Trust Form Revocable With Irrevocable Trust

Description

How to fill out Florida Living Trust For Husband And Wife With No Children?

Using legal templates that comply with federal and regional regulations is a matter of necessity, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the appropriate Trust Form Revocable With Irrevocable Trust sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and life scenario. They are easy to browse with all files collected by state and purpose of use. Our specialists keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when getting a Trust Form Revocable With Irrevocable Trust from our website.

Getting a Trust Form Revocable With Irrevocable Trust is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, adhere to the guidelines below:

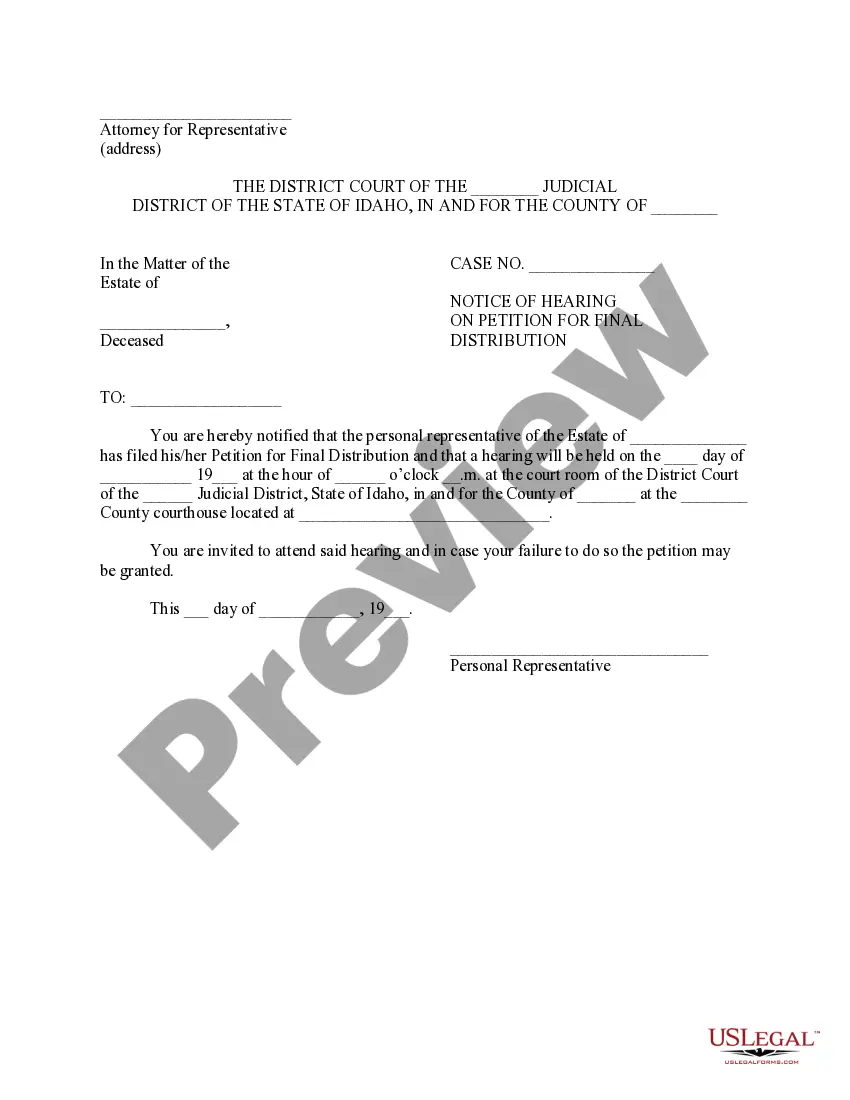

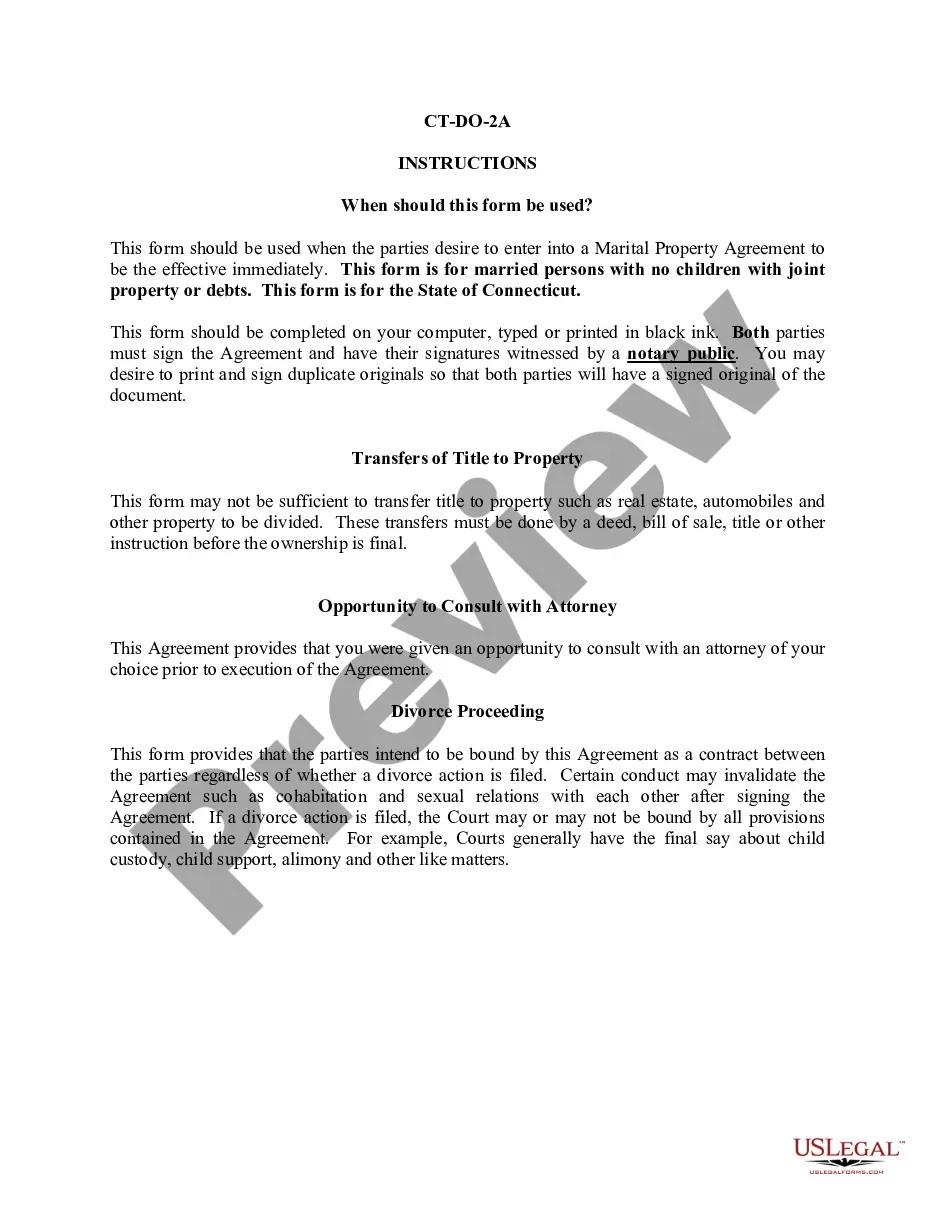

- Take a look at the template using the Preview feature or via the text description to ensure it meets your needs.

- Look for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Trust Form Revocable With Irrevocable Trust and download it.

All documents you locate through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Yes, once the trust grantor becomes incapacitated or dies, his revocable trust is now irrevocable, meaning that generally the terms of the trust cannot be changed or revoked going forward. This is also true of trusts established by the grantor with the intention that they be irrevocable from the start.

With an irrevocable trust, you get much more protection for assets. Since you have largely given up control over the trust assets and cannot just access them at will, there is more protection from creditors. You may also be able to protect irrevocable trust assets from estate tax.

Yes, once the trust grantor becomes incapacitated or dies, his revocable trust is now irrevocable, meaning that generally the terms of the trust cannot be changed or revoked going forward. This is also true of trusts established by the grantor with the intention that they be irrevocable from the start.

Since an irrevocable trust is under the trustee's care, they will be responsible for filing Form 1041 and reporting the income stream.

Almost everyone should have both an irrevocable and a revocable trust. You need a revocable trust to hold ownership of the asset that you will use in your day-to-day life. This revocable trust will hold your income, such as retirement and Social Security. Occasionally, it might also hold your home.