Dissolve Company With Irs

Description

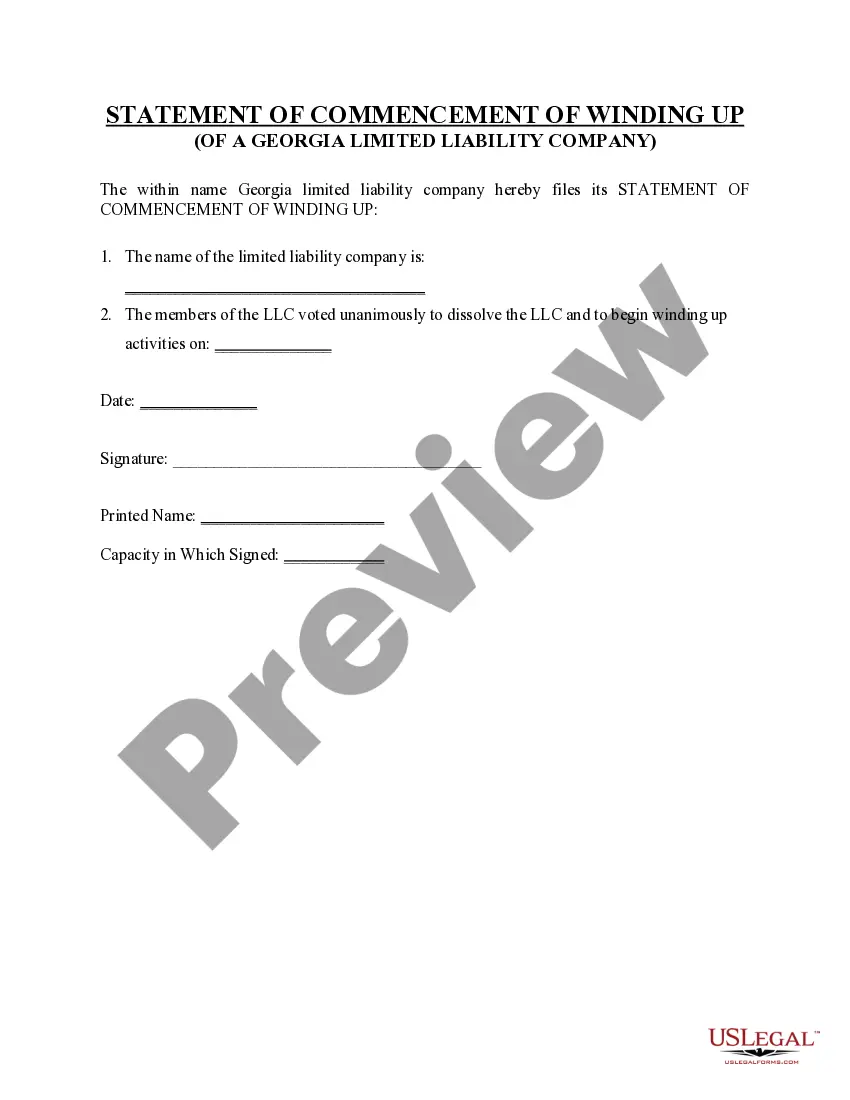

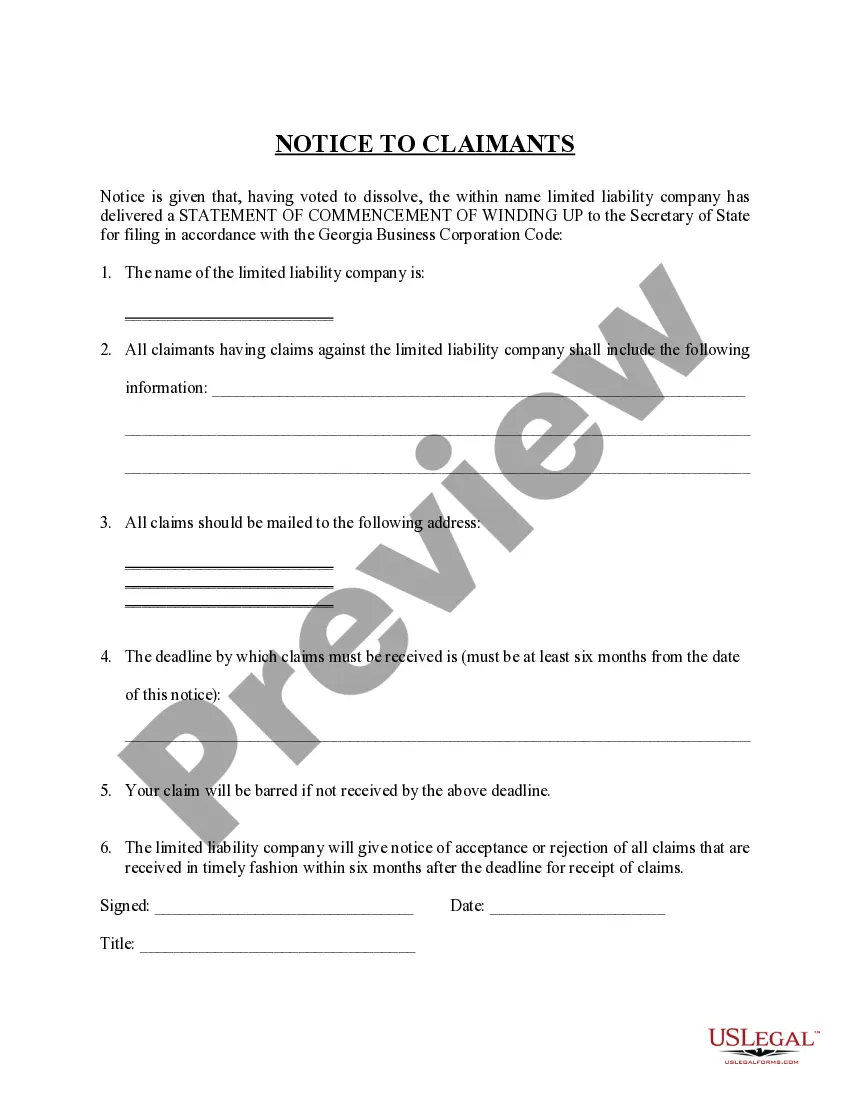

How to fill out Georgia Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your US Legal Forms account if you're a returning user, and ensure your subscription is active. If not, consider renewing it to access the various form templates.

- If you’re new to our service, start by previewing the forms available and reading the descriptions. Confirm that you select the right document that matches your local jurisdiction.

- Should you need a different template, utilize the Search function to explore other options that meet your criteria.

- Once you've found the appropriate form, click 'Buy Now' and choose your desired subscription plan. This step will require you to create an account to unlock all our resources.

- Complete your transaction by entering your payment details, either through credit card or PayPal.

- Download your form directly to your device, enabling you to fill it out whenever you need it. You can also access this document anytime from the 'My Forms' section in your profile.

In conclusion, US Legal Forms offers a robust collection of over 85,000 customizable legal documents, making it your go-to resource for dissolving your company. With support from premium experts, you can ensure accuracy and compliance throughout the process.

Take the first step towards dissolving your company today by visiting US Legal Forms!

Form popularity

FAQ

Before you dissolve your LLC, take several important steps to ensure a smooth closure. First, settle all financial obligations and outstanding debts. Next, notify all relevant parties, including employees and clients. Finally, consult resources like US Legal Forms for detailed instructions on legally and effectively dissolving your company with the IRS.

Filing IRS Form 966 is not always mandatory when dissolving an LLC, but it may be necessary depending on the circumstances of your dissolution. This form serves to inform the IRS about the closure of your business entity. To determine if you need to file this form, consider consulting with a legal expert or utilize resources from US Legal Forms for clarity.

