Quitclaim Deed To Revocable Trust Form For Florida

Description

Form popularity

FAQ

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

A quit claim deed should be filed with the clerk of court in the county where the property is located. This will involve taking the deed to the clerk's office and paying the required filing fee (typically about $10 for a one-page quit claim deed).

Although you can make a quitclaim deed yourself, we suggest hiring a real estate lawyer to ensure your deed is done right and meets the legal and filing requirements for Flordia and the local country recorders office where the property is located.

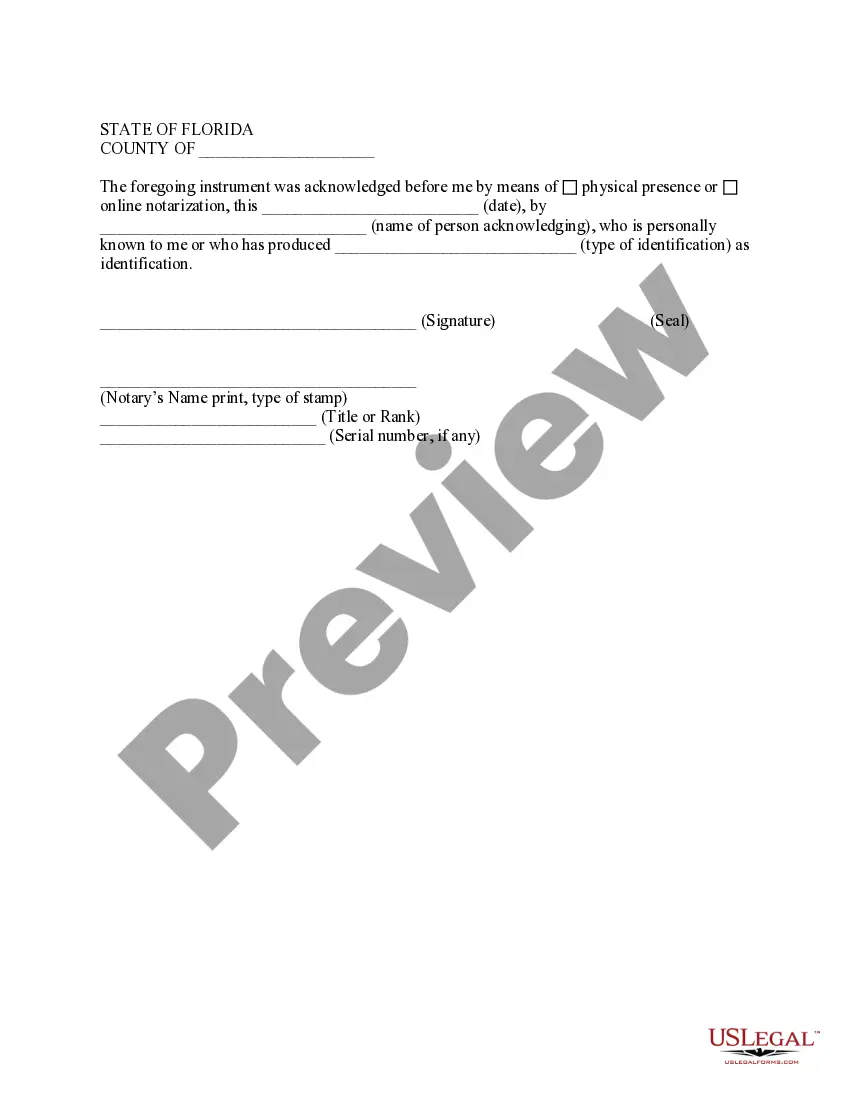

Ing to Florida Statute 695.26, a quitclaim deed must contain these certain elements: Name and address of person preparing the deed. Grantor's name and address. Grantee's name and address. Signatures of the grantors. Two witnesses for each signature/ Notary acknowledgment with signature.

Steps to Putting Your Home in a Trust in Florida Choose What Type of Trust You Want. ... Contact an Estate Planning Attorney. ... Decide Upon Beneficiaries and Trustees. ... Decide Upon The Terms of the Trust. ... Create the Trust Document. ... Prepare a New Property Deed. ... Get The New Property Deed Notarized. ... File The Deed.