Revocation Trust

Description

How to fill out Georgia Revocation Of Living Trust?

- Log in to your US Legal Forms account if you’re a returning user; ensure your subscription is active to access your documents.

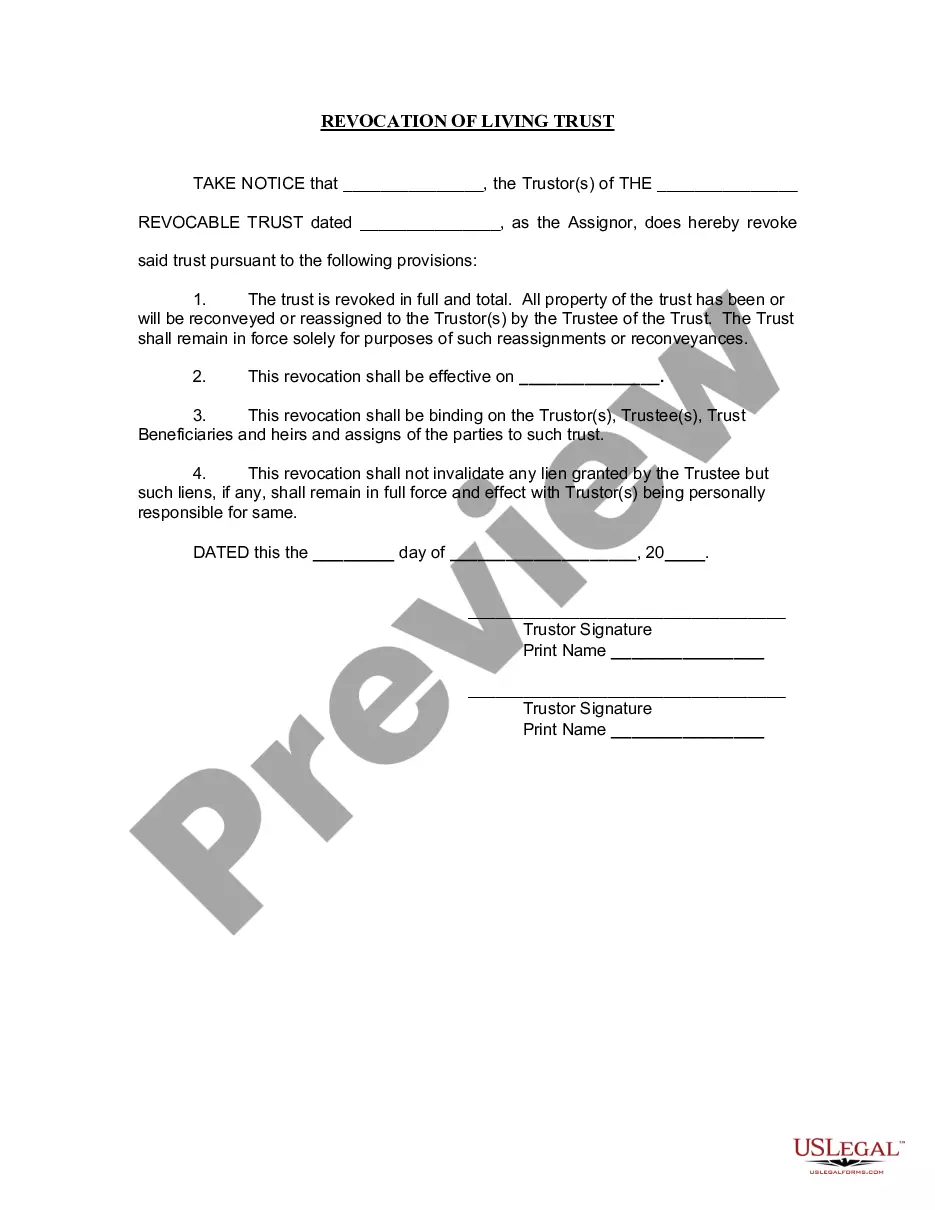

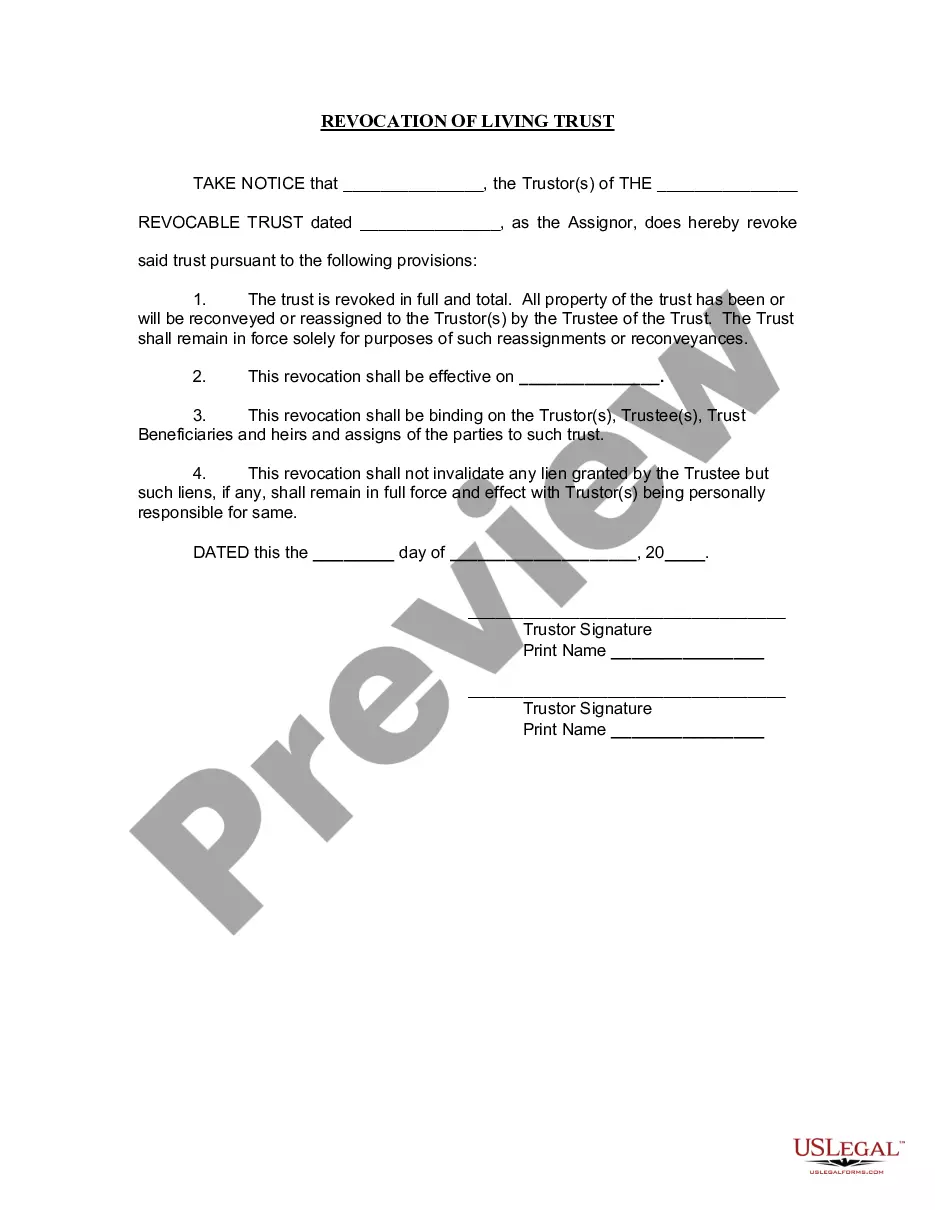

- If you are a new user, start by browsing the available options. View the Preview mode and read the form description carefully to confirm it meets your legal needs.

- Should you require a different form, utilize the Search feature to locate the correct one for your local jurisdiction.

- Once you find the right document, click on the Buy Now button. Choose the subscription plan that best fits your needs and register for an account.

- Complete your purchase using credit card or PayPal details to finalize the subscription process.

- After payment, download your revocation trust form to your device, ensuring you can fill it out whenever necessary. You’ll also find it readily accessible in the My Forms section of your profile.

By following these steps, you can utilize the robust library of legal forms offered by US Legal Forms, which outmatches competitors in quality and quantity. From revocation trusts to other essential forms, accessing expert assistance ensures your documents are accurate and legally sound.

Ready to start? Head over to US Legal Forms today and empower your estate planning with the right tools!

Form popularity

FAQ

Revoking a revocable trust is relatively straightforward and does not typically involve complex legal procedures. As the grantor, you retain the authority to dissolve the trust and redistribute assets as desired. With the right guidance, such as that provided by US Legal Forms, you can facilitate the revocation trust process smoothly.

A trust can be considered null and void for several reasons, such as the absence of the required legal formalities during its creation, lack of capacity of the grantor, or illegal purposes. If a trust violates the laws of your state, it cannot be enforced. Identifying these issues early can prevent complications, and a revocation trust can help clarify your wishes.

