Florida Promissory Note - Horse Equine Forms

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

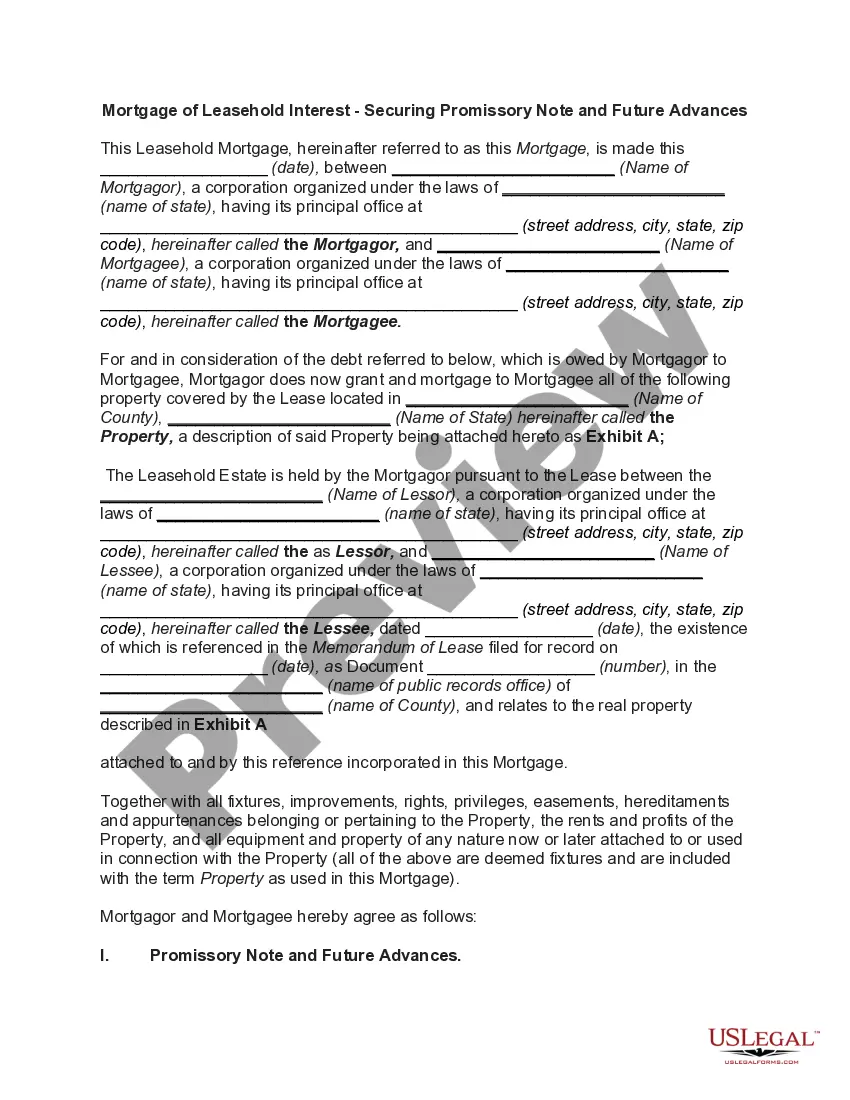

Key Concepts & Definitions

Promissory Note: A written promise to pay a specific sum of money to another party under specified terms and within a certain time frame. Equine Forms: Legal forms related to the care, transfer, or business of horses. Texas Promissory: A subtype of promissory notes that adhere to the specific legal requirements of Texas. Real Estate: Property consisting of land and the buildings on it, along with its natural resources. Landlord Tenant: Legal forms that govern the relationship between property owners and their renters. Living Conditions: Refers to the quality and condition of a living area, which is important in equine management. Small Business: An independently owned company that is limited in size and revenue according to the industry. Personal Trainer: A certified individual who guides others in exercises and personal fitness plans.

