Change Name After Marriage With Hmrc

Description

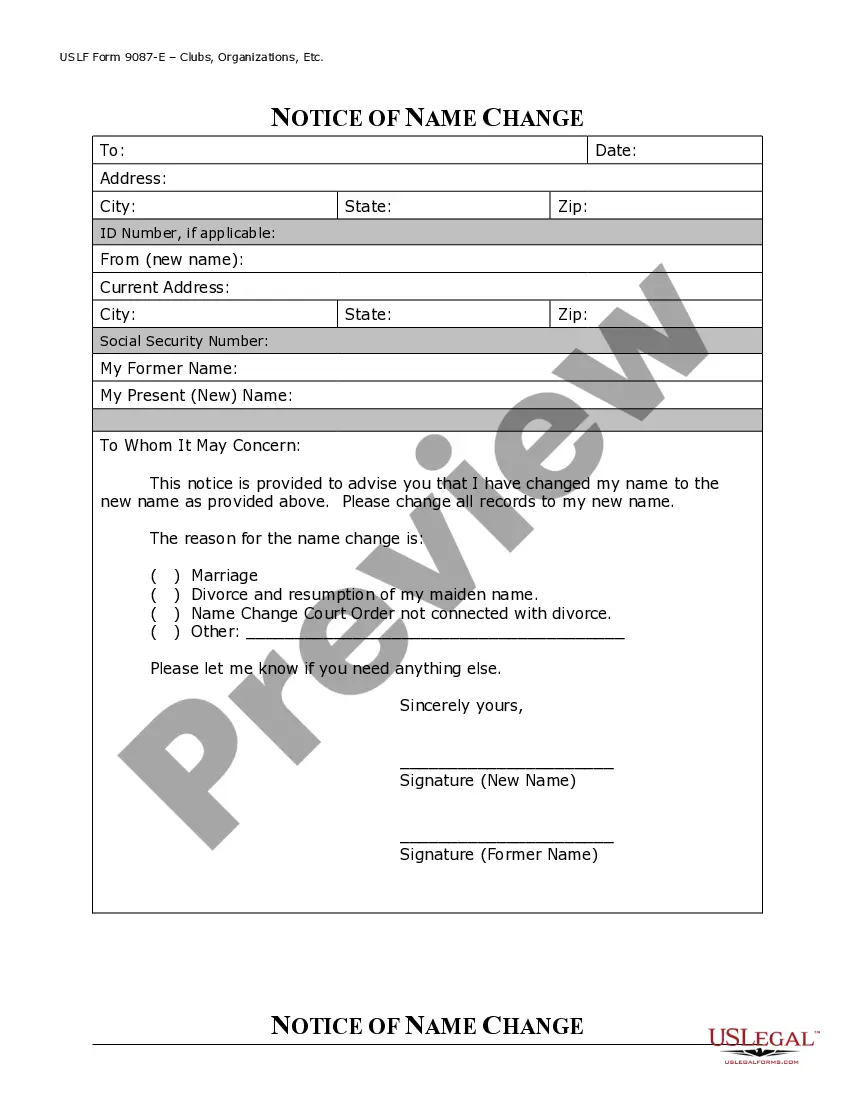

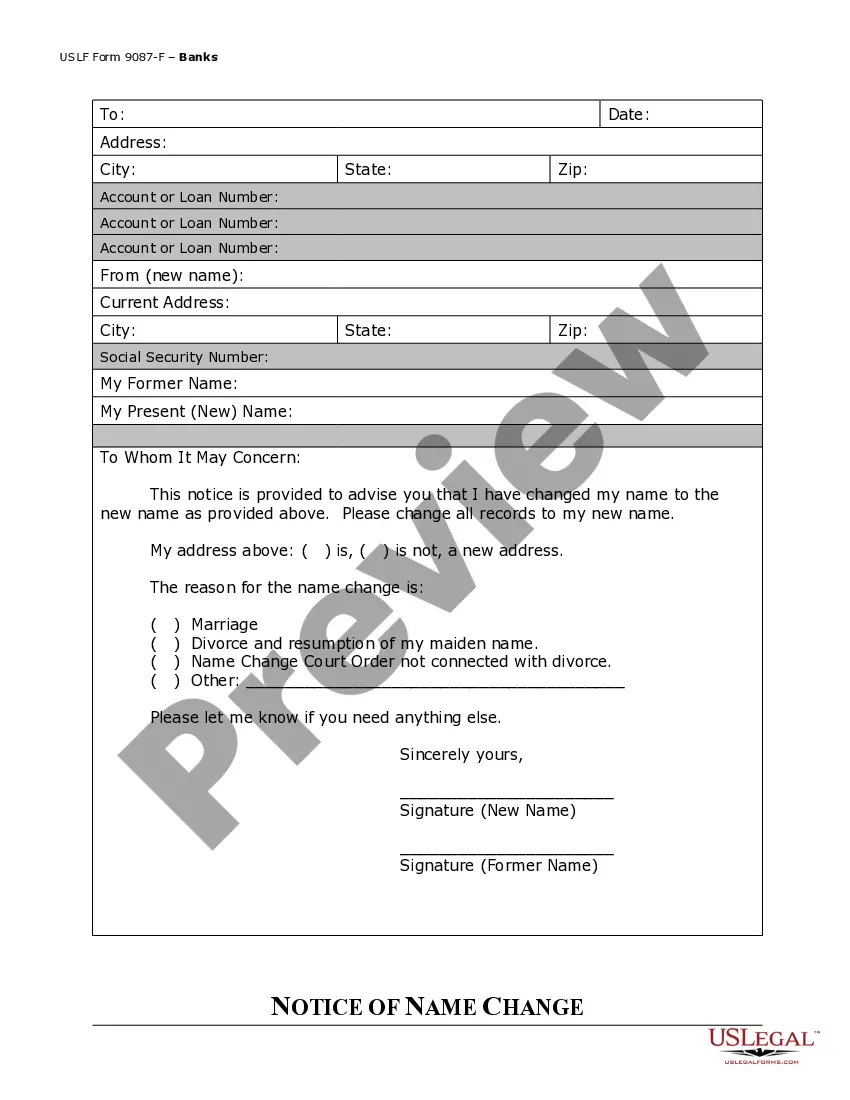

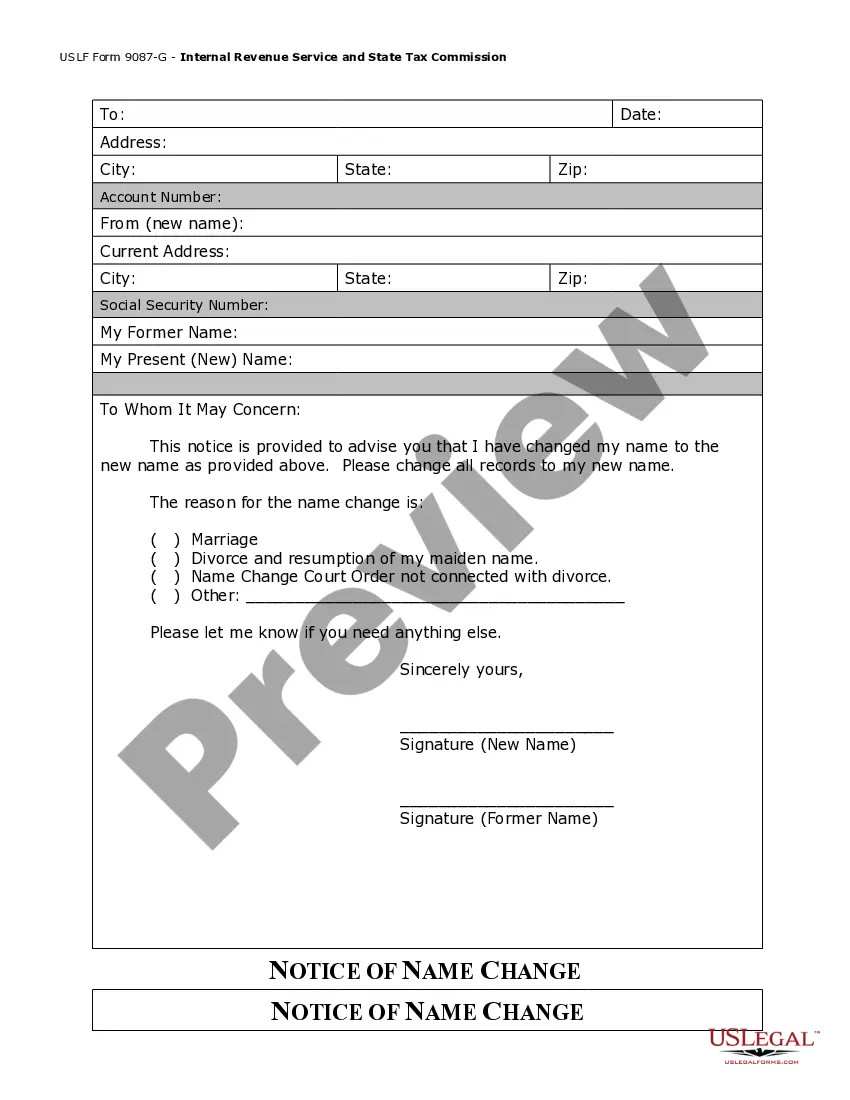

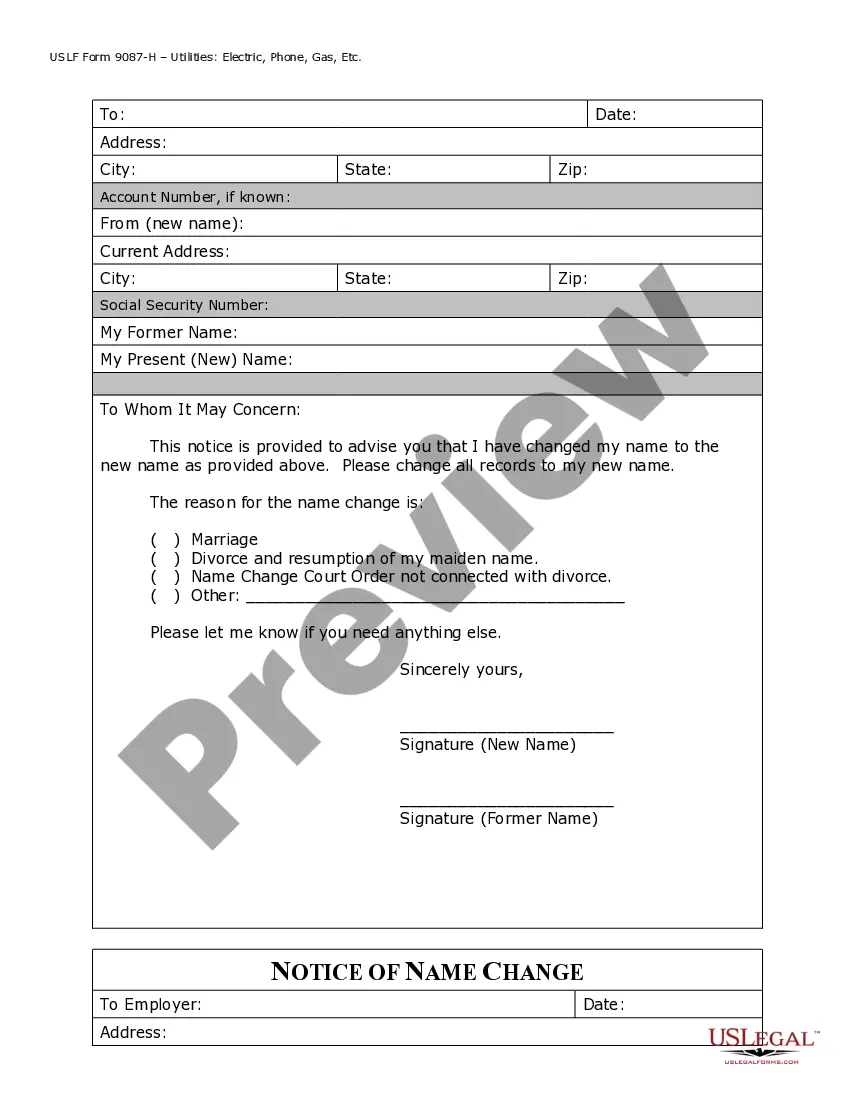

How to fill out Georgia Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- If you're a returning user, log in to your account and click the Download button for the required form template. Check your subscription status and renew if necessary.

- For first-time users, start by navigating to the US Legal Forms website. Preview the available forms and ensure the selected one complies with local requirements.

- If the initial form does not meet your needs, utilize the Search tab to locate other templates. Once you find a suitable one, proceed to the next step.

- Purchase the document by clicking the Buy Now button. Select your preferred subscription plan and create an account to access the form library.

- Complete your payment using a credit card or PayPal and then download the form to your device. Access it anytime through the My Forms section in your profile.

