Georgia Promissory Note With Collateral Template

Description

How to fill out Georgia Unsecured Installment Payment Promissory Note For Fixed Rate?

Bureaucracy necessitates exactness and correctness.

If you do not manage the completion of documents like the Georgia Promissory Note With Collateral Template regularly, it can lead to some misunderstanding.

Choosing the suitable sample from the outset will assure that your document submission proceeds smoothly and avert any inconveniences of resubmitting a file or repeating the same task from the start.

If you are not a subscribed user, locating the necessary sample may involve a few additional steps: Find the template using the search bar. Ensure the Georgia Promissory Note With Collateral Template you found is pertinent to your state or county. Open the preview or review the description that includes details regarding the sample’s usage. If the result aligns with your search, click the Buy Now button. Choose the appropriate option among the offered subscription plans. Log In to your account or create a new one. Complete the transaction using a credit card or PayPal. Download the form in your chosen file format. Discovering the correct and updated samples for your documentation is a matter of minutes with an account at US Legal Forms. Sidestep bureaucratic issues and simplify your form tasks.

- You can always secure the appropriate sample for your documentation in US Legal Forms.

- US Legal Forms is the largest online forms repository that contains over 85 thousand samples for various domains.

- You can access the latest and most suitable version of the Georgia Promissory Note With Collateral Template by simply searching for it on the site.

- Find, store, and retain templates in your profile or consult the description to ensure you possess the correct one readily available.

- With an account at US Legal Forms, it is simple to acquire, mass store, and navigate the templates you save to access them with just a few clicks.

- Once on the website, click the Log In button to authenticate.

- Next, proceed to the My documents page, where your document list is held.

- Browse through the form descriptions and retain the templates you need at any time.

Form popularity

FAQ

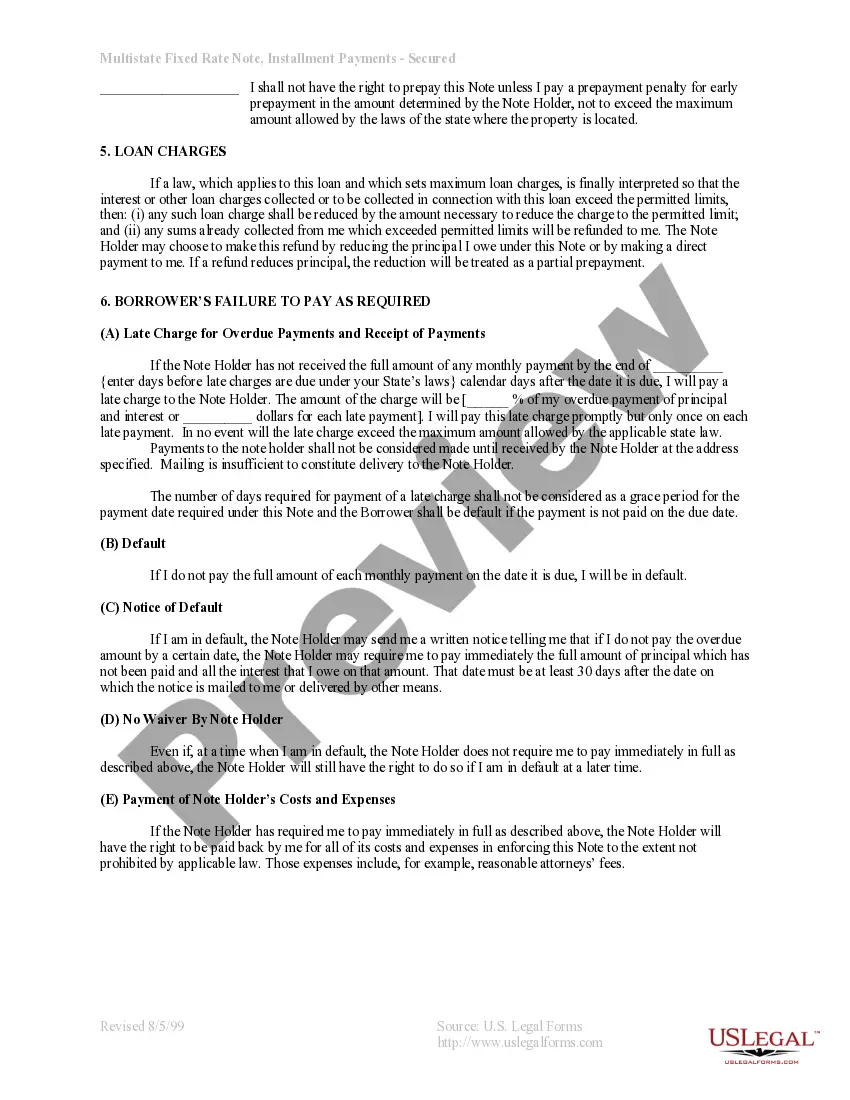

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.