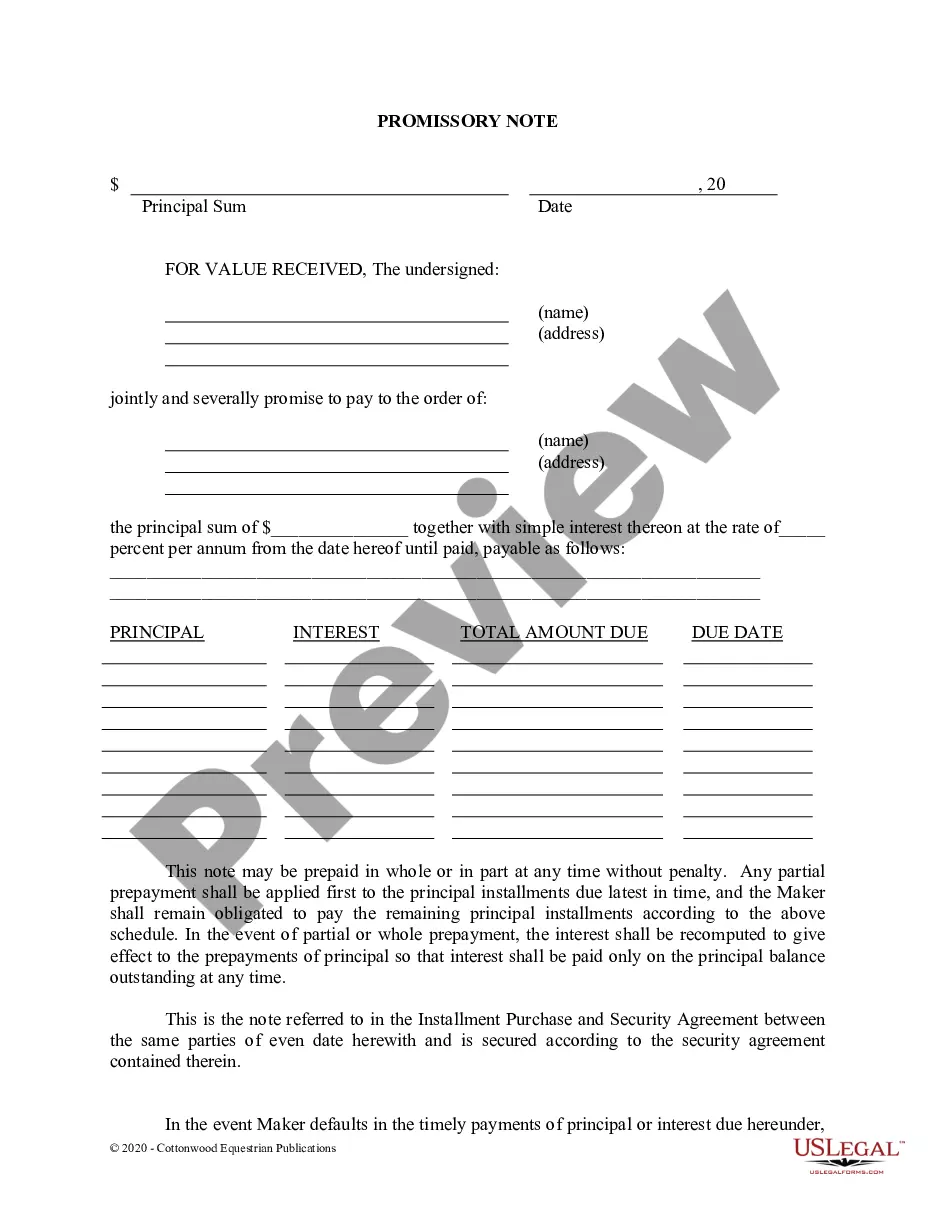

Step-by-Step Guide to Managing a Promissory Note in the Equine Industry

- Identify the Need: Determine whether a promissory note is necessary for transactions such as horse purchase, equipment, or services.

