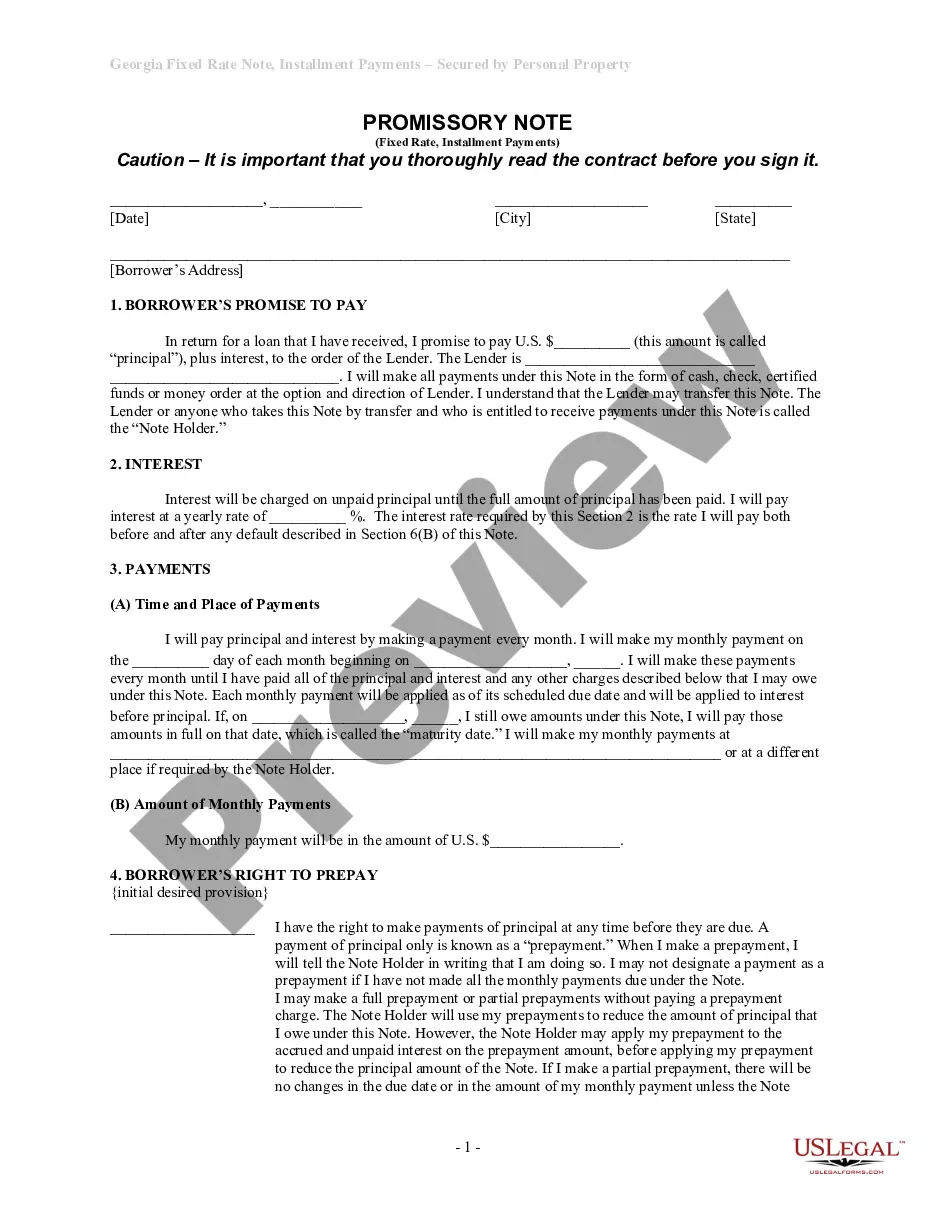

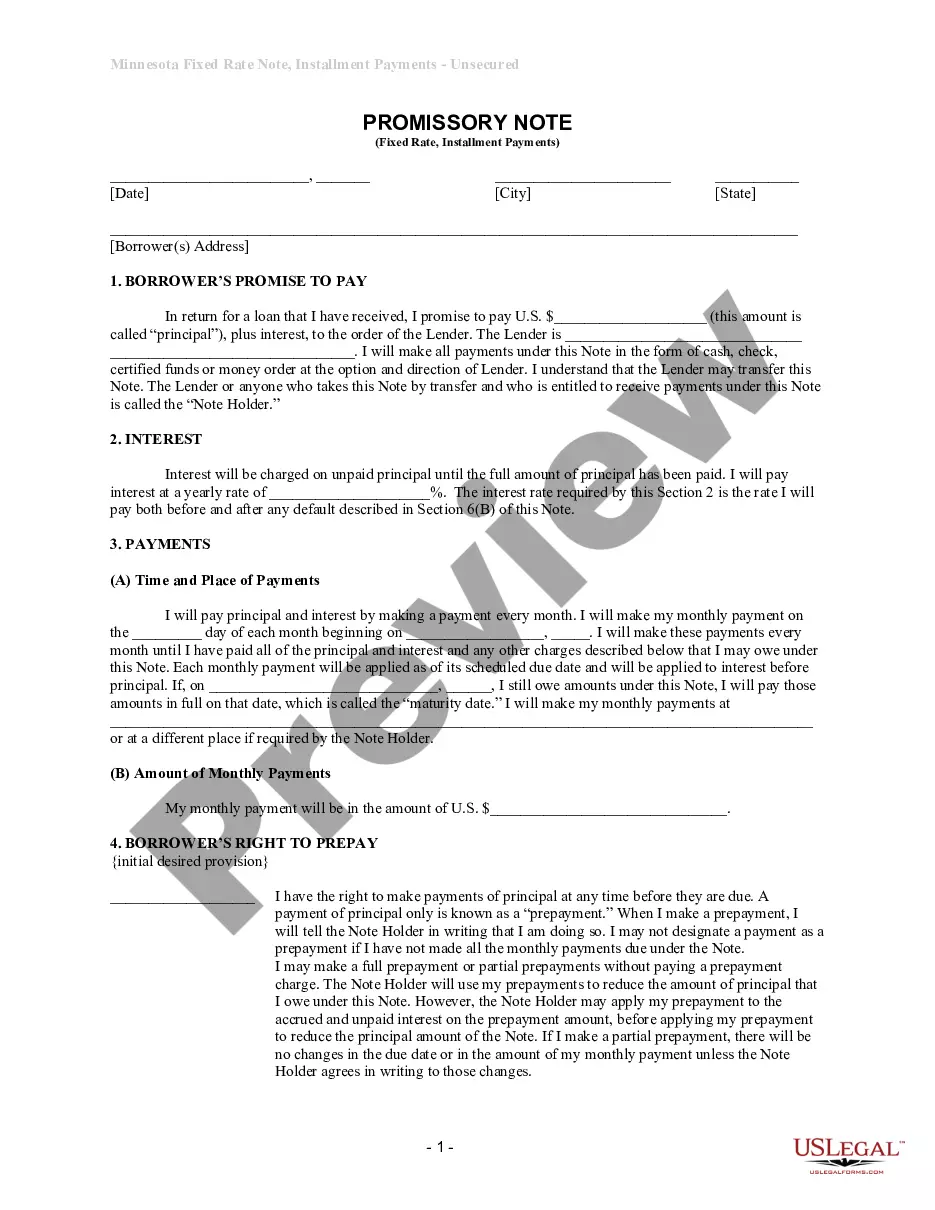

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Georgia Unsecured Installment Payment Promissory Note for Fixed Rate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Georgia Unsecured Installment Payment Promissory Note For Fixed Rate?

Obtain one of the most extensive collections of approved forms. US Legal Forms serves as a resource to locate any state-specific document in just a few clicks, including the Georgia Unsecured Installment Payment Promissory Note for Fixed Rate templates.

No need to waste time searching for a judicially acceptable sample. Our certified experts guarantee you receive the latest documents every time.

To access the documents library, select a subscription and set up an account. If you've already done so, simply Log In and then click Download. The Georgia Unsecured Installment Payment Promissory Note for Fixed Rate sample will be immediately stored in the My documents tab (which contains all forms you download on US Legal Forms).

That's all! You merely need to submit the Georgia Unsecured Installment Payment Promissory Note for Fixed Rate template and review it. To ensure everything is accurate, consult your local legal advisor for assistance. Register and easily browse approximately 85,000 useful templates.

- If you need to use a state-specific form, ensure you select the correct state.

- If possible, review the description to grasp all the details of the document.

