Sworn To And Subscribed Before Me By Meaning

Description

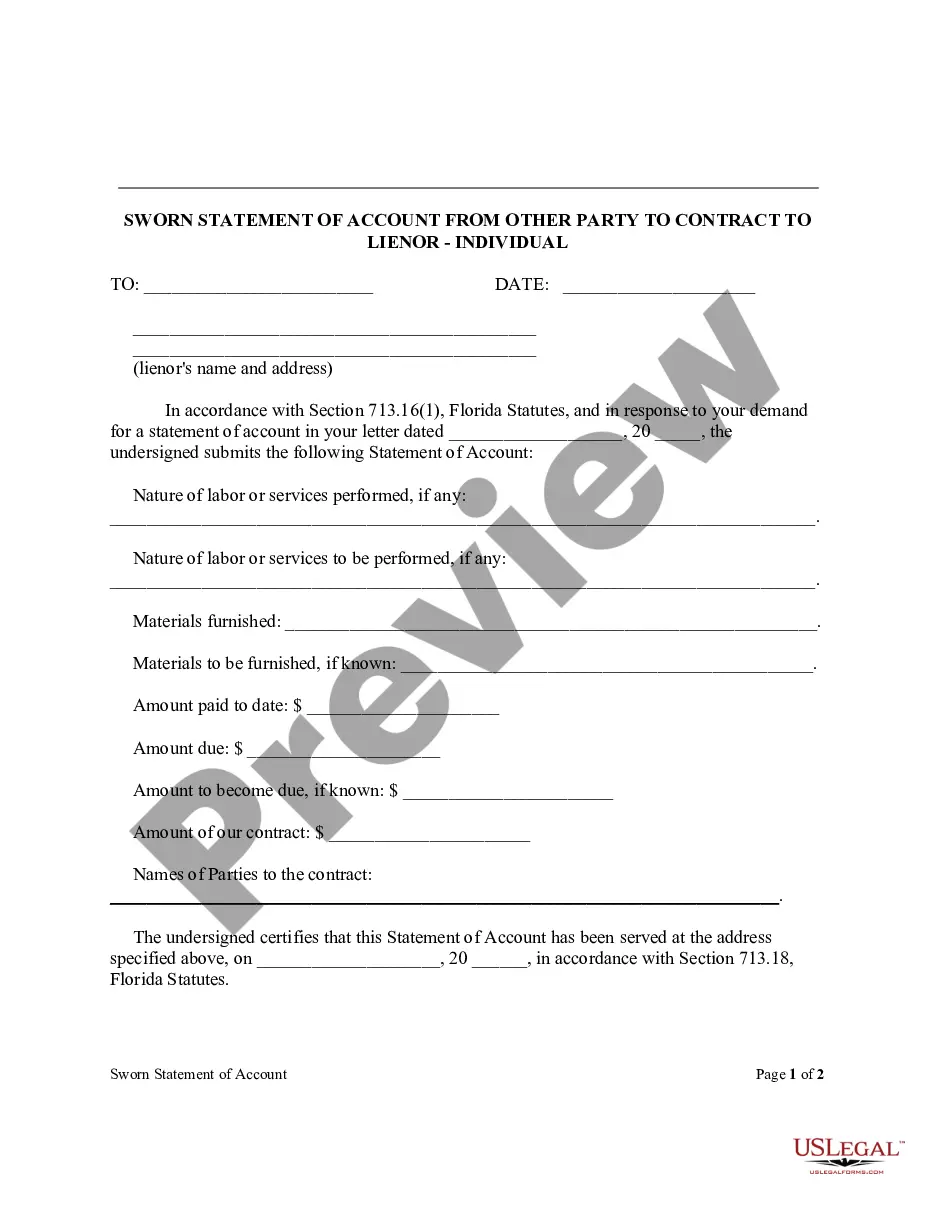

How to fill out Florida Sworn Statement Of Account From Other Party To Contract To Lienor - Individual?

It’s clear that you cannot transform into a legal authority instantly, nor can you acquire the knowledge to rapidly create Sworn To And Subscribed Before Me By Meaning without possessing a specialized foundation.

Drafting legal documents is a labor-intensive endeavor necessitating a particular education and expertise.

So why not entrust the drafting of the Sworn To And Subscribed Before Me By Meaning to the experts.

You can access your forms again from the My documents tab at any time.

If you’re an existing customer, you can simply Log In and find and download the template from the same tab. No matter the aim of your forms—be it financial and legal, or personal—our platform is equipped to serve your needs. Give US Legal Forms a try today!

- Locate the form you require by utilizing the search bar situated at the top of the page.

- Preview it (if this option is available) and review the accompanying description to ascertain if Sworn To And Subscribed Before Me By Meaning is what you seek.

- Restart your search if you need a different template.

- Establish a complimentary account and select a subscription plan to purchase the template.

- Click Buy now. Once the transaction is finalized, you can download the Sworn To And Subscribed Before Me By Meaning, fill it out, print it, and dispatch or mail it to the designated individuals or entities.