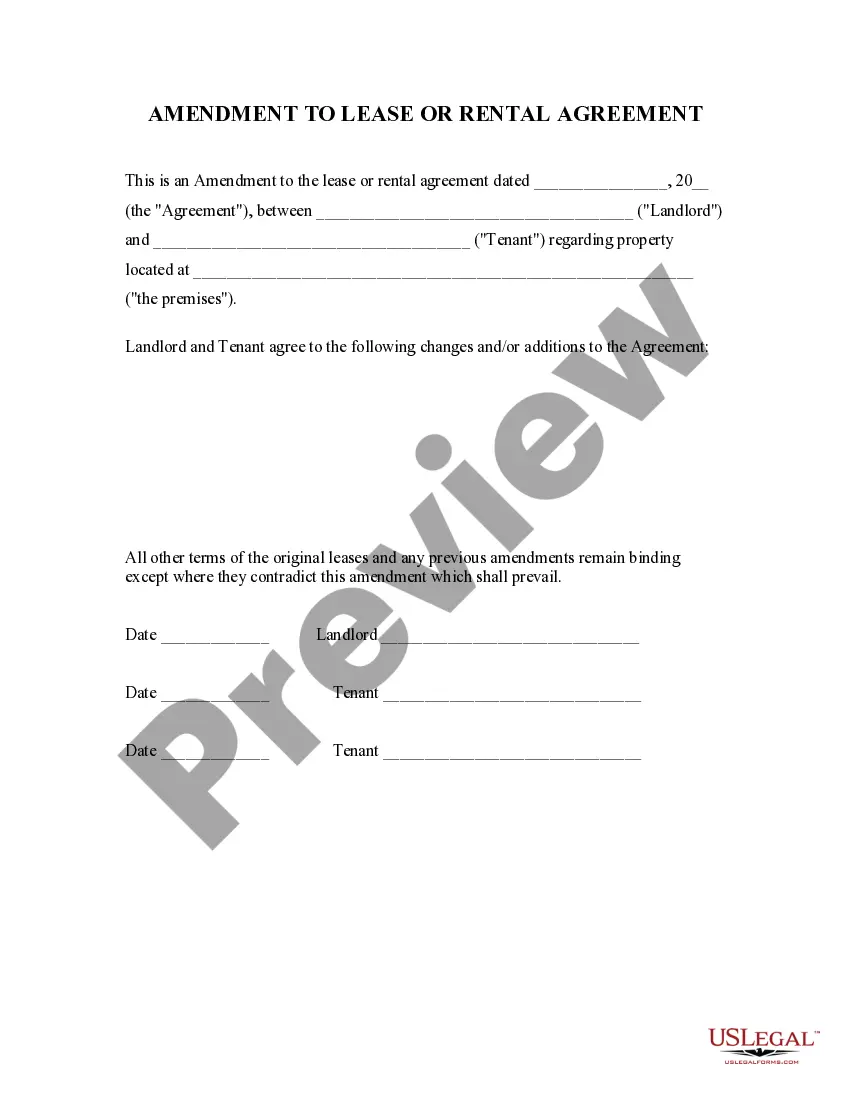

- Draft the Note: Clearly state the amount borrowed, repayment schedule, interest rate, and what both parties agree to. Consulting a legal expert is advised, especially in specific states like Texas.

- Detail Collateral : If applicable, describe any collateral (such as the horse itself), which secures the loan.

- Execute and Witness: Both parties should sign the promissory note, and ideally, it should be witnessed or notarized to enforce legality.

- Store Documents Securely: Keep the promissory note and any associated legal forms in a safe place for future reference and legal safety.