Even after you dissolve your LLC, you are generally required to file taxes for the final year of operation. This includes reporting all income, even if your business is no longer active. It's important to complete these tax filings to comply with IRS regulations and avoid penalties. Using US Legal Forms can help you navigate this tax obligation smoothly.

Yes, notifying the IRS is a crucial step when you dissolve your LLC. You must ensure that all tax obligations are settled before formally dissolving your company. While you may not always need to submit specific forms, informing the IRS helps prevent future tax issues. US Legal Forms offers resources to ensure you handle this process accurately.

When you decide to dissolve your company, you may need to file IRS Form 966. This form notifies the IRS of your intent to dissolve your corporation or LLC. However, not every business structure requires this form, so it’s essential to understand your specific situation. Fortunately, US Legal Forms can guide you in making the right choice based on your company's needs.

Yes, you should cancel your EIN if you close your business to ensure the IRS has updated records. While the EIN cannot be reused, canceling it helps avoid confusion in the future. When you dissolve company with IRS, formally canceling your EIN is an important step to take.

When you dissolve an LLC, the business ceases to exist and no longer holds legal status. This action affects all liabilities and assets tied to the LLC, and you must settle any debts. It is important to dissolve company with IRS properly to avoid future tax complications or legal repercussions.

To dissolve a company with the IRS, you need to follow a series of steps including filing your final tax return and notifying the IRS of your closure. It’s advisable to clear any tax obligations before completing the dissolution. Using platforms like USLegalForms can offer guidance on the correct forms and processes needed for a smooth dissolution.

No, you cannot keep the EIN once you dissolve an LLC. The EIN is tied to the business entity, so when you dissolve company with IRS, it becomes inactive. If you want to start a new business later, you will need to apply for a new EIN.

When you dissolve your LLC, your EIN (Employer Identification Number) does not automatically disappear. The IRS retains this number even after the company is dissolved, and it cannot be reused. Therefore, when you decide to dissolve company with IRS, consider the implications of your EIN on your future business endeavors.