Form popularity

FAQ

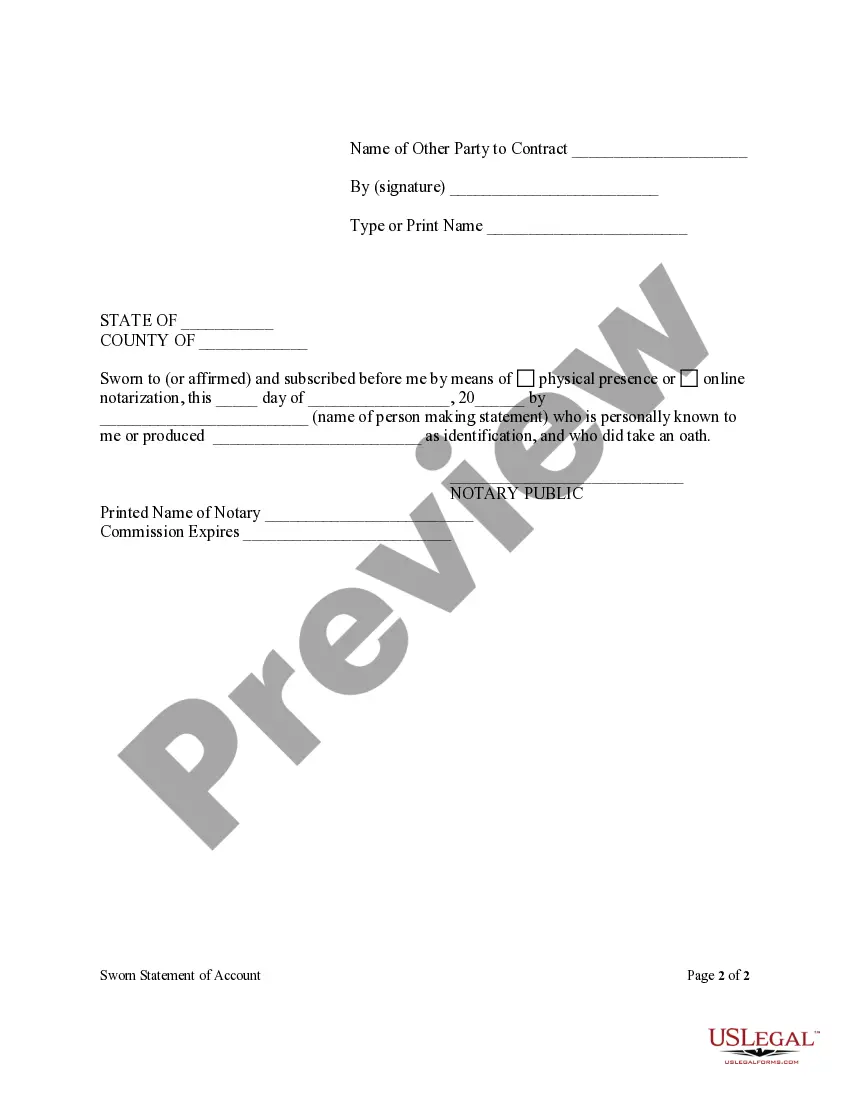

To complete the phrase 'subscribed and sworn by,' fill in the name of the individual who is signing the document. It is essential to ensure that the individual personally signs it in the presence of a notary. This phrase signifies that the person acknowledges the truth of their statements, aligning with the concept of 'sworn to and subscribed before me by.'

The phrase 'subscribed and sworn to before me' indicates that the individual has signed the document in the presence of a notary. This process confirms that the signer has declared their statements to be true under oath. Therefore, it lends significant credibility to the document, making it more trustworthy for legal purposes. If you’re preparing a document that requires this formality, using a service like US Legal Forms can streamline your experience.

Business Taxes The tax rate is 6.6% on Oregon taxable income of $1 million or less and 7.6% on Oregon taxable income above $1 million. There is a minimum excise tax of $150 for S corporations and one between $150 and $100,000 for C corporations, based on Oregon sales.

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders.

Purpose of Form OR-20-S Use Form OR-20-S, Oregon S Corporation Tax Return to calculate and report the Oregon corporate excise or income tax liability of a business entity taxable as an S corporation doing business in Oregon or with Oregon sources of income.

The cost to start an S corp varies by state, based on filing fees and state taxes, but you can expect to pay between $800 to $3,000, excluding any lawyer's fees, should you choose to hire one.

To form an Oregon S corp, you'll need to ensure your company has an Oregon formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

Oregon recognizes the federal S corporation election and does not require a state-level S corporation election.

To form an Oregon S corp, you'll need to ensure your company has an Oregon formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

An S corporation carrying on or doing business in Oregon must also pay $150 minimum excise tax. The minimum tax does not flow through to the shareholders. The income or loss of an S corporation is reported to each shareholder on federal form Schedule K-1. See shareholder filing requirements for more information.