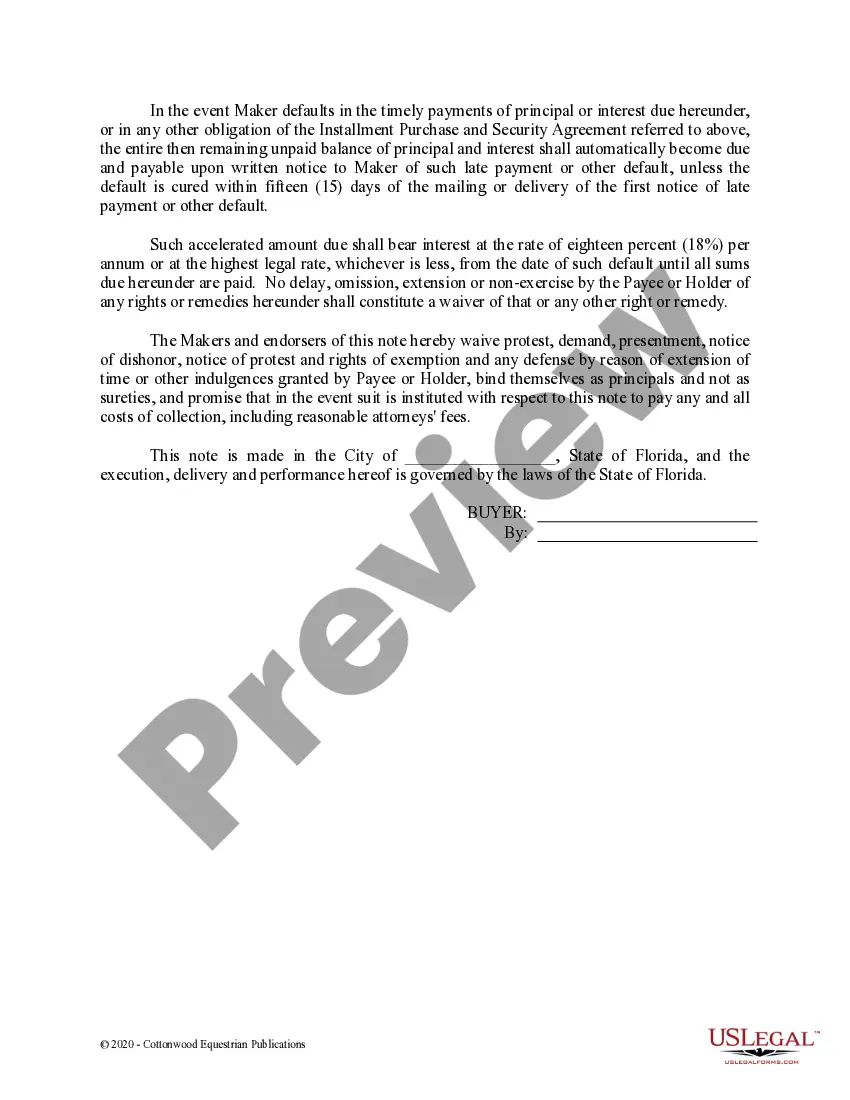

Risk Analysis for Using a Promissory Note in Equine Transactions

- Non-payment Risk: There's always a risk that the borrower might fail to make payments as agreed. Mitigate this by carefully assessing the borrower's financial background.

- Legal Disputes: Improper or unclear terms can lead to disputes. Ensuring clarity and legality in drafting can reduce this risk.

- Asset Depreciation: In cases where the horse itself is used as collateral, its value might depreciate faster than the repayment, affecting the security of the loan.