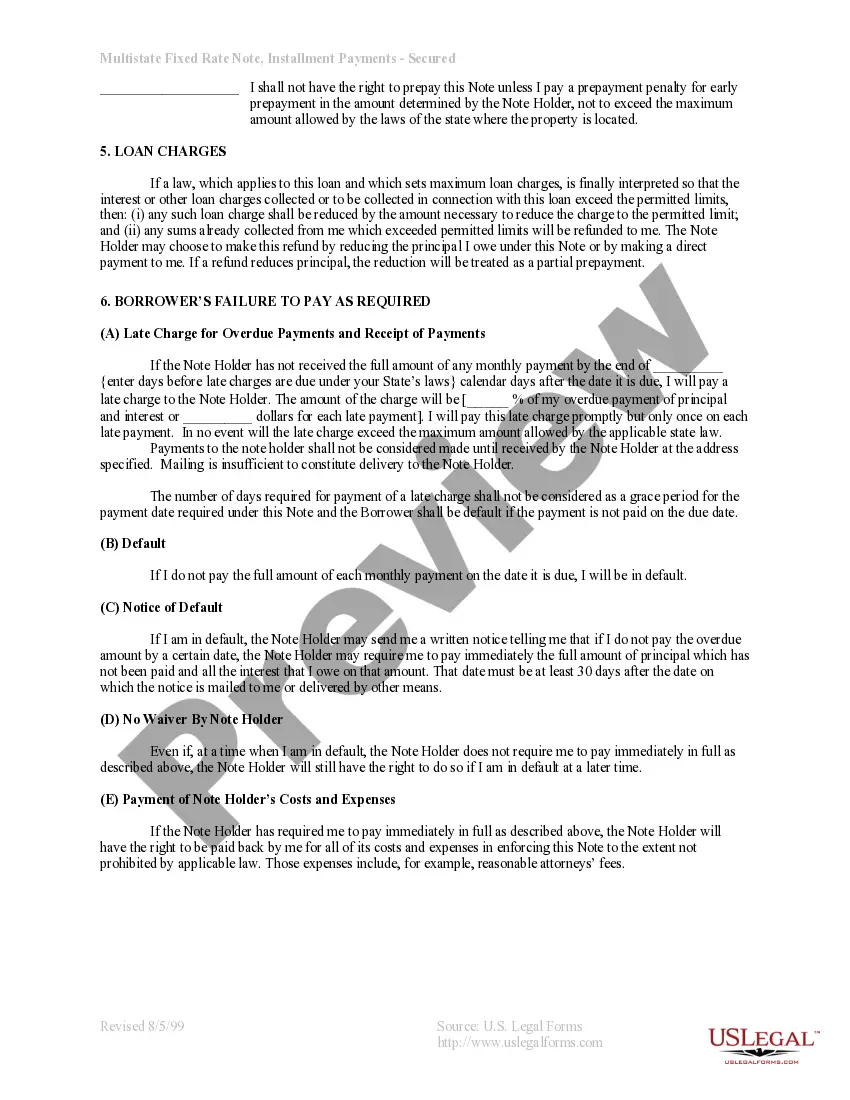

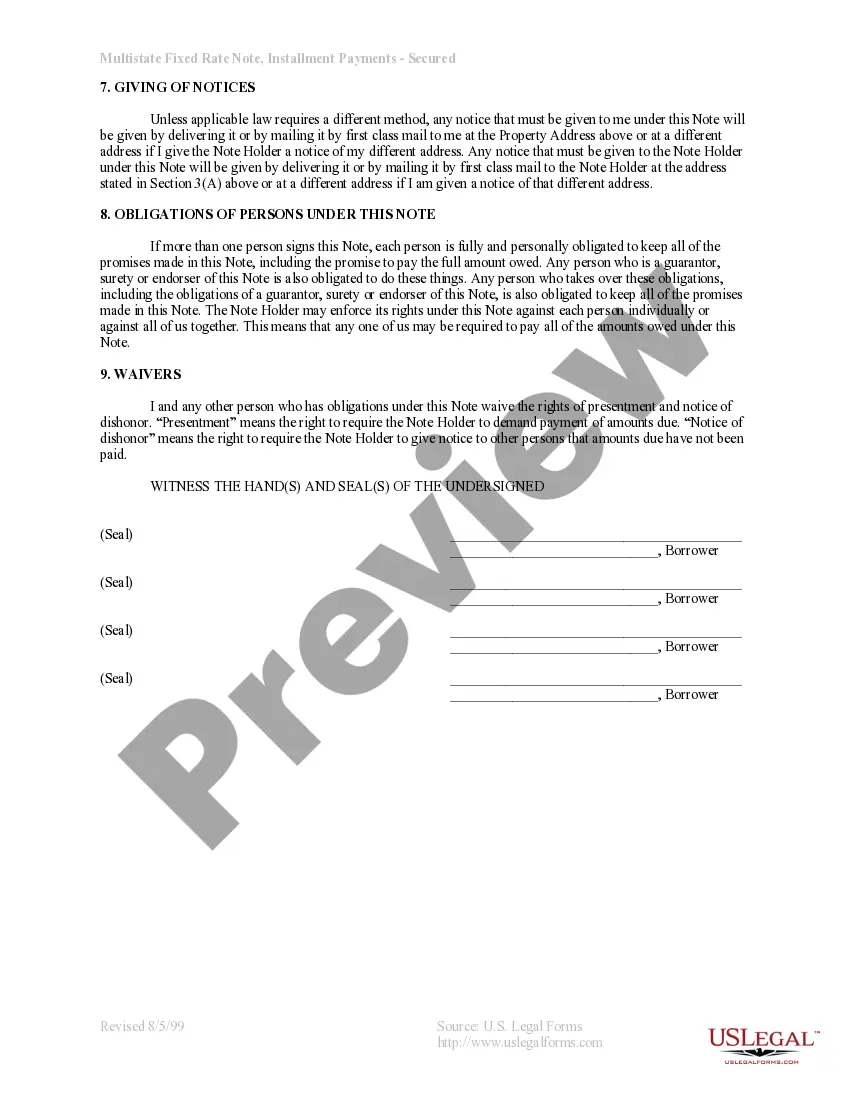

- Use the Preview feature if available to examine the document's content.

- If everything looks correct, click Buy Now.

- After choosing a pricing plan, establish your account.

- Make payment through credit card or PayPal.

- Download the document to your device by clicking on the Download button.

Form popularity

FAQ

A reasonable interest rate for a promissory note varies based on market conditions and the borrower's creditworthiness. However, for a Georgia Unsecured Installment Payment Promissory Note for Fixed Rate, interest rates typically range from 5% to 12%. Evaluating current rates and your financial situation can help you determine what is fair. You can access tools and resources on uslegalforms to assist in calculating your rates.

An installment note is a form of a promissory note, specifically structured for repayment in regular, fixed installments over a period. When looking at the Georgia Unsecured Installment Payment Promissory Note for Fixed Rate, you will see that it explicitly outlines payment schedules and interest calculations. Understanding these terms helps you manage repayments effectively. For templates and legal guidance, check out uslegalforms.

You can obtain a Georgia Unsecured Installment Payment Promissory Note for Fixed Rate through various sources. A reliable option is to visit the US Legal Forms website, where you can find templates that meet your specific needs. These forms are easy to fill out and ensure you comply with state regulations. This approach saves you time and helps ensure that your promissory note is legally valid.

To create a valid Georgia Unsecured Installment Payment Promissory Note for Fixed Rate, there are several essential requirements. First, the note must clearly state the amount being borrowed and the repayment terms. Additionally, it must include the signature of the borrower and, if applicable, a witness. Finally, while not always necessary, it is beneficial to date the document to establish a clear timeline for the transaction.

To fill out a sample promissory note, use a template that reflects your specific needs. Begin with the basic details such as the names of the borrower and lender, along with the title 'Georgia Unsecured Installment Payment Promissory Note for Fixed Rate.' Next, include the principal amount, interest rate, payment intervals, and due dates. Following this structure ensures that your promissory note is legally sound.

In Georgia, promissory notes do not necessarily require notarization to be valid; however, having them notarized can provide additional legal protection. By notarizing your Georgia Unsecured Installment Payment Promissory Note for Fixed Rate, you create a public record that can help resolve disputes. It's a good practice to have both parties sign in front of a notary to ensure clarity and trust.

Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied. When the loan is paid off, the trustee automatically records a deed of reconveyance at the county recorder's office for safekeeping.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.