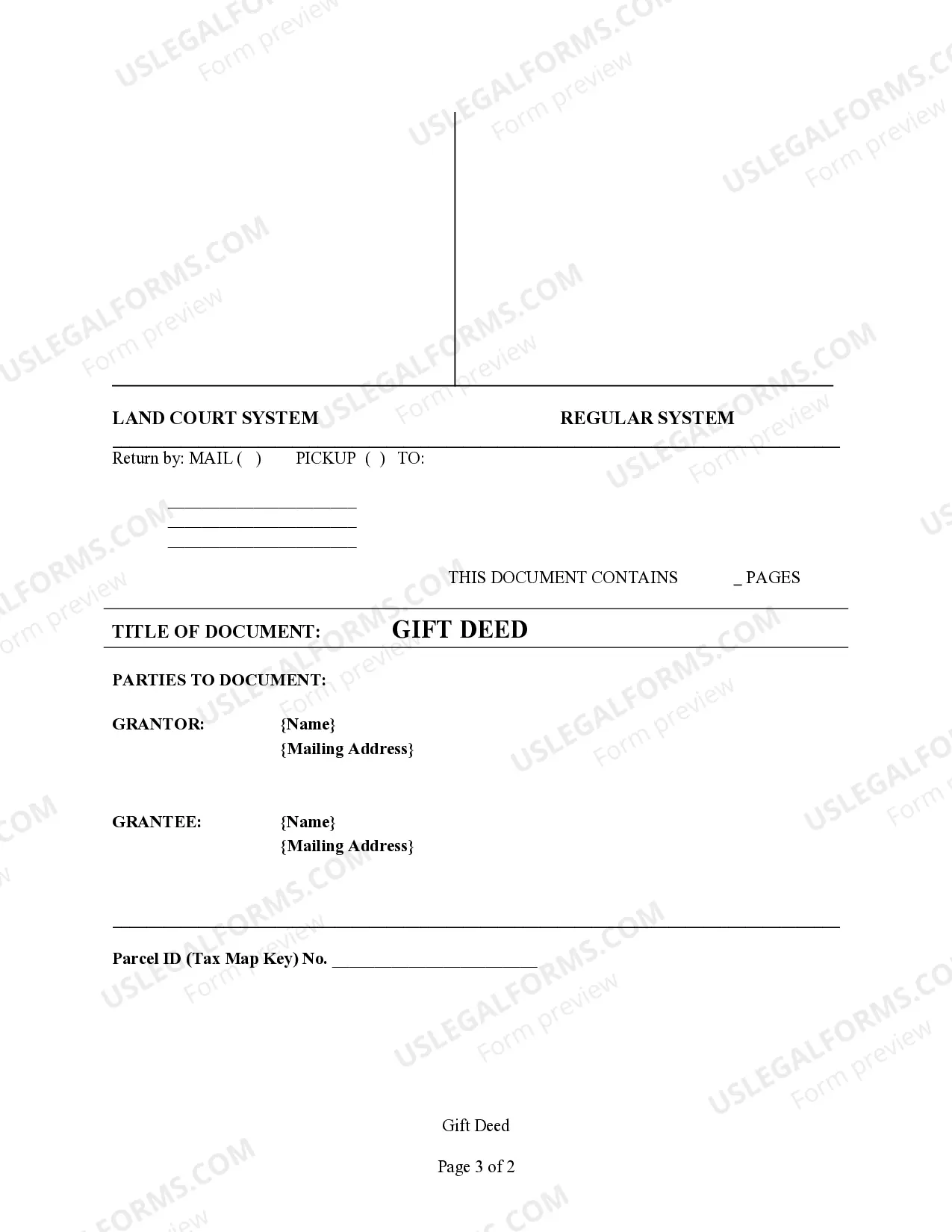

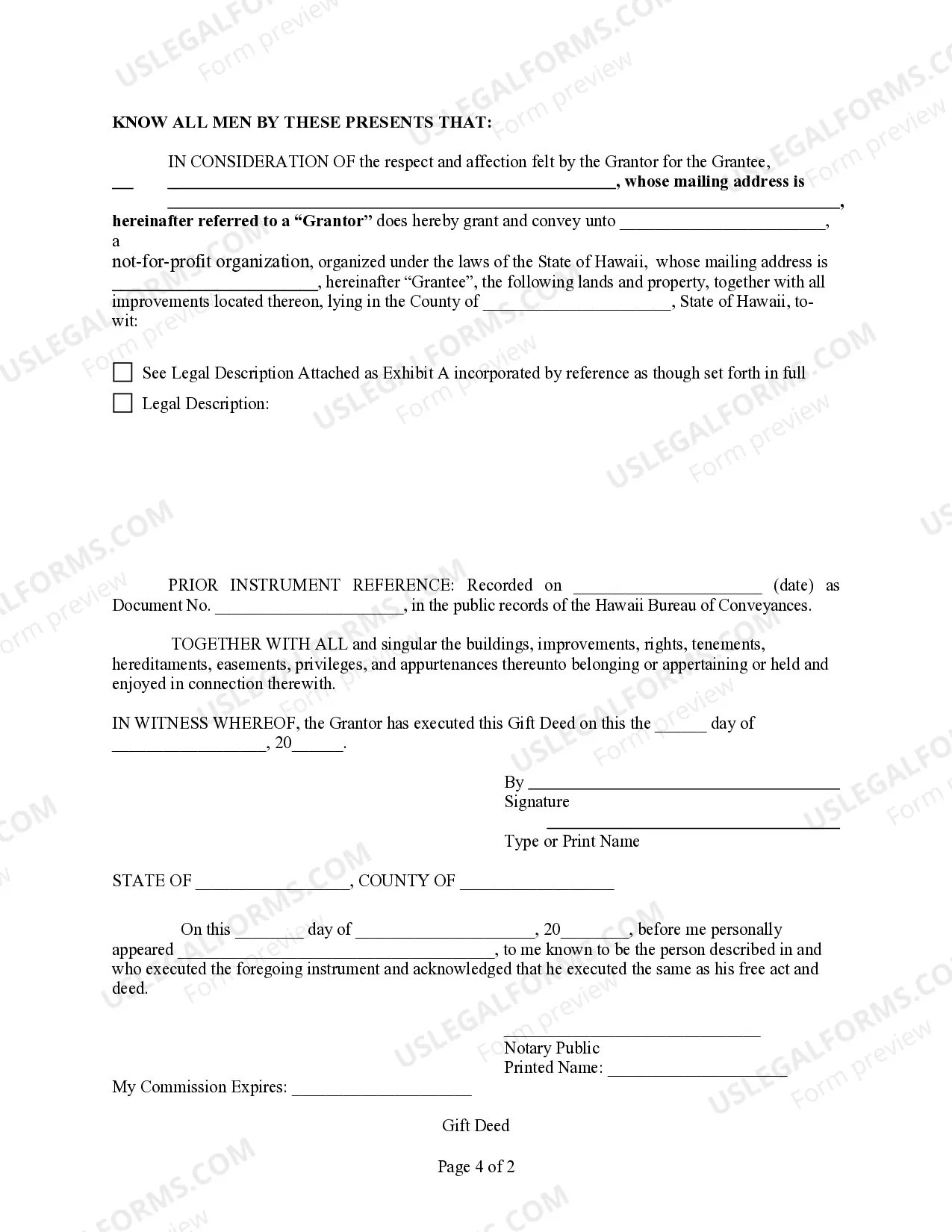

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- If you're an existing user, log into your account and select the desired form template to download immediately. Ensure your subscription remains active; renew it if necessary.

- For first-time users, start by checking the preview mode and form descriptions to find a template that fits your legal requirements, matching your local jurisdiction's laws.

- If the form doesn't meet your needs, utilize the Search tab to find an alternative template that is suitable for you.

- Once you find the right document, click 'Buy Now' and select your preferred subscription plan. Account registration is essential for access to the full library.

- Next, complete the purchase by entering your credit card details or using PayPal for payment.

- Download the document to your device and access it anytime through the My Forms section of your profile.

By leveraging the extensive resources of US Legal Forms, you can ensure your legal documents are professionally handled and compliant with legal standards. With over 85,000 fillable forms at your fingertips and access to premium expert assistance, you will find this service invaluable.

Start enjoying the benefits today by accessing US Legal Forms and simplify your legal document needs.

Form popularity

FAQ

You can apply for the University of Hawaii through their official website, where you will find the application portal and necessary information. Make sure to review the requirements and deadlines for your specific program. If you're unsure about the application process or need assistance, consider reaching out to admissions staff for support. Starting your journey at a Hawaii university can be straightforward with the right guidance.

The deadline for filing Hawaii state taxes is typically April 20th for the previous year’s income. If this date falls on a weekend or holiday, the deadline may be extended. Students and attendees of a Hawaii university should be mindful of this date to ensure timely submissions, as missing it can lead to penalties. For more specific deadlines or extensions, check with the Hawaii Department of Taxation.

Yes, you generally need to file a Hawaii state tax return if you are a resident or if you earned income in Hawaii. However, there may be exceptions based on income levels and other factors. If you attend a Hawaii university, you should consider your employment and financial aid status as it may influence your filing obligation. Consulting resources like USLegalForms can simplify the tax filing process for your situation.