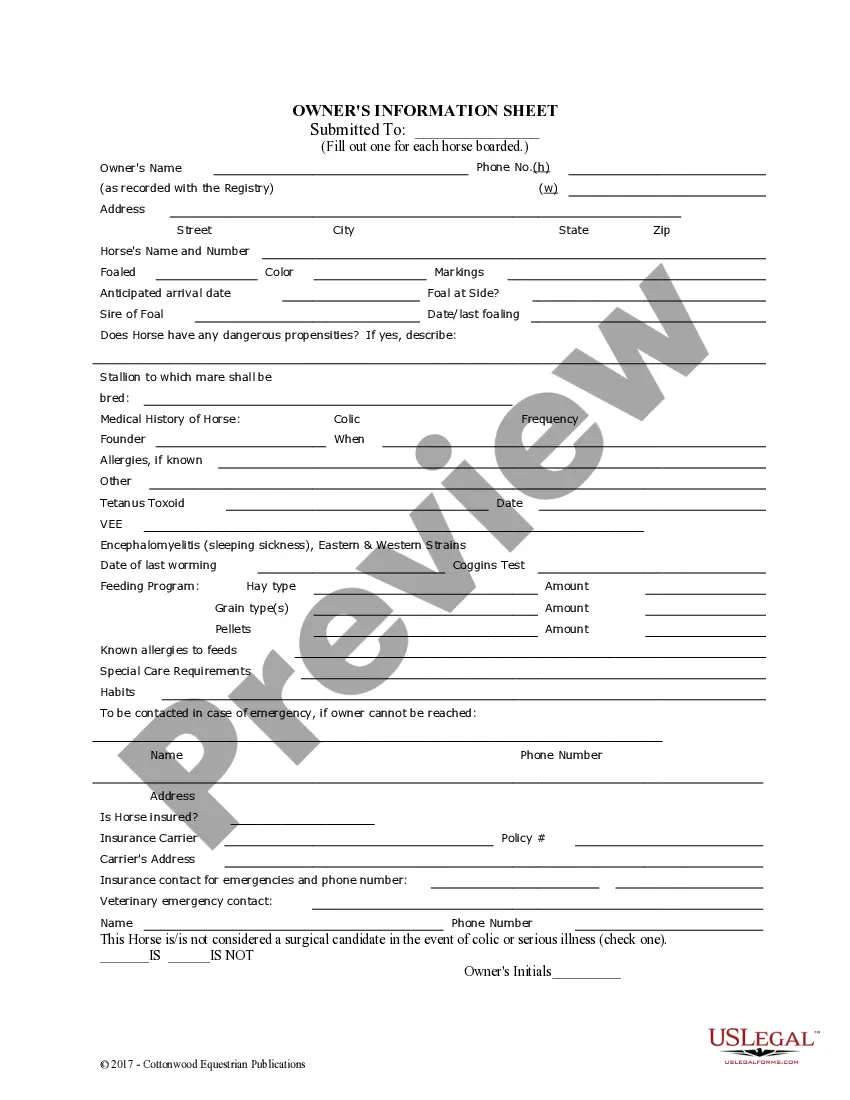

How to fill out Florida Promissory Note - Horse Equine Forms?

Obtain the most comprehensive catalog of legal documentation.

US Legal Forms serves as a resource where you can locate any state-specific forms in just a few clicks, including Florida Promissory Note - Horse Equine Forms templates.

There is no need to invest several hours searching for a court-acceptable sample.

Use the Preview feature if it’s available to view the details of the document. If everything appears correct, click Buy Now. After selecting a pricing plan, create an account. Make payment via credit card or PayPal. Download the document to your device by clicking on the Download button. That's it! You should submit the Florida Promissory Note - Horse Equine Forms template and review it. To ensure everything is precise, consult your local legal advisor for assistance. Sign up and conveniently access approximately 85,000 valuable templates.

- Our certified professionals ensure that you receive the most current documents each time.

- To utilize the forms library, choose a subscription and create an account.

- If you have already done so, simply Log In and press the Download button.

- The Florida Promissory Note - Horse Equine Forms file will swiftly be saved in the My documents section (a section for all forms you retain on US Legal Forms).

- To start a new account, adhere to the brief instructions below.

- If you need to access state-specific documents, make sure to specify the correct state.

- If feasible, review the description to grasp all the details of the document.

