Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization

What is this form?

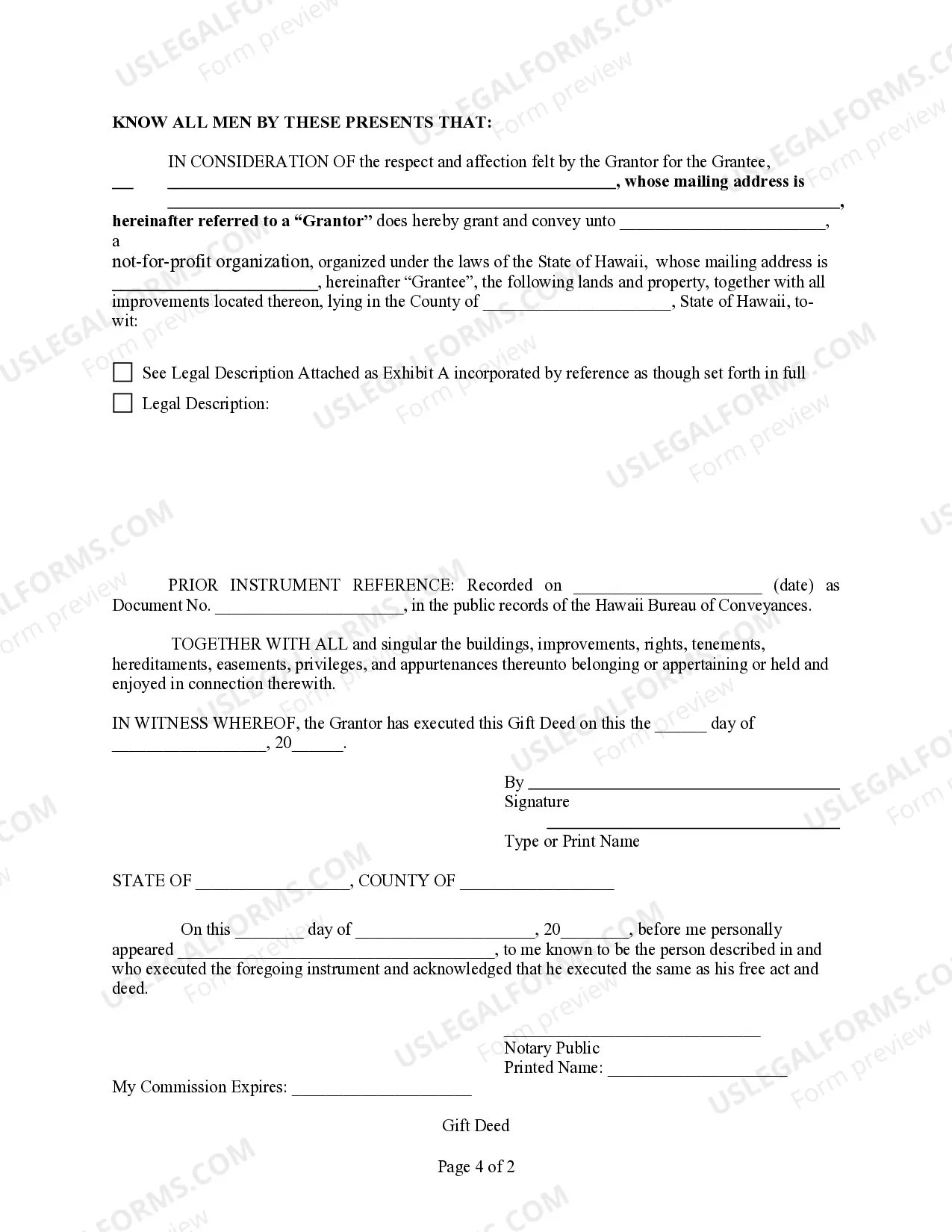

This Gift Deed is a legal document used when an individual (the grantor) wishes to donate property to an unincorporated association or not-for-profit organization (the grantee). It facilitates the transfer of ownership and outlines the intentions of the grantor while complying with state statutory laws. This form differs from other conveyance documents by focusing specifically on charitable donations rather than sales or exchanges.

Form components explained

- Grantor's information: Details about the individual donating the property.

- Grantee's information: Information about the unincorporated association or not-for-profit organization receiving the donation.