By using US Legal Forms, you benefit from a robust collection of over 85,000 legal documents that are easy to fill and edit. This service not only offers more forms than competitors at a similar cost but also provides access to premium experts for assistance with your forms.

In conclusion, changing your name after marriage with HMRC can be a streamlined process when you utilize US Legal Forms. Start today and ensure your legal documents are accurately updated!

Form popularity

FAQ

Legally, when you get married in the UK, your marital status changes, which can affect your tax situation and legal rights. You should update your name with HMRC to reflect this change. Understanding these modifications is vital to ensure all your details are current and correctly recorded.

When you get married in the UK, inform HMRC, your bank, utility companies, and any other organizations that hold your personal information. This keeps your records accurate and avoids future complications. Remember, updating your name after marriage with HMRC is essential for correct tax assessments.

To go back to your maiden name in the UK, simply inform HMRC and any other relevant institutions. You may also need to update your identification and bank details. If you've changed your name after marriage with HMRC, transitioning back to your maiden name involves straightforward updates to your records.

To change your name on your taxes after marriage, notify the IRS by sending them your new name through Form 8822. Update your information with HMRC as well. This is crucial to ensuring your tax documents reflect your current marital status and name.

To change your filing status from single to married on TurboTax, start your return and select the 'Married Filing Jointly' option. Follow the prompts to enter your new details, including your name after your marriage. If you change name after marriage with HMRC, make sure everything matches for a smoother process.

When you get married in the UK, inform several organizations, including HMRC, banks, and utility providers. It is essential to update your name and personal details to maintain accurate records. This ensures a smooth transition, especially when you change name after marriage with HMRC.

To notify the IRS of your name change, you need to complete Form 8822, 'Change of Address.' Include your new name and any necessary identification documents. If you change your name after marriage with HMRC, it’s crucial to keep your tax records consistent and up-to-date.

After getting married in the UK, you should consider changing your name, if desired, and inform HMRC about your new status. Update your records with banks, utility companies, and any other official bodies. It's a good time to review tax implications and ensure your financial matters are in order.

Getting a bigger tax refund as a married couple depends on various factors, including your income levels. Generally, married couples can benefit from tax allowances and may be eligible for a marriage tax allowance. Remember to update your details with HMRC to maximize such benefits after you change name after marriage with HMRC.

Yes, you need to declare your marriage in the UK. This includes updating your personal records with HMRC. It's important to ensure your tax records match your marital status, especially when you change your name after marriage with HMRC.