Form popularity

FAQ

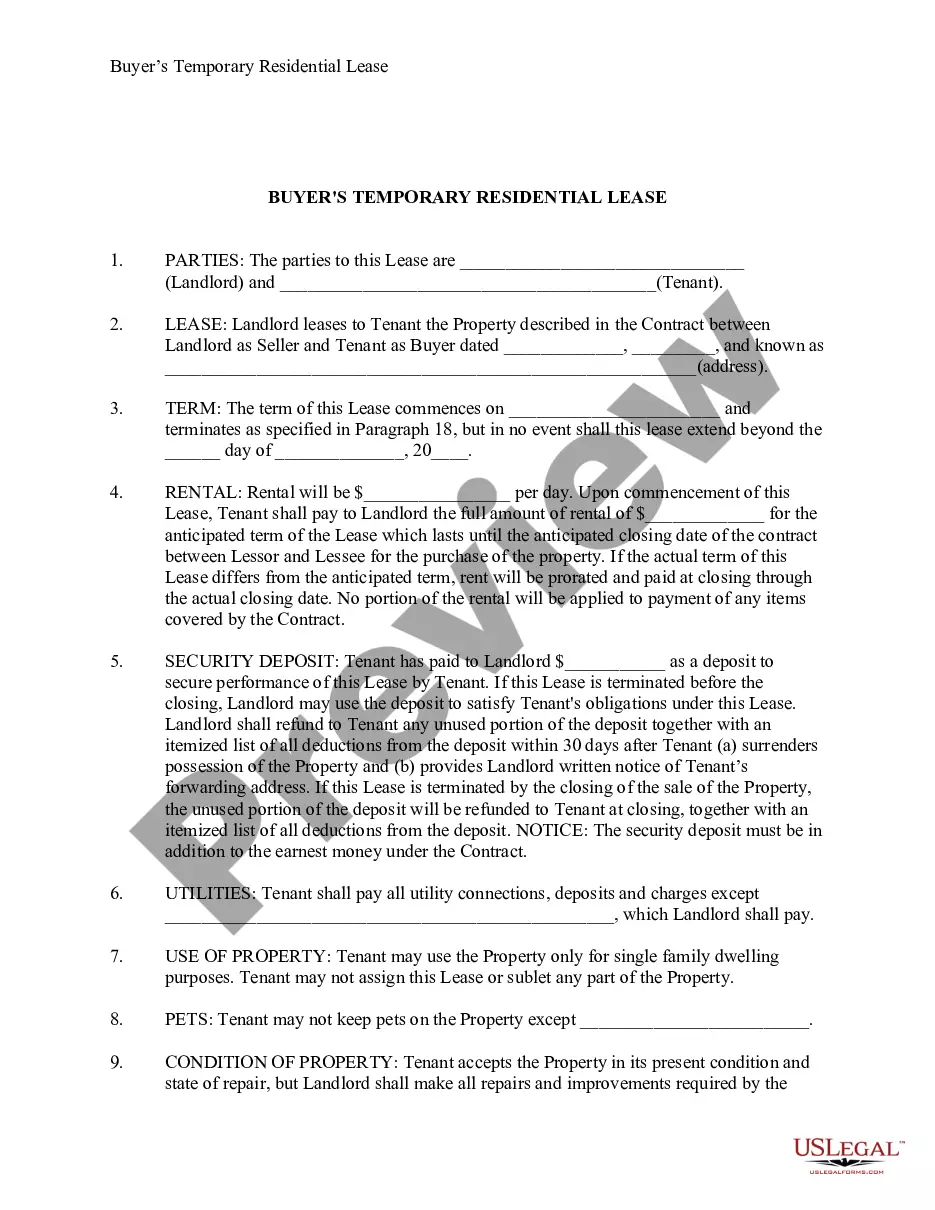

When buying a horse, you typically need a bill of sale, health certificates, and possibly a lien release, depending on the seller's circumstances. Additionally, if you are using financing, a Florida Promissory Note - Horse Equine Form might be necessary to record any agreement about payments. For a seamless purchasing process, USLegalForms provides ready-to-use templates specifically designed for horse transactions.

Yes, a promissory note can be valid even if it is not notarized in Florida, provided it meets the necessary legal requirements. However, a notarized note may serve as strong evidence in case of disputes. To enhance the validity of your document, consider utilizing the Florida Promissory Note - Horse Equine Forms from USLegalForms, which offers templates that ensure compliance with Florida law.

In Florida, a promissory note does not legally require notarization to be valid. However, having it notarized adds an extra layer of credibility and may prevent disputes about authenticity. By using the Florida Promissory Note - Horse Equine Forms available on USLegalForms, you can conveniently create a notarized document that meets all legal requirements.

A promissory note generally does not require recording to hold legal value, but recording offers additional protection by providing public notice. When you record a promissory note, it can help prevent disputes regarding the priority of claims. To simplify this process, you can use Florida Promissory Note - Horse Equine Forms and explore whether recording is appropriate for your situation.

In Florida, a promissory note does not need to be recorded to be legally valid. However, recording it can provide public notice of the transaction, which may protect the interests of the lender. Using Florida Promissory Note - Horse Equine Forms allows you to create a legally binding document while considering the benefits of recording if necessary.

In Florida, promissory notes do not necessarily need to be notarized to be enforceable; however, notarization can add an extra layer of legitimacy. If both parties agree to sign in front of a notary, it can help prevent potential disputes regarding the authenticity of the signatures. Therefore, while notarization is not mandatory, it is often recommended for added security.

To create a legally binding Florida Promissory Note - Horse Equine Forms, both the borrower and lender must agree to the terms outlined in the document. This includes having the document clearly state the payment terms, ensuring all parties sign it, and retaining copies for their records. In some cases, consulting with a legal professional can further cement its enforceability.