- Property description: A detailed description of the property being transferred, often included as an exhibit.

- Execution and notarization section: Space for signatures and notary acknowledgment to validate the deed.

Situations where this form applies

This form should be used when an individual wants to make a charitable gift of property to an unincorporated association or not-for-profit organization. Typical scenarios include donating real estate for community use, contributing land for a charitable cause, or transferring assets to a nonprofit to support its mission.

Who this form is for

- Individuals looking to make a charitable gift of property.

- Members or representatives of unincorporated associations or not-for-profit organizations receiving donations.

- Anyone interested in understanding property transfer for charitable purposes.

How to prepare this document

- Identify the parties: Provide the full names and addresses of the grantor and the grantee.

- Specify the property: Enter a clear and detailed description of the property being gifted.

- Enter the date: Fill in the date of the deed execution.

- Sign and notarize: The grantor must sign the document in the presence of a notary public.

- Include any required exhibits: Attach any additional documentation that specifies property details.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Not providing a clear description of the property can lead to disputes.

- Failing to fill out the form completely may invalidate the deed.

- Omitting signatures or notarization requirements can render the form legally ineffective.

- Using outdated language or terms not compliant with state laws.

Benefits of completing this form online

- Convenient access: Downloadable and editable forms available at your convenience.

- Expertly drafted: Created by licensed attorneys to ensure legal compliance.

- Quick completion: Fill out the form easily with guidance provided.

- Secure storage: Keep your completed forms organized and accessible.

Looking for another form?

Form popularity

FAQ

A nonprofit corporation is a formally established legal entity, while a nonprofit association is generally a more informal organization created by a group without legal recognition. Nonprofit corporations offer benefits such as limited liability and access to grants, whereas nonprofit associations provide more flexibility and simplicity in governance. For those considering gifts, a Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization can be beneficial.

While you can start a nonprofit on your own, involving others can enhance its success. A collaborative approach brings diverse skills and perspectives, increasing the organization’s effectiveness. Additionally, when using a Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization, having others involved can help with governance and ensure compliance with regulations.

An unincorporated nonprofit association is a group of individuals joined together for a common charitable purpose, but without formal incorporation. This type of organization often has simpler governance and fewer regulatory responsibilities. If you’re looking to create a flexible structure, a Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization can be a great option.

An association is typically a group of people united by a common interest who do not have to adhere to strict regulations. A corporation, however, is a legal entity that is recognized by the state and governed by formal rules and regulations. This structural difference influences how each organization operates and is vital when considering a Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization.

The three main types of nonprofits are public charities, private foundations, and unincorporated associations. Public charities serve the general public and rely on donations and grants. Private foundations usually have a single source of funding, while unincorporated associations consist of members working together for nonprofit purposes, making them ideal for using a Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization.

A significant disadvantage of a nonprofit corporation is the complexity involved in establishing and maintaining it. Nonprofit corporations must adhere to stringent regulatory requirements, including regular filings and governance protocols. This can be burdensome for small organizations, but using a Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization may provide more flexibility.

The main difference lies in their organizational structure. A nonprofit association is created by a group of individuals joining together to pursue a common goal without a formal structure. In contrast, a nonprofit corporation is a legal entity recognized by the state, providing limited liability and formal governance. Understanding this distinction is essential, especially when using a Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization.

To change the title of your property in Hawaii, you'll need to complete the appropriate deed form, such as a Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization. After completing the form, submit it to the county recording office along with any required fees. It's important to work with a legal professional or consult resources like uslegalforms to ensure that all aspects of the title change process are handled correctly.

Once submitted, recording a deed in Hawaii usually takes a few days to several weeks. Factors affecting this timeline include the local office's processing speed and the completeness of your documents. To ensure a smooth recording of your Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization, double-check that you have all required paperwork. Local recording offices can provide you with specific timelines based on their current operations.

Recording a deed in Hawaii typically takes several days to a few weeks, depending on the specific county and their current workload. When you submit your documents, including a Hawaii Gift Deed from an Individual to an Unincorporated Association or a Not-for-Profit organization, the county office will process them in the order received. To avoid delays, ensure that all necessary forms are completed accurately. If you're considering a gift deed, using uslegalforms can help ensure everything is in order.