The University of Hawaii, as a public educational institution, holds tax-exempt status under certain conditions. This means that donations to the university can be tax-deductible for the donor. Understanding this can enhance your contributions and affordability if you plan to support or attend a Hawaii university. For precise details on tax exemptions, consult the university's financial office.

Skipping your state tax filing is generally not advisable, especially if you meet the filing requirements. Doing so can lead to penalties or interest fees from the state. If you attend a Hawaii university, you may have additional considerations regarding your financial situation and obligations. It’s best to clarify your status and any necessary filings to avoid complications.

If you are a resident of Hawaii or earned income in Hawaii, you likely need to file a Hawaii state tax return. The state has specific guidelines regarding income thresholds that determine if you are required to file. To ensure you meet all the criteria, you may want to check the Hawaii Department of Taxation website. If you're a student at a Hawaii university, understanding these requirements can help you manage your finances effectively.

Gaining admission to the University of Hawaii with a 2.5 GPA is quite difficult, as it falls below the typical requirements. However, the university does consider applicants with unique talents or exceptional backgrounds. If your GPA is below average, focus on presenting a compelling narrative in your application and highlight any relevant experiences. Resources like US Legal Forms can help you navigate the application process more effectively.

Getting into the University of Hawaii with a 2.7 GPA is possible, but it might be more challenging. The university assesses applications based on various factors beyond GPA, including letters of recommendation, personal essays, and extracurricular involvement. Consider enhancing your application with strong supporting materials. Additionally, you might explore resources and guidance through platforms like US Legal Forms to better prepare your application.

While the University of Hawaii has competitive admission standards, it is not considered overly difficult to gain entry, especially for residents. The university looks for students who demonstrate both academic potential and a commitment to their education. If you meet the GPA requirements and present a strong application, you should feel confident about your chances. Applying early can also enhance your acceptance odds.

To gain admission to the University of Hawaii, a minimum GPA of 2.8 is typically required for freshman applicants. This standard ensures that students have a solid academic foundation to succeed. However, the university evaluates each application holistically, considering extracurricular activities and personal statements as well. Therefore, focus on presenting a well-rounded application that showcases your strengths.