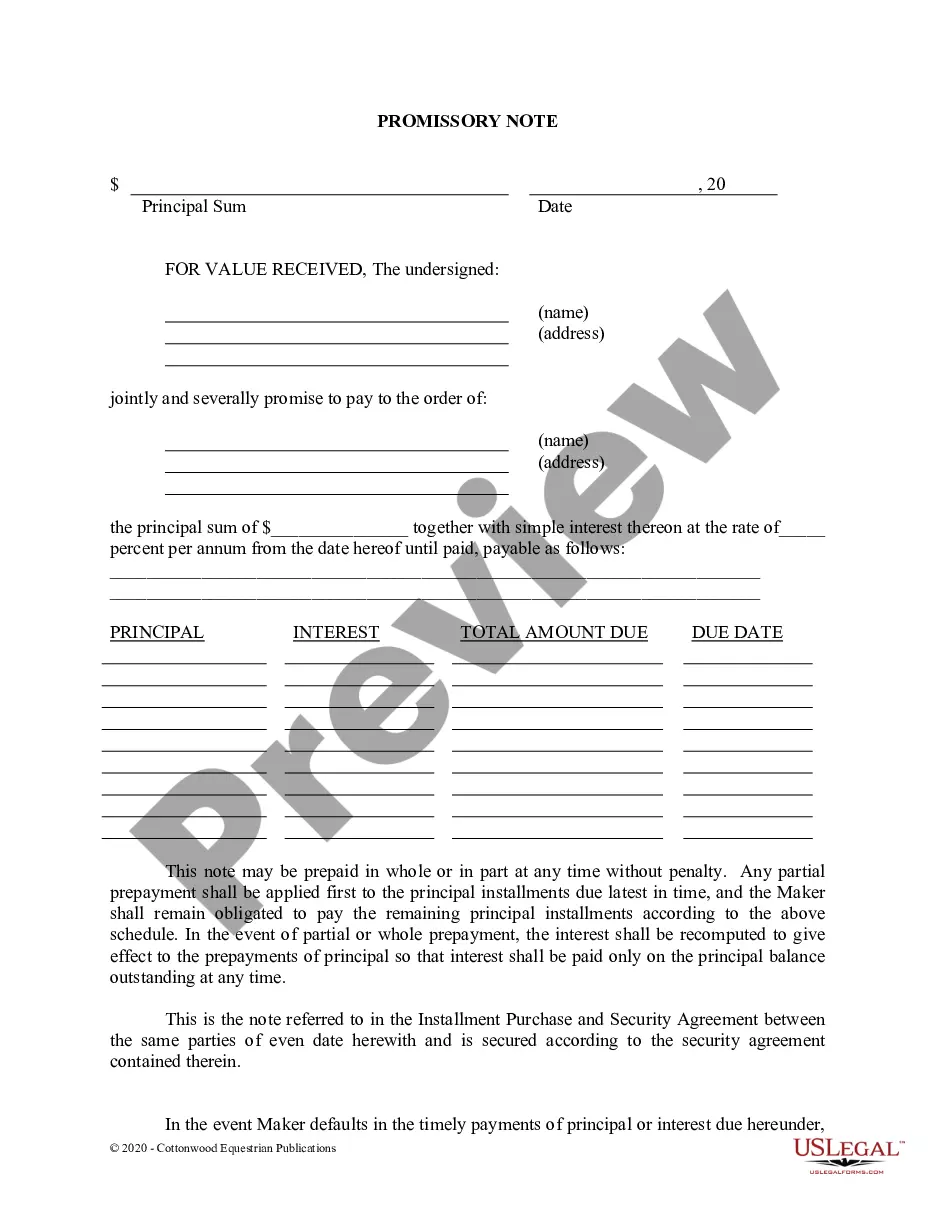

Promissory Note In Florida

Description

How to fill out Florida Promissory Note - Horse Equine Forms?

How to obtain professional legal documents that comply with your state regulations and create the Promissory Note in Florida without consulting a lawyer? Numerous online services provide templates to address various legal needs and requirements. However, it can be time-consuming to identify which of the available samples meet both your specific use case and legal obligations.

US Legal Forms is a reliable platform that assists you in finding official documents drafted in accordance with the most recent state law amendments and helps you save on legal fees.

US Legal Forms is not merely a typical online catalog. It is an extensive repository of over 85,000 verified templates for diverse business and personal situations. All documents are categorized by area and state to facilitate a quicker and more convenient search process. Moreover, it incorporates powerful tools for PDF editing and electronic signatures, allowing users with a Premium membership to efficiently complete their documents online.

The documents you acquire remain in your ownership: you can revisit them at any time in the My documents section of your account. Sign up for our platform and draft legal documents on your own like a seasoned legal expert!

- It requires minimal time and effort to obtain the necessary paperwork.

- If you already possess an account, Log In and ensure that your subscription is active.

- Download the Promissory Note in Florida using the corresponding button next to the document name.

- If you do not own an account with US Legal Forms, then follow the instructions below.

- Examine the webpage you have accessed and confirm if the form fits your requirements.

- Utilize the form description and preview options if provided.

- If necessary, look for another template in the header that lists your state.

- Once you locate the appropriate document, click the Buy Now button.

- Select the most suitable pricing plan, then Log In or create an account.

- Choose your method of payment (by credit card or through PayPal).

- Modify the file format for your Promissory Note in Florida and click Download.

Form popularity

FAQ

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

All parties must sign the promissory note. Florida law does not require that the promissory note be notarized, but parties often take this extra step.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.