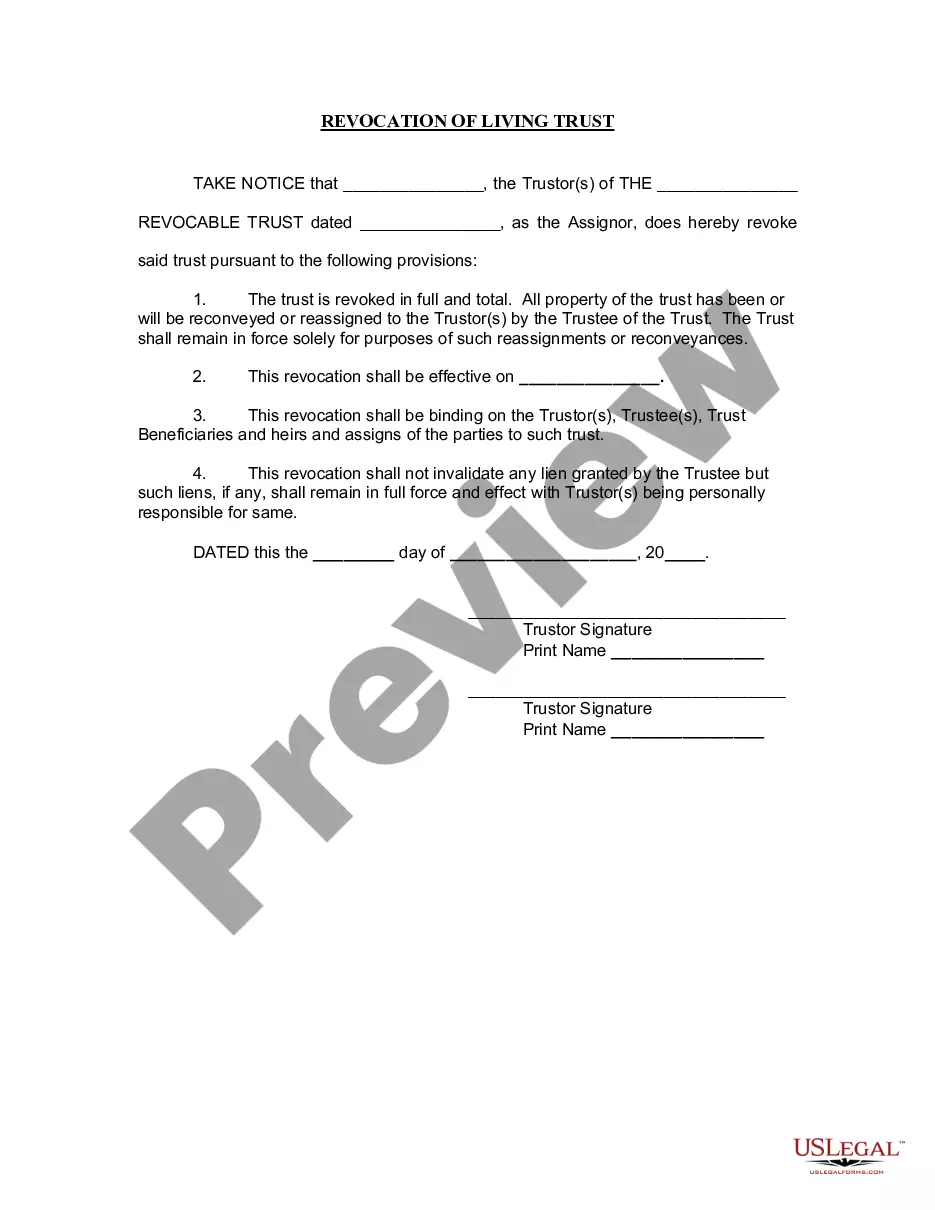

A revocable trust is terminated by the grantor’s declaration, which must show clear intent to terminate. Common methods include creating a formal revocation document or distributing the assets as per the trust terms. This straightforward process allows for flexibility and control, underscoring the advantages of a revocation trust.

To revoke a trust beneficiary, you must follow the procedures defined in the trust agreement. This often involves drafting a written amendment that specifies the change and obtaining the necessary signatures. It's essential to ensure that all legal requirements are met to avoid future disputes, making a revocation trust a useful framework.

Yes, a beneficiary of a trust can be removed through specific provisions outlined in the trust document or by mutual consent of the involved parties. The removal process may require a formal amendment to the trust or a legal proceeding, depending on state laws. It's important to handle this matter thoughtfully to avoid conflicts, and using a revocation trust can streamline this process.

To invalidate a trust, you typically need to prove that the trust was not created in accordance with legal requirements, such as lack of capacity or undue influence. Gathering sufficient evidence to support your claim is crucial, as it strengthens your case. Consulting with legal professionals can provide guidance in navigating the complexities of revocation trust.

An example of a revocation of a trust occurs when the grantor chooses to dissolve the trust, often due to changing financial circumstances or personal preferences. This action involves creating a document that clearly states the intention to revoke the trust, thereby nullifying its terms. A revocation trust can help ensure that assets are managed according to the grantor’s current wishes.

Revocation of trust refers to the process of nullifying a trust you have created. This means that you can take back the assets held in the revocation trust and eliminate the trust's terms. It's essential to understand this process for effective estate planning, and you can find user-friendly resources on platforms like US Legal Forms to guide you.

The purpose of a revocable trust is to create a structured way to manage assets during your lifetime while allowing for easy transfer upon death. It serves as a financial tool that helps you avoid probate and reduces estate settlement costs. This ensures that your wishes are fulfilled and your heirs receive their inheritance smoothly.

The major benefit of a revocable trust is that it allows for the seamless transfer of assets upon your death, minimizing delays and complications. This type of trust also provides privacy, as it does not go through the public probate process. Therefore, a revocation trust can offer peace of mind to both you and your loved ones.